Bank Of Canada's Inflation Dilemma: Balancing Growth And Price Stability

Table of Contents

The Current Inflationary Pressure

Canada is currently experiencing elevated inflation, a significant deviation from the Bank of Canada's target of 2%. The Consumer Price Index (CPI) has consistently exceeded this target, driven by a confluence of factors. Supply chain disruptions, lingering effects of the pandemic, and the surge in global energy prices have all contributed to increased production costs, leading to cost-push inflation. Simultaneously, robust consumer demand has fueled demand-pull inflation, further exacerbating the problem.

- Current CPI figures: The CPI for [Insert most recent CPI data and percentage change year-over-year].

- Contributing factors: Energy prices account for [percentage]% of the increase, while supply chain issues contribute an additional [percentage]%. Strong consumer spending has also played a significant role.

- Comparison to G7: Canada's inflation rate is [higher/lower] than the average inflation rate of other G7 countries, highlighting the unique challenges facing the Canadian economy.

This significant divergence from the target inflation rate necessitates decisive action from the Bank of Canada to restore price stability.

The Bank of Canada's Monetary Policy Tools

The Bank of Canada employs several monetary policy tools to manage inflation. The primary instrument is adjusting the overnight interest rate, influencing borrowing costs across the economy. Raising interest rates makes borrowing more expensive, discouraging spending and investment, thereby cooling down demand-pull inflation. Quantitative easing (QE) and quantitative tightening are other tools employed to influence the money supply and bond yields.

- Interest rate hikes: Increasing the overnight rate directly impacts lending rates for businesses and consumers, affecting investment and consumer spending.

- Potential side effects: Aggressive interest rate increases risk triggering a recession by significantly slowing down economic activity and potentially leading to increased unemployment.

- Effectiveness of past policies: The effectiveness of past monetary policy decisions varies depending on the economic climate and the specific tools used. Analysis of past interventions provides valuable insights for current decision-making.

The Bank of Canada must carefully calibrate its use of these tools to achieve its goals without causing undue economic harm.

The Risks of Aggressive Interest Rate Hikes

While raising interest rates is a necessary tool to combat inflation, it carries substantial risks. Rapidly increasing interest rates can lead to a sharp economic slowdown, potentially triggering a recession. This can result in job losses, decreased consumer spending, and a decline in overall economic growth.

- Impact on the housing market: Higher interest rates significantly impact the housing market, potentially leading to a decline in house prices and affecting the overall financial health of many Canadians.

- Vulnerable sectors: Sectors highly reliant on borrowing, such as construction and manufacturing, are particularly vulnerable to interest rate hikes.

- Historical examples: Examining historical instances of aggressive monetary tightening, such as the early 1980s, provides valuable lessons on the potential consequences and the importance of a carefully managed approach.

Balancing the need to control inflation with the desire to avoid a recession is a delicate balancing act that requires careful consideration of the potential repercussions.

Balancing Act: Finding the Optimal Path

The Bank of Canada's challenge is to find a path that effectively controls inflation without causing a significant economic downturn. This requires a nuanced understanding of the economy's current state and a willingness to adapt policies as new data becomes available. A "soft landing," where inflation is reduced without triggering a recession, is the ideal outcome but is extremely challenging to achieve.

- Alternative monetary policy approaches: Exploring alternative approaches, such as targeted interventions or forward guidance, could offer additional tools to fine-tune the response.

- Fiscal policy coordination: Coordination with fiscal policy, through government spending and taxation decisions, can potentially complement monetary policy and enhance effectiveness.

- Challenges in economic forecasting: Economic forecasting is inherently uncertain, making it difficult to precisely predict the impact of policy decisions. Continuous monitoring and adaptation are crucial.

The Bank of Canada's decisions will profoundly impact the Canadian economy; finding the optimal balance is crucial for long-term stability and prosperity.

Conclusion

The Bank of Canada's inflation dilemma underscores the complex interplay between price stability and economic growth. Controlling inflation without triggering a recession requires a delicate balance, careful consideration of various factors, and a willingness to adapt policies as circumstances evolve. Understanding the Bank of Canada's inflation dilemma is crucial for navigating the current economic landscape. Stay informed about the Bank of Canada's monetary policy decisions and their impact on the Canadian economy by regularly checking the Bank of Canada's website and following reputable economic news sources. This will empower you to make informed decisions and contribute to a healthier financial future.

Featured Posts

-

Federal Leaders Saskatchewan Visit Controversial Comments And Political Fallout

May 22, 2025

Federal Leaders Saskatchewan Visit Controversial Comments And Political Fallout

May 22, 2025 -

Stephane Une Artiste Suisse A Paris

May 22, 2025

Stephane Une Artiste Suisse A Paris

May 22, 2025 -

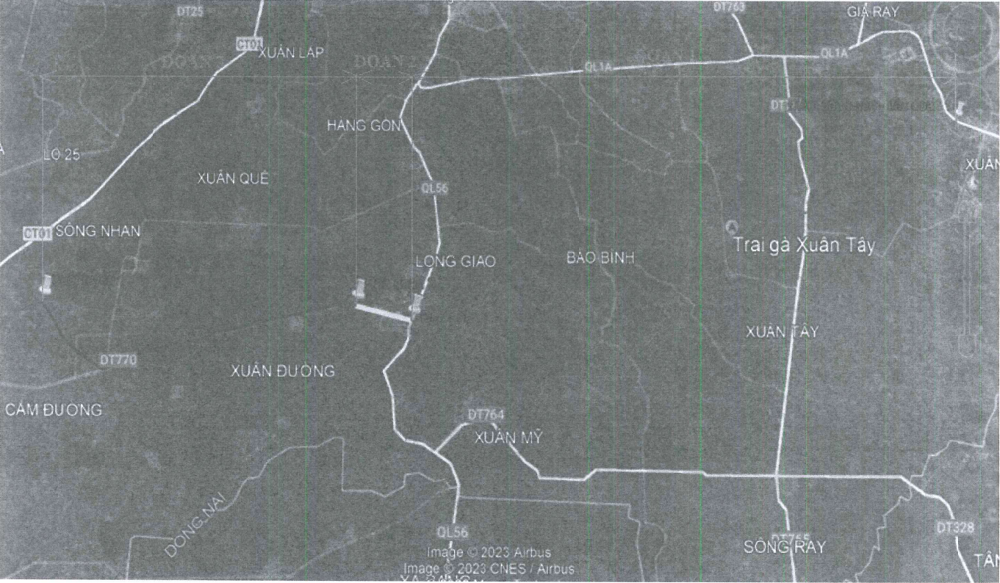

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025 -

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025 -

British Ultrarunner Challenges Australian Cross Country Speed Record

May 22, 2025

British Ultrarunner Challenges Australian Cross Country Speed Record

May 22, 2025

Latest Posts

-

Large Fire Engulfs Used Car Dealership Crews On Scene

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews On Scene

May 22, 2025 -

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025 -

Recent Susquehanna Valley Storm Damage Reports And Resources

May 22, 2025

Recent Susquehanna Valley Storm Damage Reports And Resources

May 22, 2025 -

Susquehanna Valley Storm Damage Prevention Preparation And Response

May 22, 2025

Susquehanna Valley Storm Damage Prevention Preparation And Response

May 22, 2025 -

Understanding And Mitigating Susquehanna Valley Storm Damage

May 22, 2025

Understanding And Mitigating Susquehanna Valley Storm Damage

May 22, 2025