BigBear.ai Faces Securities Fraud Lawsuit: What Investors Need To Know

Table of Contents

Understanding the Allegations in the BigBear.ai Securities Fraud Lawsuit

At the heart of the BigBear.ai securities fraud lawsuit are allegations of misleading statements and omissions made by the company to investors. The plaintiffs, [Insert names of plaintiffs or plaintiff groups if available; otherwise, state "unnamed investors"], claim that BigBear.ai violated Section 10(b) of the Securities Exchange Act of 1934, along with Rule 10b-5, by making materially false and misleading statements concerning [Insert specific areas of alleged misrepresentation, e.g., financial performance, contract wins, technological capabilities]. The defendants named in the lawsuit include [Insert names of defendants if available, e.g., BigBear.ai, specific executives].

- Key claims made by the plaintiffs: The plaintiffs allege that BigBear.ai exaggerated its revenue projections, overstated its contract wins, and misrepresented the capabilities of its artificial intelligence technologies.

- Specific examples of alleged misleading statements or omissions: [Provide specific examples from the lawsuit, if available. For example: "The complaint cites a press release announcing a major contract win that later proved to be significantly smaller than initially reported."]

- The potential financial damages involved: The lawsuit seeks [Insert the amount or type of damages sought, e.g., unspecified monetary damages, restitution for investors].

Impact on BigBear.ai Stock and Investor Confidence

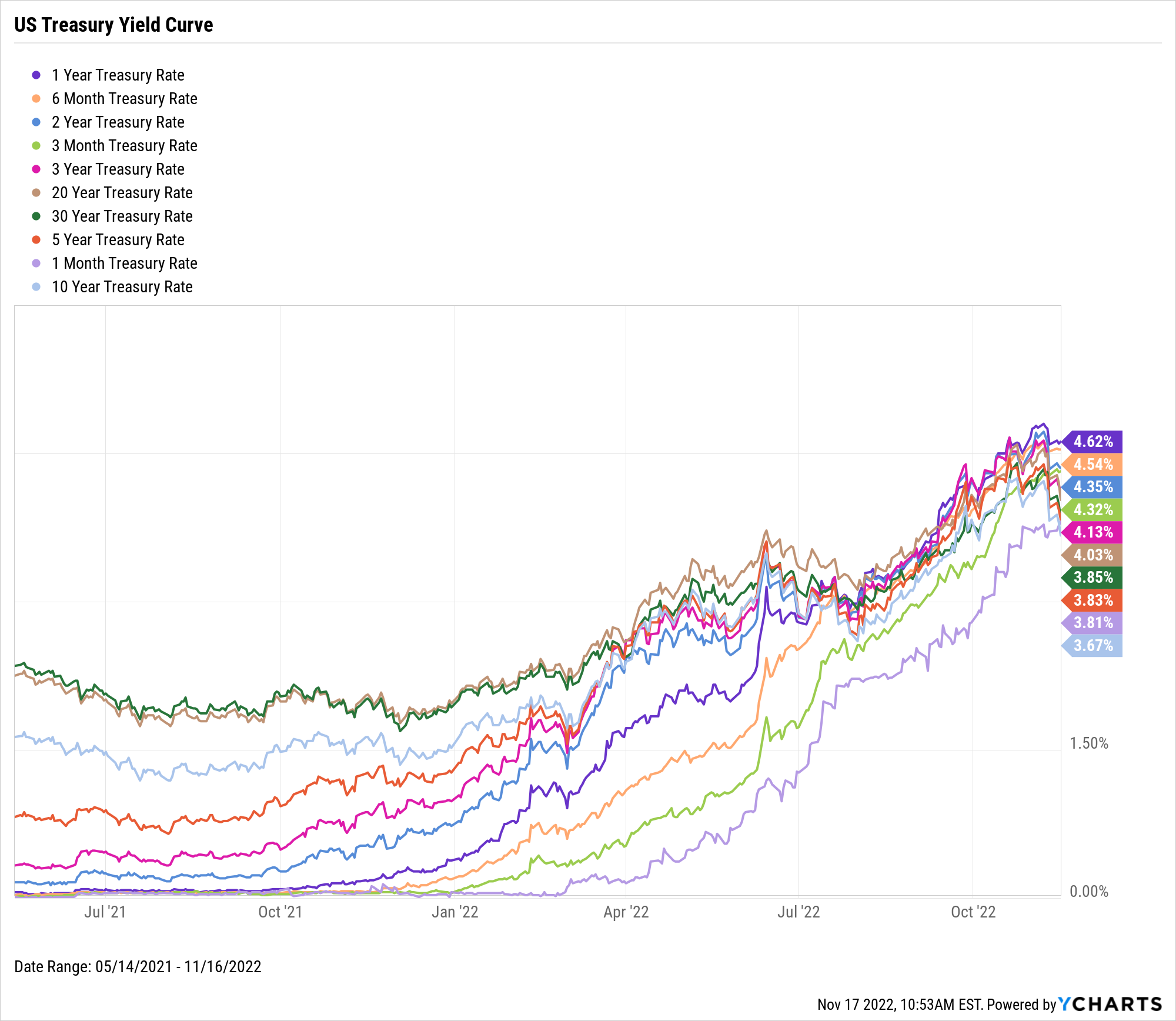

The BigBear.ai securities fraud lawsuit has had a palpable impact on the company's stock price and investor confidence. Since the lawsuit was filed on [Insert date], BigBear.ai's stock price has experienced [Describe the stock price fluctuation, e.g., a significant drop, volatility]. This decline reflects a significant erosion of investor trust in the company's leadership and its future prospects.

