BBAI Stock: Deep Dive Into The 17.87% Drop And Future Outlook

Table of Contents

Analyzing the 17.87% Drop in BBAI Stock Price

Timeline of the Decline

The dramatic decline in BBAI stock wasn't an overnight event. It unfolded over a period of [Insert timeframe, e.g., two weeks], with several key dates marking significant price drops.

- [Date]: BBAI stock experienced a [Percentage]% drop following [Specific news event or announcement, e.g., a disappointing earnings report].

- [Date]: A further [Percentage]% decline was observed after [Another specific news event or announcement, e.g., a negative analyst report].

- [Date]: The steepest single-day drop of [Percentage]% occurred, coinciding with [Specific market event or news].

Market Sentiment and Investor Reaction

The market sentiment surrounding BBAI shifted dramatically during this period. Initially, investor confidence was [Describe initial sentiment, e.g., high], but the series of negative events led to widespread selling pressure. Trading volume spiked significantly during the decline, indicating heightened investor activity and concern. Many investors viewed the drop as a selling opportunity, while others chose to exit their positions entirely. Data from [Source of trading volume data, e.g., a reputable financial website] shows a [X]% increase in trading volume during the period of the price decline.

Technical Analysis of the BBAI Stock Chart

A technical analysis of the BBAI stock chart reveals several key aspects contributing to the drop. The stock price broke below crucial support levels at [Price levels], confirming a bearish trend. Technical indicators such as the Relative Strength Index (RSI) showed [RSI value] indicating oversold conditions, while the Moving Average Convergence Divergence (MACD) displayed a clear bearish crossover. [Include a relevant chart or graph of the BBAI stock price showing key support and resistance levels and technical indicators].

Potential Causes for the BBAI Stock Price Decline

Company-Specific Factors

Several company-specific factors may have contributed to the BBAI stock price decline.

- [Potential Reason 1, e.g., Disappointing Earnings]: The company's recent earnings report fell short of analysts' expectations, leading to investor disappointment. [Cite source].

- [Potential Reason 2, e.g., Regulatory Issues]: Concerns about potential regulatory hurdles or investigations may have also weighed on the stock. [Cite source].

- [Potential Reason 3, e.g., Product Delays]: Delays in the launch of a key product could have negatively impacted investor confidence. [Cite source].

Macroeconomic Factors

Broader macroeconomic factors also played a role. Rising interest rates and persistent inflation created a challenging environment for growth stocks like BBAI. The overall market downturn also impacted investor sentiment, leading to a general sell-off across various sectors, impacting BBAI stock. Data from [Source of macroeconomic data] shows [relevant statistic, e.g., inflation rate] impacting investor sentiment.

Sector-Specific Trends

Trends within BBAI's industry also contributed to the decline. Increased competition, slowing industry growth, and changes in consumer demand may have affected investor perception of BBAI's future prospects. [Mention specific competitors and relevant market share data].

BBAI Stock: Future Outlook and Investment Implications

Fundamental Analysis of BBAI

A fundamental analysis of BBAI's financials is crucial for assessing its long-term viability. Key metrics such as revenue growth, profit margins, and debt levels need to be carefully evaluated. [Include relevant financial ratios and comparisons to competitors].

Growth Prospects and Potential Catalysts

Despite the recent drop, BBAI still possesses several growth catalysts. [Mention potential catalysts, e.g., new product launches, strategic partnerships, expansion into new markets]. The long-term outlook for [BBAI's industry] remains positive, suggesting potential for future growth.

Risk Assessment and Investment Strategies

Investing in BBAI stock carries inherent risks. The company's dependence on [key factor], potential competition, and macroeconomic uncertainties all pose challenges. Investors should carefully consider their risk tolerance before making any investment decisions. Depending on your risk profile, strategies could range from holding the stock (if you believe in its long-term potential) to selling (if you are concerned about further price drops).

