Bank Of Canada Interest Rate Outlook: Impact Of Tariffs And Employment Data

Table of Contents

The Impact of Tariffs on the Bank of Canada Interest Rate Outlook

Trade tensions and the resulting tariffs have significantly impacted the global economy, and Canada is no exception. These trade wars introduce considerable uncertainty into the Bank of Canada Interest Rate Outlook. The effects are multifaceted:

- Inflationary Pressures: Increased import costs due to tariffs directly translate to higher prices for consumers. This upward pressure on inflation is a major concern for the Bank of Canada. The impact is felt across various sectors, from manufacturing to retail.

- Economic Growth: Uncertainty stemming from tariff disputes can dampen business investment and consumer confidence, leading to slower economic growth. Businesses may delay expansion plans, fearing unpredictable trade costs.

- Canadian Dollar Exchange Rate: Fluctuations in the Canadian dollar exchange rate, influenced by global trade dynamics, further complicate the picture. A weaker dollar can exacerbate inflationary pressures by increasing the cost of imports.

The Bank of Canada's response to tariff-induced inflation will be crucial. Possible actions include:

- Increased interest rates: Raising interest rates is a traditional tool to combat inflation by cooling down economic activity and reducing demand.

- Delaying rate hikes: Depending on the severity and duration of tariff impacts, the Bank of Canada might choose to delay planned interest rate increases to avoid stifling already vulnerable economic growth.

- Impact on business investment: Higher interest rates can make borrowing more expensive, discouraging businesses from investing and potentially slowing economic growth further. This creates a delicate balancing act for the central bank.

Relevant keywords: trade tensions, inflation rate, Canadian dollar exchange rate, monetary policy response.

Employment Data: A Key Indicator for the Bank of Canada

Employment data, encompassing job creation, unemployment rates, and wage growth, serves as a critical barometer of the Canadian economy's health. For the Bank of Canada Interest Rate Outlook, this data is paramount.

- Strong Employment Data: Robust job creation and low unemployment generally signal a healthy economy. This can embolden the Bank of Canada to raise interest rates to manage potential inflationary pressures arising from strong wage growth.

- Weak Employment Data: Conversely, high unemployment and weak job growth indicate economic weakness. This might lead the Bank of Canada to adopt a more cautious approach, potentially delaying or even reversing interest rate hikes, or even considering rate cuts to stimulate the economy.

Key considerations within employment data include:

- Impact of low unemployment on wage growth and inflation: Tight labor markets can lead to increased wage demands, potentially fueling inflation.

- The significance of participation rates: Changes in labor force participation rates offer insights into the overall health of the labor market.

- Sector-specific job growth analysis: Examining job growth across different sectors provides a more nuanced understanding of the economy's strengths and weaknesses.

Relevant keywords: employment rate, unemployment rate, wage growth, labour market, economic growth.

Interplay Between Tariffs and Employment Data

The relationship between tariffs and employment data is complex and intertwined. The Bank of Canada must carefully consider their interconnectedness when formulating its monetary policy.

