Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Keywords: Bank of Canada rate cuts, interest rate cuts, Desjardins, Canadian economy, mortgage rates, economic forecast, monetary policy, inflation, recession

The Canadian economy is facing headwinds, and a major financial institution has just released a forecast that's sending ripples through the market: Desjardins predicts three more Bank of Canada rate cuts. This bold prediction has significant implications for interest rates, mortgages, and the overall health of the Canadian economy. Let's delve into the details and understand what this means for you.

Desjardins' Prediction and its Rationale

Desjardins, one of Canada's largest financial institutions, anticipates the Bank of Canada will implement three further interest rate cuts in the coming months. This forecast stems from a confluence of concerning economic indicators.

-

Weakening economic growth: Recent GDP figures show a slowdown in economic activity, with key sectors exhibiting sluggish growth. Employment data also points towards a potential cooling of the labor market, further supporting concerns about decelerating growth.

-

Persistently low inflation: While inflation has decreased from its peak, it remains stubbornly above the Bank of Canada's target range of 1-3%. This persistent inflation, albeit lower, could prompt the central bank to ease monetary policy further.

-

Global economic uncertainty: The global economic landscape is fraught with challenges, including geopolitical instability and the potential for recessions in major economies. These external factors significantly impact Canada's economic outlook.

-

Comparison to other economic forecasts: While other financial institutions hold varying viewpoints, many share concerns about economic slowdown. Desjardins' prediction, however, is particularly strong in its forecast of multiple rate cuts.

The overall economic climate suggests a cautious approach from the Bank of Canada, leading Desjardins to believe that further interest rate cuts are necessary to stimulate growth and manage inflationary pressures effectively.

Potential Impact on Interest Rates

Desjardins' prediction of three more Bank of Canada rate cuts translates to a significant decrease in interest rates across the board. This has several key consequences:

-

Lower borrowing costs: Reduced interest rates make borrowing cheaper for businesses and consumers. This could potentially stimulate investment and consumer spending.

-

Impact on savings accounts and GICs: Lower interest rates generally mean lower returns on savings accounts and Guaranteed Investment Certificates (GICs). Savers may need to explore alternative investment strategies to maintain their savings growth.

-

Potential for increased consumer spending: Lower borrowing costs could encourage consumers to make larger purchases, such as homes or vehicles, leading to a boost in consumer spending. However, this effect is contingent on consumer confidence.

