Bitcoin Price Prediction: Will Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Economic Policies and Their Potential Effect on Bitcoin

A hypothetical Trump administration's economic policies could significantly impact Bitcoin's price, both directly and indirectly. The interplay between political rhetoric and cryptocurrency markets is often complex and unpredictable, making accurate Bitcoin price prediction challenging.

Impact of Regulatory Changes

Potential regulatory changes under a hypothetical Trump administration could dramatically influence BTC.

- Positive Impact: Pro-cryptocurrency policies, such as clear regulatory frameworks and tax incentives, could boost investor confidence and drive up BTC's price. This could lead to increased institutional investment and broader adoption.

- Negative Impact: Conversely, more restrictive regulations, like stricter KYC/AML requirements or outright bans, could severely depress the Bitcoin price, creating significant volatility. Historical precedents, such as China's crackdown on cryptocurrency mining, illustrate the potential for drastic price drops in response to regulatory uncertainty.

- Expert Opinions: Experts are divided on the potential impact. Some believe clearer regulations, even stringent ones, could ultimately foster greater stability and increase investor confidence. Others fear that overly aggressive regulation could stifle innovation and limit growth.

Impact on the US Dollar

Trump's policies could also indirectly affect Bitcoin's price through their impact on the US dollar (USD).

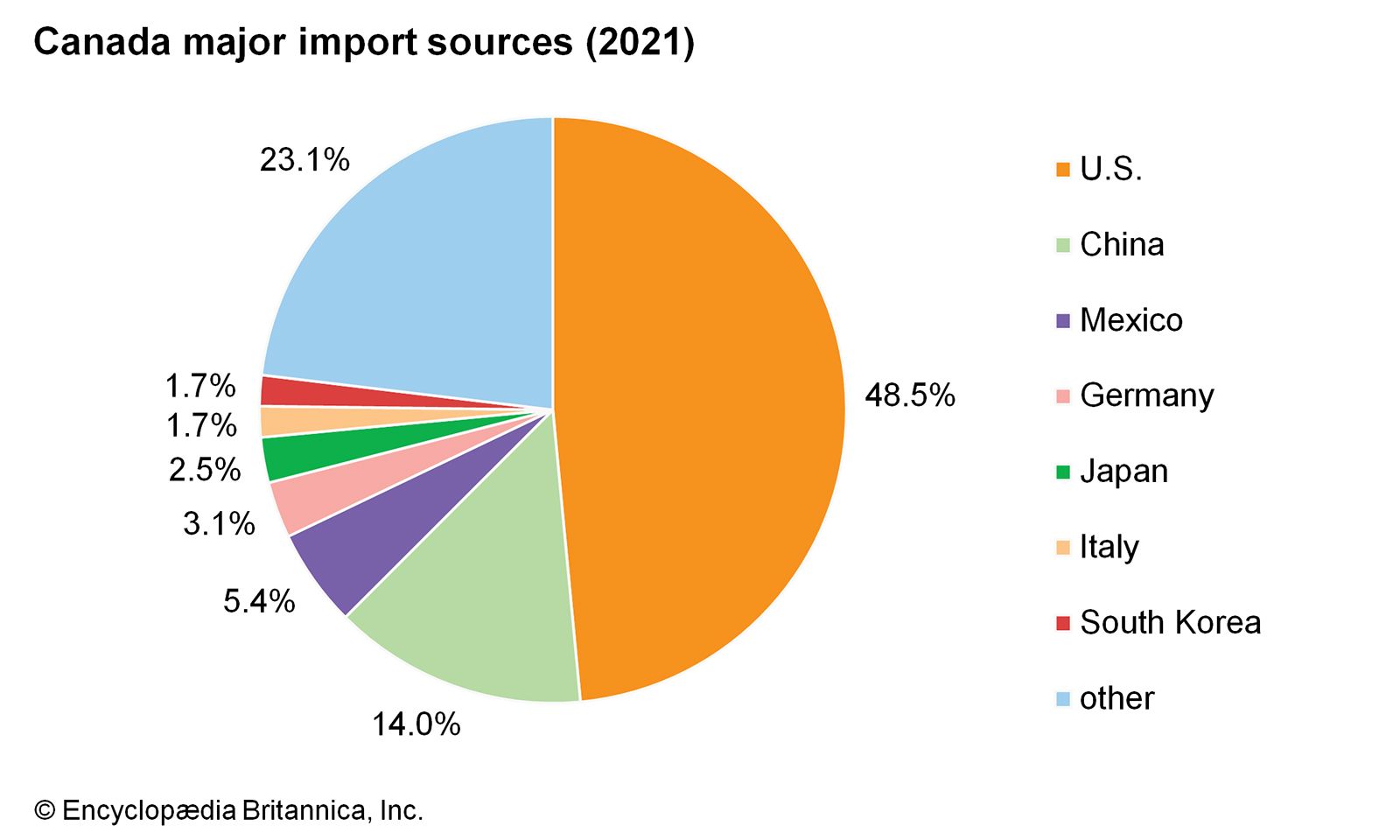

- Dollar Weakness: A weakening US dollar could make Bitcoin, as a relatively independent asset, more attractive to international investors seeking diversification and hedging against inflation. This could drive up demand and potentially push the BTC price higher.

- Dollar Strength: Conversely, a strong US dollar could reduce Bitcoin's appeal, potentially leading to price declines as investors move towards more traditional, dollar-denominated assets.

- Historical Correlation: While no direct causal link exists, historical data shows some correlation between the USD's strength and Bitcoin's price fluctuations. However, many other factors influence Bitcoin's price, making it difficult to predict the exact relationship in a given scenario.

Market Sentiment and Speculation Surrounding the Speech

The market's anticipation of a hypothetical Trump speech will significantly shape Bitcoin's price movements, both before and after the event.

Pre-Speech Market Behavior

Leading up to the speech, Bitcoin's price could experience significant volatility based on speculation and news reports.

- Increased Volatility: We might see increased trading volume and price fluctuations as investors position themselves based on their predictions of the speech's content.

