Bitcoin Hits All-Time High Amidst Positive US Regulatory Outlook

Table of Contents

Surge in Bitcoin Price: A Deep Dive into the Recent All-Time High

Technical Analysis of Bitcoin's Price Movement

Bitcoin's recent price explosion is evident in its chart analysis. We're witnessing a clear bullish market trend, with trading volume significantly increasing alongside the price. Several key technical indicators confirm this upward momentum.

- RSI (Relative Strength Index): The RSI has consistently remained above 70, suggesting overbought conditions, but the upward trend persists, indicating strong buying pressure.

- MACD (Moving Average Convergence Divergence): The MACD line has crossed above the signal line, a clear bullish signal, further validating the upward trend.

- Moving Averages: Both the 50-day and 200-day moving averages are trending upwards, providing strong support for the current price level and indicating a long-term bullish trend.

- Significant Price Breakouts: Bitcoin has consistently broken through key resistance levels, demonstrating the strength of the bullish momentum.

Institutional Investment Fuels Bitcoin's Growth

The surge in Bitcoin's price is not solely driven by retail investors. Institutional investment is playing a pivotal role in fueling this growth. The increased involvement of large-scale investors signals a growing acceptance of Bitcoin as a legitimate asset class.

- Grayscale Bitcoin Trust (GBTC): The continued accumulation of Bitcoin by GBTC highlights the significant institutional appetite for Bitcoin exposure.

- Hedge Fund Investment: Several prominent hedge funds have increased their Bitcoin holdings, further contributing to the rising demand. While exact figures are often confidential, public statements indicate billions of dollars in allocated capital.

- MicroStrategy's Bitcoin Strategy: Companies like MicroStrategy have made headlines by allocating a significant portion of their treasury reserves to Bitcoin, signaling a shift in corporate investment strategies.

Growing Demand and Scarcity

Bitcoin's inherent scarcity is a major driver of its price appreciation. The fixed supply of 21 million Bitcoin, combined with growing demand from both retail and institutional investors, creates a classic supply and demand imbalance.

- Bitcoin Halving: The Bitcoin halving mechanism, which reduces the rate of new Bitcoin creation, contributes significantly to its scarcity and long-term price appreciation potential. The next halving event is anticipated to further tighten supply.

- Increased Demand: Factors such as increasing adoption by businesses and the growing awareness of Bitcoin's potential as a hedge against inflation are driving demand.

- Market Capitalization: Bitcoin’s ever-growing market capitalization underlines its increasing dominance and value within the cryptocurrency market.

The Impact of a Positive US Regulatory Outlook on Bitcoin's Price

Clarity on Regulatory Frameworks

The potential for greater regulatory clarity in the US is a game-changer for the Bitcoin market. Uncertainty surrounding regulations has historically dampened investor confidence. A clearer regulatory framework reduces risk and fosters greater participation.

- SEC Developments: The Securities and Exchange Commission's (SEC) ongoing engagement with the crypto industry, while sometimes scrutinizing, is showing signs of shaping a framework for responsible innovation.

- CFTC Involvement: The Commodity Futures Trading Commission's (CFTC) regulatory actions regarding Bitcoin futures contracts have legitimized Bitcoin within established financial markets.

- Proposed Legislation: Discussions surrounding comprehensive crypto legislation in the US, despite ongoing debates, provide a sense of direction and anticipation for the future.

Increased Institutional Participation Due to Regulatory Clarity

Regulatory clarity is crucial for encouraging institutional investment. Large financial institutions are often hesitant to invest in assets with unclear regulatory statuses due to compliance and risk management concerns.

- Regulatory Compliance: Clearer regulations make it easier for institutions to comply with existing laws and regulations, mitigating potential legal and reputational risks.

- Risk Mitigation: Regulatory frameworks can help establish standards for custody, security, and compliance, reducing the risks associated with holding and trading Bitcoin.

- Institutional Grade Custody: The emergence of regulated and secure custody solutions designed for institutional investors is actively contributing to increased adoption.

Potential for Wider Adoption and Mainstream Acceptance

Positive regulatory developments in the US are paving the way for wider adoption of Bitcoin as a legitimate asset class. This could significantly boost its price and pave the way for mainstream acceptance.

- Mainstream Payment Processing: Increased regulatory clarity could open doors for broader use of Bitcoin in payment processing, leading to increased demand.

- Decentralized Finance (DeFi): Positive regulations could accelerate the growth of DeFi applications built on the Bitcoin blockchain, adding another layer of utility to the cryptocurrency.

