Bitcoin Rebound: Long-Term Outlook And Investment Strategies

Table of Contents

Understanding the Bitcoin Rebound

Analyzing Recent Market Trends

Bitcoin's price has experienced dramatic swings in recent times. Understanding these fluctuations is crucial to grasping the current rebound. The crypto market, of which Bitcoin is the largest component by market cap, is inherently volatile. However, recent trends indicate a potential shift.

- Price Movements: After a significant downturn in [mention specific period and approximate percentage drop], Bitcoin's price has seen a notable increase of [mention specific percentage increase] in the last [mention time period]. This upward trend needs to be viewed in context with historical volatility.

- News Events: Several news events have influenced Bitcoin's value. For example, [mention specific positive news, e.g., positive regulatory developments in a major country] contributed positively, while [mention specific negative news, e.g., a major exchange experiencing a security breach] caused temporary dips. Understanding the interplay of these factors is crucial for interpreting Bitcoin price fluctuations.

- Correlation with Macroeconomic Factors: Bitcoin's price is often correlated with macroeconomic factors such as inflation, interest rates, and global economic uncertainty. [Explain briefly how these factors might have affected recent Bitcoin price movements].

Factors Contributing to the Rebound

Several factors contribute to the current Bitcoin rebound. These factors, taken together, suggest a growing acceptance and institutional confidence in Bitcoin as a valuable asset.

- Increased Institutional Investment: Large corporations and institutional investors, such as MicroStrategy, are increasing their Bitcoin holdings, signaling a growing belief in its long-term value as a store of value. This adds significant buying pressure to the market.

- Growing Adoption in Developing Economies: Bitcoin's adoption in developing economies with unstable fiat currencies is accelerating, driven by its potential to offer financial freedom and hedge against inflation. This increased demand supports the price rise.

- Technological Advancements: Improvements within the Bitcoin network, such as the Lightning Network, are addressing scalability issues and enhancing transaction speed. These technological advancements improve Bitcoin's usability and appeal to a wider audience.

Long-Term Outlook for Bitcoin

Potential for Future Growth

The long-term potential for Bitcoin growth remains a subject of debate, but several factors suggest continued growth. However, caution and a realistic outlook are crucial.

- Bitcoin Scarcity: The fixed supply of 21 million Bitcoin creates inherent scarcity, potentially driving long-term price appreciation as demand increases.

- Increasing Global Adoption: As more individuals and institutions adopt Bitcoin, demand is expected to rise, putting upward pressure on price.

- Bitcoin as a Store of Value: Many view Bitcoin as a digital gold, a store of value that can protect against inflation and economic uncertainty.

However, potential limitations exist:

- Regulatory Uncertainty: Government regulations could significantly impact Bitcoin's price and adoption rate.

- Technological Disruptions: New technologies or unforeseen vulnerabilities could challenge Bitcoin's dominance.

Assessing Potential Risks

While Bitcoin offers exciting potential, investors must acknowledge significant risks:

- Price Volatility: Bitcoin's price is notoriously volatile, subject to sharp and unpredictable swings.

- Regulatory Uncertainty: Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to uncertainty and potential policy changes.

- Security Risks: Bitcoin exchanges and wallets are vulnerable to hacking and theft, posing a significant risk to investors.

- Technological Disruptions: New technologies could potentially render Bitcoin obsolete or less relevant.

