Bitcoin Rebound: Is This The Start Of A New Bull Run?

Table of Contents

Analyzing the Recent Bitcoin Price Surge

Bitcoin's recent price increase has been noteworthy, prompting renewed interest from both institutional and retail investors. Several factors may be contributing to this rebound. The increase isn't solely attributable to one factor, but rather a confluence of events. Let's explore some key drivers:

-

Increased Institutional Adoption: Large financial institutions are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a hedge against inflation and a potential long-term store of value. This institutional buying pressure can significantly impact the Bitcoin price. Grayscale Bitcoin Trust, for example, continues to accumulate significant holdings.

-

Positive Regulatory Developments: While regulatory clarity remains a significant challenge globally, positive developments in specific regions are fostering a more favorable environment for Bitcoin adoption and investment. This can reduce uncertainty and encourage further investment.

-

Growing Interest from Retail Investors: Increased media coverage and growing awareness of Bitcoin as an asset class are attracting a new wave of retail investors. This renewed retail interest contributes to increased trading volume and price appreciation.

-

Macroeconomic Uncertainty: Global macroeconomic uncertainty, including inflation and geopolitical instability, can drive safe-haven demand for assets like Bitcoin. Investors often seek alternative stores of value during times of economic turmoil.

[Insert a chart or graph visually representing the recent Bitcoin price movements here]

Key Indicators Suggesting a Potential Bull Run

Beyond simple price action, several key indicators suggest the possibility of a sustained Bitcoin bull run:

-

Increasing On-Chain Transaction Volume: A rising number of Bitcoin transactions indicates increased network activity and user engagement, often preceding periods of price appreciation.

-

Rising Bitcoin Mining Difficulty: A higher mining difficulty reflects a more secure and robust network, attracting more miners and strengthening the overall ecosystem.

-

High Network Hash Rate: A high network hash rate, which measures the total computational power securing the Bitcoin network, signals a healthy and resilient network, less susceptible to attacks.

-

Positive Sentiment on Social Media and Increased Google Searches: Increased positive sentiment on social media platforms and a surge in Google searches for Bitcoin-related terms suggest growing investor interest and potential future price growth.

Potential Challenges and Risks

While the signs are potentially bullish, several challenges and risks could hinder a sustained Bitcoin bull run:

-

Regulatory Uncertainty: Varying regulatory landscapes across different jurisdictions create uncertainty for investors. A sudden crackdown in a major market could significantly impact the Bitcoin price.

-

Potential for Market Manipulation and Price Volatility: The relatively young age of the cryptocurrency market makes it susceptible to price manipulation and extreme volatility. Sudden price swings are a characteristic feature of Bitcoin.

-

Macroeconomic Factors: Macroeconomic conditions, such as rising inflation or interest rate hikes, can negatively impact the Bitcoin price, as investors may shift their investments toward more traditional assets.

-

Security Risks: Security risks associated with cryptocurrency exchanges and personal wallets remain a concern. Investors must prioritize secure storage practices to protect their holdings.

Investing in Bitcoin During a Rebound: Strategies and Considerations

Navigating a Bitcoin rebound requires careful consideration of investment strategies and risk management:

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak.

-

Lump-Sum Investment: A lump-sum investment involves investing a significant amount of capital at once. This strategy can be more profitable if the market continues its upward trend, but carries significantly more risk.

-

Risk Tolerance and Investment Goals: Investors should carefully assess their risk tolerance and investment goals before investing in Bitcoin. It's crucial to only invest what you can afford to lose.

-

Portfolio Diversification: Diversifying your investment portfolio beyond Bitcoin is crucial to mitigate overall risk. Don't put all your eggs in one basket.

-

Secure Storage: Storing your Bitcoin in secure, reputable wallets is paramount to protect against theft or loss. Hardware wallets are often preferred for their enhanced security features.

Conclusion: Bitcoin Rebound – Navigating the Path to a Potential Bull Run

The recent Bitcoin rebound presents both opportunity and risk. While several factors suggest the possibility of a new bull run, significant challenges and risks remain. Increased institutional adoption, positive regulatory developments, and growing retail interest are positive signs. However, regulatory uncertainty, market manipulation, macroeconomic factors, and security risks all warrant careful consideration. Thorough research and informed decision-making are critical for navigating this dynamic market. Stay informed about the latest Bitcoin developments and consider your investment strategy carefully. Is this Bitcoin rebound the start of a new bull run? Only time will tell, but staying informed is key. Conduct further research and make informed decisions regarding your Bitcoin investment.

