Bitcoin Price Prediction: Can Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Analyzing Trump's Potential Economic Policies and Their Impact on Bitcoin

Trump's potential economic policies could significantly influence the Bitcoin price prediction. Let's analyze several key areas:

Fiscal Policy and Inflation

Potential increases in government spending or tax cuts under a Trump administration could fuel inflation. Bitcoin, often viewed as a hedge against inflation, might see increased demand in such a scenario.

- How Inflation Affects Bitcoin's Value: Inflation erodes the purchasing power of fiat currencies. Investors might turn to Bitcoin as a store of value, driving up its price.

- Historical Examples: Past periods of high inflation have correlated with periods of Bitcoin price appreciation, although the relationship isn't always straightforward.

- Potential Scenarios: Significant inflationary pressures could push Bitcoin's price higher, potentially exceeding $100,000, depending on the severity and market reaction. Conversely, unexpectedly low inflation could dampen demand.

Regulatory Landscape and Crypto Adoption

Trump's stance on crypto regulation could dramatically impact investor sentiment and Bitcoin adoption.

- Potential Scenarios for Crypto Regulation: A more lenient regulatory environment could boost investor confidence and attract institutional capital, increasing Bitcoin's price. Conversely, stricter regulations could stifle growth.

- Impact of Increased Regulation on Price: While regulation brings legitimacy, it could also limit accessibility and innovation, potentially suppressing price growth.

- Impact of Deregulation on Bitcoin Adoption: Deregulation could lead to a surge in adoption, potentially driving the price to new highs. However, it could also increase market volatility.

Geopolitical Uncertainty and Safe-Haven Assets

Geopolitical instability, a potential outcome of a Trump presidency, could enhance Bitcoin's appeal as a safe-haven asset.

- Bitcoin's Role as a Safe Haven: During periods of uncertainty, investors often seek refuge in assets perceived as less susceptible to market fluctuations. Bitcoin, due to its decentralized nature, fits this profile.

- Historical Examples: Past geopolitical events have shown a correlation between increased uncertainty and Bitcoin price surges, as investors seek diversification.

- Impact of Trump's Policies on Geopolitical Uncertainty: Depending on his policies, a Trump administration could increase or decrease geopolitical risks, influencing Bitcoin's safe-haven status and therefore its price.

