BigBear.ai Q1 Earnings Miss Expectations, Stock Price Drops

Table of Contents

BigBear.ai's Q1 Earnings Miss: A Detailed Look

The Q1 2024 earnings report revealed a significant shortfall compared to analyst projections. Key financial metrics painted a concerning picture for BigBear.ai's immediate future. Let's examine the specifics:

-

Revenue Shortfall: BigBear.ai reported [Insert actual revenue figure] in Q1 2024, falling considerably short of the anticipated [Insert analyst consensus revenue figure]. This represents a [Calculate percentage difference]% decrease compared to expectations.

-

Earnings Per Share (EPS) Miss: The reported EPS of [Insert actual EPS figure] dramatically missed the projected EPS of [Insert projected EPS figure], indicating a substantial decline in profitability.

-

Net Income Decline: Net income plummeted to [Insert actual net income figure], a stark contrast to the projected [Insert projected net income figure]. This significant decrease highlights the severity of the earnings miss.

-

Operating Margin Compression: The operating margin experienced a contraction, reaching [Insert actual operating margin figure] compared to the anticipated [Insert projected operating margin figure]. This suggests increased operating expenses or decreased efficiency.

-

One-Time Charges: [Mention any one-time charges or unusual items that impacted the results, providing details and their financial impact].

Reasons Behind BigBear.ai's Underperformance

Several factors contributed to BigBear.ai's underwhelming Q1 performance. A comprehensive understanding of these issues is vital for assessing the company's long-term prospects.

-

Government Contract Delays: A major revenue stream for BigBear.ai is government contracting. Delays in securing new contracts, perhaps due to bureaucratic processes or increased competition, likely played a significant role in the revenue shortfall. The company may need to adjust its bidding strategies or diversify its client base.

-

Intense Competition: The AI and government contracting sectors are highly competitive. BigBear.ai faces pressure from established players and emerging competitors, all vying for limited government funding and lucrative contracts. This necessitates a stronger competitive differentiation strategy for BigBear.ai.

-

Market Conditions: The overall economic climate and the specific market conditions within the defense and AI sectors could have negatively impacted BigBear.ai's ability to secure and deliver projects within the projected timeframe. This calls for adaptive strategies to navigate market fluctuations.

-

Strategic Initiatives Effectiveness: The success or failure of BigBear.ai's strategic initiatives in developing and deploying AI solutions could also contribute to the performance gap. A thorough assessment of these initiatives is necessary to identify areas for improvement. A detailed breakdown of the success (or lack thereof) of each initiative would be beneficial for further analysis.

Impact on BigBear.ai's Stock Price

The disappointing Q1 earnings report triggered a significant negative market reaction.

-

Stock Price Volatility: Following the earnings release, BigBear.ai's stock price experienced a [Insert percentage]% drop, reflecting investor concerns about the company's near-term financial health and future prospects.

-

Investor Sentiment: The substantial decline in the stock price indicates a shift in investor sentiment, with many expressing apprehension regarding the company's ability to meet future expectations. High trading volume likely accompanied the stock price drop, showcasing substantial market activity related to the earnings news.

-

Analyst Reactions: [Summarize the reactions and ratings from prominent financial analysts covering BigBear.ai, emphasizing the implications for the stock price]. The short-term outlook for the stock appears uncertain, with potential further volatility anticipated until greater clarity emerges.

BigBear.ai's Future Outlook and Guidance

BigBear.ai's management provided revised guidance for the remaining quarters of 2024, indicating [Summarize the revised guidance, including key metrics like revenue projections, EPS, etc.]. The credibility of this revised guidance will be closely scrutinized by investors.

-

Growth Strategy Adjustments: To address the Q1 shortfall, BigBear.ai might need to make changes to its growth strategy. This could include focusing on specific high-growth areas within the AI and government contracting markets, strengthening sales and marketing efforts, or further streamlining operations.

