Bank Of Canada's April Interest Rate Decision: Impact Of Trump Tariffs

Table of Contents

The Economic Landscape Preceding the April Decision

Before the April announcement, the Canadian economy presented a mixed picture. While GDP growth remained positive, it showed signs of slowing. Inflation rates were hovering near the Bank of Canada's target range, but unemployment figures were also a cause for concern. The lingering effects of previous interest rate adjustments were still being felt, with some sectors showing more resilience than others. The global economic uncertainty, particularly the lingering effects of the US-China trade war and the impact of Trump's tariffs on various industries, added to the complexity of the situation.

- Key Economic Indicators:

- GDP growth: [Insert actual data from April timeframe]

- Inflation rate: [Insert actual data from April timeframe]

- Unemployment rate: [Insert actual data from April timeframe]

- Consumer confidence index: [Insert actual data from April timeframe]

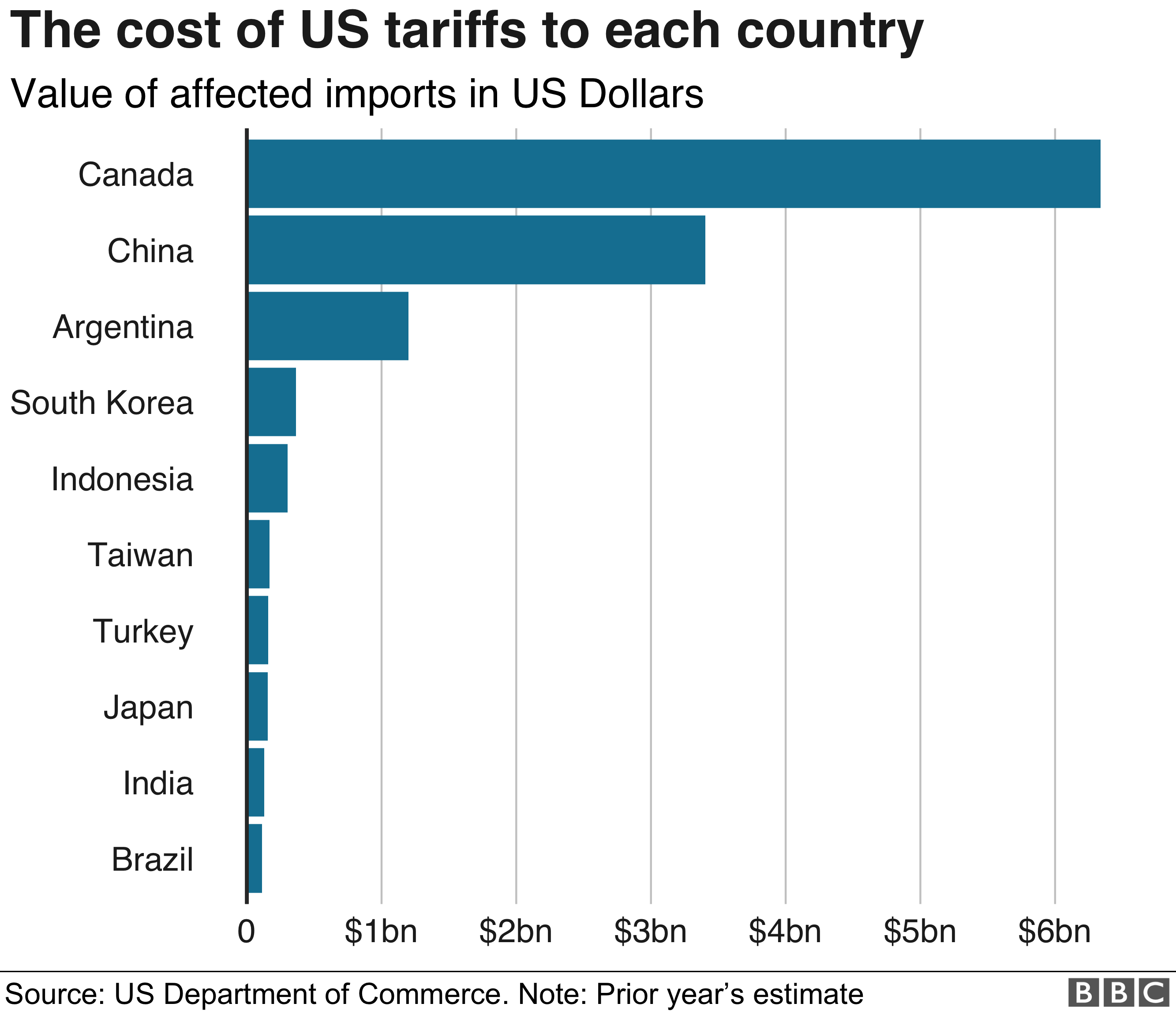

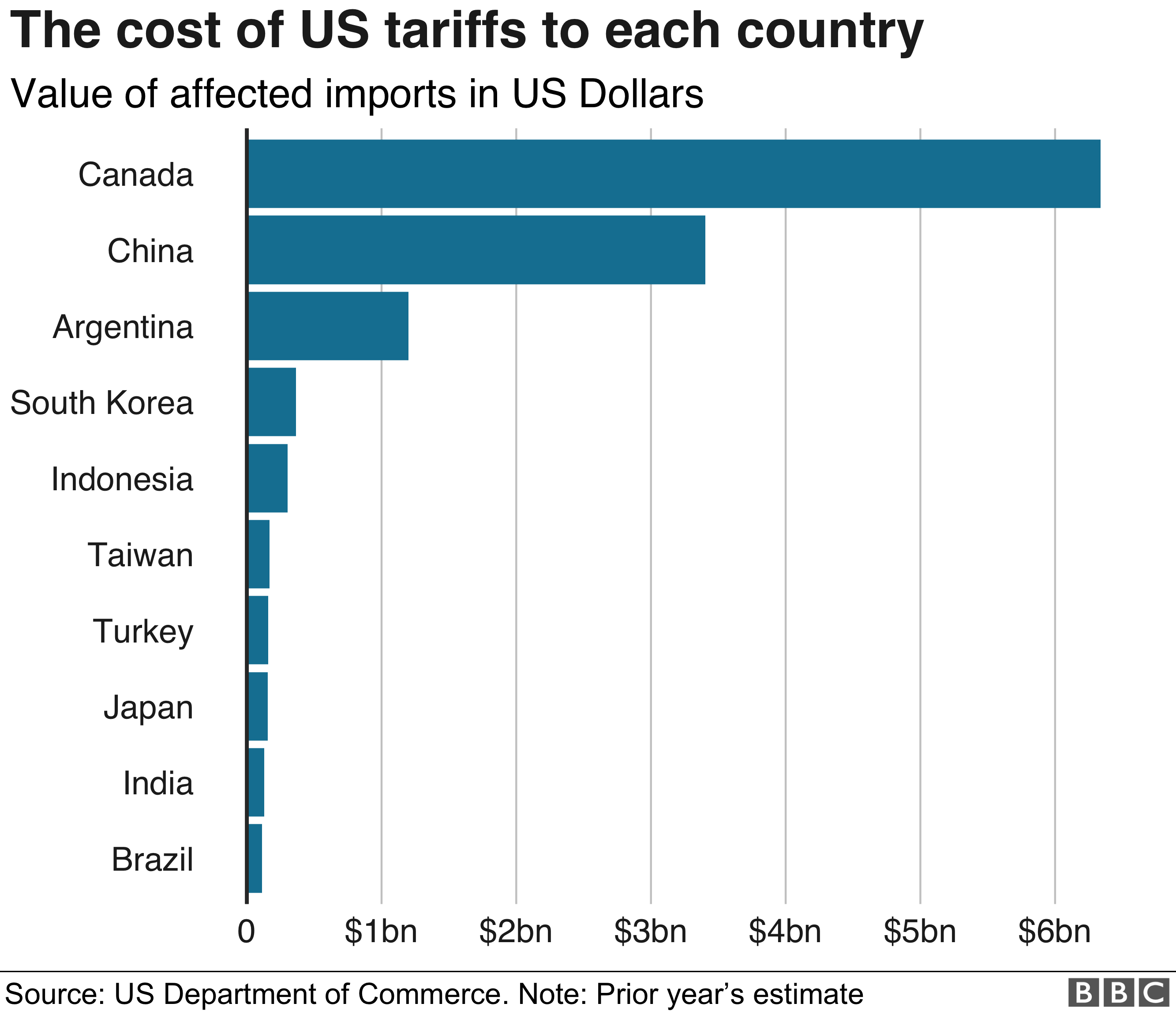

- Influence of Global Uncertainty: The unresolved trade tensions between the US and China, although easing somewhat by April, created a climate of uncertainty that influenced investor sentiment and business investment decisions. The residual effects of Trump's tariffs, which disproportionately impacted certain Canadian sectors, continued to cast a shadow over economic forecasts.