Investment Strategies for Bitcoin

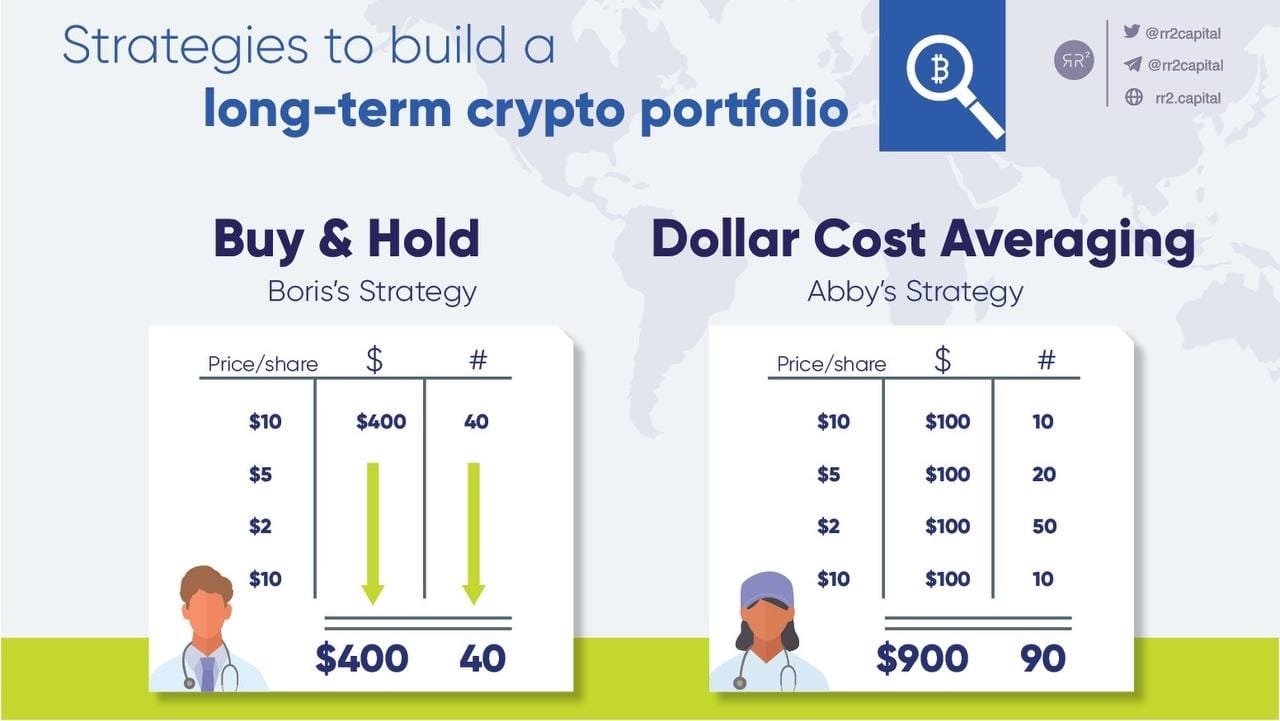

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a risk-mitigation strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Process: Invest a set amount (e.g., $100) every week or month.

- Advantages: Reduces the impact of market timing, minimizing the risk of investing a large sum at a market peak.

Diversification

Diversification is crucial for managing risk. Don't put all your eggs in one basket.

- Cryptocurrency Portfolio: Diversify across different cryptocurrencies (altcoins) to reduce the impact of a single asset's price decline.

- Asset Classes: Include other asset classes like stocks, bonds, and real estate in your overall investment portfolio to further reduce risk.

Long-Term Holding (Hodling)

Hodling, or long-term holding, is a strategy that involves buying and holding Bitcoin for an extended period, aiming to profit from its long-term growth potential.

- Long-term potential: Historical data shows that long-term Bitcoin holders have often seen substantial returns.

- Patience: This strategy requires significant patience and the ability to withstand short-term price fluctuations.

Conclusion

The Bitcoin rebound presents both exciting opportunities and considerable risks. By understanding the factors driving this rebound, considering the long-term outlook, and employing sound investment strategies like Dollar-Cost Averaging and diversification, you can approach Bitcoin investment responsibly. Remember that thorough research and a comprehensive risk assessment are crucial before investing in Bitcoin or any cryptocurrency. Start your journey towards informed Bitcoin investment today! Learn more about navigating the Bitcoin market and developing your own effective Bitcoin investment strategy.

Featured Posts

-

185 Potential Van Ecks Top Cryptocurrency Recommendation

May 08, 2025

185 Potential Van Ecks Top Cryptocurrency Recommendation

May 08, 2025 -

Tuerkiye De Sms Dolandiriciligi Sikayetleri Patladi

May 08, 2025

Tuerkiye De Sms Dolandiriciligi Sikayetleri Patladi

May 08, 2025 -

The Best War Film Debate Has Saving Private Ryan Been Overtaken

May 08, 2025

The Best War Film Debate Has Saving Private Ryan Been Overtaken

May 08, 2025 -

April 15 2025 Daily Lotto Winning Numbers

May 08, 2025

April 15 2025 Daily Lotto Winning Numbers

May 08, 2025 -

Jayson Tatums Ankle Injury Update And Potential Timeline For Recovery

May 08, 2025

Jayson Tatums Ankle Injury Update And Potential Timeline For Recovery

May 08, 2025