Australia's Opposition: A $9 Billion Budget Improvement Plan

Table of Contents

Key Proposals within the $9 Billion Plan

The Opposition's $9 billion plan encompasses several key proposals designed to stimulate economic growth and improve the lives of Australians. These proposals are intricately linked and aim for a holistic approach to economic management.

Targeted Tax Cuts for Middle-Income Earners

The plan proposes targeted tax cuts for middle-income earners, specifically those earning between $50,000 and $90,000 annually. This segment represents a significant portion of the Australian workforce. The proposed reduction is a 5% decrease in their income tax, aiming to boost disposable income and stimulate consumer spending.

- Projected revenue loss from the tax cuts: The estimated revenue loss is approximately $2 billion, offset by anticipated economic growth.

- Economic stimulus effect: The Opposition projects this will inject significant capital back into the economy, leading to increased consumer spending and business activity. This increased demand is expected to drive job creation across various sectors.

- Comparison with similar policies: Similar tax cuts implemented in other OECD countries have shown positive impacts on consumer confidence and economic growth, although the specific effects vary depending on economic context.

Increased Investment in Infrastructure Projects

A significant portion of the $9 billion plan is dedicated to boosting infrastructure investment. This includes:

-

Road upgrades: $2.5 billion allocated to upgrade major arterial roads and improve regional connectivity.

-

Railway modernization: $1.5 billion earmarked for modernizing existing railway lines and improving passenger and freight services.

-

Renewable energy projects: $1 billion commitment to investing in renewable energy infrastructure, such as solar farms and wind energy facilities, aiming to boost Australia's commitment to sustainable development.

-

Investment allocation: The investment is strategically distributed across various sectors, prioritizing projects with high economic multipliers and long-term sustainability benefits.

-

Projected timeline and impact: The projected timeline for project completion is 5-7 years, with the majority of the economic impact anticipated during the construction phase and continuing through increased efficiency and productivity.

-

Environmental benefits: The investment in renewable energy aims to reduce carbon emissions and foster a greener economy. Upgrades to public transport also promote a reduction in traffic congestion and air pollution.

Reforms to Healthcare Funding and Delivery

The plan also includes reforms to healthcare funding and delivery to address growing concerns about accessibility and affordability. The aim is to:

-

Improve public hospital funding: Increased funding to reduce wait times and improve the quality of care in public hospitals.

-

Enhance Medicare benefits: Expanding Medicare benefits to cover additional essential services and medicines.

-

Streamline pharmaceutical benefits: Measures to make essential medications more affordable and accessible.

-

Anticipated effects: The reforms are expected to enhance patient care, reduce wait times, and increase access to affordable healthcare.

-

Cost savings and efficiency gains: The plan anticipates cost savings through improved efficiency and reduced administrative burdens in the healthcare system.

-

Impact on patient access: The reforms aim to significantly improve access to quality healthcare for all Australians, regardless of socioeconomic status.

Addressing the National Debt

The Opposition's plan addresses the national debt through a two-pronged strategy:

-

Targeted spending cuts: Identifying areas of government spending that can be reduced without negatively impacting essential services. This involves streamlining administrative processes and improving efficiency in government departments.

-

Revenue-raising measures: Exploring revenue-raising opportunities, but without introducing new taxes that burden Australians. This could involve initiatives focusing on improved tax collection and compliance.

-

Specific measures: Detailed proposals for spending cuts and revenue-raising measures will be released in a separate document.

-

Feasibility and potential risks: The Opposition acknowledges the challenges involved and commits to a detailed analysis of the feasibility and potential risks associated with these measures.

-

Comparison with government strategy: The Opposition will contrast its strategy with the current government's approach to managing the national debt, highlighting differences in approach and potential outcomes.

Potential Economic Impacts of the Plan

The Opposition's budget improvement plan aims to generate substantial positive economic impacts.

Job Creation and Economic Growth

The plan projects significant job creation and economic growth through various channels:

-

Infrastructure investment: Construction and related industries are expected to experience substantial growth.

-

Tax cuts: Increased consumer spending will stimulate demand and create jobs across multiple sectors.

-

Healthcare reforms: Investment in healthcare will generate jobs in the healthcare sector.

-

Projected job creation: The Opposition estimates that the plan will create hundreds of thousands of jobs over the next decade.

-

GDP growth forecast: The plan projects a significant increase in GDP growth, boosting Australia's overall economic performance.

-

Impact on inflation: The Opposition aims to manage the impact on inflation through careful fiscal management and targeted spending.

Fiscal Sustainability

The long-term fiscal sustainability of the plan is a key consideration:

- Impact on government debt and deficit: The plan aims to reduce the national debt over the long term through strategic spending cuts and revenue-raising measures.