-

Long-Term Prospects: While the Q1 results are concerning, it is crucial to consider BigBear.ai's long-term prospects. The company's core competencies in AI and its established presence in the government contracting market still hold some potential for future growth. However, decisive action and demonstrable improvement are needed to restore investor confidence.

Conclusion:

BigBear.ai's Q1 earnings miss significantly impacted its stock price, raising serious concerns among investors. While the reasons behind the underperformance are multifaceted, ranging from contract delays to broader market conditions and the effectiveness of strategic initiatives, understanding these factors is crucial for navigating the future of this AI-focused company. The company's revised guidance and its ability to execute on its strategic initiatives will be key determinants of its future success.

Call to Action: Stay informed about BigBear.ai’s performance and future developments by following our updates on their financial reports and market analysis. Continue monitoring the BigBear.ai stock price and the company's response to the Q1 earnings miss for valuable insights into their evolving strategy and long-term prospects in the dynamic AI and government contracting markets. Understanding the nuances of the BigBear.ai earnings miss and its impact on the stock is crucial for making informed investment decisions.

Featured Posts

-

Nyt Mini Crossword Puzzle Solutions April 18 2025

May 21, 2025

Nyt Mini Crossword Puzzle Solutions April 18 2025

May 21, 2025 -

Wayne Gretzky Fast Facts For Hockey Fans

May 21, 2025

Wayne Gretzky Fast Facts For Hockey Fans

May 21, 2025 -

Nintendos Action Against Ryujinx Emulator Development Ceases

May 21, 2025

Nintendos Action Against Ryujinx Emulator Development Ceases

May 21, 2025 -

Ftv Lives A Hell Of A Run An In Depth Look

May 21, 2025

Ftv Lives A Hell Of A Run An In Depth Look

May 21, 2025 -

New Attempt To Break The Trans Australia Run Record

May 21, 2025

New Attempt To Break The Trans Australia Run Record

May 21, 2025

Latest Posts

-

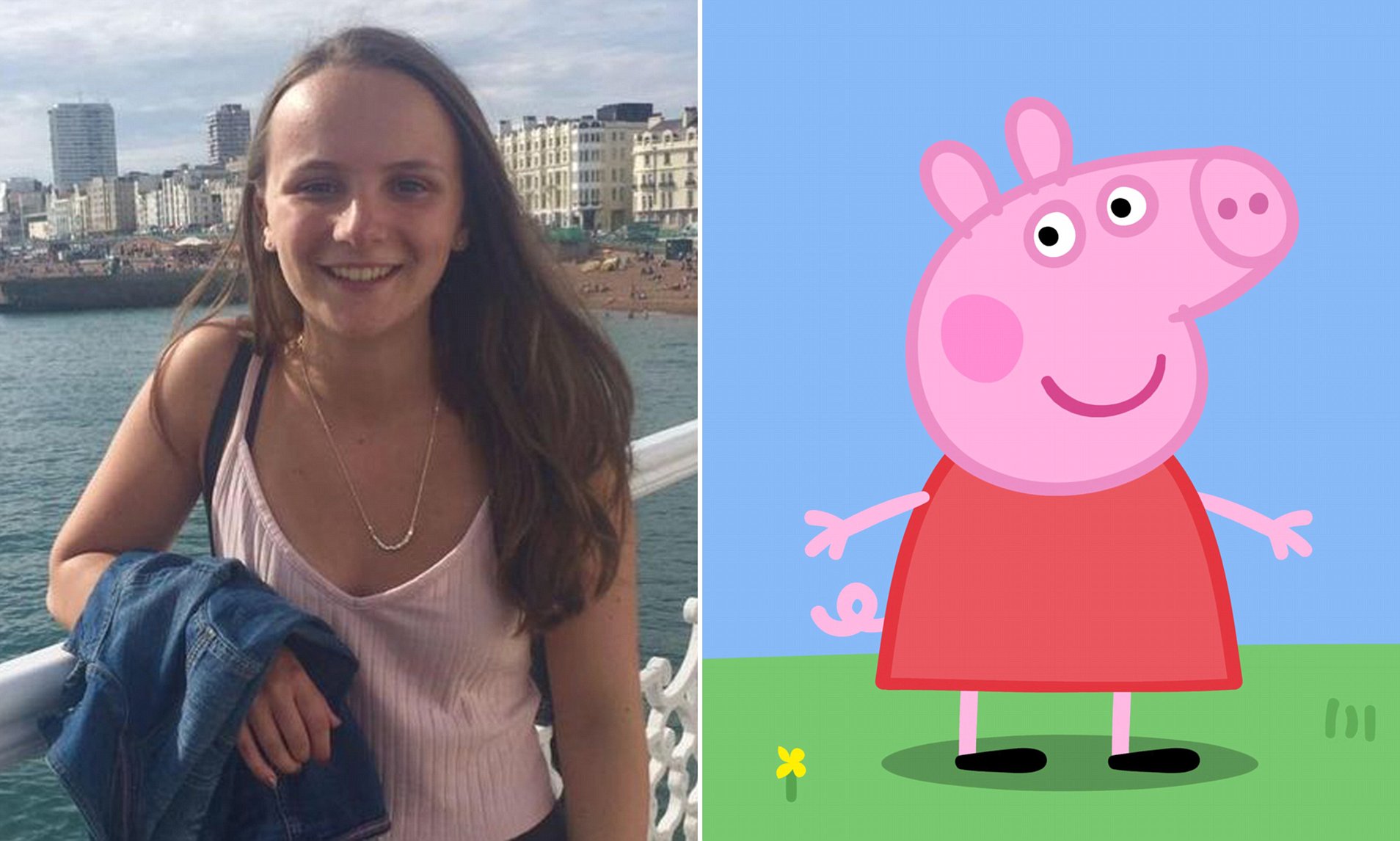

Peppa Pigs Real Name Revealed Fans React To Surprise Discovery

May 22, 2025

Peppa Pigs Real Name Revealed Fans React To Surprise Discovery

May 22, 2025 -

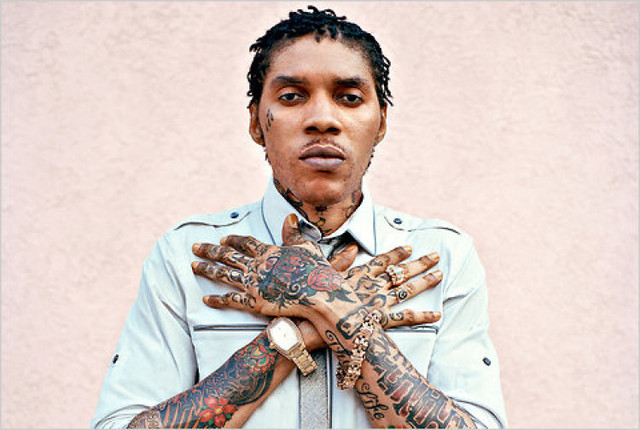

Vybz Kartel Announces Nyc Barclay Center Concert This April

May 22, 2025

Vybz Kartel Announces Nyc Barclay Center Concert This April

May 22, 2025 -

The Unforgettable Vybz Kartel Brooklyn Concerts Sell Out

May 22, 2025

The Unforgettable Vybz Kartel Brooklyn Concerts Sell Out

May 22, 2025 -

Vybz Kartels New York Shows Sold Out Success In Brooklyn

May 22, 2025

Vybz Kartels New York Shows Sold Out Success In Brooklyn

May 22, 2025 -

Brooklyn Roars For Vybz Kartel Sold Out Shows A Testament To His Enduring Popularity

May 22, 2025

Brooklyn Roars For Vybz Kartel Sold Out Shows A Testament To His Enduring Popularity

May 22, 2025