BigBear.ai (BBAI): Analyzing The Significant Stock Decline And Implications

Table of Contents

Analyzing the Factors Contributing to BBAI's Stock Decline

Several interconnected factors have contributed to the recent BBAI stock decline. Understanding these factors is crucial for assessing the current situation and forecasting future potential.

Disappointing Financial Performance

Recent BBAI financial results have fallen short of expectations, significantly impacting investor sentiment. The company's earnings reports have revealed missed revenue projections and a less-than-stellar financial performance overall. Key financial metrics like revenue growth, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and profitability have all come under scrutiny.

- Specific examples of underperformance: [Insert specific examples of missed revenue targets, lower-than-anticipated earnings, etc. from recent financial reports. Use quantifiable data].

- Negative revisions to future guidance: [Mention any downgrades in the company's projections for future revenue or earnings].

- Impact on investor confidence: The consistent underperformance has eroded investor confidence, leading to selling pressure and a subsequent drop in the BBAI stock price. This lack of confidence reflects a concern over the company's ability to achieve sustainable growth and profitability.

Competitive Landscape and Market Saturation

The AI and big data analytics sector is intensely competitive. BigBear.ai faces established players with substantial market share and resources. This competitive landscape presents challenges for BBAI in terms of gaining market share and achieving significant growth.

- Key competitors and their strengths: [List major competitors in the AI and big data analytics market and highlight their respective strengths, e.g., market position, technological advancements, brand recognition].

- Challenges in gaining market share: BBAI needs to differentiate its offerings and demonstrate a clear competitive advantage to gain traction against these established players. This includes showcasing superior technology, customer service, and cost-effectiveness.

- Market saturation: The increasing number of players in the market suggests a level of market saturation, making it harder for newcomers and smaller players like BBAI to quickly capture a significant market share.

Geopolitical and Macroeconomic Factors

Broader macroeconomic conditions and geopolitical events also play a role in the performance of BBAI stock. The overall market volatility, influenced by factors such as interest rate hikes, inflation, and economic uncertainty, can significantly impact investor sentiment toward even promising companies like BigBear.ai.

- Specific economic events: [Mention specific economic events, such as interest rate increases by central banks or global inflationary pressures, that could be impacting the stock market and BBAI specifically].

- Influence on investor behavior: Negative macroeconomic news often prompts investors to shift towards safer investments, leading to a sell-off in riskier assets, including AI stocks like BBAI.

- Overall market sentiment: The prevailing bearish sentiment in the overall market can further exacerbate the decline in BBAI's stock price, regardless of the company's individual performance.

Implications of the BBAI Stock Decline for Investors

The decline in BBAI's stock price has significant implications for investors, both in the short term and the long term.

Short-Term and Long-Term Implications

For investors currently holding BBAI stock, the short-term implications are largely negative, with potential for further losses depending on market conditions and company performance. However, the long-term outlook hinges on the company's ability to execute its strategic initiatives and overcome the challenges it faces.

- Strategies for investors: Investors holding BBAI should carefully assess their risk tolerance and consider diversifying their portfolio to mitigate potential losses. Depending on individual circumstances, holding, selling, or averaging down might be considered.

- Long-term prospects: The long-term prospects of BigBear.ai depend heavily on its success in navigating the competitive landscape, improving its financial performance, and capitalizing on opportunities within the rapidly evolving AI sector.

- Due diligence: Before investing in any stock, thorough due diligence is essential. Investors should carefully examine financial statements, understand the company's business model, and assess the competitive landscape before making investment decisions.

Future Outlook and Potential for Recovery

While the current situation is challenging, BBAI's future isn't entirely bleak. The company's strategic initiatives and potential catalysts could lead to a stock price recovery.

- Positive developments: [Highlight any positive developments, such as new partnerships, successful product launches, or technological breakthroughs, that could signal future growth].

- Likelihood of a rebound: A stock price rebound is possible if BBAI can demonstrate improved financial performance, secure new contracts, and effectively address the competitive challenges it faces. However, there are no guarantees.

- Risk-reward profile: Investing in BBAI currently presents a relatively high-risk, high-reward profile. Investors must carefully weigh the potential for substantial gains against the possibility of further losses.

Conclusion: Navigating the BigBear.ai (BBAI) Stock Situation

The BBAI stock decline is a complex issue stemming from disappointing financial performance, intense competition, and broader macroeconomic factors. The short-term implications for investors are negative, but the long-term outlook depends on BBAI's ability to execute its strategic plans and improve its financial health. Before making any investment decisions related to BigBear.ai (BBAI) stock or any similar AI stock, thorough research and due diligence are crucial. Conduct your own in-depth BBAI stock analysis, understand the risks involved, and make informed investment decisions. Remember that past performance is not indicative of future results.

