BigBear.ai Stock: Buy, Sell, Or Hold?

Table of Contents

BigBear.ai's Financial Performance and Valuation

Understanding BigBear.ai's financial health is crucial for any investment decision. Let's examine key aspects of its performance and valuation.

Revenue Growth and Profitability

BigBear.ai's revenue growth trajectory and profitability margins are key indicators of its financial strength. Analyzing year-over-year growth, alongside profitability challenges and future projections, offers crucial insights into the company’s financial stability.

- Year-over-Year Growth: Examine the company's reported revenue figures for the past few years to identify trends. Consistent and substantial growth is a positive sign, indicating a healthy and expanding business. (Note: Specific data should be inserted here from reputable financial sources, such as SEC filings or financial news websites).

- Profitability Challenges: Assess BigBear.ai's profitability, considering metrics like gross profit margin, operating profit margin, and net profit margin. Analyze any historical losses and the company's strategies to achieve profitability. (Again, insert specific data here).

- Future Projections: Consider analyst forecasts and the company's own guidance on future revenue growth and profitability. This helps to anticipate future financial performance.

Key financial ratios like the Price-to-Earnings (P/E) ratio, along with other relevant valuation metrics, should also be considered to gauge the stock's valuation relative to its earnings and industry peers.

Debt and Cash Flow

Analyzing BigBear.ai's debt levels, cash flow, and liquidity reveals its financial stability and ability to meet its obligations.

- Debt-to-Equity Ratio: A high debt-to-equity ratio can indicate significant financial risk, while a lower ratio suggests greater financial stability. (Insert relevant data).

- Free Cash Flow: Positive and growing free cash flow demonstrates the company's ability to generate cash after covering its operating expenses and capital expenditures. This is a crucial factor for long-term sustainability. (Insert relevant data).

- Working Capital: Sufficient working capital ensures that BigBear.ai has enough liquid assets to meet its short-term obligations. (Insert relevant data).

Competitive Landscape and Market Position

BigBear.ai operates in a dynamic market; understanding its competitive positioning is essential.

Key Competitors and Market Share

BigBear.ai competes with several established players in the AI and government contracting sectors. Identifying these key competitors and comparing their market share, strengths, and weaknesses provides context for BigBear.ai's position. (List key competitors and provide a comparative analysis, citing reputable sources).

- Market Share Analysis: Determining BigBear.ai's market share within its target segments is crucial to assess its competitive strength. (Include data if available).

- Competitive Advantages: Identify BigBear.ai's unique strengths, such as its proprietary technology, expertise in specific AI applications, or strong relationships with government agencies.

Market Growth Potential

The overall market growth potential for BigBear.ai’s services and products is a critical factor.

- AI Market Growth: The artificial intelligence market is experiencing rapid growth, presenting significant opportunities for BigBear.ai. (Cite relevant market research data).

- Government Technology Spending: Government spending on technology, particularly AI-driven solutions, is expected to continue increasing. This presents a significant potential market for BigBear.ai's services. (Cite relevant sources).

- BigBear.ai's Growth Opportunities: Identify specific growth opportunities for BigBear.ai within these expanding markets, considering their strategic initiatives and expansion plans.

BigBear.ai's Technological Advantages and Innovations

BigBear.ai's success hinges on its technological capabilities.

- Proprietary Technologies: Assess the strength and uniqueness of BigBear.ai's proprietary technologies and their competitive advantages. (Detail these technologies, if publicly known).

- R&D Investments: Analyze the company's investment in research and development, indicating its commitment to innovation and long-term growth. (Include data if available).

- AI Solutions: Evaluate the range and quality of BigBear.ai's AI solutions and their applicability across various sectors.

Risk Assessment for BigBear.ai Stock

Investing in BigBear.ai involves inherent risks.

Financial Risks

Several financial risks could affect BigBear.ai's performance.

- Revenue Volatility: The nature of the government contracting business can lead to revenue volatility. (Discuss potential causes and mitigating factors).

- Profitability Challenges: The company's path to consistent profitability should be closely examined. (Analyze potential obstacles and the company's plans to overcome them).

- Debt Levels: High debt levels can pose a financial risk, especially during economic downturns. (Analyze the level of debt and its impact on the company's financial health).

Market Risks

External factors can also significantly impact BigBear.ai's stock price.

