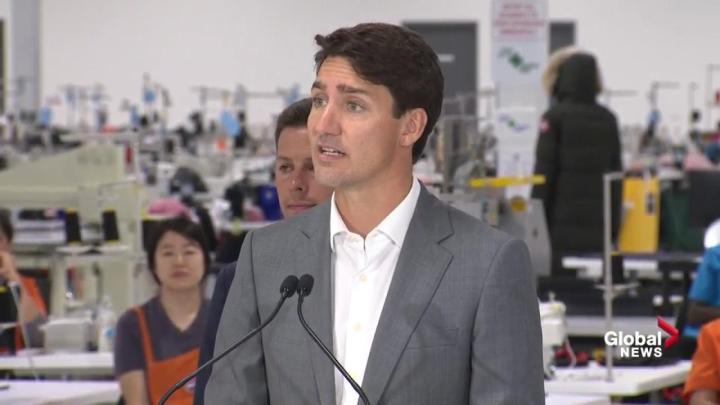

Bank Of Canada Interest Rate Outlook: Tariff-Related Job Losses Spur Predictions Of Cuts

Table of Contents

Tariff Impact on the Canadian Economy

The ongoing trade tensions and the impact of tariffs, particularly those stemming from the US-China trade war, have significantly impacted the Canadian economy. Key Canadian export sectors, such as automotive manufacturing and agriculture, have felt the brunt of these increased trade barriers. The uncertainty surrounding the implementation and future of the USMCA (United States-Mexico-Canada Agreement) further exacerbates the situation, making accurate economic projections challenging. The resulting economic headwinds are causing ripples throughout the Canadian economy, affecting both businesses and individuals.

- Decreased exports to key trading partners: Tariffs have made Canadian goods less competitive in international markets, leading to a decline in exports. This reduction in export revenue negatively impacts businesses and overall economic growth.

- Increased production costs for businesses: Tariffs on imported goods increase production costs for Canadian businesses, squeezing profit margins and potentially leading to layoffs and reduced investment.

- Reduced consumer spending due to higher prices: Tariffs contribute to higher prices for consumers, reducing their disposable income and leading to decreased consumer spending, a key driver of economic growth.

- Job losses across various sectors: The combination of decreased exports, higher production costs, and reduced consumer spending has resulted in significant job losses across numerous sectors of the Canadian economy.

- Weakening Canadian dollar: The economic slowdown and reduced demand for Canadian exports have contributed to a weakening of the Canadian dollar, further impacting export competitiveness.

Bank of Canada's Response to Economic Slowdown

The Bank of Canada's primary mandate is to maintain price stability and promote full employment. Historically, in response to economic slowdowns, the Bank has used monetary policy tools, primarily adjusting interest rates, to stimulate economic activity. Lowering interest rates aims to incentivize borrowing and investment, ultimately boosting economic growth. In the face of the current challenges, interest rate cuts are considered a key strategy to counteract the negative impacts of tariffs and the resulting economic slowdown.

- Lower interest rates to encourage borrowing and investment: Reduced interest rates make borrowing more attractive for businesses and consumers, leading to increased investment and spending.

- Increased consumer spending due to lower borrowing costs: Lower interest rates reduce borrowing costs for consumers, potentially leading to increased spending on big-ticket items like homes and cars, thereby stimulating economic activity.

- Potential for quantitative easing (QE) if the situation worsens: If interest rate cuts prove insufficient, the Bank of Canada might resort to quantitative easing (QE), a strategy involving large-scale asset purchases to inject liquidity into the financial system.

- Balancing the need to stimulate the economy with inflation targets: The Bank of Canada must carefully balance the need to stimulate the economy with its inflation target, ensuring that any rate cuts do not lead to excessive inflation.

Predictions and Market Reactions

Various economists and financial institutions have offered differing predictions regarding the Bank of Canada's next move on interest rates. Some predict a significant interest rate cut, while others suggest a more cautious approach. These predictions significantly influence market reactions, impacting bond yields, the Canadian dollar, and stock market performance. Market volatility is expected to increase as the anticipation builds.

- Range of interest rate cut predictions: Forecasts range from a single, modest rate cut to multiple, more substantial reductions depending on the severity of the economic slowdown.

