BigBear.ai Stock: A Comprehensive Investment Review

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai is a leading provider of artificial intelligence (AI)-powered data analytics and digital transformation solutions. Its core business revolves around leveraging advanced AI and machine learning technologies to solve complex problems for its clients in both the government and commercial sectors. Their target market encompasses a broad range of industries, including defense, intelligence, and cybersecurity, as well as commercial applications in areas like financial services and healthcare.

BigBear.ai differentiates itself through its unique blend of advanced technology and deep domain expertise. While facing competition from larger players, it has established a strong niche with specialized solutions and a dedicated customer base.

- Key Competitors: Palantir Technologies, Booz Allen Hamilton, Accenture Federal Services

- BigBear.ai's Competitive Advantages: Specialized AI algorithms, extensive experience in government contracting, strong customer relationships, and a focus on mission-critical solutions.

- Market Share and Growth Potential: BigBear.ai occupies a segment of the rapidly expanding AI and data analytics market, indicating substantial growth potential, especially within the government sector. However, intense competition demands continuous innovation and strategic partnerships.

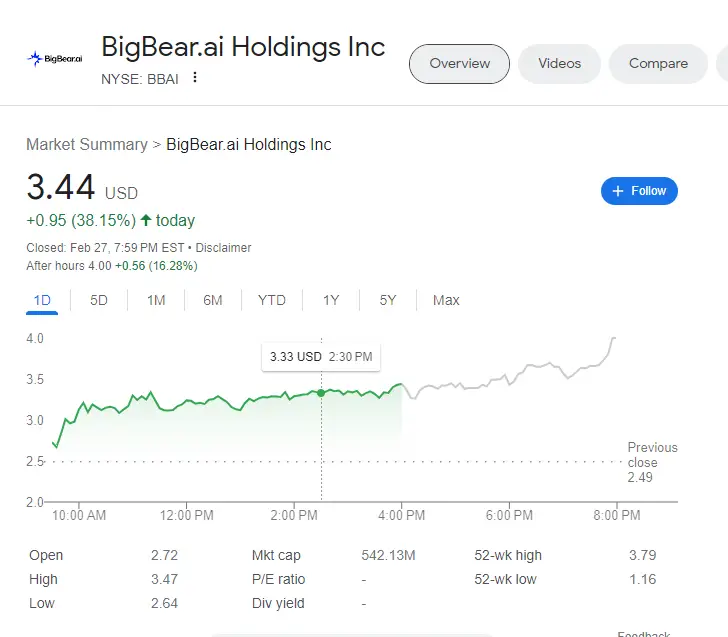

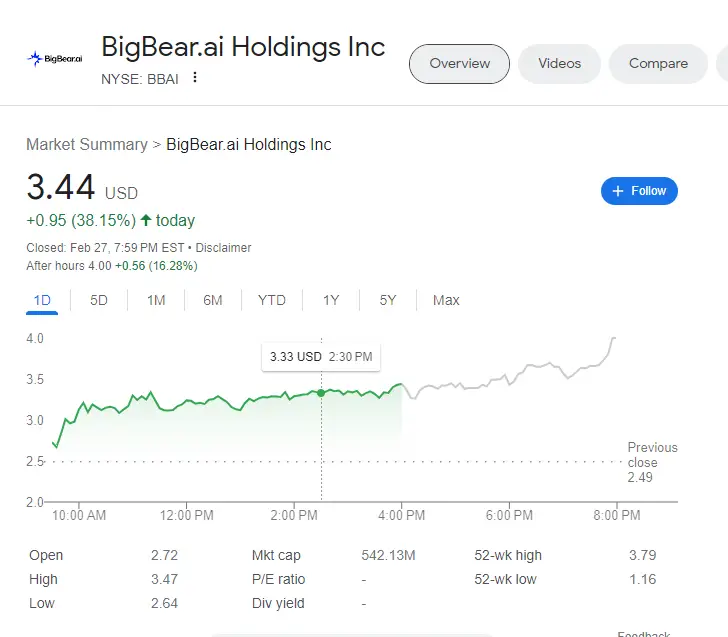

Financial Performance and Key Metrics of BigBear.ai Stock

Analyzing BigBear.ai's financial performance requires careful examination of several key metrics. Reviewing recent earnings reports, investor presentations, and financial statements is crucial for a thorough understanding. While revenue growth might be positive, profitability and margins require close scrutiny. Consider the following:

- Key Financial Data: Revenue growth rate, profit margins (gross and operating), debt-to-equity ratio, cash flow from operations. (Specific figures should be sourced from the company's financial reports.)

- Financial Ratio Analysis: P/E ratio, price-to-sales ratio, return on equity (ROE) should be compared to industry benchmarks to provide context.

- Significant Financial Events: Any acquisitions, mergers, or significant contracts awarded should be noted for their potential impact on BigBear.ai stock valuation. Keeping up-to-date with news and SEC filings is essential for accurate evaluation.

Risk Assessment and Potential Challenges Facing BigBear.ai

Investing in BigBear.ai stock involves inherent risks. A thorough risk assessment is crucial before making any investment decisions.

- Potential Risks: Intense competition from established players, technological disruption, economic downturns affecting government spending, regulatory changes impacting the AI and data analytics sector, and the inherent volatility of the technology stock market.

- Risk Mitigation Strategies: BigBear.ai's success depends on its ability to continue innovating, securing new contracts, and managing its financial resources effectively. Its diversification across sectors and commitment to R&D are mitigating factors.

- Geopolitical Impact: Global events can impact government spending and contract awards, creating both opportunities and challenges for BigBear.ai.

