Bank Of Canada Rate Cuts: Economists Predict Renewed Rate Reductions Amidst Tariff Job Losses

Table of Contents

Economists' Predictions for Further Bank of Canada Rate Reductions

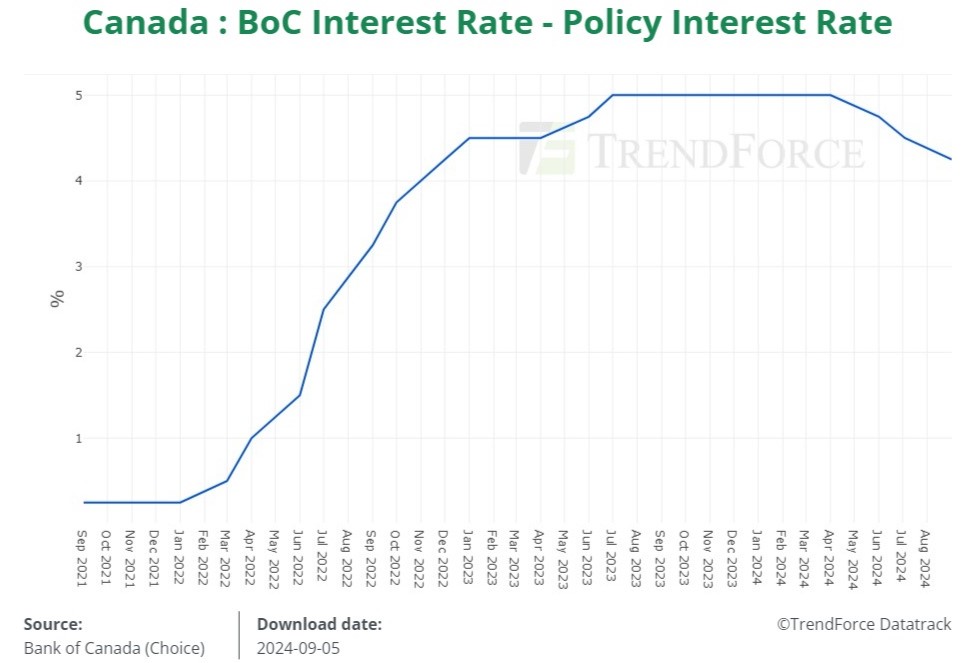

A growing consensus among leading economists points towards further Bank of Canada rate cuts in the coming months. The current economic climate, characterized by sluggish growth and rising unemployment linked to tariffs, is fueling this prediction. Many believe the Bank of Canada will need to act decisively to prevent a more significant economic downturn.

-

Specific economist quotes supporting rate cuts: "Given the weakening economic indicators and the impact of tariffs, a rate cut is almost inevitable," stated Dr. Anya Sharma, Chief Economist at Global Macro Advisors. Similar sentiments have been echoed by other prominent figures, including David Rosenberg of Gluskin Sheff + Associates, who predicts at least one more 25-basis-point cut before the year's end.

-

Referenced economic indicators pointing to a rate cut: Key indicators like declining consumer confidence, softening manufacturing output, and a weakening labor market all contribute to the prediction of further Bank of Canada rate cuts. The recent decline in the Purchasing Managers' Index (PMI) further reinforces this expectation.

-

Analysis of the current economic climate and its implications: The current economic slowdown, exacerbated by the ongoing trade disputes and associated tariff impacts, necessitates proactive monetary policy intervention. The Bank of Canada is likely to prioritize preventing a recessionary spiral over concerns about inflation in the short term.

The Impact of Tariffs on Canadian Employment and the Economy

The impact of tariffs on the Canadian economy is multifaceted and deeply concerning. The direct consequences include job losses in sectors heavily reliant on international trade, such as manufacturing and agriculture. The indirect consequences are equally significant, leading to decreased consumer spending and dampened overall economic growth.

