Bank Of Canada Faces Tough Choices Amid Rising Core Inflation

Table of Contents

The Persistent Problem of Core Inflation

Core inflation, which excludes volatile items like food and energy, provides a more accurate picture of underlying inflationary pressures than headline inflation. For the Bank of Canada, persistently high core inflation signals a deeper, more systemic problem demanding decisive action. Several factors contribute to this persistent issue:

-

Supply Chain Disruptions: Lingering effects of the pandemic and geopolitical instability continue to disrupt global supply chains, leading to increased production costs and higher prices for goods.

-

Wage Pressures: A tight labor market, with low unemployment rates, is pushing wages upward, contributing to a wage-price spiral where rising wages fuel further inflation.

-

Housing Costs: The persistently high cost of housing, both for ownership and rental, significantly contributes to core inflation, impacting a large portion of household budgets.

-

Headline vs. Core Inflation: Headline inflation reflects the overall price increase, including volatile components. Core inflation removes these volatile elements to provide a clearer picture of underlying inflationary pressures. This distinction is crucial for the Bank of Canada's policy decisions.

-

Global Factors: Global inflation is impacting Canada through higher import prices and increased commodity costs. The strength of the US dollar and global supply chain issues further exacerbate the situation.

The Bank of Canada's Policy Dilemma

The Bank of Canada faces a classic policy dilemma: balancing the need to control inflation with the desire to maintain economic growth and avoid a recession. Aggressive interest rate hikes are a common tool to combat inflation, but they carry significant risks.

-

Aggressive Rate Hikes: Raising interest rates sharply could curb inflation by reducing consumer spending and investment. However, it might also trigger a recession, leading to job losses and economic hardship.

-

Less Aggressive Rate Hikes: Maintaining lower interest rates could support economic growth in the short term, but the risk is that inflation will become entrenched, eroding purchasing power and leading to long-term economic instability.

-

Monetary Policy Tools: The Bank of Canada has various tools at its disposal, including adjusting the overnight rate, conducting quantitative easing or tightening, and influencing bank reserves.

-

Effectiveness & Risks: The effectiveness of each tool depends on the specific economic conditions and can carry different risks, such as impacting the housing market or exchange rates. The Bank needs to carefully assess the potential impacts of each policy choice before implementation.

Analyzing the Economic Indicators

To make informed decisions, the Bank of Canada closely monitors several key economic indicators:

-

GDP Growth: Slowing GDP growth suggests weakening economic activity and may signal a need for less aggressive interest rate hikes.

-

Unemployment Rate: A rising unemployment rate indicates potential economic weakness and might suggest a pause or reversal in interest rate hikes.

-

Consumer Confidence: Falling consumer confidence suggests reduced spending and may imply a need for more accommodative monetary policy.

-

Data Interpretation: Analyzing these indicators requires careful consideration of their interrelationship. For instance, strong GDP growth coupled with high inflation might necessitate further interest rate increases, while weak GDP growth combined with low inflation could warrant a more expansionary monetary policy.

-

Conflicting Signals: Economic indicators often send mixed signals, making the Bank of Canada's job even more challenging. The Bank must carefully weigh the different indicators and their potential implications for policy decisions.

Predicting Future Monetary Policy Moves

Given the current economic situation, several scenarios are possible regarding future interest rate changes:

-

Scenario 1: Continued Gradual Increases: If core inflation remains stubbornly high despite previous rate hikes, the Bank may opt for further gradual increases, aiming for a "soft landing."

-

Scenario 2: Pause or Hold: If economic indicators point towards weakening growth and rising unemployment, the Bank might pause or hold interest rates to prevent a deeper recession.

-

Scenario 3: Rate Cuts: If inflation falls significantly and economic growth weakens substantially, the Bank could even consider cutting interest rates to stimulate the economy.