Featured Posts

-

F1 Kaoset Hamilton Och Leclerc Diskvalificerade Vad Haende

May 20, 2025

F1 Kaoset Hamilton Och Leclerc Diskvalificerade Vad Haende

May 20, 2025 -

Premijera Filma Zvijezde Na Crvenom Tepihu Jutarnjeg Lista

May 20, 2025

Premijera Filma Zvijezde Na Crvenom Tepihu Jutarnjeg Lista

May 20, 2025 -

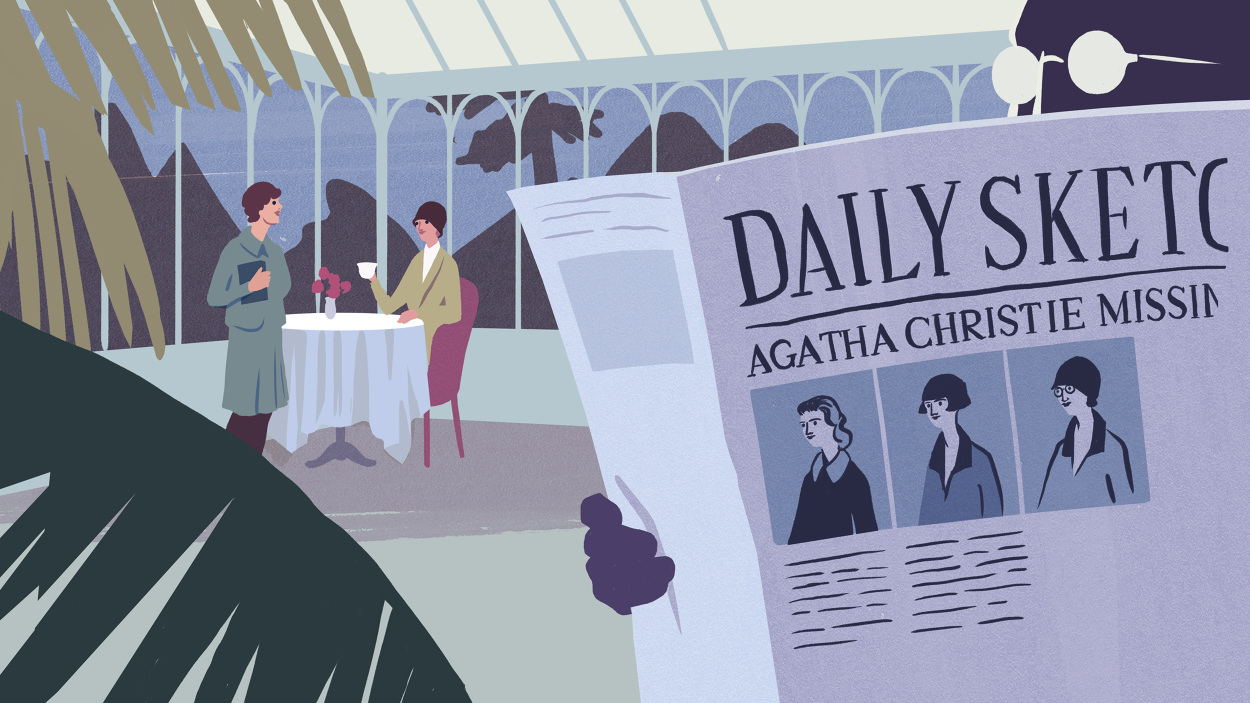

A New Bbc Venture Brings Agatha Christie Back To Life

May 20, 2025

A New Bbc Venture Brings Agatha Christie Back To Life

May 20, 2025 -

Gina Maria Schumacher Kci Michaela Schumachera

May 20, 2025

Gina Maria Schumacher Kci Michaela Schumachera

May 20, 2025 -

Efimeries Iatron Stin Patra Ayto To Savvatokyriako

May 20, 2025

Efimeries Iatron Stin Patra Ayto To Savvatokyriako

May 20, 2025

Latest Posts

-

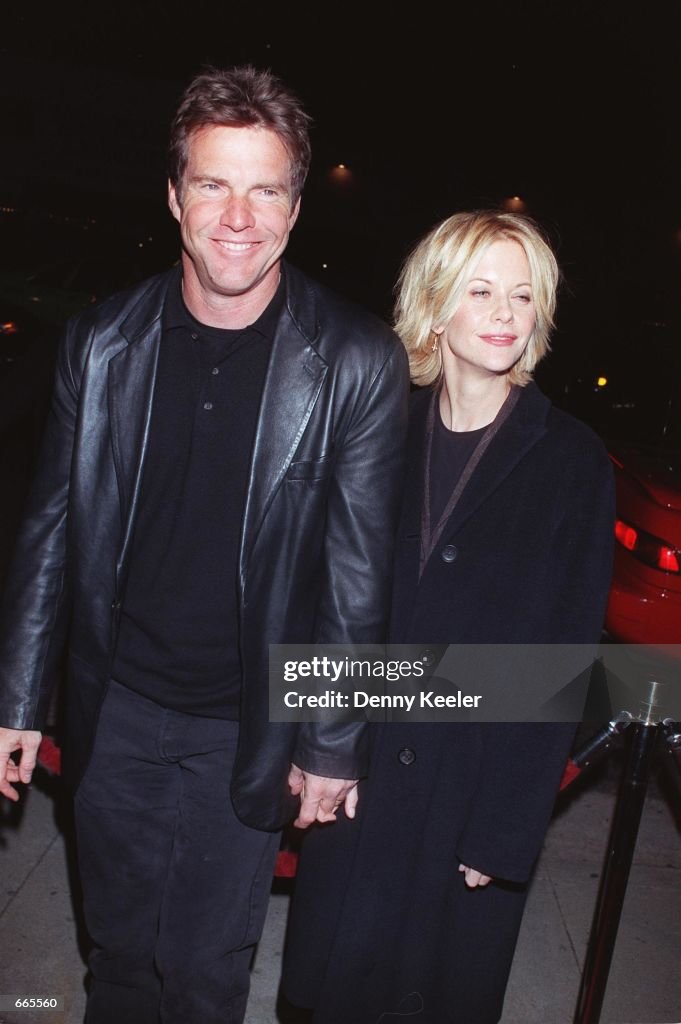

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025 -

Sejarah Kemenangan Liverpool Di Liga Inggris Peran Krusial Para Pelatih

May 21, 2025

Sejarah Kemenangan Liverpool Di Liga Inggris Peran Krusial Para Pelatih

May 21, 2025 -

Chicago Cubs Couples Hot Dog Kiss Captures Hearts

May 21, 2025

Chicago Cubs Couples Hot Dog Kiss Captures Hearts

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025