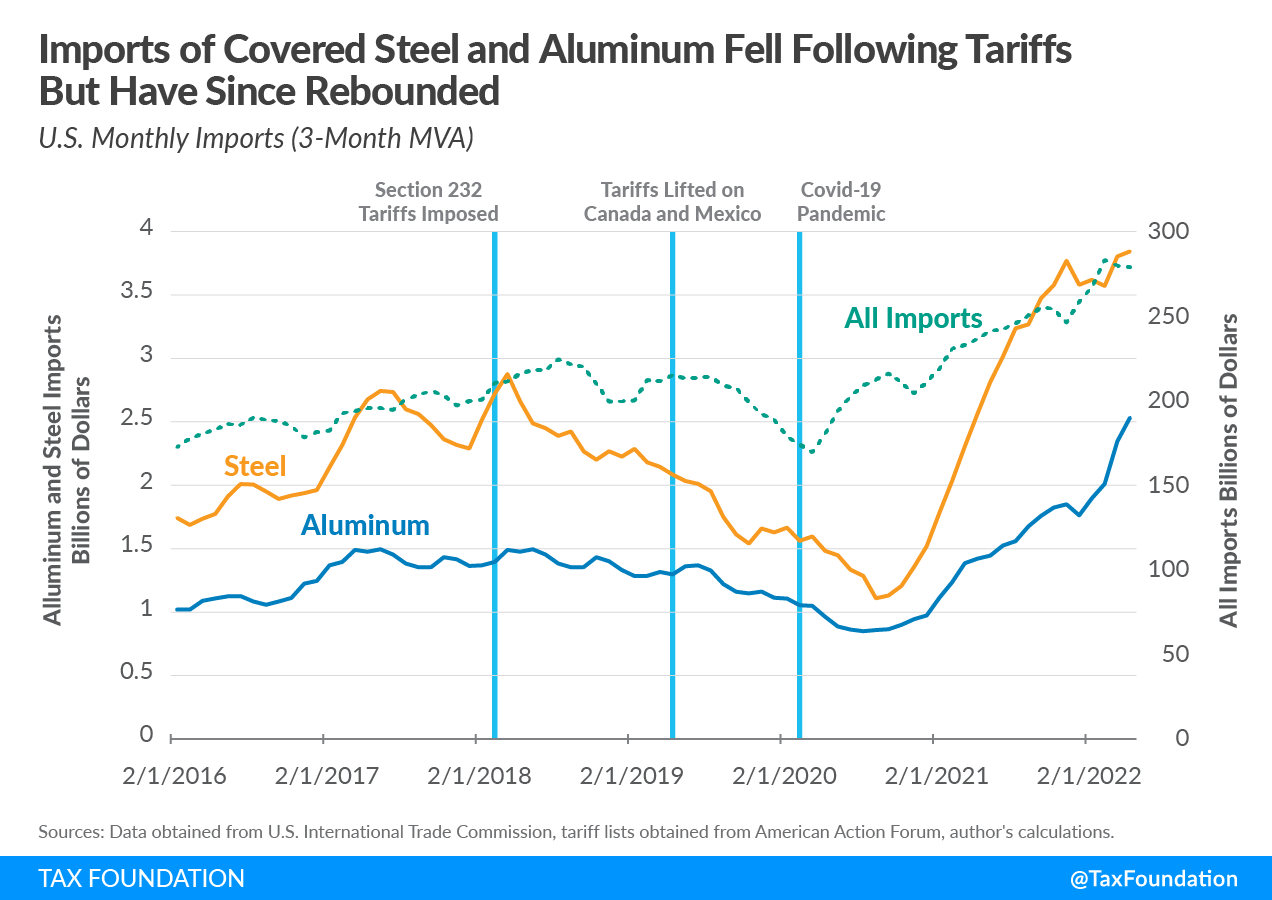

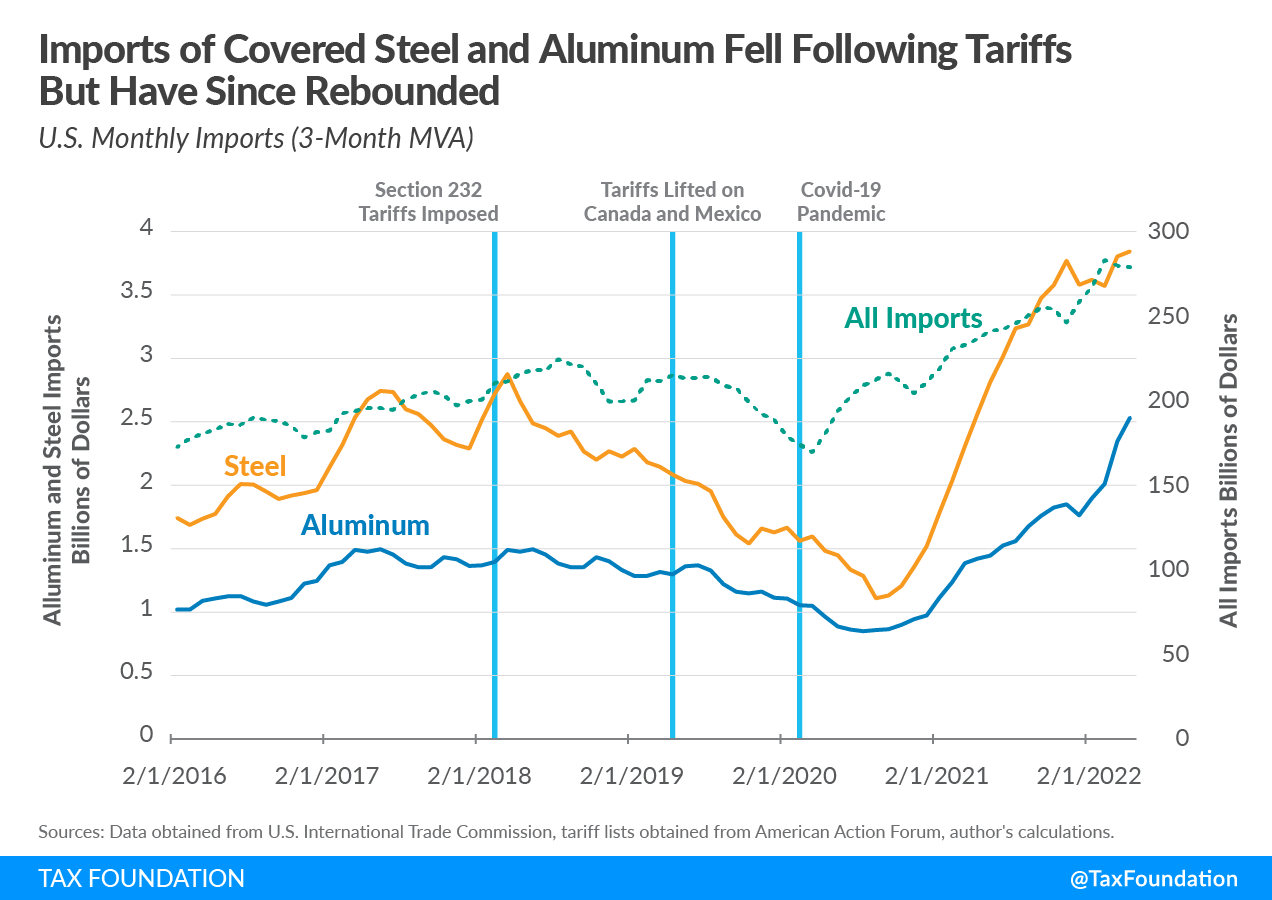

- Sectoral Impacts: Tariffs disproportionately impact certain sectors. For example, tariffs on imported steel could negatively affect manufacturing jobs reliant on steel imports. This sector-specific impact requires nuanced analysis.

- Balancing Act: The Bank of Canada faces the challenging task of balancing the risks of inflation and unemployment. Strong employment might offset some inflationary pressures from tariffs, but high inflation could lead to job losses if not addressed effectively. Conversely, weak employment might reduce inflationary pressure but maintain overall economic malaise.

- Government Intervention: Government policies, such as targeted support for affected industries or fiscal stimulus measures, can influence both employment and inflation, thereby impacting the Bank of Canada’s approach to interest rates.

The Bank of Canada utilizes sophisticated forecasting models to analyze these complex interactions and predict potential future scenarios.

Relevant keywords: economic indicators, inflation control, monetary policy tools, economic forecasting.

Conclusion: Understanding the Bank of Canada Interest Rate Outlook

The Bank of Canada Interest Rate Outlook is intricately linked to the interplay between tariffs and employment data. Predicting interest rate movements remains a complex endeavor, requiring careful consideration of numerous economic indicators. While strong employment data might suggest rate hikes, the inflationary pressures from tariffs could necessitate a more cautious approach. Conversely, weak employment might necessitate rate cuts, regardless of inflationary pressures from tariffs.

To stay informed about the Bank of Canada's decisions and their impact on the Canadian economy, it's crucial to follow the Bank of Canada Interest Rate Outlook closely. Subscribe to relevant economic newsletters and follow reputable financial news sources for timely updates. Understanding this outlook is key for making informed financial decisions.