- Competition Risk: Intense competition in the AI and government contracting sectors poses a significant risk. (Discuss the competitive landscape and its potential impact on BigBear.ai).

- Regulatory Risk: Changes in government regulations could affect BigBear.ai's operations and profitability. (Discuss potential regulatory changes and their possible impact).

- Macroeconomic Factors: Broader economic conditions, such as recessions or geopolitical instability, can significantly influence investor sentiment and stock prices. (Analyze potential macroeconomic risks).

Conclusion: BigBear.ai Stock: The Verdict

Based on our analysis of BigBear.ai's financial performance, competitive landscape, technological capabilities, and inherent risks, a comprehensive assessment can be made. (Here, provide a concise summary of the findings, weighing the pros and cons discussed above. Then, clearly state a recommendation: Buy, Sell, or Hold. Justify this recommendation based on your analysis). Remember to always conduct your own thorough due diligence before making any investment decisions.

What are your thoughts on BigBear.ai stock? Share your analysis in the comments below. Remember to always conduct your own thorough research before investing in BBAI stock or any other security.

Featured Posts

-

Abidjan Accueille Le Premier Marche Africain Des Solutions Spatiales Mass

May 20, 2025

Abidjan Accueille Le Premier Marche Africain Des Solutions Spatiales Mass

May 20, 2025 -

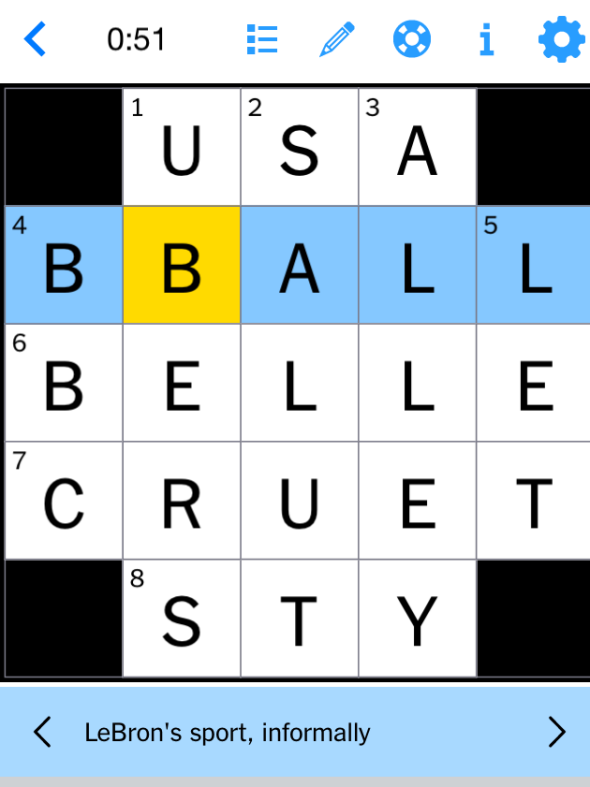

Todays Nyt Mini Crossword Answers March 22nd Solutions

May 20, 2025

Todays Nyt Mini Crossword Answers March 22nd Solutions

May 20, 2025 -

Ewdt Aghatha Krysty Kyf Ysahm Aldhkae Alastnaey Fy Ktabt Rwayat Jdydt

May 20, 2025

Ewdt Aghatha Krysty Kyf Ysahm Aldhkae Alastnaey Fy Ktabt Rwayat Jdydt

May 20, 2025 -

Amazons Spring 2025 Sale Big Discounts On Hugo Boss Perfumes

May 20, 2025

Amazons Spring 2025 Sale Big Discounts On Hugo Boss Perfumes

May 20, 2025 -

Malta Mot Sverige Jacob Friis Debutsaesong Inleds Med Seger

May 20, 2025

Malta Mot Sverige Jacob Friis Debutsaesong Inleds Med Seger

May 20, 2025

Latest Posts

-

Arne Slots Psg Masterclass Was Liverpools Victory Down To Luck Or Goalkeeping Prowess

May 21, 2025

Arne Slots Psg Masterclass Was Liverpools Victory Down To Luck Or Goalkeeping Prowess