Conclusion

The 17.87% drop in BBAI stock price was a result of a confluence of factors, including company-specific issues, macroeconomic headwinds, and sector-specific trends. While the short-term outlook may be uncertain, BBAI's long-term potential remains dependent on its ability to overcome current challenges and capitalize on future growth opportunities. Stay informed on the latest developments in BBAI stock and other relevant market trends to make savvy investment choices.

Featured Posts

-

Lightning 100s New Music Monday 2 24 25 Playlist

May 20, 2025

Lightning 100s New Music Monday 2 24 25 Playlist

May 20, 2025 -

Pro D2 Valence Romans Su Agen Et La Course Au Maintien Calendrier Et Enjeux

May 20, 2025

Pro D2 Valence Romans Su Agen Et La Course Au Maintien Calendrier Et Enjeux

May 20, 2025 -

Cunhas Departure From Us Attorneys Office New Private Practice Role

May 20, 2025

Cunhas Departure From Us Attorneys Office New Private Practice Role

May 20, 2025 -

Biarritz Le Bo Cafe Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025

Biarritz Le Bo Cafe Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025 -

Projet Du 4eme Pont D Abidjan Tout Savoir Sur Le Delai D Execution Le Cout Et Les Depenses

May 20, 2025

Projet Du 4eme Pont D Abidjan Tout Savoir Sur Le Delai D Execution Le Cout Et Les Depenses

May 20, 2025

Latest Posts

-

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025 -

Sydney Sweeneys Post Breakup Career Moves New Film Role

May 21, 2025

Sydney Sweeneys Post Breakup Career Moves New Film Role

May 21, 2025 -

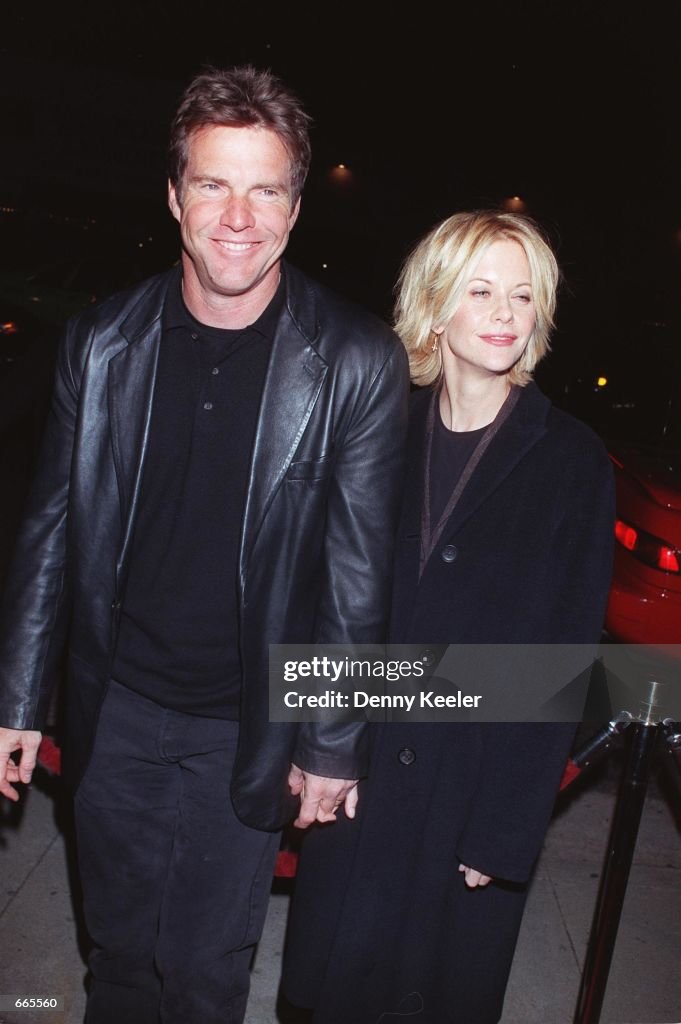

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

Faktor Kunci Keberhasilan Liverpool Sosok Pelatih Di Liga Inggris 2024 2025

May 21, 2025

Faktor Kunci Keberhasilan Liverpool Sosok Pelatih Di Liga Inggris 2024 2025

May 21, 2025 -

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025