Bank Of Japan's Revised Growth Forecast Reflects Trade War Concerns

Table of Contents

Weakening Export Performance Due to Trade Tensions

The ongoing trade war between the US and China has significantly dampened Japanese export performance. Japan, heavily reliant on global trade, finds itself caught in the crossfire. The decline in exports is not simply a reduction in volume; it represents a broader weakening of global demand and increasing uncertainty for Japanese businesses.

-

Reduced Exports to Key Markets: The US and China represent crucial export markets for Japan. Tariffs and trade restrictions imposed by both countries have directly impacted the volume and value of Japanese exports. Data shows a considerable year-on-year decline in exports to these markets in key sectors.

-

Specific Sectors Hit Hard: The automotive and electronics industries, major contributors to Japan's GDP growth, are particularly vulnerable. Supply chain disruptions and reduced consumer demand in affected markets have led to decreased production and lower export revenues.

-

Impact on Businesses: Uncertainty surrounding future trade policies is forcing Japanese businesses to reassess their investment strategies and production plans. This leads to decreased investment and hiring, further slowing economic growth. Keywords: Japanese exports, trade tensions, export decline, US-China trade war, global trade, supply chains.

Impact on Supply Chains and Manufacturing

The US-China trade war has caused significant disruptions to global supply chains, directly affecting Japanese manufacturing. The intricate network of global production relies on seamless flow of goods and components. Trade restrictions and tariffs create bottlenecks and increased costs.

-

Increased Input Costs: Japanese manufacturers rely on imported components from various countries. Tariffs increase input costs, squeezing profit margins and making Japanese goods less competitive in the global market.

-

Production Slowdowns: Uncertainty regarding future trade policies leads to cautious production planning, resulting in lower output and impacting employment. Companies hesitate to invest in new capacity when the future of global trade remains unclear.

-

Restructuring and Relocation: Some Japanese companies are considering relocating parts of their production facilities to reduce reliance on affected regions, adding to the economic uncertainty. Keywords: Global supply chains, manufacturing, production, business uncertainty, input costs.

Revised Inflation Forecasts and Monetary Policy Response

The weakening export sector has significantly impacted Japan's inflation projections. Lower export revenues reduce domestic demand, increasing the risk of deflation – a persistent decline in the general price level. This necessitates a response from the BOJ.

-

Deflationary Pressures: The slowdown in economic activity, coupled with weak consumer spending, puts downward pressure on prices. This is a serious concern for the BOJ, as deflation can be a significant obstacle to economic recovery.

-

BOJ's Monetary Policy Response: To counter deflationary risks and stimulate economic growth, the BOJ might adjust its monetary policy. This could involve further quantitative easing (increasing the monetary base) or maintaining ultra-low interest rates.

-

Challenges of Monetary Policy: The effectiveness of monetary policy in addressing the current situation is debated, as the core issue stems from external factors like trade tensions rather than solely domestic economic weaknesses. Keywords: Inflation rate, deflation, monetary policy, interest rates, quantitative easing, BOJ policy.

Potential Impact on Yen Exchange Rate

The uncertainty surrounding trade wars and the slowdown in the Japanese economy can affect the Yen's exchange rate. A weakening economy might lead to a weaker Yen, while increased uncertainty could drive investors towards safe-haven assets, strengthening the Yen.

-

Safe Haven Asset: The Yen is often considered a safe-haven currency during times of global economic uncertainty. Increased trade tensions could push investors towards the Yen, appreciating its value.

-

Impact on Businesses: A stronger Yen makes Japanese exports more expensive in international markets, further hurting export-oriented businesses. A weaker Yen, conversely, could boost exports but also increase import costs. Keywords: Yen exchange rate, currency fluctuations, foreign exchange, economic impact.

Future Economic Outlook and Scenarios

The future economic outlook for Japan hinges heavily on the resolution – or escalation – of global trade disputes. The BOJ is likely preparing for several scenarios.

-

Trade War Resolution: A de-escalation of trade tensions could lead to a gradual recovery in exports, boosting Japan's economic growth.

-

Prolonged Trade War: A prolonged trade war could lead to a deeper economic slowdown, increasing deflationary pressures and requiring more aggressive monetary policy responses from the BOJ.

-

BOJ's Contingency Plans: The BOJ is likely developing contingency plans to address various potential scenarios, potentially including further monetary easing or other fiscal stimulus measures. Keywords: Economic outlook, future scenarios, economic growth, risk assessment, policy response.

Conclusion: Understanding the Bank of Japan's Revised Growth Forecast in the Context of Trade Wars

The Bank of Japan's revised growth forecast clearly reflects the significant impact of trade war concerns on Japan's economic outlook. The weakening export performance, the risk of deflation, and the resulting adjustments to monetary policy all highlight the vulnerability of the Japanese economy to global trade tensions. It's crucial to monitor global trade developments and their effects on the Japanese economy closely. Stay informed about the Bank of Japan's growth forecast and trade war developments for a better understanding of the Japanese economy's future. For further research and detailed data, refer to the official Bank of Japan website and other reputable economic sources. Keywords: Bank of Japan, growth forecast, trade war impact, Japanese economy, economic analysis.