Featured Posts

-

Friday April 18th 2025 Daily Lotto Winning Numbers

May 08, 2025

Friday April 18th 2025 Daily Lotto Winning Numbers

May 08, 2025 -

16th April 2025 Lotto Results

May 08, 2025

16th April 2025 Lotto Results

May 08, 2025 -

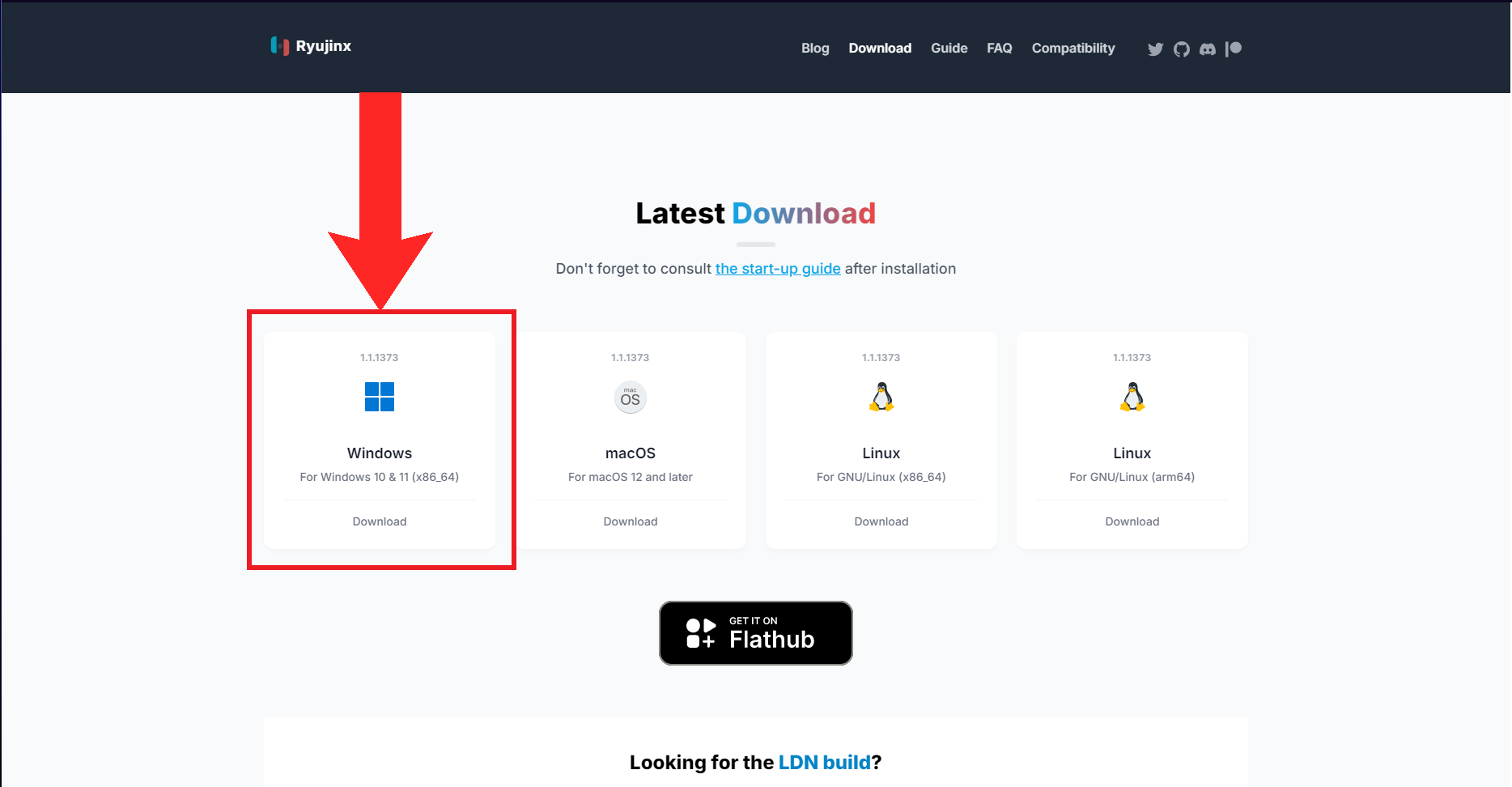

Ryujinx Switch Emulator Development Ends After Nintendo Intervention

May 08, 2025

Ryujinx Switch Emulator Development Ends After Nintendo Intervention

May 08, 2025 -

How To Watch The Oklahoma City Thunder Vs Portland Trail Blazers Game On March 7th

May 08, 2025

How To Watch The Oklahoma City Thunder Vs Portland Trail Blazers Game On March 7th

May 08, 2025 -

Lahwr Chkn Mtn Awr Byf Ky Blnd Asmany Qymtwn Ka Msylh Awr As Ka Hl

May 08, 2025

Lahwr Chkn Mtn Awr Byf Ky Blnd Asmany Qymtwn Ka Msylh Awr As Ka Hl

May 08, 2025