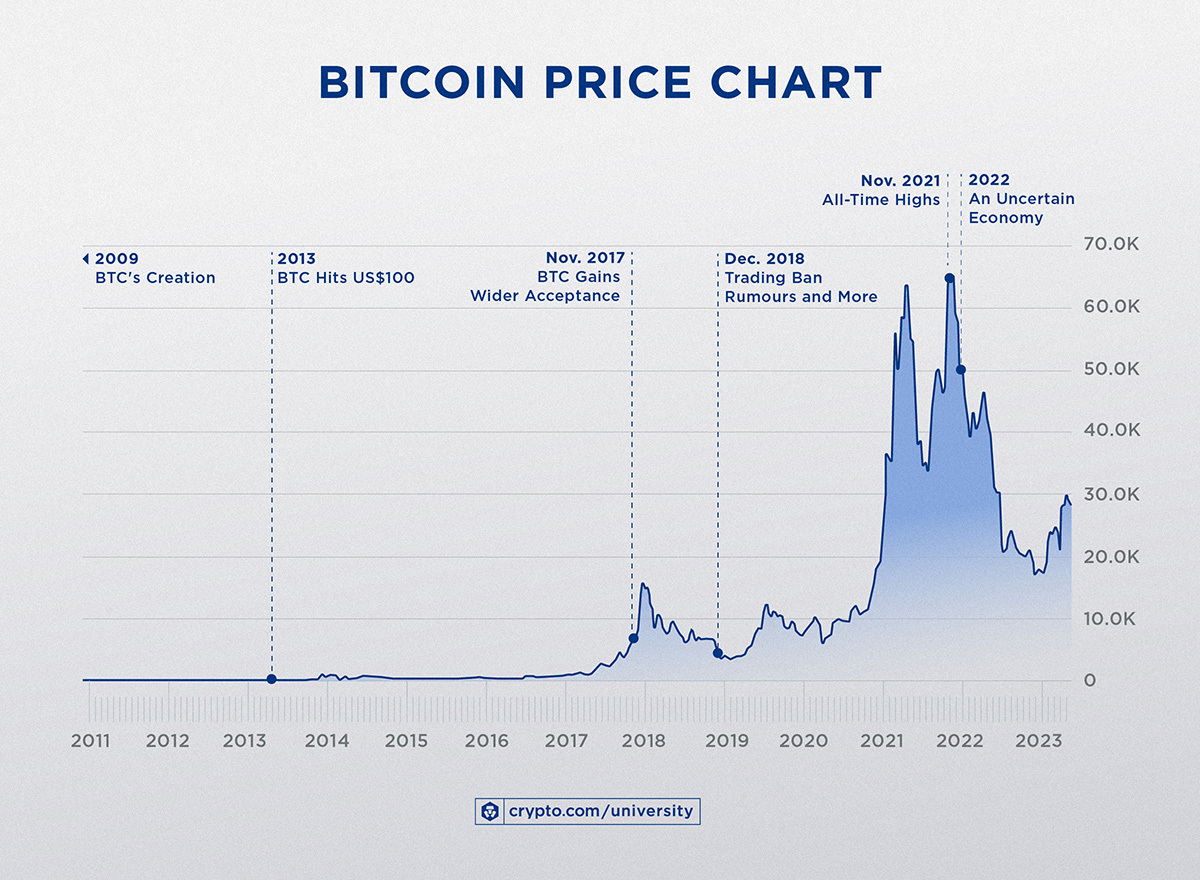

Bitcoin's Current Market Conditions and Technical Indicators

Understanding Bitcoin's current market conditions and technical indicators is crucial for accurate Bitcoin price prediction.

Technical Analysis of BTC Charts

Analyzing BTC charts, including support and resistance levels, is essential for short-term and mid-term predictions.

- Key Indicators: Indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and various moving averages provide insights into price momentum and potential trend reversals.

- Current Price and Trading Volume: Current price action, coupled with trading volume, provides context for interpreting technical indicators. High volume breakouts above resistance levels can signal strong upward momentum.

- Impact of Trump's Announcements: Significant news related to Trump's policies could trigger sharp price movements, either up or down, depending on market interpretation.

On-Chain Metrics and Adoption Rates

On-chain data provides a deeper understanding of market sentiment and adoption rates.

- On-Chain Metrics: Analyzing metrics like transaction volume, active addresses, and network hash rate offers insights into the health and growth of the Bitcoin network.

- Significance of Growing or Shrinking Adoption Rates: Increased adoption signifies growing interest and potential price increases. Conversely, declining adoption rates could signal bearish sentiment.

- Linking Metrics to Price Prediction: Combining on-chain data with technical analysis can lead to more informed Bitcoin price predictions.

Alternative Factors Influencing Bitcoin's Price Beyond Trump's Influence

While Trump's influence is significant, it's not the only factor determining Bitcoin price prediction.

Technological Advancements in the Crypto Space

Technological innovations continue to shape the cryptocurrency landscape.

- Key Technological Advancements: Layer-2 scaling solutions, DeFi growth, and improvements in Lightning Network efficiency can positively influence Bitcoin's adoption and price.

- Impact on Bitcoin's Adoption and Price: These advancements improve scalability, transaction speed, and usability, making Bitcoin more attractive to a wider range of users.

Macroeconomic Factors and Global Events

Broader economic forces significantly influence Bitcoin price prediction.

- Role of Interest Rates: Interest rate hikes by central banks can impact the attractiveness of Bitcoin relative to traditional assets.

- Impact of Global Economic Slowdowns: Recessions or economic uncertainty can drive investors towards Bitcoin as a safe-haven asset.

- Correlation between Macro Events and BTC: Global events and macroeconomic conditions often correlate with Bitcoin's price movements, creating opportunities and risks.

Conclusion: Bitcoin Price Prediction – A Complex Equation

Predicting whether Trump's policies will push Bitcoin past $100,000 is challenging. While his actions could significantly impact the crypto market, several other factors – from technical analysis to macroeconomic trends and technological innovation – play a crucial role. Trump's potential influence on inflation, regulation, and geopolitical stability will undoubtedly impact the Bitcoin price prediction, but it's only one piece of a complex puzzle. The inherent volatility of the cryptocurrency market necessitates a cautious outlook.

Stay informed about Bitcoin price predictions and the factors influencing its value. Continue to research the impact of political events and market dynamics on your Bitcoin investments. Keywords: Bitcoin price prediction, BTC, cryptocurrency investment, market analysis.

Featured Posts

-

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025 -

Brasileirao Jugador Argentino Recibe Sancion De Un Mes

May 08, 2025

Brasileirao Jugador Argentino Recibe Sancion De Un Mes

May 08, 2025 -

Is 5 Realistic Xrp Price Prediction Following Sec Developments

May 08, 2025

Is 5 Realistic Xrp Price Prediction Following Sec Developments

May 08, 2025 -

Dbs Singapore Major Polluters Need Time For Green Transition

May 08, 2025

Dbs Singapore Major Polluters Need Time For Green Transition

May 08, 2025 -

Bitcoin Madenciliginin Gelecegi Son Mu Doenuesuem Mue

May 08, 2025

Bitcoin Madenciliginin Gelecegi Son Mu Doenuesuem Mue

May 08, 2025