- Sensitivity to economic shocks: The Opposition acknowledges the risks associated with unforeseen economic events and proposes measures to mitigate these potential challenges.

- Comparison with alternative strategies: The Opposition will compare its plan with alternative strategies to highlight the long-term sustainability and economic benefits of its proposed approach.

Conclusion

The Opposition's $9 billion budget improvement plan presents a comprehensive strategy addressing key economic challenges facing Australia. By combining targeted tax cuts, strategic infrastructure investment, healthcare reforms, and a focused approach to debt reduction, the plan aims to stimulate economic growth, create jobs, and improve the overall well-being of Australians. While the plan's success depends on effective implementation and unforeseen economic factors, its proposals offer a compelling alternative vision for Australia's future. Understanding the details of this Australia's Opposition Budget Plan is crucial for informed political participation and economic discussion. Learn more about the specifics and potential implications of this plan by conducting further research using reputable sources and following the political discourse surrounding the Australia's Opposition Budget Plan.

Featured Posts

-

Tbs Klinieken Overvol Wachttijden Van Meer Dan Een Jaar

May 02, 2025

Tbs Klinieken Overvol Wachttijden Van Meer Dan Een Jaar

May 02, 2025 -

Safety Inspection Clears Path For Robinson Nuclear Plant License Renewal Until 2050

May 02, 2025

Safety Inspection Clears Path For Robinson Nuclear Plant License Renewal Until 2050

May 02, 2025 -

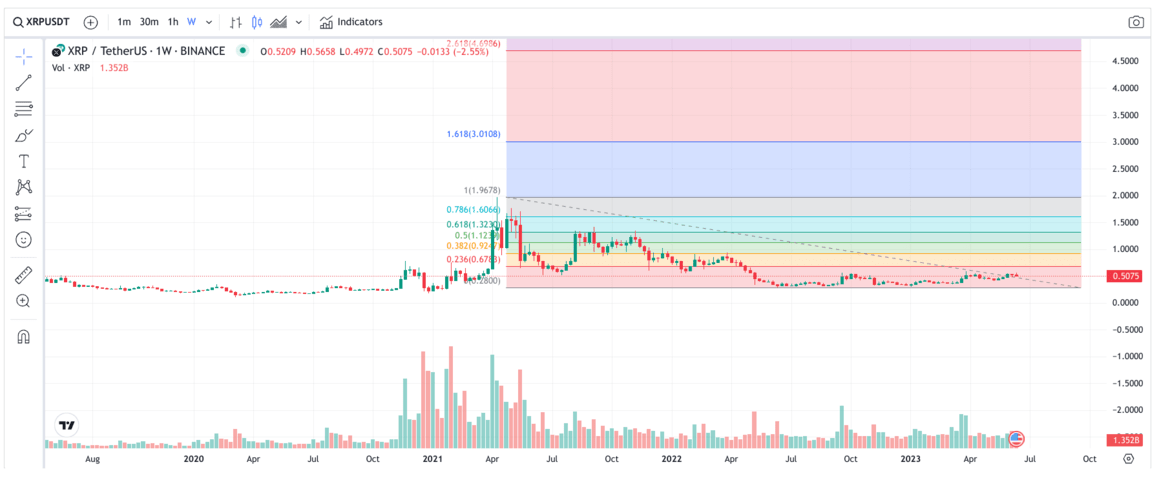

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025 -

The Impact Of Mental Health Policies On Employee Productivity

May 02, 2025

The Impact Of Mental Health Policies On Employee Productivity

May 02, 2025 -

Early Intervention Lasting Impact The Benefits Of Investing In Childrens Mental Health

May 02, 2025

Early Intervention Lasting Impact The Benefits Of Investing In Childrens Mental Health

May 02, 2025

Latest Posts

-

Newsround Bbc Two Hd Air Times And Broadcast Details

May 02, 2025

Newsround Bbc Two Hd Air Times And Broadcast Details

May 02, 2025 -

Bbc Two Hd Programming Newsround Showtimes

May 02, 2025

Bbc Two Hd Programming Newsround Showtimes

May 02, 2025 -

Pancake Day Traditions A Look At The History Of Shrove Tuesday

May 02, 2025

Pancake Day Traditions A Look At The History Of Shrove Tuesday

May 02, 2025 -

Bbc Two Hd Tv Guide Newsround Listings And Schedule

May 02, 2025

Bbc Two Hd Tv Guide Newsround Listings And Schedule

May 02, 2025 -

The History Of Pancake Day Why We Celebrate Shrove Tuesday

May 02, 2025

The History Of Pancake Day Why We Celebrate Shrove Tuesday

May 02, 2025