Bitcoin Or MicroStrategy Stock: Investment Analysis For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

Bitcoin's Technological Advantages and Decentralization

- Blockchain Technology: Bitcoin operates on a secure, transparent, and decentralized blockchain technology, recording all transactions across a distributed network. This eliminates the need for a central authority, offering resilience against censorship and single points of failure.

- Decentralized Nature: Unlike traditional currencies controlled by governments or central banks, Bitcoin's decentralized nature makes it resistant to manipulation and inflation. Its limited supply of 21 million coins contributes to its scarcity and potential for long-term value appreciation.

- Global Adoption: Bitcoin's increasing adoption as a store of value and a medium of exchange globally fuels its potential for growth. The expanding cryptocurrency market cap further strengthens this outlook. Many are considering Bitcoin a hedge against inflation and a potential alternative to traditional financial systems.

- Keywords: Bitcoin price prediction, Bitcoin investment, cryptocurrency investment, decentralized finance (DeFi), blockchain technology, digital currency, cryptocurrency market cap

Bitcoin's resistance to censorship and inflation is a key differentiator. Traditional financial systems are susceptible to government intervention and inflationary pressures, while Bitcoin offers a potential alternative. This decentralized architecture is a significant factor driving its appeal to investors seeking diversification and protection against economic uncertainty.

Risks Associated with Bitcoin Investment

- Volatility: Bitcoin's price is notoriously volatile, experiencing significant price swings in short periods. This inherent volatility presents a considerable risk for investors.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving globally. Changes in regulations can significantly impact Bitcoin's price and accessibility.

- Security Risks: Security breaches, hacking, and loss of private keys are significant risks associated with Bitcoin ownership. Investors need to employ robust security measures to protect their holdings.

- Market Manipulation: The possibility of market manipulation by large players or coordinated efforts cannot be disregarded.

- Keywords: Bitcoin volatility, cryptocurrency regulation, Bitcoin security, crypto scams, digital asset risk

The potential for complete loss of investment is a very real possibility with Bitcoin. Effective risk management strategies, such as diversification and only investing what you can afford to lose, are crucial.