- Bitcoin ETF Approval: The potential approval of a Bitcoin exchange-traded fund (ETF) could significantly increase accessibility and liquidity, attracting even more investors.

Conclusion

Bitcoin's recent all-time high is a result of several interconnected factors. The technical strength of the market, fueled by significant institutional investment and growing demand, has created a perfect storm. Crucially, the increasingly positive US regulatory outlook is providing a crucial boost to investor confidence and encouraging greater participation. This improved regulatory environment is not just supporting the current price surge but also sets the stage for future growth and wider mainstream adoption. Bitcoin's journey is far from over.

Call to Action: Learn more about Bitcoin and its potential. Stay informed about price fluctuations and regulatory developments to make informed investment decisions. Invest wisely in Bitcoin while the market shows positive signs, but remember to always conduct thorough research and assess your own risk tolerance.

Featured Posts

-

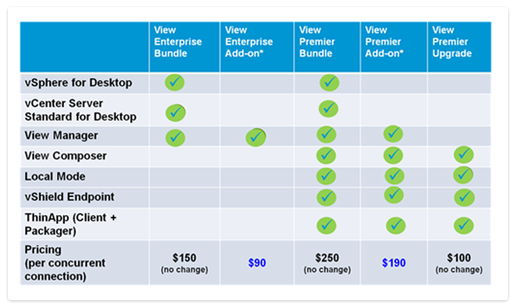

V Mware Price Shock At And T Reports 1 050 Increase From Broadcom