-

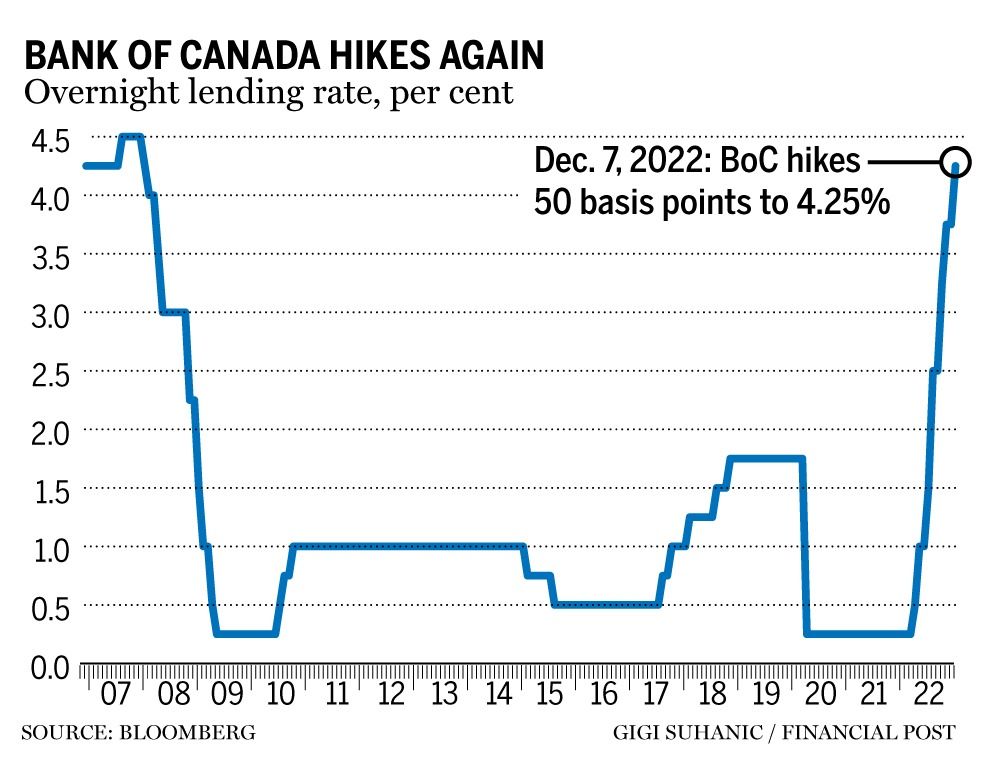

Comparison to historical interest rate trends: Examining historical interest rate trends provides valuable context. The current situation represents a significant shift from the period of rising interest rates experienced in recent years.

The decrease in interest rates is likely to be a gradual process, with the Bank of Canada carefully monitoring the economic response to each cut.

Impact on Mortgages and Housing Market

The predicted rate cuts will undoubtedly influence the Canadian mortgage market:

-

Lower mortgage payments: Lower interest rates will translate directly into lower mortgage payments for both new and existing homeowners, potentially increasing affordability.

-

Potential increase in housing demand: Reduced mortgage costs could lead to increased demand in the housing market, potentially driving up home prices in some areas. This is particularly relevant in markets that are already experiencing strong demand.

-

Impact on homebuyers and existing homeowners: First-time homebuyers will likely benefit most from lower mortgage rates, while existing homeowners might see an increase in their home's value.

-

Risks associated with lower interest rates: While lower rates stimulate the market, it also presents the risk of creating an unsustainable housing bubble. Careful monitoring and regulatory measures are crucial to mitigate these risks.

Impact Beyond Mortgages

The consequences of Bank of Canada rate cuts extend beyond the mortgage market:

-

Business Investment: Lower borrowing costs can incentivize businesses to invest in expansion and new projects, boosting economic activity.

-

Consumer Confidence: Lower interest rates can improve consumer confidence, leading to increased spending and economic growth. However, this effect depends on other factors, such as job security and inflation expectations.

-

Government Spending: The government may choose to adjust its fiscal policy in response to the changing economic climate caused by the rate cuts.

The ripple effects of these rate cuts will be felt throughout the Canadian economy, influencing various sectors and individuals in diverse ways.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts signals a cautious approach to managing the current economic climate. These cuts are likely to impact interest rates, mortgages, and the overall economic activity in Canada. While lower interest rates can benefit borrowers and stimulate spending, it's crucial to understand the potential risks involved, such as the possibility of inflationary pressures or the creation of asset bubbles. Stay informed about future Bank of Canada rate cuts and their impact on your finances. Follow Desjardins' expert analysis and plan accordingly, consulting other reputable financial sources for a comprehensive understanding. Understanding these changes is vital for making informed financial decisions in the evolving Canadian economic landscape.

Featured Posts

-

Decoding Big Rig Rock Report 3 12 An X101 5 Perspective

May 23, 2025

Decoding Big Rig Rock Report 3 12 An X101 5 Perspective

May 23, 2025 -

2025 Memorial Day Weekend Beach Forecast For Ocean City Rehoboth And Sandy Point

May 23, 2025

2025 Memorial Day Weekend Beach Forecast For Ocean City Rehoboth And Sandy Point

May 23, 2025 -

The Karate Kid Part Iii Analyzing The Characters And Their Development

May 23, 2025

The Karate Kid Part Iii Analyzing The Characters And Their Development

May 23, 2025 -

March 20 2025 Horoscope Predictions For 5 Lucky Zodiac Signs

May 23, 2025

March 20 2025 Horoscope Predictions For 5 Lucky Zodiac Signs

May 23, 2025 -

Kermit The Frog As Umd Commencement Speaker A Hilarious Online Response

May 23, 2025

Kermit The Frog As Umd Commencement Speaker A Hilarious Online Response

May 23, 2025

Latest Posts

-

Jonathan Groff On Asexuality Instinct Magazine Interview

May 23, 2025

Jonathan Groff On Asexuality Instinct Magazine Interview

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Era Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Era Musical Triumph

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groff Opens Up About His Experiences With Asexuality

May 23, 2025

Jonathan Groff Opens Up About His Experiences With Asexuality

May 23, 2025 -

Jonathan Groffs Past An Open Discussion On Asexuality

May 23, 2025

Jonathan Groffs Past An Open Discussion On Asexuality

May 23, 2025