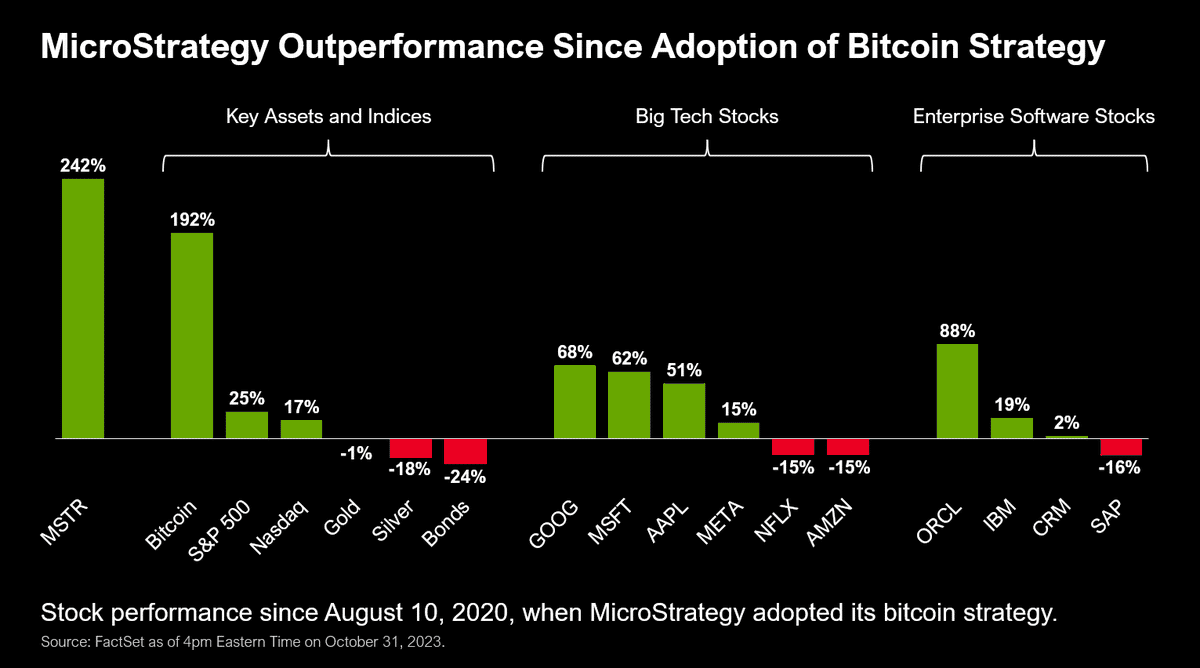

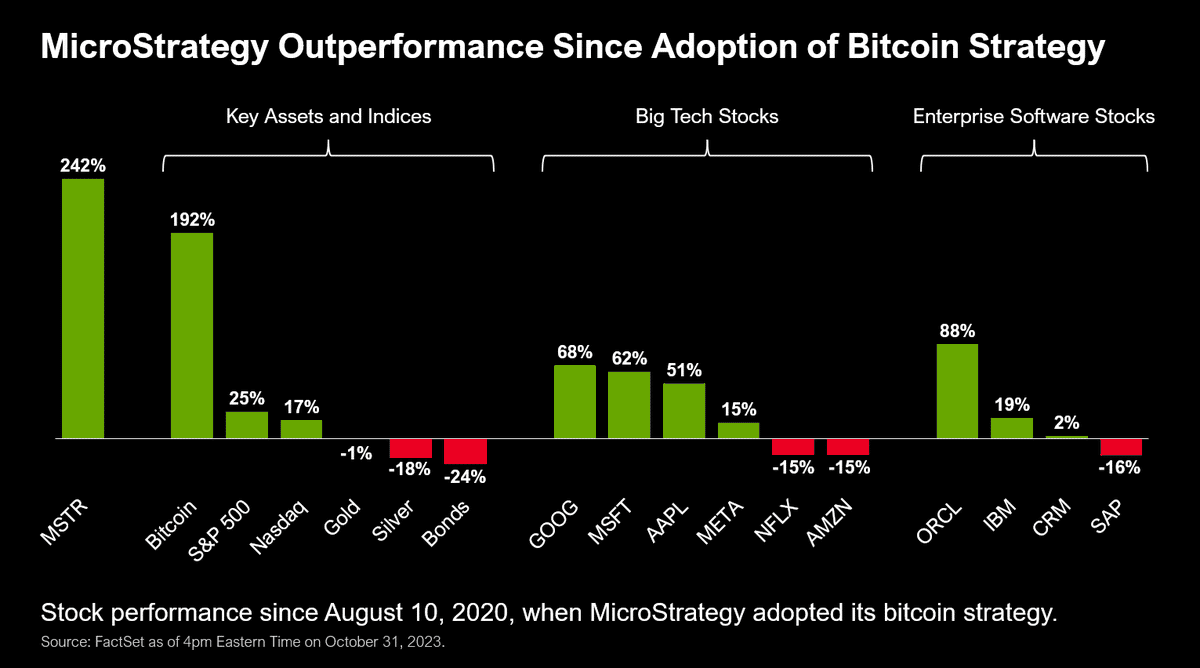

Analyzing MicroStrategy's Bitcoin Strategy and Stock Performance

MicroStrategy's Bitcoin Holdings and Business Model

- Significant Bitcoin Holdings: MicroStrategy, a business intelligence company, has made a significant bet on Bitcoin, holding a substantial amount of the cryptocurrency as a treasury reserve asset. This bold strategy has tied its fortunes to Bitcoin's price performance.

- Business Model Dependence: MicroStrategy's business model, while encompassing business intelligence software, is significantly influenced by the performance of its Bitcoin holdings. This creates a high degree of correlation between its stock price and Bitcoin's price.