- Stock price changes before, during, and after the lawsuit announcement: [Provide specific data points on stock price changes. Use charts and graphs if possible.]

- Analyst reactions and ratings changes: [Report on any changes in analyst ratings or recommendations for BigBear.ai stock.]

- Impact on BigBear.ai's market capitalization: The lawsuit has resulted in a considerable decrease in BigBear.ai's market capitalization, indicating a loss of investor confidence and a diminished valuation.

- Potential impact on future funding rounds or acquisitions: The lawsuit could make it more difficult for BigBear.ai to secure future funding or attract potential acquirers.

Legal Ramifications and Potential Outcomes of the BigBear.ai Lawsuit

The legal process surrounding the BigBear.ai lawsuit is likely to be protracted and complex. The case will progress through various stages, including discovery, motions, and potentially a trial.

- Stages of the legal process (discovery, motions, trial): The timeline for the lawsuit is uncertain, but these stages could span several years.

- Potential penalties (fines, restitution, injunctions): If found guilty, BigBear.ai could face substantial fines, be required to provide restitution to harmed investors, and/or be subject to injunctions restricting its future activities.

- Precedents set by similar securities fraud cases: [Discuss relevant precedents set by similar securities fraud cases that might influence the outcome of the BigBear.ai lawsuit.]

- Expert legal opinions on the likelihood of different outcomes: [If available, include expert opinions on the potential outcomes of the lawsuit.]

Advice for BigBear.ai Investors: What to Do Next

The BigBear.ai securities fraud lawsuit creates significant uncertainty for investors. It's crucial to take proactive steps to manage your risk and protect your investment.

- Consider diversifying your investment portfolio: Reducing your exposure to BigBear.ai by diversifying your investments can mitigate potential losses.

- Monitor news and developments related to the lawsuit: Stay informed about the lawsuit's progress by following reputable financial news sources.

- Consult a financial advisor before making any investment decisions: A financial professional can provide personalized advice based on your specific situation and risk tolerance.

- Document all investment transactions related to BigBear.ai: Maintaining meticulous records of your investments is crucial for potential legal recourse.

Conclusion: Navigating the BigBear.ai Securities Fraud Lawsuit

The BigBear.ai securities fraud lawsuit presents a complex and challenging situation for investors. Understanding the allegations, potential impacts, and legal ramifications is crucial for making informed decisions. Staying informed about BigBear.ai lawsuit updates, monitoring stock price fluctuations, and seeking professional financial guidance are critical steps for navigating this uncertain period. For personalized advice and to stay updated on BigBear.ai investor information, consult with a qualified financial advisor immediately. Don't hesitate to seek expert help to protect your investment in the face of this significant legal challenge.

Featured Posts

-

Hegseth Announces Further Us Military Buildup In The Philippines

May 20, 2025

Hegseth Announces Further Us Military Buildup In The Philippines

May 20, 2025 -

Sell America Moodys 30 Year Yield Hike To 5 And What It Means

May 20, 2025

Sell America Moodys 30 Year Yield Hike To 5 And What It Means

May 20, 2025 -

Traslado En Helicoptero Michael Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025

Traslado En Helicoptero Michael Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025 -

Wnba Probes Reports Of Racial Abuse Against Angel Reese

May 20, 2025

Wnba Probes Reports Of Racial Abuse Against Angel Reese

May 20, 2025 -

Chinas Space Based Supercomputer A New Era Of Computation

May 20, 2025

Chinas Space Based Supercomputer A New Era Of Computation

May 20, 2025

Latest Posts

-

Building A Food Business In Louth Lessons From A Young Entrepreneur

May 21, 2025

Building A Food Business In Louth Lessons From A Young Entrepreneur

May 21, 2025 -

Arne Slot Admits Liverpool Fortune Enrique Weighs In On Alisson

May 21, 2025

Arne Slot Admits Liverpool Fortune Enrique Weighs In On Alisson

May 21, 2025 -

From Local Food Hero To Business Mentor A Louth Success Story

May 21, 2025

From Local Food Hero To Business Mentor A Louth Success Story

May 21, 2025 -

Arne Slot On Liverpools Luck Luis Enriques Alisson Assessment

May 21, 2025

Arne Slot On Liverpools Luck Luis Enriques Alisson Assessment

May 21, 2025 -

Young Louth Food Heros Success Story Inspiring Other Businesses

May 21, 2025

Young Louth Food Heros Success Story Inspiring Other Businesses

May 21, 2025