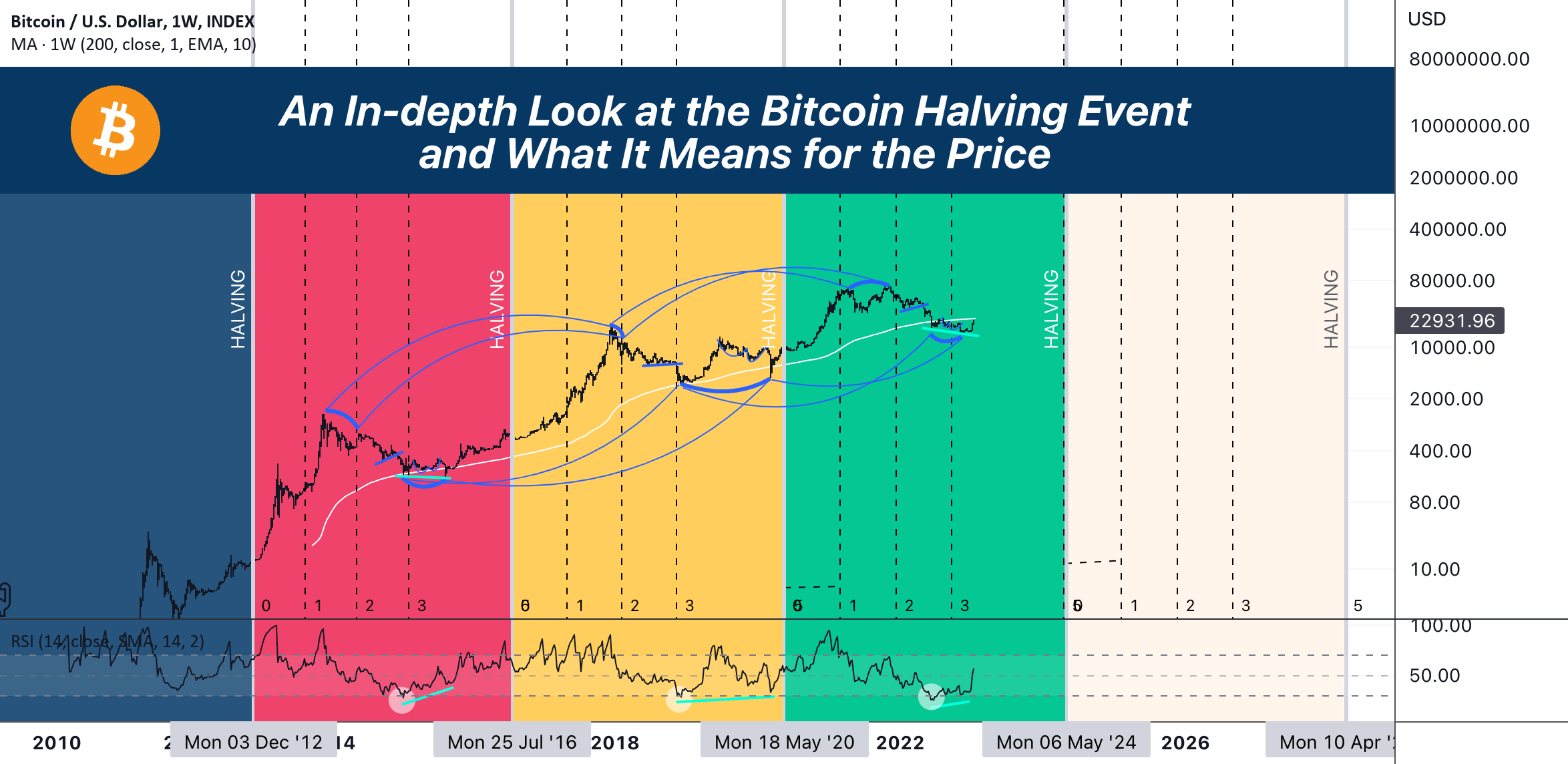

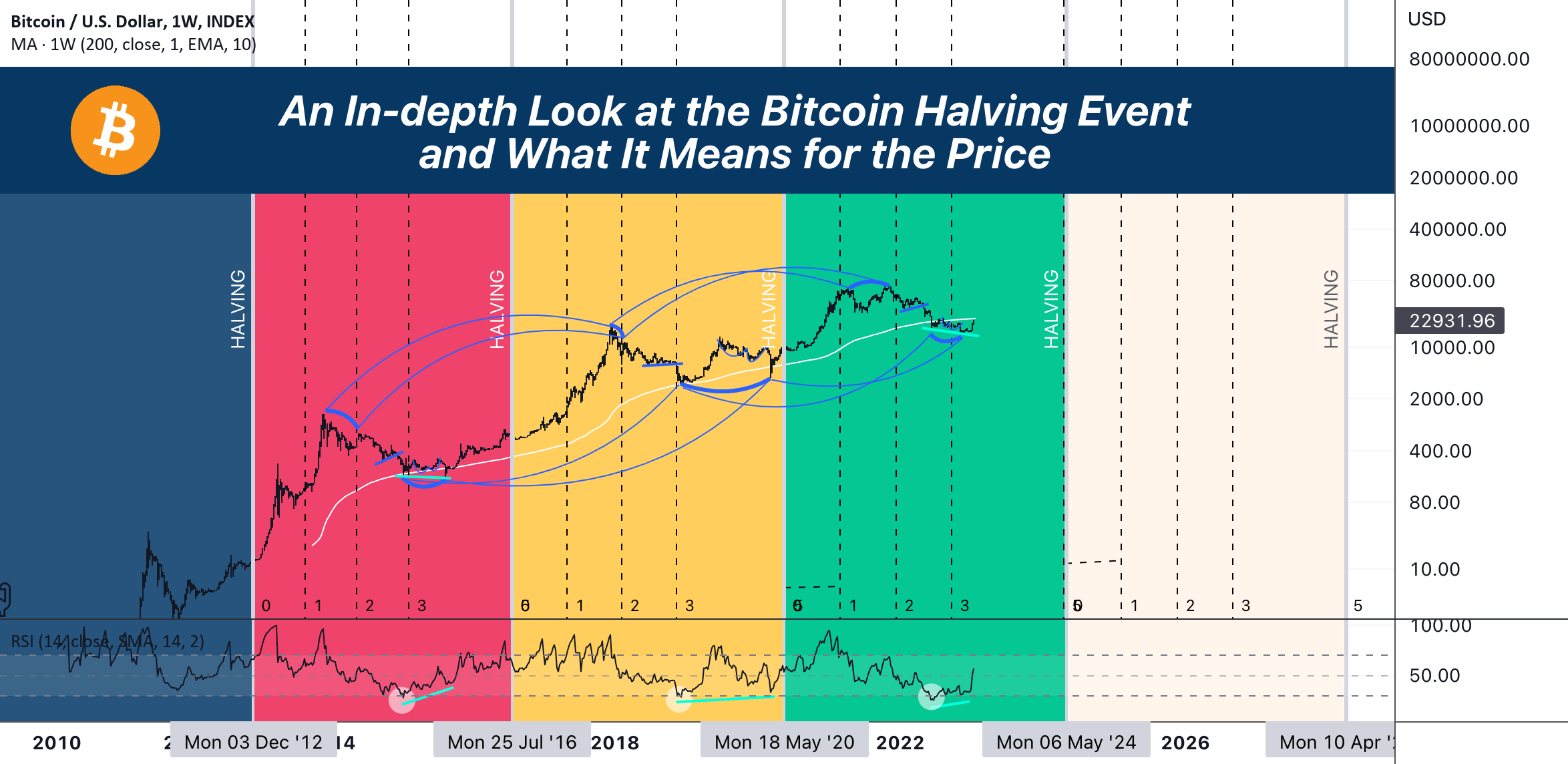

- Technical Analysis: Technical analysts would likely scrutinize Bitcoin's price charts, looking for patterns and indicators that could suggest future price movements. This might include studying support and resistance levels, trading volumes, and momentum indicators.

- News and Sentiment Analysis: Media coverage and social media sentiment will play a crucial role in shaping market expectations and influencing pre-speech price movements.

Post-Speech Price Reactions

The immediate and long-term price reactions would depend heavily on the speech's content.

- Positive Speech: A positive speech, perceived as pro-crypto or favorable to economic growth, could send Bitcoin's price soaring.

- Negative Speech: Conversely, a negative speech, perceived as anti-crypto or signaling economic instability, could lead to a significant price drop.

- Neutral Speech: A neutral or ambiguous speech might cause only minor price fluctuations, with the market quickly returning to its pre-speech trajectory.

- Trading Strategies: Traders would employ various strategies based on their interpretation of the speech. This could include long or short positions, hedging strategies, and stop-loss orders to manage risk.

Factors Beyond Trump's Speech Affecting Bitcoin Price

While Trump's speech could be a significant catalyst, several other factors independently influence Bitcoin's price.

Macroeconomic Factors

Global economic trends significantly affect Bitcoin's price.