Featured Posts

-

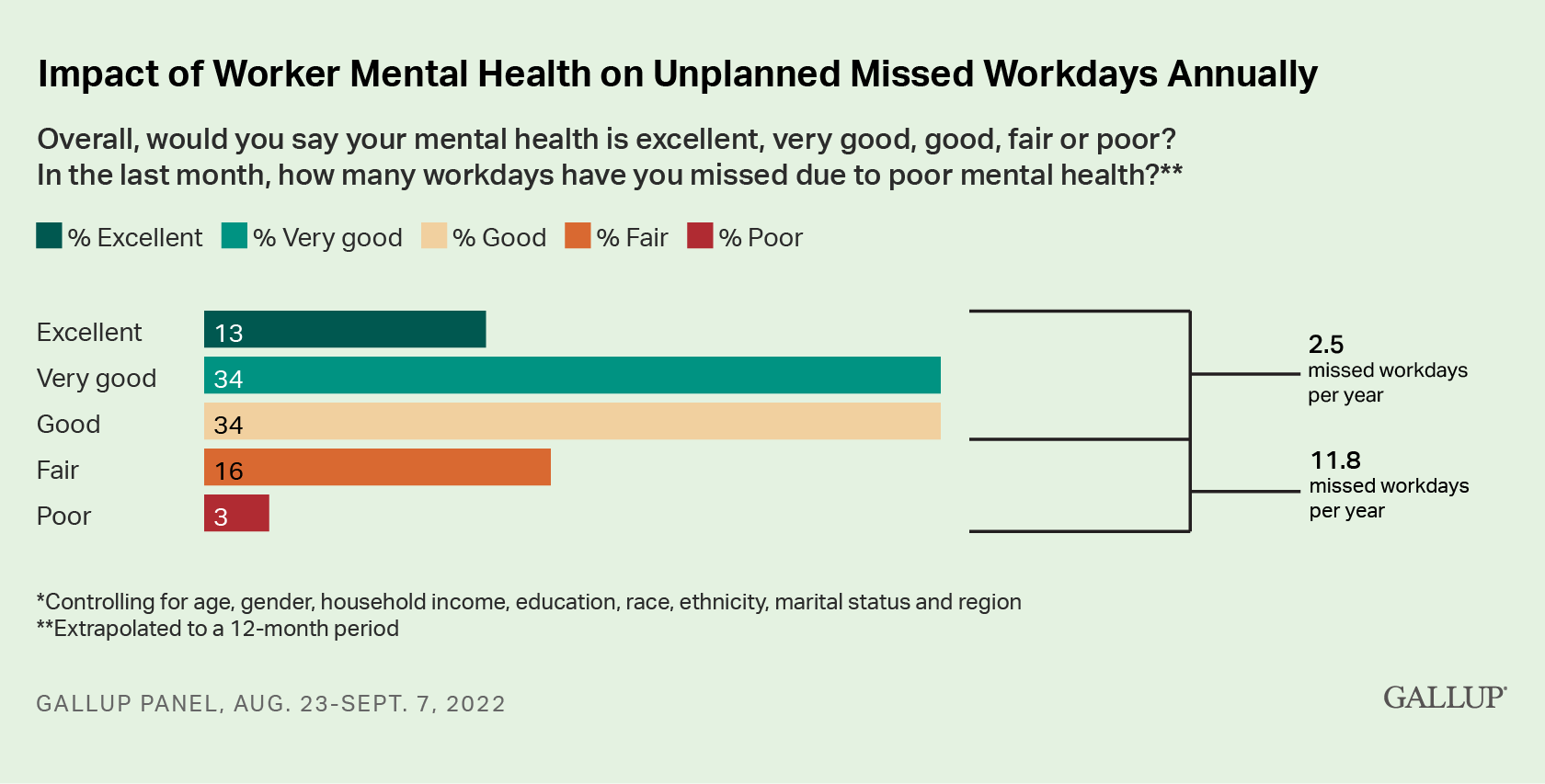

Mental Health In The Workplace A Policy Driven Approach To Increased Productivity

May 02, 2025

Mental Health In The Workplace A Policy Driven Approach To Increased Productivity

May 02, 2025 -

Ripple Lawsuit News Potential Commodity Classification For Xrp

May 02, 2025

Ripple Lawsuit News Potential Commodity Classification For Xrp

May 02, 2025 -

Michael Sheens Charitable Act 100 K Donation Clears 1 M Debt For 900 People Wsoc Tv Report

May 02, 2025

Michael Sheens Charitable Act 100 K Donation Clears 1 M Debt For 900 People Wsoc Tv Report

May 02, 2025 -

Six Nations 2025 Can France Continue Their Winning Streak

May 02, 2025

Six Nations 2025 Can France Continue Their Winning Streak

May 02, 2025 -

Enexis Weigert Aansluiting Kampen Start Kort Geding

May 02, 2025

Enexis Weigert Aansluiting Kampen Start Kort Geding

May 02, 2025

Latest Posts

-

Celebrity Traitors On Bbc Chaos Ensues As Siblings Quit Weeks Before Shoot

May 02, 2025

Celebrity Traitors On Bbc Chaos Ensues As Siblings Quit Weeks Before Shoot

May 02, 2025 -

Bbc Celebrity Traitors Sibling Withdrawals Cause Chaos Before Filming

May 02, 2025

Bbc Celebrity Traitors Sibling Withdrawals Cause Chaos Before Filming

May 02, 2025 -

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025

Celebrity Traitors Uk Early Departures Confirmed

May 02, 2025 -

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025

Two Celebrity Traitors Uk Contestants Have Left The Show

May 02, 2025 -

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025

Cooper Siblings Land New Bbc Show Following Celeb Traitors Exit

May 02, 2025