May 24, 2025

V Mware Price Shock At And T Reports 1 050 Increase From Broadcom

May 24, 2025 -

U S Penny Phase Out Circulation Halt By Early 2026

May 24, 2025

U S Penny Phase Out Circulation Halt By Early 2026

May 24, 2025 -

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025 -

Drivers Face Significant Delays On M6 Southbound After Crash

May 24, 2025

Drivers Face Significant Delays On M6 Southbound After Crash

May 24, 2025 -

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudby I Nyneshnyaya Zhizn

May 24, 2025

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudby I Nyneshnyaya Zhizn

May 24, 2025

Latest Posts

-

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025 -

Sylvester Stallones Tulsa King Season 2 Blu Ray Release Date And Sneak Peek

May 24, 2025

Sylvester Stallones Tulsa King Season 2 Blu Ray Release Date And Sneak Peek

May 24, 2025 -

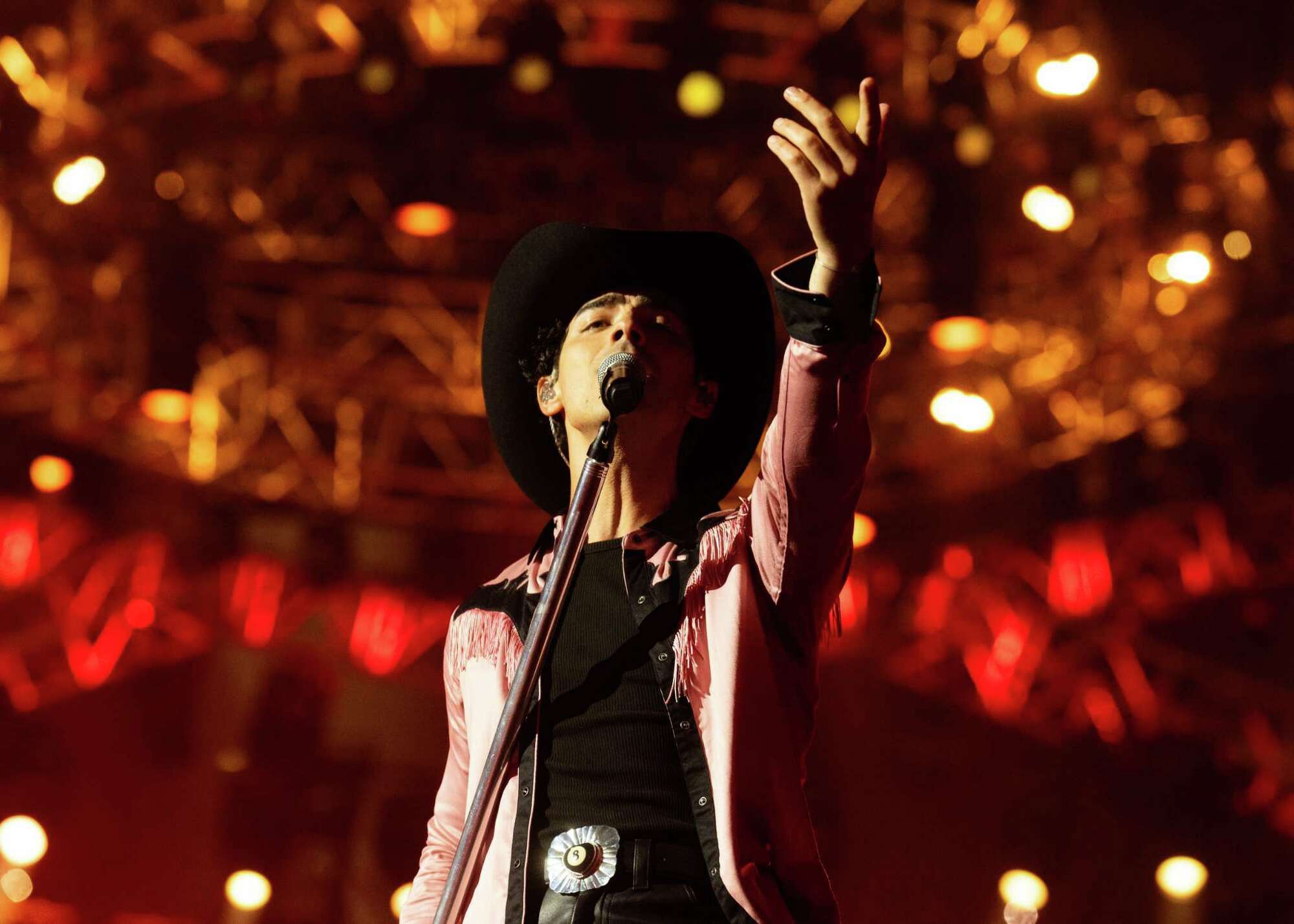

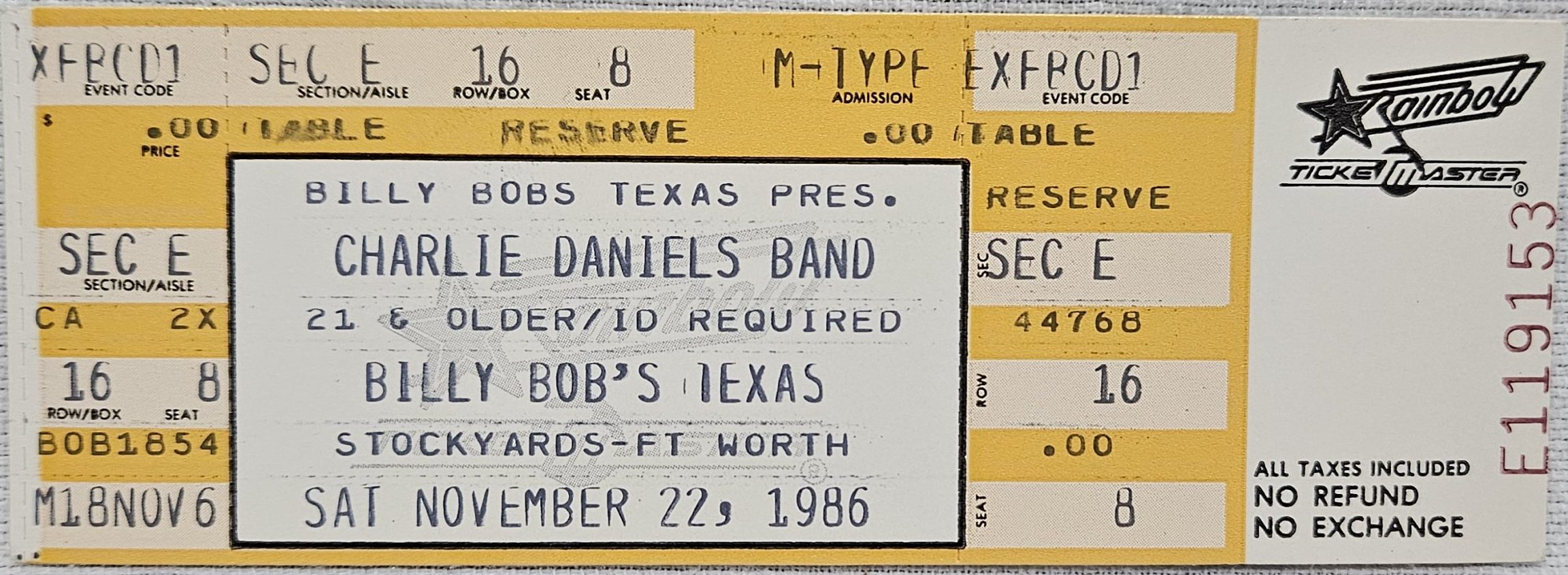

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025 -

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025 -

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025