- Impact on the Canadian dollar exchange rate: Expectations of interest rate cuts can weaken the Canadian dollar, making Canadian exports more competitive but potentially impacting the cost of imports.

- Investor confidence levels and market volatility: Uncertainty surrounding the Bank of Canada's actions can lead to increased market volatility and fluctuations in investor confidence.

- Analysis of bond yields and their implications: Bond yields generally move inversely to interest rates. Anticipation of rate cuts typically leads to lower bond yields.

Implications for Businesses and Consumers

The Bank of Canada's interest rate decisions have significant implications for both businesses and consumers. Lower interest rates can provide a boost to business investment and consumer spending, but also carry the risk of increased inflation. Understanding these potential impacts is crucial for strategic planning.

- Lower borrowing costs for businesses: Reduced interest rates translate to lower borrowing costs for businesses, making it cheaper to invest in expansion, equipment, and hiring.

- Potential increase in business investment and expansion: Lower borrowing costs can encourage businesses to invest in expansion projects, creating jobs and boosting economic growth.

- Lower mortgage rates for homeowners: Lower interest rates typically lead to lower mortgage rates, making homeownership more affordable and potentially stimulating the housing market.

- Potential increase in consumer spending and economic activity: Lower interest rates can encourage consumers to increase spending, boosting economic activity.

- Potential risks of increased inflation: However, significantly lower interest rates carry the risk of increased inflation, eroding the purchasing power of consumers.

Conclusion

Tariff-related job losses are significantly impacting the Canadian economy, leading many to predict that the Bank of Canada will cut interest rates to stimulate growth and mitigate the negative effects. The impact on businesses and consumers will depend on the magnitude and timing of any rate cuts. Understanding the interplay between tariffs, economic slowdown, and the Bank of Canada's response is crucial for informed decision-making.

Stay informed about the Bank of Canada's interest rate decisions and their implications for your business or personal finances. Monitor the Bank of Canada's official website and reputable financial news sources for the latest updates on the Bank of Canada interest rates. Understanding the Bank of Canada interest rate outlook is crucial for navigating the current economic climate and making sound financial decisions.

Featured Posts

-

Uncertainty Remains Over Full Elimination Of Canada Tariffs

May 12, 2025

Uncertainty Remains Over Full Elimination Of Canada Tariffs

May 12, 2025 -

Walmarts Bestselling Jessica Simpson Kimono Cardigan Only 29

May 12, 2025

Walmarts Bestselling Jessica Simpson Kimono Cardigan Only 29

May 12, 2025 -

Netherlands To Implement Area Bans For Troublesome Asylum Seekers

May 12, 2025

Netherlands To Implement Area Bans For Troublesome Asylum Seekers

May 12, 2025 -

Semana Santa O Semana De Turismo La Realidad Uruguaya Y Su Significado

May 12, 2025

Semana Santa O Semana De Turismo La Realidad Uruguaya Y Su Significado

May 12, 2025 -

Mirnoe Uregulirovanie Konflikta Pozitsiya Dzhonsona I Kritika Mirnogo Plana Trampa

May 12, 2025

Mirnoe Uregulirovanie Konflikta Pozitsiya Dzhonsona I Kritika Mirnogo Plana Trampa

May 12, 2025

Latest Posts

-

Angela Swartz Key Accomplishments And Projects

May 13, 2025

Angela Swartz Key Accomplishments And Projects

May 13, 2025 -

Oregon Ducks Womens Basketball Season Ends In Ncaa Tournament Loss To Duke

May 13, 2025

Oregon Ducks Womens Basketball Season Ends In Ncaa Tournament Loss To Duke

May 13, 2025 -

Hope Diminishes As Search Continues For Missing Elderly Hiker In Peninsula Hills

May 13, 2025

Hope Diminishes As Search Continues For Missing Elderly Hiker In Peninsula Hills

May 13, 2025 -

Exploring The Work Of Angela Swartz

May 13, 2025

Exploring The Work Of Angela Swartz

May 13, 2025 -

Obituaries Town City Name Recent Departures

May 13, 2025

Obituaries Town City Name Recent Departures

May 13, 2025