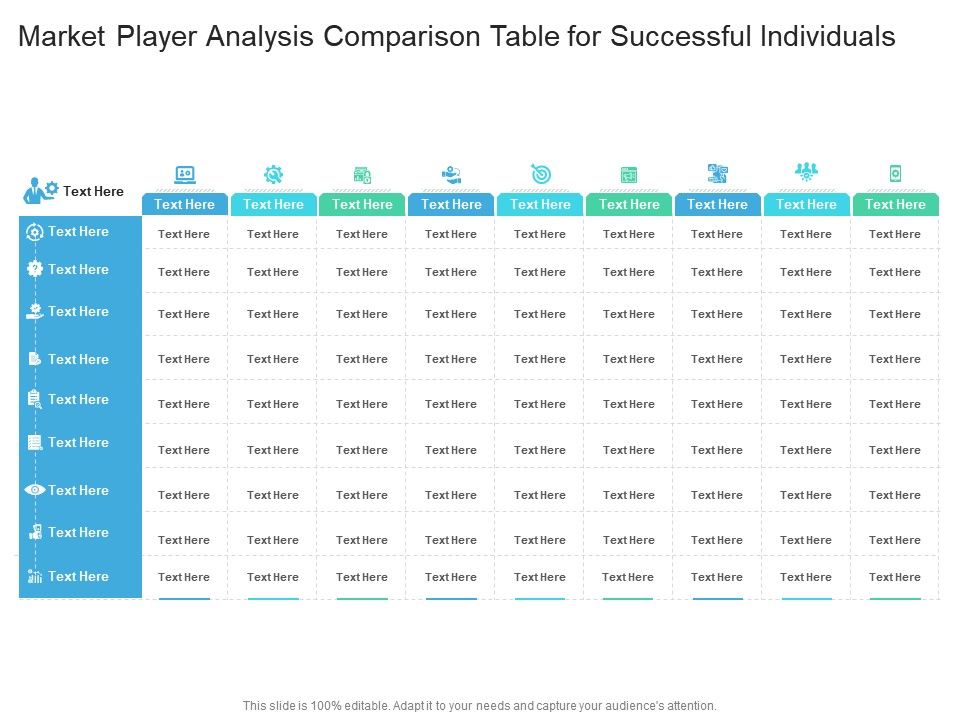

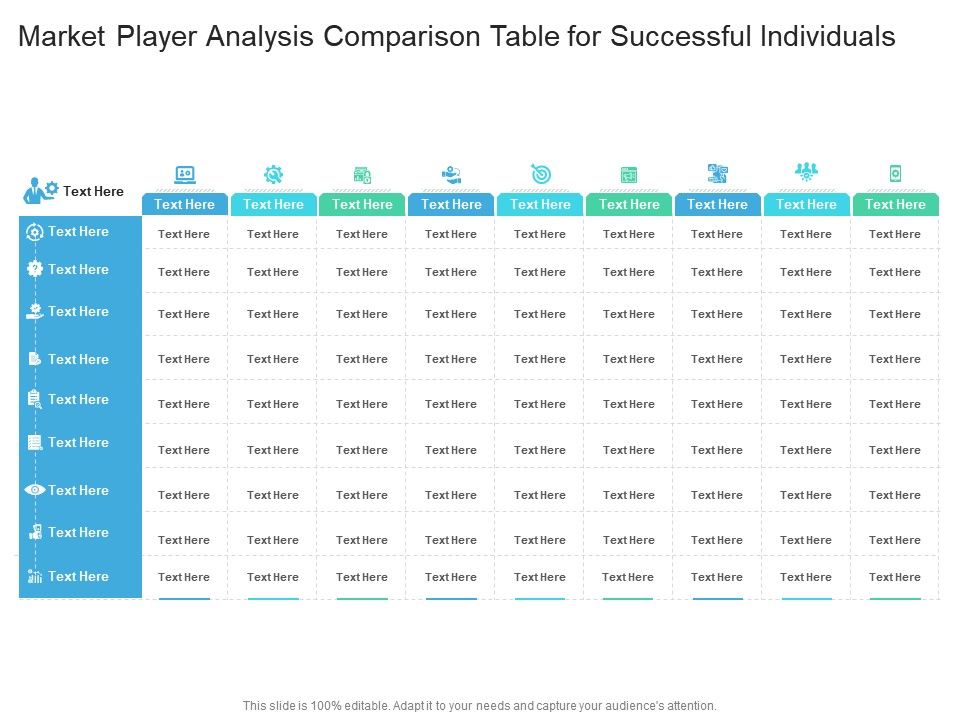

As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

The Professional Sell-Off: Understanding Institutional Investor Behavior

Professional investors, managing vast sums of money, operate under different constraints than individual investors. Their actions during market swoons are often driven by sophisticated risk management strategies and a focus on preserving capital.

Risk Assessment and Portfolio Adjustments

Institutional investors utilize complex risk assessment models to predict and mitigate potential losses. When markets exhibit significant volatility, these models often trigger sell-offs to protect portfolio value.

- Examples of risk assessment models: Value at Risk (VaR), Expected Shortfall (ES), stress testing.

- Hedging strategies: Using derivatives like options and futures to offset potential losses.

- Portfolio diversification techniques: Spreading investments across various asset classes to reduce overall portfolio risk.

These actions, driven by sophisticated risk management and portfolio rebalancing, are essential for institutional investors navigating market volatility. Their primary focus is on institutional investors' responsibilities to protect client assets.

Short-Term vs. Long-Term Strategies

The time horizon significantly influences professional investors' decisions. While some individual investors may hold assets for decades, many institutional investors operate under shorter-term performance pressures.

- Examples of short-term trading strategies: Arbitrage, market neutral strategies.

- Fund manager performance metrics: Often judged on quarterly or annual returns.

- Pressure to deliver short-term returns: Can lead to selling assets even if long-term prospects are positive.

This focus on short-term trading versus long-term investing is a key differentiator. Fund managers are often evaluated based on performance benchmarks that prioritize short-term results.

Regulatory Factors and Reporting Requirements

Regulatory constraints and reporting requirements also influence institutional selling. Transparency and compliance necessitate certain actions during market turbulence.

