Bank Of Canada Rate Cuts: Economists Predict Renewed Cuts Amidst Tariff Job Losses

Table of Contents

The Impact of Tariffs on the Canadian Economy

The imposition of tariffs, particularly in the context of the ongoing trade war, has dealt a significant blow to several key Canadian industries. The tariff impact Canada is multifaceted, significantly impacting sectors like manufacturing and agriculture. Canadian manufacturers, facing increased import costs for raw materials and components, struggle to compete in the global market, leading to decreased production and, consequently, job losses Canada. This decline in manufacturing activity has a ripple effect, impacting related industries and reducing consumer spending, contributing to a Canadian economic slowdown. The trade war impact extends beyond direct job losses; it erodes business confidence, discouraging investment and hindering overall economic growth.

Statistics Canada data reveals a concerning trend. For example, (insert specific data and source here, e.g., "The manufacturing sector experienced a 2% decline in employment in Q3 2023, according to Statistics Canada."). This demonstrates the tangible impact of tariffs.

- Increased import costs leading to higher prices for consumers. This reduces purchasing power and dampens consumer demand.

- Reduced competitiveness of Canadian businesses in global markets. This leads to lost market share and decreased profitability.

- Decreased investment and business confidence. Uncertainty surrounding future trade policies discourages businesses from investing and expanding.

Economists' Predictions for Further Bank of Canada Rate Cuts

Given the weakening economic indicators and rising concerns about a recession, a significant number of economists predict further Bank of Canada interest rates reductions. The consensus, though not unanimous, leans towards at least one more interest rate cuts prediction in the coming months. Prominent economists like (insert name and affiliation of an economist and their prediction here) argue that lower interest rates are necessary to stimulate economic activity and mitigate the negative effects of tariffs. Their analysis utilizes various macroeconomic models and forecasts, considering factors like inflation rates, labor market conditions, and projected economic growth. The economic forecast Canada remains uncertain, but many believe a proactive monetary policy response is warranted.

- Analysis of inflation rates and their trajectory. Low inflation provides the Bank of Canada with room to cut rates without fueling inflationary pressures.

- Assessment of the current state of the labor market. High unemployment and declining job growth underscore the need for stimulus.

- Expectations regarding future economic growth. Pessimistic forecasts for growth strengthen the case for interest rate cuts.

Potential Consequences of Further Bank of Canada Rate Cuts

Lowering Bank of Canada interest rates aims to stimulate the economy by making borrowing cheaper, thereby encouraging investment and consumer spending. However, there are potential downsides. While a Canadian economic stimulus is the desired outcome, monetary policy effects can be complex and unpredictable. Lower interest rates could lead to increased inflation, potentially eroding the purchasing power of consumers. Furthermore, a decrease in interest rates might weaken the Canadian dollar exchange rate, impacting imports and exports.

- Impact on the housing market: Lower rates could fuel further price increases in the already heated housing market.

- Effects on government debt: Lower interest rates reduce the cost of servicing government debt, but could increase overall debt levels.

- Influence on foreign investment: A weaker Canadian dollar may attract some foreign investment but could also discourage others.

Alternative Economic Strategies to Address Job Losses

While Bank of Canada rate cuts are a crucial tool, they are not a panacea. Addressing the root cause of job losses requires a multifaceted approach. The Canadian government economic policy needs to explore alternative strategies beyond monetary policy adjustments. This includes targeted government support for business in affected sectors, coupled with job creation initiatives and worker retraining programs. Economic diversification Canada is crucial to reduce dependence on vulnerable industries.

- Investment in infrastructure projects: This creates jobs and boosts economic activity.

- Targeted tax breaks for specific industries: This can help struggling businesses stay competitive.

- Enhancement of trade agreements: Securing new trade deals and strengthening existing ones can mitigate the impact of tariffs.

Conclusion: Navigating the Future with Informed Bank of Canada Rate Cuts Decisions

The predicted Bank of Canada rate cuts are a direct response to the economic challenges created by tariff-induced job losses and the resulting Canadian economic slowdown. While these cuts aim to stimulate the economy, the potential consequences require careful consideration. Monitoring key economic indicators, including inflation, unemployment, and the Canadian dollar exchange rate, is crucial for informed decision-making. Alternative strategies focusing on supporting affected industries, job creation, and economic diversification are also essential. Stay informed about future Bank of Canada rate cuts announcements by following reputable sources such as the Bank of Canada website ([link to Bank of Canada website]), Statistics Canada ([link to Statistics Canada website]), and other credible financial news outlets. Understanding the nuances of monetary policy and its implications for the Canadian economy is crucial in these uncertain times.