Featured Posts

-

Benny Blanco And Selena Gomez 10 Photos Fueling Cheating Rumors

May 12, 2025

Benny Blanco And Selena Gomez 10 Photos Fueling Cheating Rumors

May 12, 2025 -

Unmasking The Prototypes The Real Men Who Shaped Gatsby

May 12, 2025

Unmasking The Prototypes The Real Men Who Shaped Gatsby

May 12, 2025 -

Broadcoms Proposed V Mware Price Hike A 1050 Increase Concerns At And T

May 12, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Increase Concerns At And T

May 12, 2025 -

The Significance Of Payton Pritchards Roots A Look At His Career Achievement

May 12, 2025

The Significance Of Payton Pritchards Roots A Look At His Career Achievement

May 12, 2025 -

Jazz Chisholm Jr S Hot Start Statistical Evidence Against Aaron Judges Early Season Performance

May 12, 2025

Jazz Chisholm Jr S Hot Start Statistical Evidence Against Aaron Judges Early Season Performance

May 12, 2025

Latest Posts

-

Analysis Of Cross Border Crime Fighting Mechanisms And Their Effectiveness

May 13, 2025

Analysis Of Cross Border Crime Fighting Mechanisms And Their Effectiveness

May 13, 2025 -

Improving Cross Border Crime Fighting Strategies A Global Perspective

May 13, 2025

Improving Cross Border Crime Fighting Strategies A Global Perspective

May 13, 2025 -

Strengthening Cross Border Cooperation To Combat Crime

May 13, 2025

Strengthening Cross Border Cooperation To Combat Crime

May 13, 2025 -

Cross Border Mechanisms For Effective Crime Fighting

May 13, 2025

Cross Border Mechanisms For Effective Crime Fighting

May 13, 2025 -

Britain And Australias Selective Justice In Myanmar A Critical Analysis Of Sanctions

May 13, 2025

Britain And Australias Selective Justice In Myanmar A Critical Analysis Of Sanctions

May 13, 2025