May 21, 2025 -

1 1

May 21, 2025

1 1

May 21, 2025 -

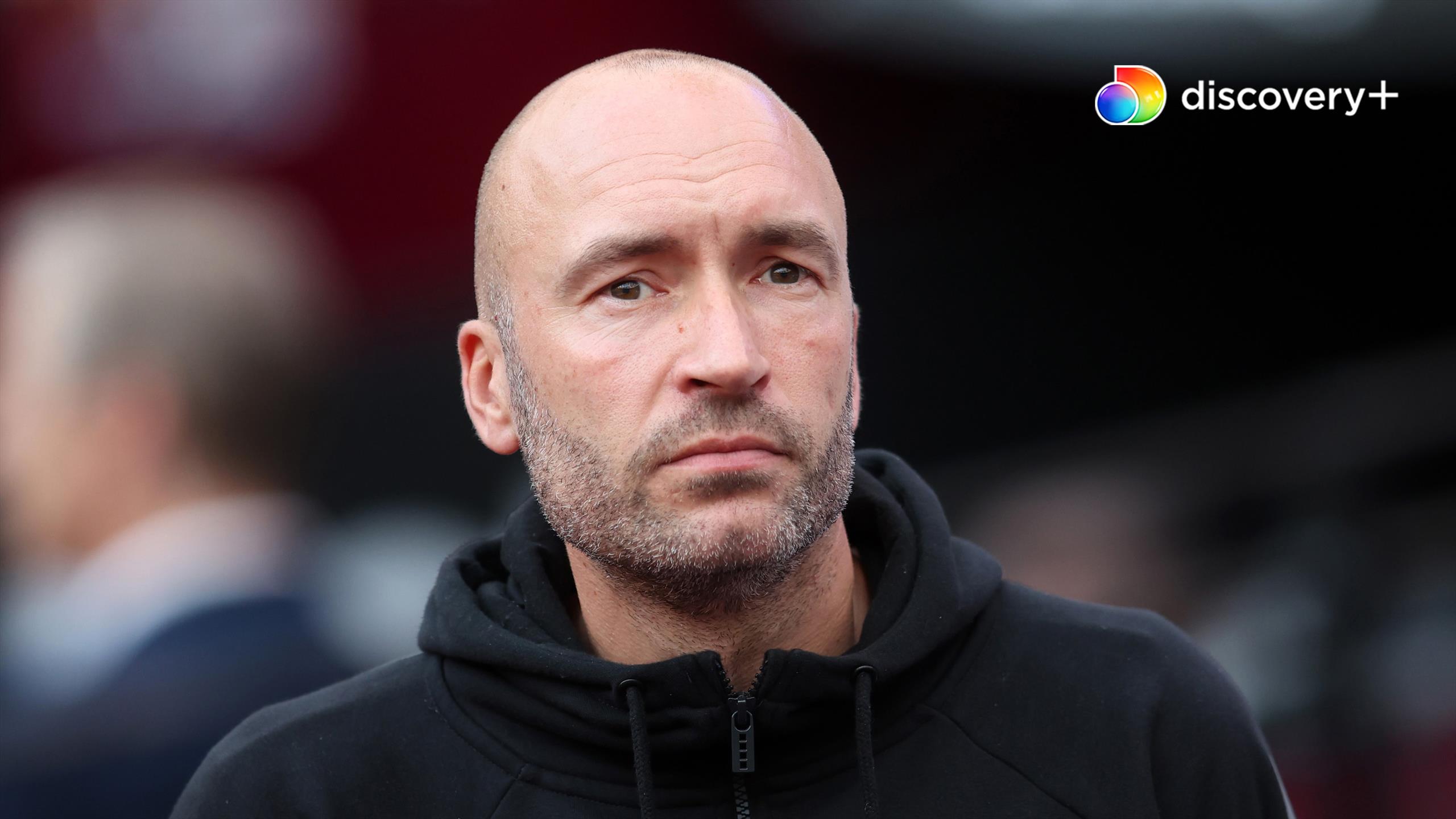

Is An Arsenal Legend The Next Manchester City Manager A Report Emerges

May 21, 2025

Is An Arsenal Legend The Next Manchester City Manager A Report Emerges

May 21, 2025 -

Ea Fc 24 Fut Birthday Tier List Of The Best Cards To Use

May 21, 2025

Ea Fc 24 Fut Birthday Tier List Of The Best Cards To Use

May 21, 2025 -

Understanding The Sound Perimeter Music And Community

May 21, 2025

Understanding The Sound Perimeter Music And Community

May 21, 2025