BigBear.ai (BBAI) Stock Performance In 2025: Reasons Behind The Fall

Table of Contents

Macroeconomic Factors Affecting BBAI Stock Performance

The performance of BigBear.ai (BBAI) stock, like many other technology stocks, is highly sensitive to macroeconomic conditions. Understanding these broader trends is crucial for assessing the potential for a BBAI stock price decrease in 2025.

Overall Market Volatility and Tech Sector Downturn

Broader market trends significantly impact technology stocks. Interest rate hikes implemented by central banks to combat inflation can decrease investor confidence and reduce appetite for riskier investments, including many technology stocks. This can lead to a broader tech sell-off, negatively affecting even well-performing companies like BBAI.

- Decreased investor confidence: Higher interest rates often make bonds more attractive, diverting investment away from equities.

- Reduced risk appetite: Uncertainty in the economic outlook prompts investors to favor safer, less volatile investments.

- Potential for broader tech sell-off: A general downturn in the technology sector can drag down even fundamentally strong companies like BigBear.ai.

For example, the tech sector experienced a significant downturn in 2022 due to rising interest rates and concerns about inflation. This illustrates the vulnerability of even promising AI stocks like BBAI to macroeconomic headwinds.

Competition in the AI and Big Data Market

BigBear.ai operates in a highly competitive landscape. The AI and big data market is attracting significant investment and innovation, leading to increased competition and potential pressure on pricing and market share.

- Increased competition: Numerous established players and new entrants are vying for market share in the AI and big data space.

- Pressure on pricing: Intense competition can force companies to lower prices, squeezing profit margins.

- Difficulty in maintaining market share: BigBear.ai needs to constantly innovate and adapt to maintain a competitive edge in this rapidly evolving market.

Companies like Palantir Technologies, IBM, and Google Cloud all offer competing solutions, making it crucial for BBAI to differentiate itself and demonstrate sustained growth to maintain investor confidence in its BBAI stock forecast. News articles highlighting new entrants or successful competitor strategies can further impact investor sentiment.

Company-Specific Challenges Impacting BBAI Stock Price

Beyond macroeconomic factors, company-specific challenges can significantly impact BBAI stock price. Analyzing these internal factors is vital for predicting future BBAI stock performance.

Revenue Growth and Profitability Concerns

Sustained revenue growth and achieving profitability are essential for any company’s stock price. If BigBear.ai fails to meet expectations in these areas, it could negatively affect investor sentiment and lead to a decline in the BBAI stock price.

- Missed earnings expectations: Failure to meet projected earnings can trigger a sell-off by investors.

- Slower-than-anticipated revenue growth: A slowdown in revenue growth can signal underlying problems with the company's business model or market positioning.

- Increased operating costs: Rising operational costs can squeeze profit margins and negatively affect profitability.

Analyzing BBAI's financial statements, including revenue growth charts and profit margin trends, is crucial for assessing these risks. A consistent failure to meet projected figures could significantly contribute to a negative BBAI stock forecast.

Execution Risks and Challenges in Delivering on Promises

BigBear.ai’s success hinges on its ability to deliver on its technological promises and strategic objectives. Failures in execution can significantly damage investor confidence and lead to a drop in the BBAI stock price.

- Delays in product development: Missed deadlines and delays in launching new products can erode investor confidence.

- Challenges in integrating acquisitions: Successfully integrating acquired companies is crucial for realizing synergies and avoiding disruptions. Failure to do so can impact overall performance.

- Difficulties in scaling operations: Rapid growth can present operational challenges that, if not addressed effectively, can hamper BBAI's ability to meet demand.

Evidence of execution challenges, such as delayed product launches or difficulties in integrating acquisitions, reported in company press releases or financial reports, could negatively influence the BBAI stock price.

Potential for Negative News or Regulatory Scrutiny

Negative news events, lawsuits, or regulatory investigations can significantly impact investor confidence and negatively affect the BBAI stock price.

- Negative publicity: Any negative publicity surrounding the company, regardless of its validity, can lead to a sell-off.

- Regulatory fines: Significant fines for violating regulations can severely impact profitability and investor confidence.

- Potential lawsuits: Legal challenges, even if ultimately unsuccessful, can create uncertainty and negatively affect the stock price.

The unpredictable nature of these events makes them a significant risk factor for investors considering BBAI stock. Staying informed about any potential legal or regulatory issues is crucial for assessing the risks involved.

Alternative Scenarios and Potential for BBAI Stock Recovery

While the previous sections highlighted potential risks, it's important to consider alternative scenarios and factors that could positively influence BBAI stock.

Positive Developments that could Boost BBAI Stock

Several factors could positively influence BBAI's stock price in 2025.

- Successful product launches: The successful launch of new, innovative products could significantly boost revenue and attract new investors.

- Strategic partnerships: Collaborations with larger companies could provide access to new markets and resources.

- Strong financial performance: Consistent strong financial results, surpassing expectations, would significantly bolster investor confidence.

While these positive developments are possible, their realization is not guaranteed and should be viewed alongside the potential risks outlined above when evaluating the BBAI stock forecast.

Risk Mitigation Strategies for Investors

Investors considering BBAI stock should employ risk mitigation strategies to protect their investments.

- Diversification: Diversifying your investment portfolio across various asset classes and sectors reduces overall risk.