Trump Tariffs and Their Ripple Effect on the Canadian Economy

Trump's tariffs, particularly those targeting Canadian lumber and aluminum, had a significant impact on the Canadian economy. These tariffs disrupted established trade relationships, leading to decreased exports and impacting the profitability of Canadian businesses in those sectors. The effects weren't limited to the directly targeted industries; supply chain disruptions rippled through the economy, affecting related businesses and creating broader economic uncertainty.

- Specific Tariff Impacts:

- Lumber: [Insert quantitative data on the impact of lumber tariffs on Canadian exports and employment]

- Aluminum: [Insert quantitative data on the impact of aluminum tariffs on Canadian exports and employment]

- Other sectors: [Mention other impacted sectors and quantify their losses if possible]

- Government Support Measures: The Canadian government implemented various support measures to help businesses impacted by the tariffs. [Detail these measures, e.g., financial assistance programs, trade diversification initiatives].

The Bank of Canada's Response and Rationale

In April [Year], the Bank of Canada [Insert actual interest rate decision: increased, decreased, or held the rate]. This decision was largely attributed to [Explain the Bank's rationale, linking it to the economic indicators discussed earlier]. The Bank's statement emphasized [Summarize the key points from the Bank's official statement] and offered forward guidance on future interest rate movements, suggesting a [Describe the Bank's outlook – cautious, optimistic, etc.].

- Interest Rate Change: [State the specific change in the interest rate]

- Justification: [Detailed explanation of the Bank's reasoning, emphasizing the role of economic data and the lingering effects of Trump's tariffs]

- Bank's Outlook: [Summary of the Bank's predictions for the future economic performance]

Potential Long-Term Implications and Future Scenarios

The long-term impacts of Trump's tariffs on the Canadian economy are still unfolding. While the tariffs have been removed, their legacy continues to influence trade patterns and business strategies. Different future trade policies and global economic conditions could lead to a variety of scenarios. The Bank of Canada will likely continue to monitor these developments closely and adjust its monetary policy accordingly.

- Possible Future Scenarios:

- Scenario 1: Continued economic growth, with gradual interest rate increases.

- Scenario 2: Slower economic growth, requiring further monetary stimulus.

- Scenario 3: Increased global uncertainty leading to unpredictable interest rate adjustments.

- Influence on Future Interest Rate Decisions: The Bank of Canada's future interest rate decisions will depend on a multitude of factors, including inflation, unemployment, global economic conditions, and the ongoing evolution of trade relationships.

Conclusion: Understanding the Bank of Canada's April Interest Rate Decision in the Context of Trump Tariffs

The Bank of Canada's April interest rate decision was a complex response to a multifaceted economic landscape. The lingering impact of Trump's tariffs played a significant role in shaping the Bank's assessment of the economy and its subsequent policy decision. Understanding this connection is vital for investors, businesses, and individuals alike. To stay abreast of future Bank of Canada interest rate decisions and their impact on the Canadian economy, subscribe to our newsletter or follow reputable economic news sources for up-to-date analysis and commentary on Canadian interest rate policy and Bank of Canada interest rate announcements.

