BigBear.ai (BBAI): Evaluating The Penny Stock Investment Opportunity.

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai (BBAI) is a leading provider of AI-powered solutions for the defense, intelligence, and commercial sectors. Their core business revolves around delivering advanced data analytics and artificial intelligence capabilities to solve complex problems for their clients. They offer a range of services and products tailored to meet the specific needs of these diverse markets. Their key offerings leverage cutting-edge AI technologies to provide actionable insights from massive datasets.

Key offerings and target markets include:

- AI Solutions for National Security: BBAI provides crucial AI-driven capabilities to government agencies, aiding in national security efforts through advanced threat detection, predictive modeling, and mission optimization. This involves leveraging machine learning algorithms to analyze vast amounts of intelligence data.

- Data Analytics for Commercial Applications: BBAI also caters to the commercial sector, offering AI-powered solutions for various industries, including finance, healthcare, and logistics. These applications range from fraud detection and risk management to supply chain optimization and personalized customer experiences.

Here's a closer look at their capabilities:

- Key AI Technologies and Capabilities: BBAI utilizes advanced machine learning, deep learning, natural language processing (NLP), and computer vision technologies to deliver powerful AI solutions.

- Major Clients and Contracts: While specific client details are often confidential due to the nature of their work, BBAI has secured contracts with various government agencies and commercial enterprises. Publicly available information should be reviewed for details.

- Market Size and Growth Potential: The market for AI-powered solutions is experiencing explosive growth across both the public and private sectors. BBAI is well-positioned to benefit from this expansion due to its specialized expertise and strong client relationships. Researching market reports on AI and government contracting will provide better estimations of this growth potential.

Analyzing BBAI's Financial Performance and Valuation

Analyzing BBAI's financial performance requires a close examination of its financial statements. Key aspects to consider include:

- Recent Financial Reports: Investors should carefully review BBAI's recent quarterly and annual reports, focusing on revenue growth, profitability, and cash flow. Consider the impact of government contracts and commercial projects on financial stability.

- Key Financial Ratios: Analyzing key financial ratios such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio provides insights into the company's valuation and financial health. Compare these metrics to industry averages and competitors for a comprehensive assessment.

- Market Capitalization and Valuation Metrics: BBAI's market capitalization should be examined in the context of its revenue, earnings, and growth prospects. Compare its valuation to similar companies in the AI and government contracting sectors to gauge if it is overvalued or undervalued.

Here are some specific aspects of the financial analysis:

- Summary of Recent Quarterly or Annual Reports: Look for consistent revenue growth and indications of improving profitability. Pay close attention to any significant changes in operating expenses.

- Comparison to Competitors' Financial Performance: Benchmark BBAI's financial metrics against its key competitors to understand its relative strength and weaknesses.

- Discussion of Significant Financial Risks or Opportunities: Identify potential risks such as dependence on government contracts, competition, or challenges in scaling operations. Also, analyze potential opportunities arising from technological advancements and market expansion.

Assessing the Risks and Rewards of Investing in BBAI

Investing in penny stocks like BBAI carries inherent risks. Before investing, consider the following:

- Penny Stock Risks: High volatility, limited liquidity, and the potential for significant financial instability are common risks associated with penny stocks. These factors can lead to substantial losses if the investment does not perform as expected.

- Specific Risks Related to BBAI: BBAI's dependence on government contracts, intense competition in the AI sector, and potential technological disruption pose specific risks to investors. The success of BBAI is also tied to securing and completing contracts, many of which may be subject to budget constraints or changes in governmental policy.

- Potential Rewards: Despite the risks, the potential rewards of investing in BBAI are considerable if the company achieves significant growth and establishes itself as a market leader. High growth potential in the AI market could translate into substantial returns for investors.

Let's examine the specifics:

- Detailed Explanation of the Major Risks Associated with BBAI: A comprehensive risk assessment should consider factors such as the concentration of revenue in specific sectors, competition from established players, and the potential for delays or cancellations in government contracts.

- Assessment of the Company's Competitive Landscape: Analysis of BBAI's competitive position, including its technological advantages, pricing strategies, and market share, is critical.

- Discussion of Potential Catalysts for Future Growth: Identify potential catalysts that could drive BBAI's future growth, such as new product launches, strategic partnerships, and expansion into new markets.

Comparing BBAI to Similar Penny Stocks

To better understand BBAI's investment potential, it's helpful to compare it to similar penny stocks in the AI and government contracting sectors. A comparative analysis should include:

- Industry Comparison: Compare BBAI's financial performance, valuation, and risk profile to its direct competitors. This analysis might reveal opportunities or areas of concern not immediately apparent when considering only BBAI's internal metrics.

- Competitor Analysis: Identifying and evaluating key competitors is crucial to assessing BBAI's competitive advantage and long-term viability.

- Peer Group Analysis: Analyzing BBAI's performance relative to a peer group of companies with similar business models and market positions provides a more comprehensive context for valuation.

- Relative Valuation: Comparing BBAI's valuation metrics to its peers allows for a more objective assessment of whether it's overvalued or undervalued.