- Setting realistic expectations: Understand that investing in BBAI or any technology stock involves inherent risk and potential losses.

- Thorough due diligence: Conduct thorough research before investing, carefully evaluating the company's financial health, competitive landscape, and potential risks.

It's always recommended to seek advice from a qualified financial advisor before making any investment decisions concerning BBAI stock or other securities.

Conclusion

This analysis explored several potential reasons for a hypothetical decline in BigBear.ai (BBAI) stock price in 2025, including macroeconomic factors, company-specific challenges, and competitive pressures within the AI and big data markets. While the future of BBAI remains uncertain, understanding these potential risks is crucial for informed investment decisions. Further research into BigBear.ai (BBAI) stock, including a thorough review of its financial reports and industry analysis, is essential before making any investment decisions. Stay informed about BBAI stock performance and market trends to make well-informed choices regarding your BBAI investment strategy.

Featured Posts

-

The Big Reveal Mummy Pigs Gender Celebration At A London Landmark

May 21, 2025

The Big Reveal Mummy Pigs Gender Celebration At A London Landmark

May 21, 2025 -

Australian Outback Conquered New Speed Record Set On Foot

May 21, 2025

Australian Outback Conquered New Speed Record Set On Foot

May 21, 2025 -

Tyler Bate Back On Wwe A Look At His Potential Future

May 21, 2025

Tyler Bate Back On Wwe A Look At His Potential Future

May 21, 2025 -

Un Siecle De Diversification A Clisson Pres De Moncoutant Sur Sevre

May 21, 2025

Un Siecle De Diversification A Clisson Pres De Moncoutant Sur Sevre

May 21, 2025 -

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025

Latest Posts

-

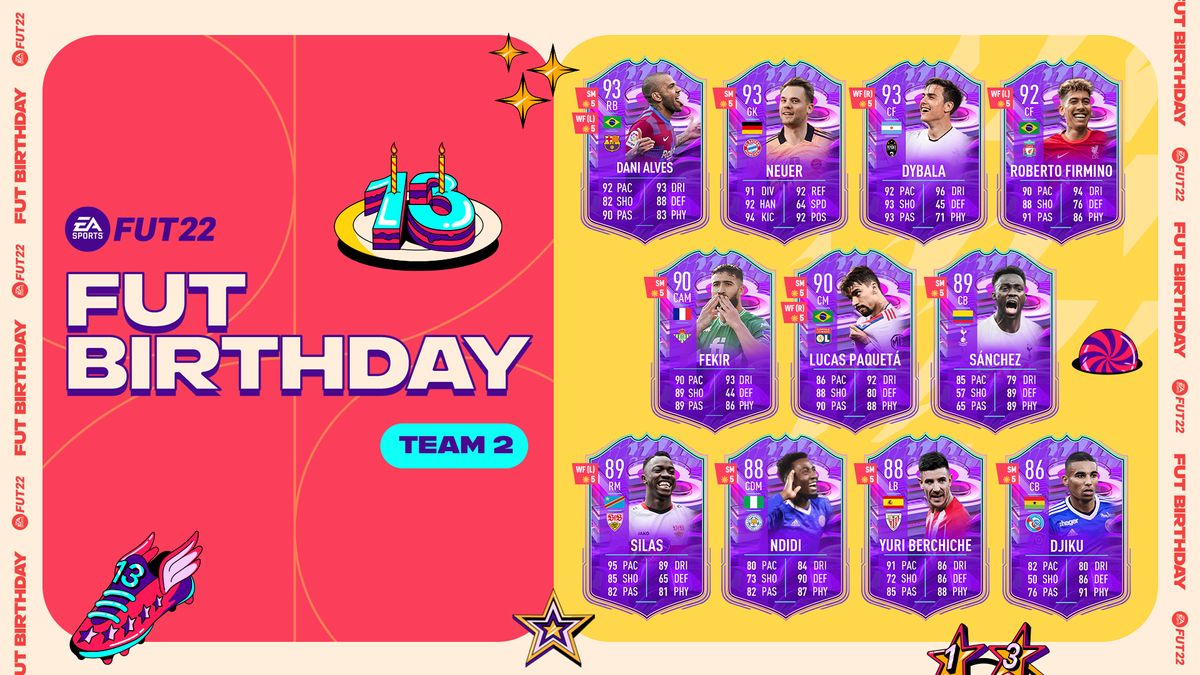

Best Ea Fc 24 Fut Birthday Cards A Complete Tier List Guide

May 22, 2025

Best Ea Fc 24 Fut Birthday Cards A Complete Tier List Guide

May 22, 2025 -

Ea Fc 24 Fut Birthday Ultimate Team Player Tier List And Ratings

May 22, 2025

Ea Fc 24 Fut Birthday Ultimate Team Player Tier List And Ratings

May 22, 2025 -

Ea Fc 24 Fut Birthday Tier List Top Players To Use

May 22, 2025

Ea Fc 24 Fut Birthday Tier List Top Players To Use

May 22, 2025 -

Tdeymat Jdydt Lmntkhb Amryka Bthlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025

Tdeymat Jdydt Lmntkhb Amryka Bthlatht Laebyn Tht Qyadt Bwtshytynw

May 22, 2025 -

Ea Fc 24 Fut Birthday Best Player Cards And Tier List

May 22, 2025

Ea Fc 24 Fut Birthday Best Player Cards And Tier List

May 22, 2025