Featured Posts

-

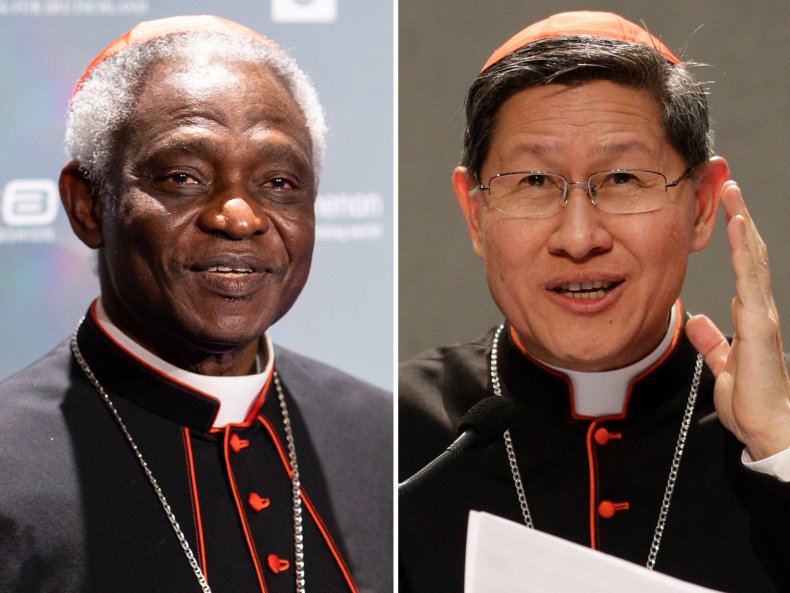

The Next Pope Profiling The Leading Candidates To Succeed Francis

May 12, 2025

The Next Pope Profiling The Leading Candidates To Succeed Francis

May 12, 2025 -

Danmark Sender Sissal Til Eurovision 2025

May 12, 2025

Danmark Sender Sissal Til Eurovision 2025

May 12, 2025 -

Resi Awards 2025 Winners Announced

May 12, 2025

Resi Awards 2025 Winners Announced

May 12, 2025 -

Shevchenko Vs Fiorot A Fight That Might Not Happen

May 12, 2025

Shevchenko Vs Fiorot A Fight That Might Not Happen

May 12, 2025 -

Stilska Analiza Kim Kardashi An I Ne Zinata Vpechatliva Obleka

May 12, 2025

Stilska Analiza Kim Kardashi An I Ne Zinata Vpechatliva Obleka

May 12, 2025

Latest Posts

-

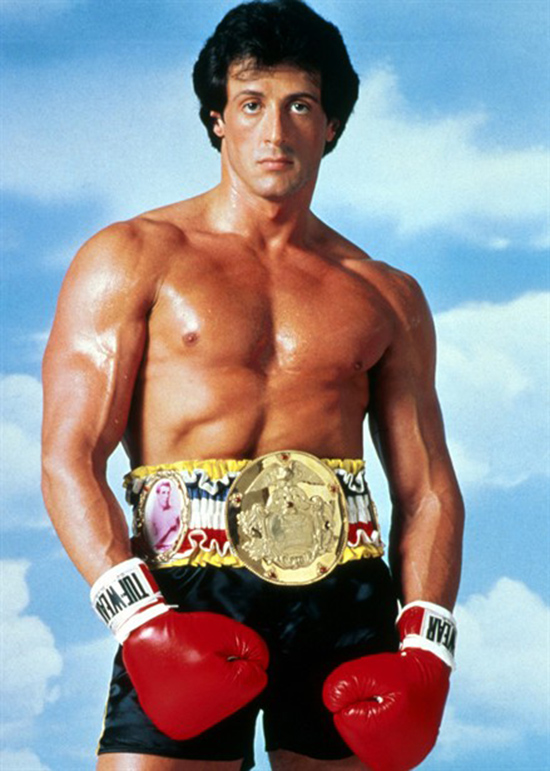

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025 -

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical And Commercial Failure

May 12, 2025

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical And Commercial Failure

May 12, 2025 -

Action Thriller Armor Starring Sylvester Stallone Free Online Streaming

May 12, 2025

Action Thriller Armor Starring Sylvester Stallone Free Online Streaming

May 12, 2025 -

Sylvester Stallone Action Thriller Armor Now Streaming Free

May 12, 2025

Sylvester Stallone Action Thriller Armor Now Streaming Free

May 12, 2025 -

Find Kojak On Itv 4 A Comprehensive Guide To Airtimes

May 12, 2025

Find Kojak On Itv 4 A Comprehensive Guide To Airtimes

May 12, 2025