Investment Outlook and Future Predictions for BigBear.ai Stock

The investment outlook for BigBear.ai stock is complex and depends on several factors. While the company operates in a high-growth market, significant challenges remain.

- Growth Drivers: Continued innovation, successful government contract wins, expansion into new commercial markets, and strategic partnerships.

- Headwinds: Competitive pressures, potential economic slowdown, and challenges in scaling operations.

- Potential Price Targets (Disclaimer): Any price targets provided here are purely speculative and should not be considered financial advice. Thorough research and independent analysis are necessary. (Avoid offering specific price targets without strong justification and disclaimers).

- Investment Recommendation (Disclaimer): (This section must include a clear disclaimer stating that this is not financial advice. A cautious approach is advised, possibly suggesting further research or consulting a financial advisor before making any investment decisions.) For example, a possible statement could be: "Based on the analysis, a cautious approach may be warranted. However, this is not financial advice, and further due diligence is strongly recommended before any investment decisions are made."

Conclusion: Final Thoughts on BigBear.ai Stock Investment

This BigBear.ai stock analysis reveals a company operating in a dynamic and rapidly evolving market. While possessing strong potential, investing in BigBear.ai involves significant risks. The company's success hinges on its ability to navigate competitive pressures, secure new contracts, and effectively manage its financial resources. Before committing to any BigBear.ai investment, understanding the inherent risks and conducting thorough due diligence is absolutely crucial. Remember to consult with a qualified financial advisor for personalized investment advice tailored to your individual financial situation and risk tolerance. This BigBear.ai investment review should serve as a starting point for your own comprehensive research.

Featured Posts

-

Vodacom Vod Q Quarter Earnings Surpass Forecasts Dividend Increase

May 20, 2025

Vodacom Vod Q Quarter Earnings Surpass Forecasts Dividend Increase

May 20, 2025 -

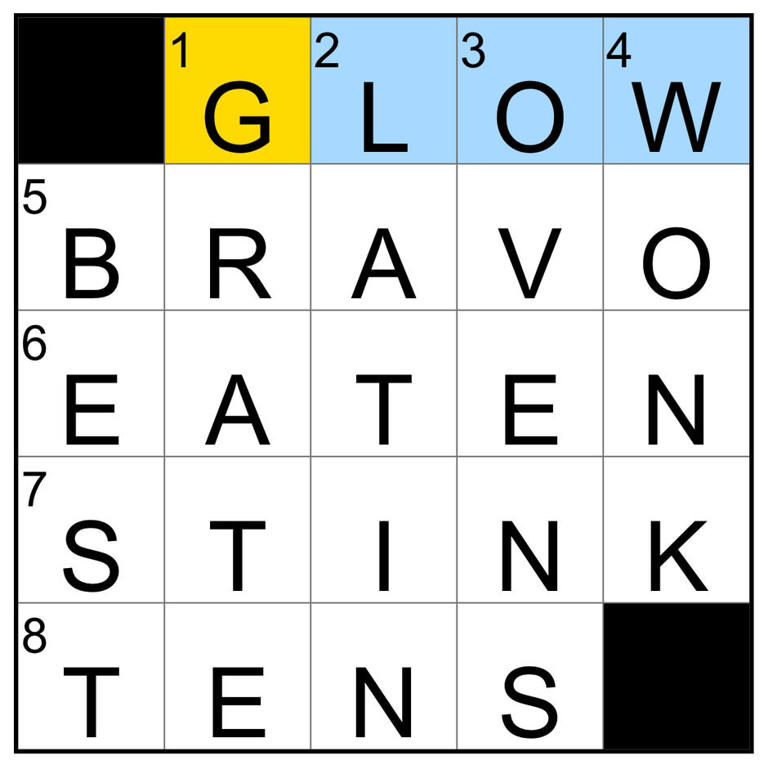

Todays Nyt Mini Crossword Answers April 25th

May 20, 2025

Todays Nyt Mini Crossword Answers April 25th

May 20, 2025 -

Strike Over Nj Transit Engineers Union Agrees To Contract

May 20, 2025

Strike Over Nj Transit Engineers Union Agrees To Contract

May 20, 2025 -

Robert P Burke Former Navy Admiral Convicted On Bribery Charges

May 20, 2025

Robert P Burke Former Navy Admiral Convicted On Bribery Charges

May 20, 2025 -

John Cena And Randy Orton Potential Feud And Bayleys Injury News

May 20, 2025

John Cena And Randy Orton Potential Feud And Bayleys Injury News

May 20, 2025

Latest Posts

-

Redditova Prica Postaje Film Sa Sidnej Sveni

May 21, 2025

Redditova Prica Postaje Film Sa Sidnej Sveni

May 21, 2025 -

Sydney Sweeney To Star In Movie Based On Viral Reddit Story Missing Girl

May 21, 2025

Sydney Sweeney To Star In Movie Based On Viral Reddit Story Missing Girl

May 21, 2025 -

Film Po Popularnoj Redditovoj Prici Sidnej Sveni U Glavnoj Ulozi

May 21, 2025

Film Po Popularnoj Redditovoj Prici Sidnej Sveni U Glavnoj Ulozi

May 21, 2025 -

Javier Baez Salud Rendimiento Y El Futuro En Las Grandes Ligas

May 21, 2025

Javier Baez Salud Rendimiento Y El Futuro En Las Grandes Ligas

May 21, 2025 -

Film Adaptation Of Outrun Video Game Michael Bay At The Helm Sydney Sweeney Confirmed

May 21, 2025

Film Adaptation Of Outrun Video Game Michael Bay At The Helm Sydney Sweeney Confirmed

May 21, 2025