-

Statistics on tariff-related job losses in specific sectors: Statistics Canada recently reported a significant increase in unemployment claims in the manufacturing sector, directly attributable to tariff-related disruptions. The agriculture sector has also experienced considerable hardship due to reduced export opportunities.

-

Examples of companies affected by tariffs and resulting job cuts: Several prominent Canadian manufacturers have announced layoffs due to decreased demand stemming from tariffs. This ripple effect extends beyond the directly impacted companies, affecting suppliers and related industries.

-

Discussion of the impact on consumer confidence and spending: The uncertainty surrounding the trade war and the subsequent job losses have significantly impacted consumer confidence. Reduced consumer spending creates a further drag on economic growth, creating a vicious cycle.

Potential Consequences of Further Bank of Canada Rate Cuts

Lowering interest rates is a powerful tool, but it's a double-edged sword. While Bank of Canada rate cuts can stimulate economic activity and prevent a recession, they also carry potential risks.

-

Potential positive economic outcomes of lower interest rates: Lower borrowing costs can encourage businesses to invest and expand, leading to job creation and increased economic activity. Consumers may also be incentivized to spend more, boosting aggregate demand.

-

Potential negative economic outcomes of lower interest rates: The primary concern is inflation. Lower rates can potentially fuel inflation if demand outpaces supply. Furthermore, lower interest rates can lead to increased household debt, potentially making the economy more vulnerable to future shocks. A weaker Canadian dollar is also a possibility, affecting import costs.

-

Analysis of the risk-reward assessment for the Bank of Canada: The Bank of Canada faces a difficult trade-off. The risk of inaction – a deeper recession – is substantial. However, the risks associated with aggressive rate cuts, particularly inflation, must also be carefully weighed.

Alternative Economic Strategies and Policy Responses

While Bank of Canada rate cuts are a crucial tool, they are not a panacea. The government could implement complementary fiscal policies to support the economy.

-

Examples of fiscal policy options the government could implement: Increased government spending on infrastructure projects can stimulate economic activity and create jobs. Targeted tax cuts for businesses or specific sectors could also provide much-needed support.

-

Discussion of the effectiveness of different policy strategies: The effectiveness of any policy depends on its design, implementation, and coordination with monetary policy. A well-coordinated approach combining fiscal and monetary policy is likely to yield better results than a single-pronged strategy.

-

Analysis of the potential long-term economic effects of various strategies: Long-term economic success requires a multi-faceted approach focusing not only on short-term stabilization but also on long-term sustainable growth and diversification of the Canadian economy.

Conclusion: Navigating the Future with Informed Expectations of Bank of Canada Rate Cuts

The likelihood of further Bank of Canada rate cuts remains high, driven by the economic challenges posed by tariffs and their impact on employment. While rate reductions can stimulate the economy, they also carry potential risks. Understanding these risks and exploring alternative policy responses is critical. Staying informed about the Bank of Canada's decisions and their potential impact on your finances and investments is crucial. Regularly consult the Bank of Canada website [link to Bank of Canada website] and other reputable financial news sources to stay abreast of the latest developments regarding Bank of Canada rate cuts and their implications for the Canadian economy.

Featured Posts

-

Segunda Division Uruguaya 2025 Calendario Y Sistema De Juego

May 11, 2025

Segunda Division Uruguaya 2025 Calendario Y Sistema De Juego

May 11, 2025 -

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 11, 2025

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 11, 2025 -

2025 Indy 500 Analysis Of 5 Drivers At Risk Of Missing The Race

May 11, 2025

2025 Indy 500 Analysis Of 5 Drivers At Risk Of Missing The Race

May 11, 2025 -

Mask Singer 2025 Chantal Ladesou A T Elle Devoile L Autruche Nos Predictions

May 11, 2025

Mask Singer 2025 Chantal Ladesou A T Elle Devoile L Autruche Nos Predictions

May 11, 2025 -

Mauricio Ruffys Spinning Kick Road To Ufc 313

May 11, 2025

Mauricio Ruffys Spinning Kick Road To Ufc 313

May 11, 2025