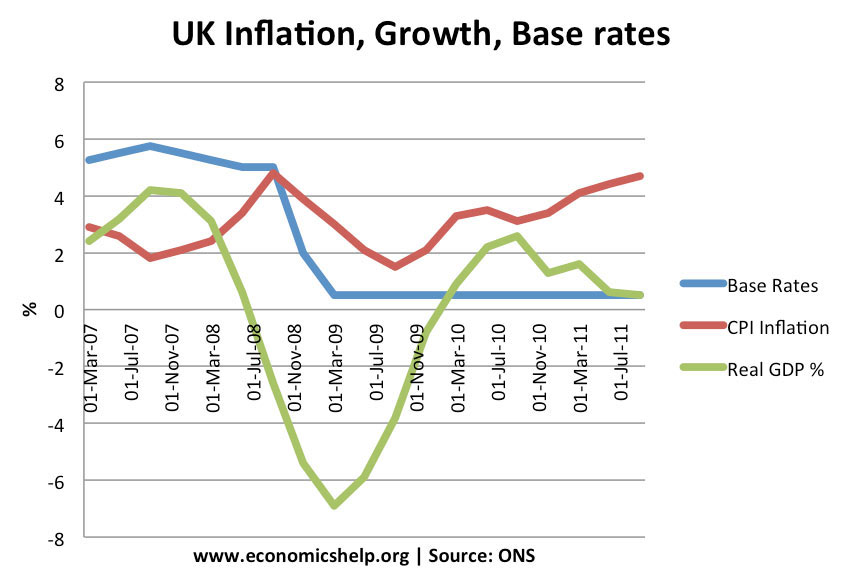

- Inflation: High inflation often boosts Bitcoin's appeal as a hedge against inflation, potentially pushing its price higher.

- Interest Rates: Changes in interest rates, particularly in the US, affect investor behavior and can influence the demand for Bitcoin.

- Geopolitical Events: Global uncertainties and geopolitical tensions can cause investors to seek safe-haven assets like Bitcoin, leading to price increases.

- Cryptocurrency Adoption: Wider adoption of Bitcoin and other cryptocurrencies by institutions and individuals contributes to increasing demand and price appreciation.

Technological Developments in the Bitcoin Ecosystem

Technological advancements within the Bitcoin ecosystem play a crucial role in its long-term price trajectory.

- Network Upgrades: Upgrades like Taproot enhance Bitcoin's scalability, security, and efficiency, potentially driving its price upward.

- On-Chain Analysis: Studying on-chain metrics, such as transaction volume, mining difficulty, and network hash rate, provides valuable insights into the health and growth of the Bitcoin network, thereby influencing investor sentiment and price.

- Institutional Adoption: Growing adoption by institutional investors, such as hedge funds and asset management companies, contributes to increased demand and price appreciation.

- Lightning Network: The Lightning Network, a second-layer scaling solution, can enhance Bitcoin's usability, potentially attracting more users and driving up demand.

Conclusion: Bitcoin Price Prediction Summary and Call to Action

Predicting Bitcoin's price with certainty is impossible, especially considering the multitude of factors at play, including the potential influence of a hypothetical Trump speech. While such a speech might significantly impact market sentiment and create short-term price volatility, macroeconomic factors and technological advancements within the Bitcoin ecosystem will ultimately play a more decisive role in its long-term price trajectory. Remember that any Bitcoin price prediction is inherently speculative. Thorough research and risk assessment are crucial before investing in Bitcoin.

To stay informed about Bitcoin price predictions and market trends, subscribe to our blog, follow us on and , and engage with our community. Bitcoin presents exciting possibilities, but responsible investing requires careful consideration of the inherent risks involved in any Bitcoin price prediction.

Featured Posts

-

Chinas Monetary Policy Shift Lower Rates Increased Bank Lending

May 08, 2025

Chinas Monetary Policy Shift Lower Rates Increased Bank Lending

May 08, 2025 -

Us Canada Trade A Path Towards Coherence And Cooperation

May 08, 2025

Us Canada Trade A Path Towards Coherence And Cooperation

May 08, 2025 -

Ps 5 Pro Sales Lag Behind Ps 4 Pro Whats The Story

May 08, 2025

Ps 5 Pro Sales Lag Behind Ps 4 Pro Whats The Story

May 08, 2025 -

Jysws Wflamnghw Alshmrany Yuelq Ela Alantqal Almrtqb Fydyw Hsry

May 08, 2025

Jysws Wflamnghw Alshmrany Yuelq Ela Alantqal Almrtqb Fydyw Hsry

May 08, 2025 -

X Men Rogues Unexpected Power Mimicry

May 08, 2025

X Men Rogues Unexpected Power Mimicry

May 08, 2025