Specific aspects of this comparison include:

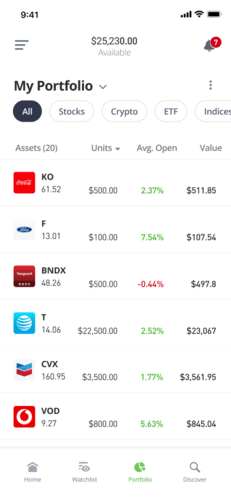

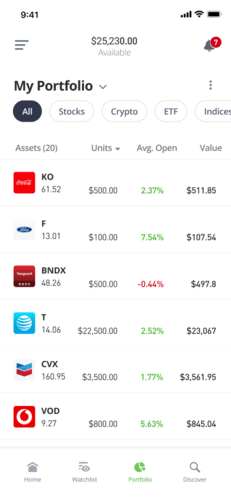

- Comparison Table Highlighting Key Metrics of BBAI and its Competitors: A table comparing key metrics like revenue growth, profitability, valuation ratios, and debt levels can help investors understand BBAI's relative position within the market.

- Discussion of the Advantages and Disadvantages of BBAI Compared to its Competitors: This detailed comparison allows for a nuanced view of BBAI’s potential for success.

Developing an Investment Strategy for BBAI

Developing a sound investment strategy for BBAI requires careful consideration of risk tolerance, investment timeframe, and diversification.

- Investment Approaches (Long-Term vs. Short-Term): A long-term investment approach might be suitable for investors with a higher risk tolerance who believe in BBAI's long-term growth prospects. A short-term approach might be more appropriate for investors seeking quicker returns but willing to accept higher volatility.

- Diversification Strategies to Mitigate Risk: Diversification across various asset classes, including stocks, bonds, and other investments, is critical to reduce overall portfolio risk. This mitigates the impact of potential losses in a single investment.

- Importance of Due Diligence: Thorough due diligence is essential before investing in BBAI or any penny stock. This involves careful analysis of the company's financial statements, business model, competitive landscape, and overall risk profile.

The following points will assist in strategy development:

- Guidance on Determining an Appropriate Investment Amount: Investors should only invest an amount they can afford to lose, considering their overall financial situation and risk tolerance.

- Explanation of Different Investment Time Horizons: The chosen investment timeframe depends on the investor's risk tolerance and investment goals. Long-term investors might hold the stock for several years, while short-term investors might trade it more frequently.

- Recommendations for Monitoring the Investment: Regular monitoring of BBAI's performance, financial reports, and news related to the company is vital for making informed decisions about adjustments to the investment strategy.

Conclusion

This analysis of BigBear.ai (BBAI) reveals a company operating in a high-growth sector with significant potential but also considerable risks inherent in penny stock investing. While BBAI's AI-powered solutions offer compelling advantages in the defense and commercial sectors, its financial performance and reliance on government contracts present substantial uncertainties. The company's valuation relative to competitors must be carefully assessed before any investment decision. Remember, high growth potential comes with high risk, and significant volatility is expected.

Before making any investment decisions regarding BigBear.ai (BBAI) or any penny stock, conduct thorough research and consider consulting with a qualified financial advisor. Remember, investing in BBAI involves significant risk, and only invest what you can afford to lose. This analysis is for informational purposes only and is not financial advice. Continue your due diligence on BigBear.ai (BBAI) to make a well-informed investment decision.

Featured Posts

-

How To Successfully Implement A Screen Free Week For Kids

May 21, 2025

How To Successfully Implement A Screen Free Week For Kids

May 21, 2025 -

Book Club Le Matin Explore Les Grands Fusains De Boulemane Par Abdelkebir Rabi

May 21, 2025

Book Club Le Matin Explore Les Grands Fusains De Boulemane Par Abdelkebir Rabi

May 21, 2025 -

Combate Las Enfermedades Cronicas El Superalimento Que Supera Al Arandano

May 21, 2025

Combate Las Enfermedades Cronicas El Superalimento Que Supera Al Arandano

May 21, 2025 -

Little Britain Revival What Matt Lucas Said About The Future Of The Show

May 21, 2025

Little Britain Revival What Matt Lucas Said About The Future Of The Show

May 21, 2025 -

New York City To Witness Vybz Kartels Historic Performance

May 21, 2025

New York City To Witness Vybz Kartels Historic Performance

May 21, 2025

Latest Posts

-

Beenie Mans It A Stream Strategy Analyzing His New York Play

May 22, 2025

Beenie Mans It A Stream Strategy Analyzing His New York Play

May 22, 2025 -

Nuffy On Touring With Vybz Kartel A Dream Fulfilled

May 22, 2025

Nuffy On Touring With Vybz Kartel A Dream Fulfilled

May 22, 2025 -

Beenie Man Announces New York Domination What Does It Mean For It A Stream

May 22, 2025

Beenie Man Announces New York Domination What Does It Mean For It A Stream

May 22, 2025 -

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025 -

Beenie Mans New York Takeover Is This The Future Of It A Stream

May 22, 2025

Beenie Mans New York Takeover Is This The Future Of It A Stream

May 22, 2025