- Corporate Bitcoin Adoption: MicroStrategy's adoption of Bitcoin as a treasury asset has paved the way for other corporations to consider similar strategies, boosting Bitcoin's institutional adoption.

- Keywords: MicroStrategy stock price, MicroStrategy Bitcoin holdings, MSTR stock analysis, corporate Bitcoin adoption, business intelligence software

The impact of Bitcoin's price fluctuations on MicroStrategy's stock price is undeniable. A significant increase in Bitcoin's value boosts MicroStrategy's balance sheet and stock price, and vice versa.

Evaluating the Risks and Rewards of Investing in MicroStrategy Stock

- Correlation with Bitcoin: MicroStrategy's stock price is heavily correlated with Bitcoin's price. This creates both significant upside potential and downside risk.

- Risks of Bitcoin Dependence: Investing in MicroStrategy involves taking on the risks associated with Bitcoin's volatility and regulatory uncertainty, amplified by the company's significant exposure to this single asset.

- Potential Rewards: If Bitcoin's value appreciates significantly, MicroStrategy's stock price is likely to follow, providing substantial returns for investors.

- Keywords: MicroStrategy investment, stock market investment, MSTR stock forecast, risk assessment, investment strategy

Compared to a direct Bitcoin investment, MicroStrategy stock offers a more regulated and potentially less volatile entry point into the Bitcoin market, but it still carries significant risk due to its high correlation with Bitcoin's price.

Bitcoin vs. MicroStrategy: A Comparative Analysis for 2025

Weighing the Potential Returns and Risks

| Feature | Bitcoin | MicroStrategy Stock |

|---|---|---|

| Volatility | High | High (correlated with Bitcoin) |

| Liquidity | High (depending on exchange) | High |

| Long-Term Potential | High (depending on adoption) | High (depending on Bitcoin's performance) |

| Risk | High (loss of private keys, regulation) | High (dependent on Bitcoin's price) |

| Investment Type | Digital Asset | Equity |

Keywords: Bitcoin vs Stock, cryptocurrency vs stocks, investment comparison, asset allocation, portfolio diversification

Considering Your Investment Goals and Risk Tolerance

Investors with a high-risk tolerance and a long-term investment horizon might find Bitcoin more appealing, despite its volatility. Conversely, those seeking a slightly less volatile but still Bitcoin-exposed investment might consider MicroStrategy stock. However, both options carry substantial risk. Diversification is key to mitigating risk.

Conclusion

Choosing between Bitcoin and MicroStrategy stock for investment in 2025 hinges on your risk tolerance and investment goals. Bitcoin offers potentially higher rewards but carries significantly higher volatility and risk. MicroStrategy stock offers a more indirect exposure to Bitcoin, with potential benefits but still considerable risk due to its strong correlation with Bitcoin's price. This analysis highlights the strengths and weaknesses of both options. Remember, conducting thorough research, defining a clear investment strategy, and understanding your own risk profile is crucial before investing in either Bitcoin, MicroStrategy stock, or any asset. Remember to consult with a qualified financial advisor before making any investment decisions. Careful consideration of Bitcoin investment strategies and MicroStrategy stock performance, combined with diversification, is essential for navigating this complex landscape successfully.

Featured Posts

-

Extradition Bid Malaysia Targets Disgraced Ex Goldman Partner In 1 Mdb Case

May 08, 2025

Extradition Bid Malaysia Targets Disgraced Ex Goldman Partner In 1 Mdb Case

May 08, 2025 -

Is An Ethereum Price Surge On The Horizon

May 08, 2025

Is An Ethereum Price Surge On The Horizon

May 08, 2025 -

Arsenal Ps Zh Barselona Inter Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025

Arsenal Ps Zh Barselona Inter Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025 -

Impact Of Dwps Six Month Universal Credit Rule Change

May 08, 2025

Impact Of Dwps Six Month Universal Credit Rule Change

May 08, 2025 -

Liga De Quito Empata Con Flamengo En La Copa Libertadores

May 08, 2025

Liga De Quito Empata Con Flamengo En La Copa Libertadores

May 08, 2025