Bitcoin Reaches New Peak On Anticipation Of US Regulations

Table of Contents

The Impact of Potential US Regulatory Clarity on Bitcoin

The prospect of clearer US regulations for Bitcoin is a major catalyst for the recent price surge. This regulatory clarity is expected to significantly alter the market landscape, attracting new investors and bolstering market stability.

Increased Institutional Investment

Uncertainty surrounding regulations has historically deterred large institutional investors from entering the Bitcoin market. Clearer rules, however, could change this. The potential for reduced risk and increased legal certainty would make Bitcoin a more attractive asset class for pension funds, hedge funds, and other institutional players.

- Several large financial institutions have already shown interest in Bitcoin, with some actively exploring investment strategies.

- Increased institutional investment would lead to higher trading volume and potentially drive the Bitcoin price significantly higher.

- This influx of capital could create a more mature and liquid market, benefiting all participants. Keywords: Institutional investors, Bitcoin investment, institutional Bitcoin adoption, regulatory certainty.

Reduced Volatility and Increased Market Stability

One of the most significant drawbacks of Bitcoin has been its volatility. Well-defined regulations could mitigate this risk by providing a robust framework for Bitcoin operations and exchanges.

- A regulated market fosters trust and legitimacy, attracting a wider range of investors, including those with risk-averse profiles.

- Clearer rules on taxation, anti-money laundering (AML), and know-your-customer (KYC) compliance would enhance transparency and accountability.

- This improved regulatory environment would contribute to a more stable and predictable Bitcoin market. Keywords: Bitcoin volatility, market stability, regulatory framework, Bitcoin legitimacy.

The Role of the SEC and Other Regulatory Bodies

The Securities and Exchange Commission (SEC) and other regulatory bodies play a crucial role in shaping the future of Bitcoin in the US. Their stance, and any forthcoming regulations, will significantly impact the market.

- The SEC's ongoing assessment of Bitcoin and other cryptocurrencies is closely watched by investors.

- Any regulatory decisions will determine how Bitcoin is classified – as a security, a commodity, or something else entirely – and impact trading practices, taxation, and investor protection.

- Statements and actions from these bodies regarding cryptocurrency regulation will continue to influence Bitcoin's price and market sentiment. Keywords: SEC regulation, Bitcoin SEC, cryptocurrency regulation, regulatory bodies, financial regulation.

Factors Beyond Regulation Contributing to Bitcoin's Price Rise

While regulatory anticipation is a significant driver, other factors contribute to Bitcoin's price increase.

Increased Adoption and Usage

The growing adoption of Bitcoin as a payment method and store of value is fueling its price rise. More businesses are accepting Bitcoin, creating increased demand.

- The use of Bitcoin as a means of payment is expanding globally, indicating wider acceptance and growing utility.

- This increase in real-world usage signifies a shift towards Bitcoin's mainstream adoption, further pushing its price upwards.

- This growing adoption enhances Bitcoin's position as a viable alternative to traditional financial systems. Keywords: Bitcoin adoption, Bitcoin payment, Bitcoin usage, cryptocurrency adoption.

Macroeconomic Factors

Global macroeconomic conditions also play a significant role. Inflation, geopolitical uncertainty, and economic instability can drive investors towards Bitcoin as a hedge.

- Bitcoin's limited supply and decentralized nature make it an attractive asset during times of economic uncertainty.

- High inflation in various countries encourages investors to seek alternative stores of value, boosting demand for Bitcoin.

- Geopolitical events and global instability often lead to increased Bitcoin investment as a safe haven asset. Keywords: Bitcoin inflation hedge, macroeconomic factors, geopolitical risk, Bitcoin price drivers.

Potential Risks and Challenges Despite Positive Regulatory Outlook

While the anticipated regulatory clarity is positive, potential risks and challenges remain.

Uncertain Regulatory Outcomes

The outcome of US regulatory efforts remains uncertain. Unfavorable regulations could negatively impact Bitcoin's price and market growth.

- Overly stringent or poorly designed regulations could stifle innovation and limit Bitcoin's adoption.

- Regulatory uncertainty itself presents a significant risk, causing volatility and potentially deterring investment.

- Different regulatory approaches across various jurisdictions could create fragmentation and complexity within the Bitcoin ecosystem. Keywords: Regulatory uncertainty, Bitcoin risk, negative regulation, regulatory hurdles.

Environmental Concerns and Energy Consumption

The energy consumption associated with Bitcoin mining remains a significant environmental concern. Stricter environmental regulations could impact the cost and efficiency of mining.

