Belgium's Energy Market: A Guide To Financing A 270MWh BESS Project

Table of Contents

Understanding Belgium's Regulatory Landscape for BESS Projects

Investing in a large-scale BESS project in Belgium requires a thorough understanding of the regulatory environment. Navigating the legal and administrative processes is paramount for securing permits and accessing potential incentives.

- Key regulations impacting BESS installations: Belgium's regulatory framework for energy storage is constantly evolving. Key legislation pertains to grid connection standards, safety regulations, and environmental impact assessments. Staying updated on these evolving regulations through CREG (Commission de Régulation de l'Electricité et du Gaz) is crucial.

- Grid connection procedures and timelines: Connecting a 270MWh BESS project to the Belgian grid involves a complex process managed primarily by Elia, the Belgian transmission system operator. This process includes detailed technical specifications, impact studies, and securing the necessary grid connection agreements. Timelines can vary depending on the specific location and grid capacity.

- Permitting processes and required documentation: Obtaining the necessary permits requires meticulous preparation and adherence to stringent environmental regulations. This includes environmental impact assessments, building permits, and other relevant approvals from local and regional authorities. The process necessitates collaboration with environmental consultants and legal experts.

- Incentive schemes and subsidies available for BESS projects: The Belgian government actively promotes renewable energy integration, including energy storage. Several incentive programs and subsidies may be available to support BESS projects, such as tax breaks, feed-in tariffs, and investment grants. Thorough research of available programs is vital to maximizing financial benefits.

Elia plays a pivotal role in the integration of BESS into the Belgian electricity grid. Their technical guidelines and grid connection requirements must be carefully considered throughout the project development and financing phases.

Assessing Funding Options for a 270MWh BESS Project

Securing funding for a 270MWh BESS project requires a diversified approach, leveraging multiple financing avenues to mitigate risk and optimize capital structure.

- Debt financing (bank loans, green bonds): Bank loans offer traditional financing, often requiring robust project financials and collateral. Green bonds, specifically designed for environmentally friendly projects, are increasingly attractive to investors seeking sustainable investments, offering potential access to a wider pool of capital.

- Equity financing (private equity, venture capital): Private equity and venture capital firms can provide significant capital injections but often require substantial equity stakes and a higher return on investment. These investors are particularly attracted to projects with strong growth potential and experienced management teams.

- Public funding (grants, subsidies, government programs): Various regional and national government programs in Belgium support renewable energy projects. Exploring these funding sources can significantly reduce the project's overall financing burden and enhance its financial feasibility.

- Project finance structures: Given the scale of this project, specialized project finance structures, such as limited partnerships or special purpose vehicles, will likely be necessary to manage risk and attract investors. These structures allocate risk and reward among different stakeholders appropriately.

- Power Purchase Agreements (PPAs): Securing long-term PPAs with off-takers is crucial for guaranteeing revenue streams and reducing financing risk. PPAs provide certainty to lenders and investors, improving the project's creditworthiness.

Due Diligence and Risk Mitigation

Thorough due diligence is crucial before securing any financing. Overlooking key aspects can lead to significant financial and operational setbacks.

- Technical due diligence: This involves a comprehensive site assessment, including grid connection feasibility, land acquisition, and technology selection.

- Financial due diligence: Rigorous financial modeling, cash flow projections, and sensitivity analysis are essential to assess the project's viability and profitability under various scenarios.

- Regulatory due diligence: Ensuring full compliance with all applicable Belgian and EU regulations, including environmental regulations, is critical for securing permits and avoiding costly delays.

- Environmental impact assessment and permitting: A comprehensive environmental impact assessment is necessary to meet regulatory requirements and minimize any potential negative environmental consequences.

- Risk assessment and mitigation strategies: Identifying and mitigating potential risks, including technological failures, regulatory changes, and market volatility, is vital for securing financing and ensuring project success.

Navigating the Belgian Energy Market: Key Considerations for BESS Investors

The Belgian energy market presents both opportunities and challenges for BESS investors. Understanding the market dynamics is essential for assessing potential ROI.

- Analysis of the Belgian electricity market: Analyzing wholesale electricity prices, demand fluctuations, and peak/off-peak pricing patterns is crucial for determining the profitability of arbitrage strategies and frequency regulation services.

