Bitcoin Price Rebound: A Look At The Future Of Bitcoin

Table of Contents

Factors Contributing to the Bitcoin Price Rebound

Several intertwined factors have contributed to the recent Bitcoin price rebound, pushing it from the bear market lows. Understanding these elements is crucial for predicting future price movements and making informed investment decisions.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin's price. The current inflationary environment in many countries, coupled with weakening fiat currencies, has driven investors to seek alternative assets.

- Inflation Hedge: Bitcoin's limited supply of 21 million coins makes it an attractive hedge against inflation. As traditional currencies lose purchasing power, investors are turning to Bitcoin as a store of value.

- Weakening Fiat Currencies: The devaluation of various national currencies due to inflationary pressures and geopolitical instability increases the appeal of Bitcoin as a relatively stable alternative.

- Institutional Adoption: Increased institutional interest, with major corporations and investment firms adding Bitcoin to their portfolios, provides substantial support for the price.

- Geopolitical Instability: Global uncertainty and conflicts often lead to safe-haven investment flows into Bitcoin, boosting demand and price. For example, the ongoing war in Ukraine and rising global tensions have fueled interest in Bitcoin as a decentralized, less vulnerable asset.

Technological Advancements

Advancements in Bitcoin's underlying technology and the broader cryptocurrency ecosystem are fueling further adoption and impacting price.

- The Lightning Network: This second-layer scaling solution significantly improves Bitcoin's transaction speed and reduces fees, making it more user-friendly and scalable for everyday transactions.

- Taproot Upgrade: This significant upgrade improved Bitcoin's privacy and efficiency, further strengthening its technological foundation.

- DeFi and NFTs: The growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) on platforms integrated with Bitcoin has broadened its utility and expanded its appeal to a wider range of investors. This creates increased demand for Bitcoin as a base layer asset.

Market Sentiment and Investor Behavior

The collective psychology of investors plays a critical role in driving Bitcoin price fluctuations. A shift in market sentiment from fear to optimism significantly contributes to price rebounds.

- Social Media Influence: Social media platforms significantly influence market sentiment, with news and opinions spreading rapidly and impacting trading activity. Positive news and influencer endorsements can trigger buying pressure.

- On-Chain Metrics: Analyzing on-chain metrics, such as trading volume, exchange balances, and the number of active addresses, provides valuable insights into investor behavior and market dynamics. Increased on-chain activity often suggests growing confidence and demand.

- Fear and Greed Index: Monitoring the crypto Fear and Greed Index helps gauge overall market sentiment. A shift from "fear" to "greed" can indicate a potential price rebound.

Analyzing Potential Future Price Scenarios

Predicting the future price of Bitcoin is inherently challenging, but analyzing potential scenarios based on various factors can offer valuable insights.

Bullish Predictions

Several factors could propel Bitcoin into a sustained bull market:

- Increased Institutional Adoption: Continued adoption by institutional investors could drive significant price appreciation.

- Regulatory Clarity: Clearer and more favorable regulations in key jurisdictions could unlock significant investment and boost market confidence.

- Network Effects: As more people use Bitcoin, its value and network effects increase, potentially leading to exponential price growth.

Bearish Predictions

Conversely, several factors could hinder Bitcoin's price growth or trigger another decline:

- Regulatory Crackdown: Increased regulatory scrutiny or restrictive policies in major economies could negatively impact Bitcoin's price.

- Macroeconomic Downturn: A global economic recession could reduce investor risk appetite and trigger capital flight away from riskier assets like Bitcoin.

- Security Concerns: Major security breaches or hacks could erode investor confidence and negatively impact the Bitcoin price.

Realistic Outlook

A realistic outlook acknowledges both the bullish and bearish possibilities. A moderate price increase or period of consolidation seems most likely in the near term, while the long-term potential for Bitcoin remains significant, given its underlying technology and growing adoption.

Investing in Bitcoin During a Rebound

Investing in Bitcoin during a price rebound requires a cautious and strategic approach.

Risk Management Strategies

Implementing robust risk management strategies is crucial:

- Diversification: Diversify your investment portfolio to mitigate risks associated with Bitcoin's volatility. Don't put all your eggs in one basket.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, helps reduce the impact of volatility.

- Stop-Loss Orders: Setting stop-loss orders can help limit potential losses if the price drops unexpectedly.

Understanding Bitcoin's Volatility

Bitcoin's price is known for its significant volatility. Understanding this volatility and managing your emotional responses are critical for successful investment:

- Historical Volatility Analysis: Studying Bitcoin's historical price volatility can help you understand the potential range of price fluctuations.

- Emotional Discipline: Avoid making impulsive decisions based on short-term price swings. Stick to your investment strategy and risk tolerance.

Conclusion

The recent Bitcoin price rebound presents a complex picture, with various factors contributing to its upward trajectory. While a sustained bull market is possible, driven by macroeconomic factors, technological advancements, and shifting investor sentiment, it's crucial to acknowledge potential risks and implement sound risk management strategies. Thorough research and a careful understanding of market dynamics are essential for navigating this exciting yet volatile landscape.