- Examples of regulations affecting institutional investors: Securities and Exchange Commission (SEC) regulations, Dodd-Frank Act provisions.

- Mandatory disclosures: Regular reporting on investment performance and risk exposure.

- The impact of transparency on investment decisions: The need to explain investment choices to regulators and clients can influence selling decisions.

Regulation, compliance, and the need for financial reporting and transparency create additional layers of complexity for institutional investors during market downturns.

The Individual Investor Surge: Examining Retail Investor Behavior

In contrast to the professional sell-off, individual investors exhibited a surprising buying spree during the market downturn. This behavior can be attributed to various psychological and technological factors.

Fear vs. Greed & The Psychology of Investing

Behavioral finance plays a significant role in explaining individual investor behavior. "Fear of missing out" (FOMO) and the belief that the market is presenting "bargain hunting" opportunities can drive buying decisions.

- Behavioral finance concepts: Confirmation bias, herd behavior, overconfidence.

- Emotional biases: Fear, greed, regret aversion.

- Influence of market sentiment on individual decisions: Following market trends rather than conducting independent research.

Understanding behavioral finance, FOMO, and the psychological aspects of bargain hunting is crucial in analyzing retail investors' behavior and the influence of market sentiment.

Increased Access to Information and Trading Platforms

The democratization of investing, facilitated by readily available information and user-friendly trading platforms, has empowered individual investors.

- Impact of online brokerage accounts: Low-cost access to markets.

- Mobile trading apps: Increased convenience and ease of participation.

- Financial news websites: Constant stream of information, although not always reliable.

The rise of online trading, mobile trading, and accessible brokerage accounts and investment platforms has significantly increased retail investor participation.