-

Impact on Different Sectors: Future policy changes will have varying impacts on different sectors of the Canadian economy. For example, higher interest rates will likely cool the housing market while impacting consumer spending and business investment.

-

Impact on the Canadian Dollar: Changes in interest rates can also affect the Canadian dollar's exchange rate relative to other currencies. Higher rates might attract foreign investment, strengthening the dollar, while lower rates could weaken it.

Conclusion: Navigating the Path Forward for the Bank of Canada

The Bank of Canada faces tough choices amid rising core inflation, navigating a complex interplay of economic factors and potential policy outcomes. The persistent problem of core inflation, coupled with the inherent risks of both aggressive and less aggressive monetary policy responses, necessitates a cautious and data-driven approach. The Bank's future moves will significantly impact various sectors of the Canadian economy, from the housing market to consumer spending and the exchange rate. To stay informed about the evolving economic landscape and the Bank of Canada's response to rising core inflation, follow reputable financial news outlets, economic analysis reports, and official announcements from the Bank of Canada. Further research into specific economic indicators, such as the Consumer Price Index (CPI) and the Gross Domestic Product (GDP), will provide a deeper understanding of the challenges faced by the Bank of Canada in its efforts to manage inflation effectively.

Featured Posts

-

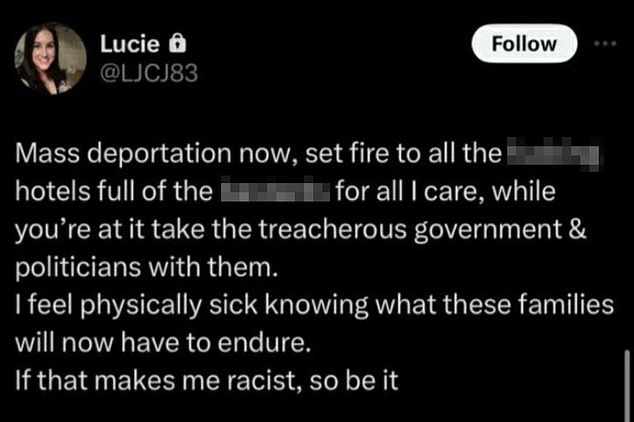

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025 -

Abn Amros Bonus Payments Under Scrutiny Potential Fine From Dnb

May 22, 2025

Abn Amros Bonus Payments Under Scrutiny Potential Fine From Dnb

May 22, 2025 -

Court Upholds Sentence Against Councillors Wife For Social Media Post

May 22, 2025

Court Upholds Sentence Against Councillors Wife For Social Media Post

May 22, 2025 -

Massive Fire At Franklin County Pa Chicken Farm 600 Foot Barn In Flames

May 22, 2025

Massive Fire At Franklin County Pa Chicken Farm 600 Foot Barn In Flames

May 22, 2025 -

Blue Origin Cancels Launch Subsystem Issue Halts Mission

May 22, 2025

Blue Origin Cancels Launch Subsystem Issue Halts Mission

May 22, 2025

Latest Posts

-

Falling Gas Prices In Illinois A Nationwide Decline

May 22, 2025

Falling Gas Prices In Illinois A Nationwide Decline

May 22, 2025 -

Massive Fire At Franklin County Pa Chicken Farm 600 Foot Barn In Flames

May 22, 2025

Massive Fire At Franklin County Pa Chicken Farm 600 Foot Barn In Flames

May 22, 2025 -

Week Over Week Decrease In Toledo Gas Prices Reported

May 22, 2025

Week Over Week Decrease In Toledo Gas Prices Reported

May 22, 2025 -

Understanding The Lancaster City Stabbing A Comprehensive Overview

May 22, 2025

Understanding The Lancaster City Stabbing A Comprehensive Overview

May 22, 2025 -

Gas Prices In Southeast Wisconsin Understanding The Recent Spike

May 22, 2025

Gas Prices In Southeast Wisconsin Understanding The Recent Spike

May 22, 2025