Bad Credit Loans: Exploring Tribal Lender Options & Guaranteed Approvals

Table of Contents

Understanding Tribal Lenders and Their Loan Products

Tribal lenders are lending institutions owned and operated by Native American tribes. Operating under the principle of tribal sovereignty, these lenders often provide financial services to individuals who may not qualify for loans from traditional banks. Their legal standing is complex, stemming from the unique legal status of Native American reservations. This means they may operate under different regulatory frameworks than state-licensed lenders.

- Definition: Tribal lenders are businesses owned and operated by Native American tribes, offering various financial products. They leverage their sovereign nation status in their lending practices.

- Advantages: Tribal lenders may offer more flexible eligibility criteria than traditional banks, potentially catering to those with bad credit. Online access provides convenience.

- Disadvantages: Interest rates and fees can be significantly higher than traditional loans. Transparency may vary, and some lenders may engage in predatory practices.

- Loan Products: Common loan types include payday loans (short-term, high-interest loans), installment loans (longer repayment periods), and sometimes even larger personal loans. Always compare terms and interest rates carefully.

- Transparency and Comparison Shopping: Before committing to any loan, meticulously compare interest rates, fees (origination, late payment, etc.), and repayment terms across multiple tribal lenders and other options.

The Reality of "Guaranteed Approval" for Bad Credit Loans

The phrase "guaranteed loan approval" is often a misleading marketing tactic. No reputable lender can genuinely guarantee loan approval, regardless of your credit history. While tribal lenders might have more flexible criteria than traditional banks, several factors still determine loan eligibility.

- Why "Guaranteed Approval" is Misleading: Lenders must assess risk. Your creditworthiness, income, and existing debt significantly influence their decision.

- Factors Influencing Approval: Your credit score, income level, debt-to-income ratio (DTI), employment history, and even your existing bank account history are all taken into consideration.

- Pre-qualification: Utilize pre-qualification tools offered by many lenders. This allows you to check your eligibility without impacting your credit score significantly.

- Improving Your Chances: Focus on improving your credit score, reducing debt, and demonstrating financial stability before applying for a loan.

Improving Your Chances of Loan Approval with Bad Credit

Taking proactive steps to improve your financial standing before applying for a loan can significantly increase your chances of approval, even with bad credit.

- Check Your Credit Report: Review your credit report for errors; disputing inaccurate information can positively affect your score.

- Debt Consolidation: Consolidating high-interest debts into a lower-interest loan can improve your DTI ratio.

- Building Positive Credit History: Use credit responsibly—paying bills on time and keeping credit utilization low.

- Credit Counseling: Consider professional credit counseling services to learn debt management strategies.

Finding Reputable Tribal Lenders and Avoiding Scams

The online lending space includes both legitimate and predatory lenders. Thorough research is crucial to protect yourself from scams and high-cost loans.

- Research Lender Licenses and Legitimacy: Verify the lender's legitimacy through independent research and checking for state licensing where applicable.

- Read Online Reviews and Testimonials: Examine reviews from other borrowers to gauge the lender's reputation for fair practices and customer service.

- Understand Loan Agreements: Read all loan documents carefully before signing, paying close attention to interest rates, fees, and repayment terms.

- Report Suspected Scams: If you suspect a lender is operating fraudulently, report them to the appropriate authorities (e.g., the Consumer Financial Protection Bureau).

- Seek Independent Financial Advice: Consult a financial advisor for personalized guidance before making any borrowing decisions.

Conclusion

Securing a bad credit loan can be challenging, but understanding the nuances of tribal lenders and the realities of loan approval is crucial. While tribal lenders offer an alternative for those with bad credit, they're not a guaranteed solution. "Guaranteed approval" is often a deceptive marketing strategy. The key is to find reputable lenders, carefully compare loan terms, and prioritize responsible borrowing practices. Explore your tribal lender options thoroughly, but remember to improve your creditworthiness through responsible financial planning and debt management to secure responsible bad credit loans and avoid future financial difficulties. Find the best bad credit loan for your situation through careful research and comparison.

Featured Posts

-

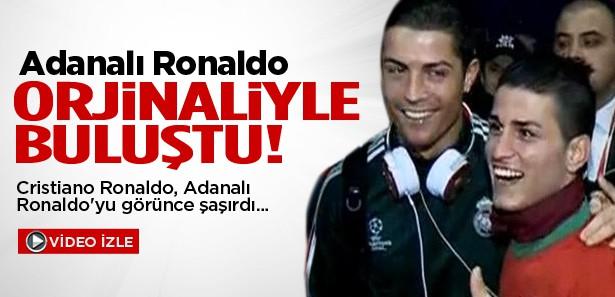

Cristiano Ronaldo Ve Adanali Ronaldo Karsilasma Ve Tartisma

May 28, 2025

Cristiano Ronaldo Ve Adanali Ronaldo Karsilasma Ve Tartisma

May 28, 2025 -

Metro Detroit Weather Sunny Skies After A Cool Monday

May 28, 2025

Metro Detroit Weather Sunny Skies After A Cool Monday

May 28, 2025 -

Kevin De Bruyne Contract Talks Man City Chief Confirms Key Issue

May 28, 2025

Kevin De Bruyne Contract Talks Man City Chief Confirms Key Issue

May 28, 2025 -

Venetian Palazzos The Architectural Influence On Wes Andersons Phoenician Project

May 28, 2025

Venetian Palazzos The Architectural Influence On Wes Andersons Phoenician Project

May 28, 2025 -

Arsenals 58m Transfer Battle Strikers Choice Between Gunners And Spurs

May 28, 2025

Arsenals 58m Transfer Battle Strikers Choice Between Gunners And Spurs

May 28, 2025