The Role of Social Media and Influencer Marketing

Social media platforms have become powerful tools for disseminating information (and misinformation) about investments. Financial influencers can significantly impact individual investors’ decisions.

- Examples of social media's impact on market trends: Viral trends can drive market movements.

- Herd behavior: Following the actions of others without independent analysis.

- Potential for misinformation: The spread of inaccurate or misleading information.

The influence of social media trading, financial influencers, and the risk of market manipulation and herd behavior due to misinformation cannot be ignored.

Analyzing the Risks and Rewards of Each Approach

Both professional and individual investors face distinct risks and rewards during market swoons. Understanding these differences is crucial for developing a sound investment strategy.

Potential Pitfalls for Individual Investors

Individual investors' emotional decision-making can lead to significant pitfalls. Reactive buying without thorough research can be detrimental.

- Examples of risks: Poor market timing, emotional investing, lack of diversification.

- Risk tolerance: Understanding one's ability to withstand market fluctuations.

Ignoring risk tolerance, making decisions based on emotions rather than analysis, and neglecting diversification can be costly for individual investors.

Potential Benefits for Individual Investors

Conversely, buying low during market dips can yield significant long-term benefits. Value investing can be particularly rewarding during such periods.

- Examples of benefits: Potential for high returns through long-term value investing.

- Compounding returns: The power of reinvesting profits over time.

- Long-term gains: Outweighing short-term market volatility.

Successful long-term investing and strategic value investing can lead to substantial long-term gains and compounding returns over time.

Conclusion: Key Takeaways and Call to Action

This analysis reveals a striking contrast between professional and individual investor behavior during market downturns. Professionals, driven by risk management and regulatory considerations, often sell assets, while individuals, influenced by psychology and accessible trading platforms, may buy. Both approaches have potential benefits and risks. Understanding the nuances of "As Markets Swooned, Pros Sold—and Individuals Pounced" is crucial for navigating future market volatility. Continue your research and develop a robust investment strategy tailored to your risk tolerance and long-term goals. Only through informed decision-making can you effectively manage your investments during periods of market uncertainty.

Featured Posts

-

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

Navigating The High Cost Of Gpus

Apr 28, 2025

Navigating The High Cost Of Gpus

Apr 28, 2025 -

Tesla And Tech Drive Us Stock Market Surge

Apr 28, 2025

Tesla And Tech Drive Us Stock Market Surge

Apr 28, 2025 -

Will Aaron Judge Get His Way Analyzing The Yankees Lineup Decisions

Apr 28, 2025

Will Aaron Judge Get His Way Analyzing The Yankees Lineup Decisions

Apr 28, 2025 -

Understanding Market Behavior Professional Selling And Individual Buying Trends

Apr 28, 2025

Understanding Market Behavior Professional Selling And Individual Buying Trends

Apr 28, 2025

Latest Posts

-

Will Aaron Judge Get His Way Analyzing The Yankees Lineup Decisions

Apr 28, 2025

Will Aaron Judge Get His Way Analyzing The Yankees Lineup Decisions

Apr 28, 2025 -

Aaron Judges Lineup Spot Boones Comments And The Leadoff Debate

Apr 28, 2025

Aaron Judges Lineup Spot Boones Comments And The Leadoff Debate

Apr 28, 2025 -

Historic Night Aaron Judge Matches Babe Ruths Yankees Mark

Apr 28, 2025

Historic Night Aaron Judge Matches Babe Ruths Yankees Mark

Apr 28, 2025 -

Decoding Aaron Judges Push Ups Hints At A 2025 Performance Goal

Apr 28, 2025

Decoding Aaron Judges Push Ups Hints At A 2025 Performance Goal

Apr 28, 2025 -

Yankee Star Aaron Judge Push Ups And A 2025 Prediction

Apr 28, 2025

Yankee Star Aaron Judge Push Ups And A 2025 Prediction

Apr 28, 2025