Call to Action: Stay informed about the latest developments impacting the Bitcoin price rebound. Continue your research on Bitcoin and cryptocurrency investments to make informed decisions about your portfolio. Learn more about the future of Bitcoin and how you can participate in this evolving market. Understanding the factors driving the Bitcoin price rebound is key to making sound investment choices.

Featured Posts

-

Tramway Dijon Adoption Du Projet De 3e Ligne Apres Concertation

May 09, 2025

Tramway Dijon Adoption Du Projet De 3e Ligne Apres Concertation

May 09, 2025 -

Solve Nyt Strands Game 403 April 10th Complete Hints And Answers

May 09, 2025

Solve Nyt Strands Game 403 April 10th Complete Hints And Answers

May 09, 2025 -

Mame Slovensku Dakotu Johnson Porovnanie Fotografii Ohromi

May 09, 2025

Mame Slovensku Dakotu Johnson Porovnanie Fotografii Ohromi

May 09, 2025 -

Pakistans Stock Exchange Outage Amidst Heightened Political Tensions

May 09, 2025

Pakistans Stock Exchange Outage Amidst Heightened Political Tensions

May 09, 2025 -

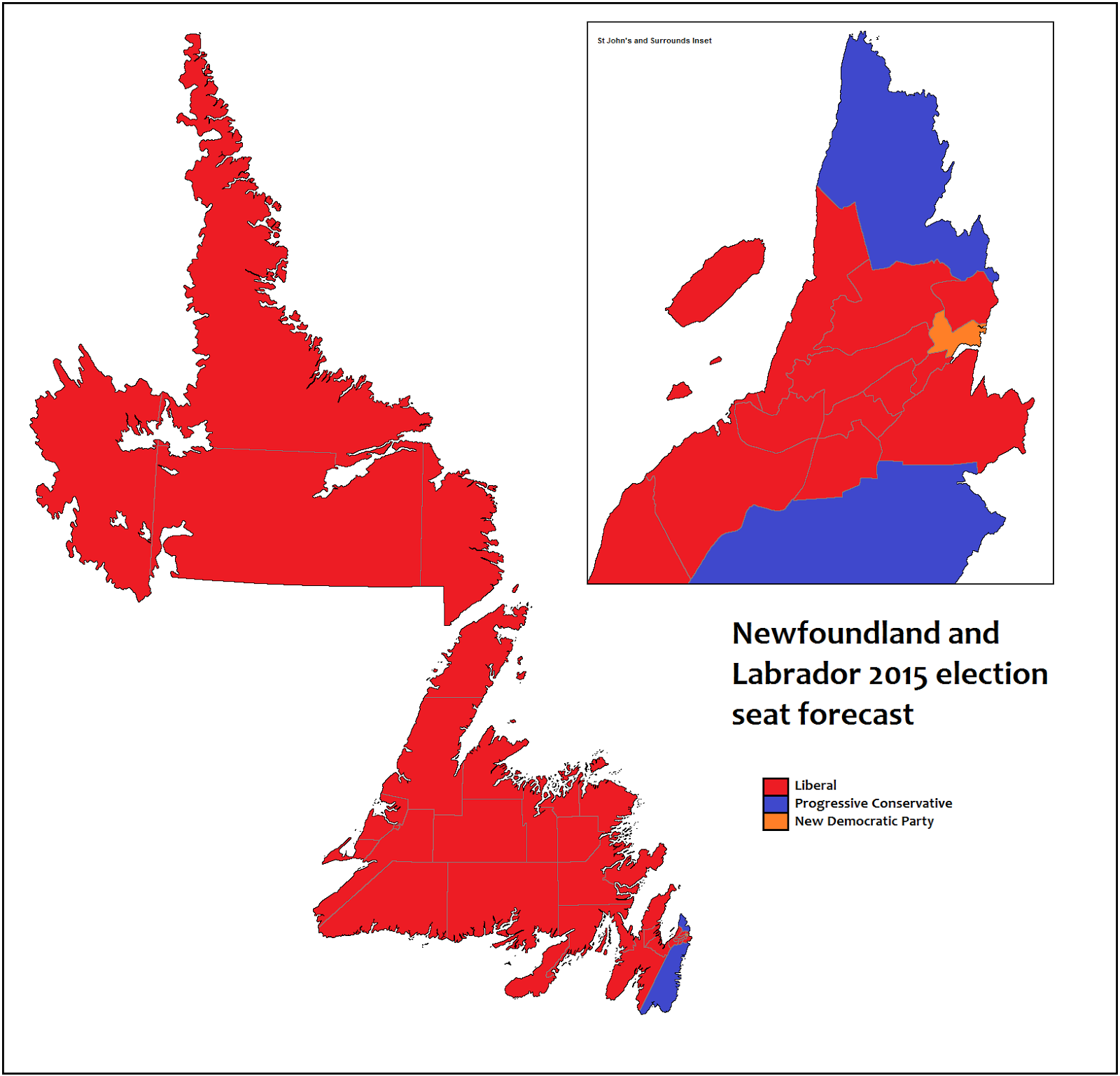

Understanding The Candidates In Your Nl Federal Election Riding

May 09, 2025

Understanding The Candidates In Your Nl Federal Election Riding

May 09, 2025