- Opportunities for arbitrage and frequency regulation services: BESS projects can participate in energy arbitrage, profiting from price differences between peak and off-peak hours, and provide frequency regulation services to enhance grid stability. These services generate additional revenue streams.

- Potential risks and challenges associated with BESS investment in Belgium: Risks include regulatory changes, technological advancements, competition from other energy storage technologies, and potential fluctuations in electricity prices.

- Long-term outlook for BESS projects and the future of the Belgian energy market: The long-term outlook for BESS in Belgium is positive, driven by the country's commitment to renewable energy and the growing need for grid stabilization.

Conclusion

Successfully financing a 270MWh BESS project in Belgium demands a comprehensive understanding of the regulatory landscape, a diversified financing strategy, and thorough due diligence. By carefully navigating the complexities of the Belgian energy market and employing effective risk mitigation strategies, developers can unlock the significant potential of BESS in supporting Belgium's energy transition. This guide provides a crucial foundation for exploring the opportunities available in the growing Belgian energy storage market. Contact us today to discuss your BESS project financing needs in Belgium and begin your journey towards a successful energy storage investment.

Featured Posts

-

Expensive Offshore Wind Farms Falling Out Of Favor With Energy Companies

May 04, 2025

Expensive Offshore Wind Farms Falling Out Of Favor With Energy Companies

May 04, 2025 -

Resistance To Ev Mandates Intensifies Car Dealers Push Back

May 04, 2025

Resistance To Ev Mandates Intensifies Car Dealers Push Back

May 04, 2025 -

Generational Economic Change Carneys Promises And Plans

May 04, 2025

Generational Economic Change Carneys Promises And Plans

May 04, 2025 -

Farages Future And Reforms Leadership The Case For Rupert Lowe

May 04, 2025

Farages Future And Reforms Leadership The Case For Rupert Lowe

May 04, 2025 -

Spotify I Phone App Flexible Payment Options Now Available

May 04, 2025

Spotify I Phone App Flexible Payment Options Now Available

May 04, 2025

Latest Posts

-

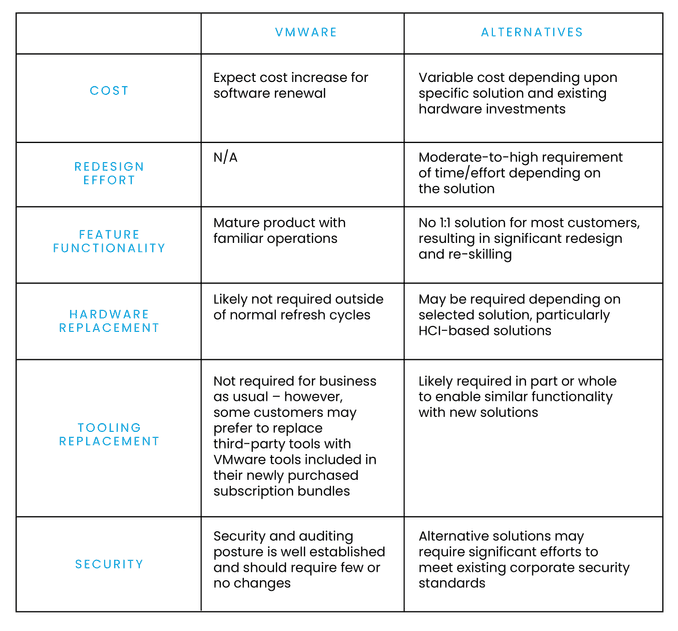

Broadcoms Proposed V Mware Price Hike At And T Faces 1 050 Cost Surge

May 04, 2025

Broadcoms Proposed V Mware Price Hike At And T Faces 1 050 Cost Surge

May 04, 2025 -

The Cusma Negotiations Carneys Crucial Meeting With Trump

May 04, 2025

The Cusma Negotiations Carneys Crucial Meeting With Trump

May 04, 2025 -

V Mware Price Shock At And T Reports 1 050 Increase Proposed By Broadcom

May 04, 2025

V Mware Price Shock At And T Reports 1 050 Increase Proposed By Broadcom

May 04, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Hike Threatens At And T

May 04, 2025

Broadcoms V Mware Acquisition A 1 050 Price Hike Threatens At And T

May 04, 2025 -

Googles Advertising Monopoly The U S Weighs A Breakup

May 04, 2025

Googles Advertising Monopoly The U S Weighs A Breakup

May 04, 2025