- Growing concerns about Bitcoin's carbon footprint could lead to stricter regulations on energy consumption.

- This could increase mining costs and potentially reduce Bitcoin's overall appeal.

- However, ongoing efforts to improve energy efficiency through renewable energy sources offer potential solutions. Keywords: Bitcoin energy consumption, Bitcoin mining, environmental impact, sustainable Bitcoin.

Conclusion: Navigating the Future of Bitcoin Under US Regulation

The recent Bitcoin price peak is a complex phenomenon driven by anticipated US regulatory clarity, increased adoption, and macroeconomic factors. Understanding both the potential benefits and risks associated with these developments is crucial for navigating the future of Bitcoin. While a clear regulatory framework can increase institutional investment and market stability, unfavorable regulations or unforeseen challenges could negatively impact the market. Stay updated on the latest developments in US Bitcoin regulation and make informed decisions about your Bitcoin investments. Learn more about how US Bitcoin regulations could impact your portfolio and navigate the evolving landscape of this exciting cryptocurrency.

Featured Posts

-

Actress Mia Farrow Sounds Alarm American Democracys 3 4 Month Timeframe

May 24, 2025

Actress Mia Farrow Sounds Alarm American Democracys 3 4 Month Timeframe

May 24, 2025 -

Walt Frazier Shows Off Championship Rings To Dylan Dreyer On Today

May 24, 2025

Walt Frazier Shows Off Championship Rings To Dylan Dreyer On Today

May 24, 2025 -

Job Offer Negotiation Strategies For A Best And Final Offer

May 24, 2025

Job Offer Negotiation Strategies For A Best And Final Offer

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025 -

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sale

May 24, 2025

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sale

May 24, 2025

Latest Posts

-

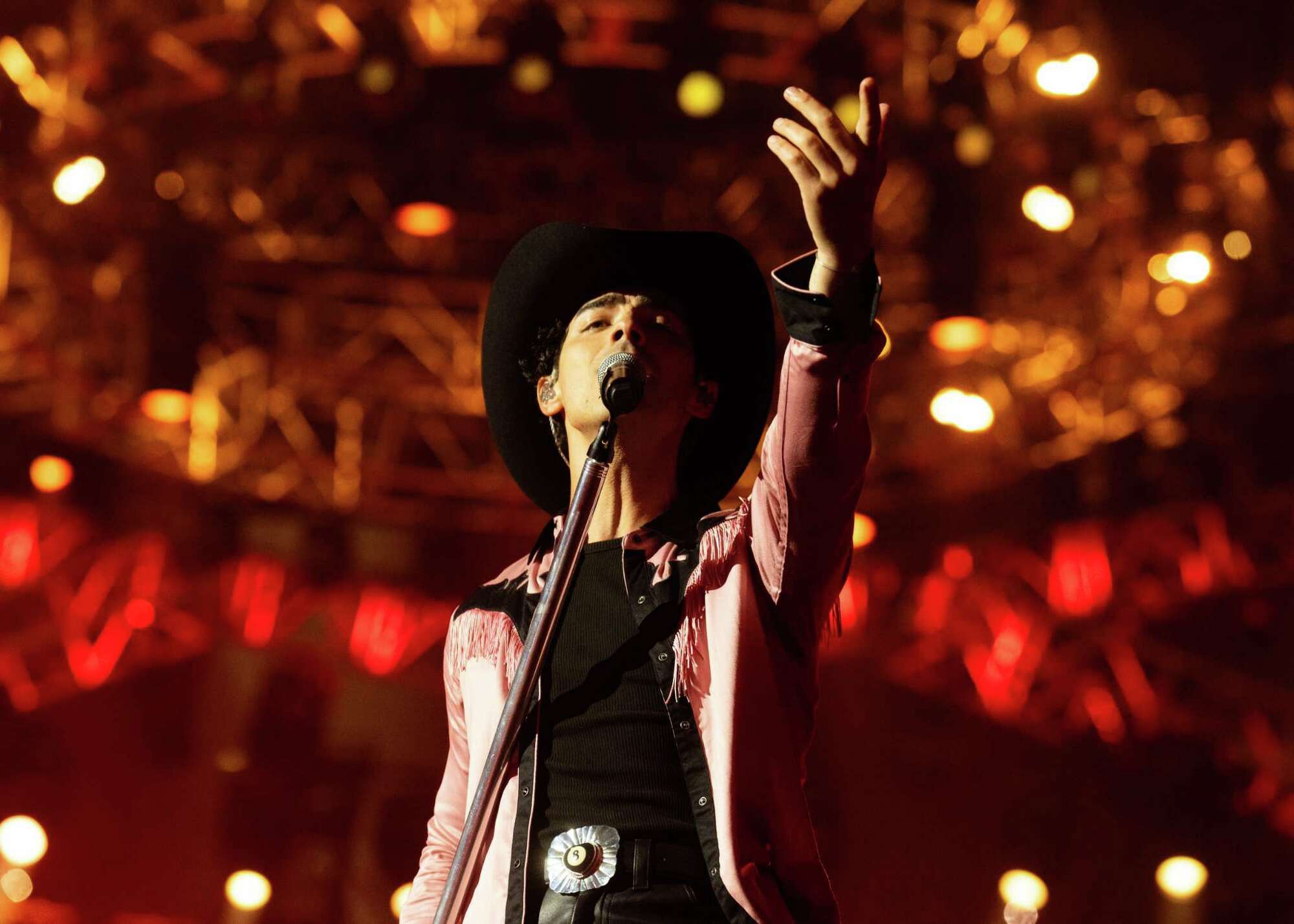

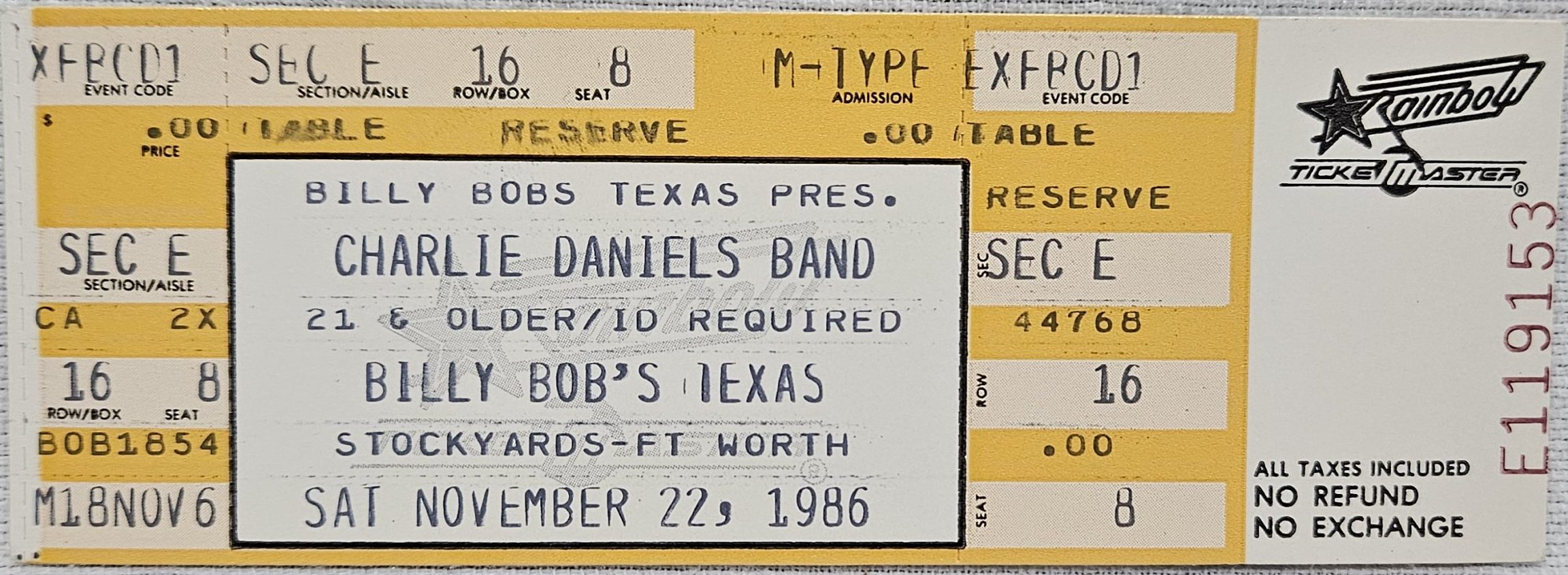

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025 -

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025 -

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025 -

Joe Jonas Unexpected Fort Worth Stockyards Performance Details And Videos

May 24, 2025

Joe Jonas Unexpected Fort Worth Stockyards Performance Details And Videos

May 24, 2025 -

Joe Jonas Surprise Fort Worth Stockyards Concert Fan Reactions

May 24, 2025

Joe Jonas Surprise Fort Worth Stockyards Concert Fan Reactions

May 24, 2025