Featured Posts

-

Northumberland Man Embarks On Round The World Trip In Self Built Boat

May 02, 2025

Northumberland Man Embarks On Round The World Trip In Self Built Boat

May 02, 2025 -

Broadcoms V Mware Acquisition At And T Reports A 1050 Price Surge

May 02, 2025

Broadcoms V Mware Acquisition At And T Reports A 1050 Price Surge

May 02, 2025 -

Loblaw Ceo On The Buy Canadian Movement A Short Lived Phenomenon

May 02, 2025

Loblaw Ceo On The Buy Canadian Movement A Short Lived Phenomenon

May 02, 2025 -

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025 -

Die Lottozahlen 6aus49 Vom 19 April 2025

May 02, 2025

Die Lottozahlen 6aus49 Vom 19 April 2025

May 02, 2025

Latest Posts

-

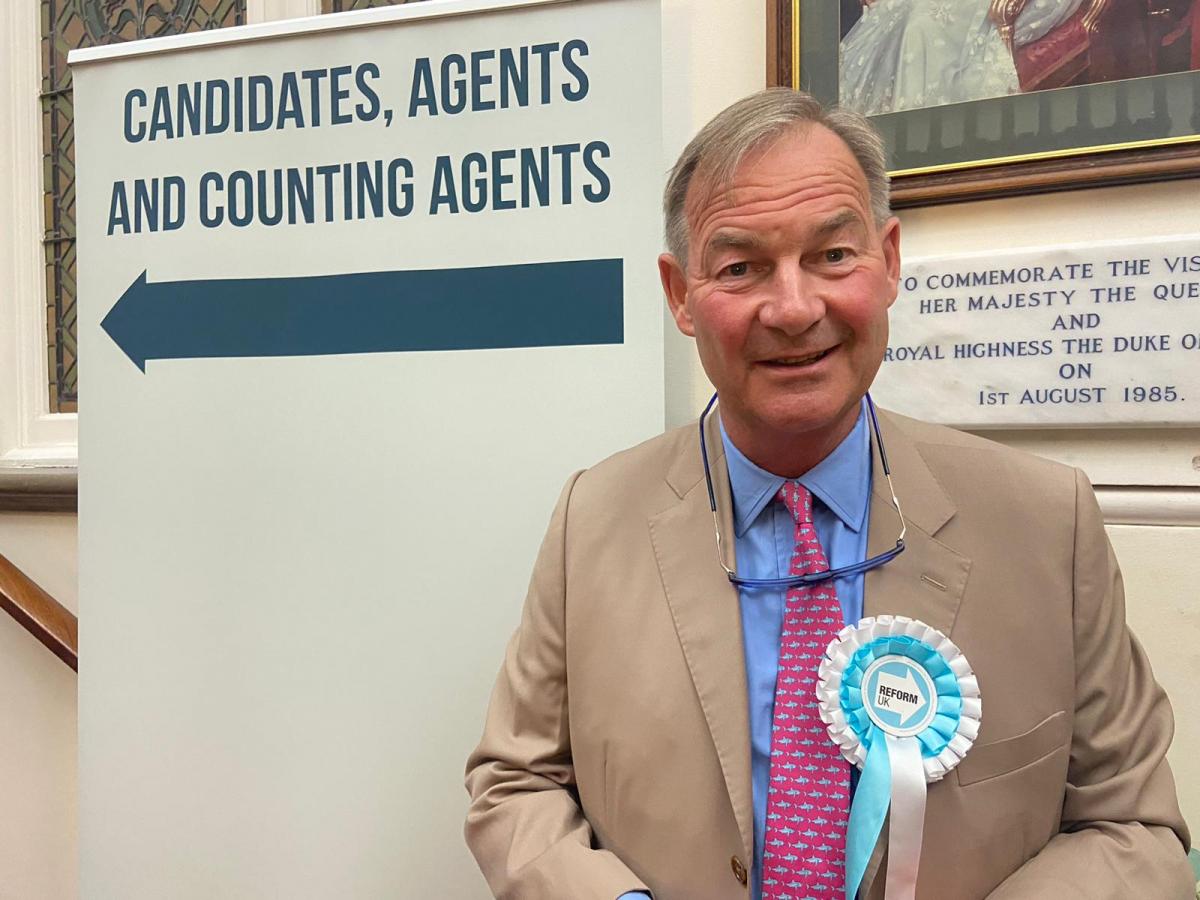

Toxic Office Culture Allegations Against Former Uk Mp Rupert Lowe Examining The Evidence

May 02, 2025

Toxic Office Culture Allegations Against Former Uk Mp Rupert Lowe Examining The Evidence

May 02, 2025 -

Evidence Of Toxic Workplace Culture Rupert Lowes Time As A Uk Mp

May 02, 2025

Evidence Of Toxic Workplace Culture Rupert Lowes Time As A Uk Mp

May 02, 2025 -

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025 -

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025 -

Analyzing The Minnesota Special House Election An Ap Decision Notes Perspective

May 02, 2025

Analyzing The Minnesota Special House Election An Ap Decision Notes Perspective

May 02, 2025