Are We Normalizing Disaster? The Case Of Betting On The LA Wildfires

Table of Contents

The Rise of Disaster Betting

The concept of "disaster betting" might sound far-fetched, but the reality is more insidious. It encompasses a range of financial instruments and practices designed to profit from the devastation of natural disasters like the LA wildfires. This isn't simply about insurance payouts, although those certainly play a role. Instead, it involves a complex web of financial products and strategies that seek to capitalize on wildfire risk.

Financial Instruments Tied to Wildfire Risk

Several avenues exist for profiting from wildfire devastation. One example is the intricate network of derivatives markets. These markets allow investors to buy and sell contracts whose value is tied to the amount of damage caused by wildfires. Essentially, they're betting on the scale of the disaster. Furthermore, speculative investment in wildfire-related industries – construction companies specializing in rebuilding, cleanup crews, and even the manufacturers of firefighting equipment – can also lead to substantial profits, regardless of the human cost. This creates a perverse incentive structure.

- Examples of specific financial products: Catastrophe bonds, derivatives linked to disaster relief funds, index funds tracking wildfire-related stocks.

- Statistics illustrating the growth of this market: (Insert statistics here – research needed on the growth of financial instruments linked to wildfire risk). Data from insurance companies and financial news sources would be ideal.

- Discussion of the potential for manipulation or unethical practices: The potential for insider trading, price manipulation, and other unethical activities within these markets is significant. Information about the predicted path or intensity of a wildfire could give certain investors an unfair advantage.

Ethical Concerns and the Normalization of Risk

The moral implications of profiting from suffering are profound. Disaster betting inherently devalues human life and suffering, reducing the impact of wildfires to mere financial calculations. It’s a deeply unsettling shift in societal perspective.

The Moral Implications of Profiteering from Suffering

The ethical arguments against disaster betting are compelling. It suggests a callous disregard for the human cost of these disasters. This practice raises fundamental questions about the value we place on human life versus profit.

- Arguments against disaster betting from an ethical standpoint: It incentivizes a lack of proactive disaster prevention measures, prioritizing profit over preparedness. It's exploitative and morally reprehensible.

- The potential to incentivize negligence in wildfire prevention and mitigation: If individuals and organizations can profit from wildfires, there's less incentive to invest in preventative measures. This could lead to increased frequency and severity of future disasters.

- The dehumanizing aspect of treating disaster as a financial opportunity: Reducing human suffering to a financial opportunity strips away the emotional and psychological impact on victims and their communities.

The Psychological Impact of Normalizing Disaster

The normalization of disaster, facilitated by practices like disaster betting, carries significant psychological consequences. By treating devastating events as mere financial opportunities, we risk becoming desensitized to their gravity and undermining public concern for preventative measures. The acceptance of disaster as an inevitable, even profitable, occurrence can lead to societal apathy and inaction.

The Desensitization Effect

Repeated exposure to disaster and the normalization of disaster through financial markets can have a profound desensitizing effect. This can manifest in decreased public engagement with disaster preparedness initiatives and a reduced willingness to support policies aimed at mitigating future risks.

- Evidence of decreased public concern about wildfires in areas with high rates of disaster betting (if available): (This section requires research to find supporting data). Surveys, public opinion polls, and news reports could be used to support this point.

- Psychological studies on desensitization to repeated exposure to traumatic events: (Cite relevant psychological studies on the effects of repeated exposure to traumatic events and desensitization).

- The impact on public policy and disaster preparedness: Apathy towards wildfire prevention due to the normalization of disaster can lead to inadequate funding and insufficient resources for effective disaster preparedness.

Regulation and the Future of Disaster Betting

Currently, the regulatory landscape surrounding disaster betting is underdeveloped. While existing regulations might address certain aspects of financial markets, the unique ethical challenges posed by profiting from natural disasters often fall outside their scope.

Existing Regulations and Their Effectiveness

The lack of robust, specific regulations concerning disaster betting creates a significant gap. Existing securities laws and regulations might touch upon certain aspects, but comprehensive frameworks specifically targeting this phenomenon are largely absent.

- Overview of relevant laws and regulations (if any): (Research is needed to identify existing regulations that might touch upon this issue).

- Discussion of loopholes or areas needing improvement: Highlight any deficiencies in current regulations that allow for exploitation of disaster-related financial markets.

- Potential for new regulations or legal frameworks to address the issue: Suggest possible regulatory approaches, such as stricter oversight of financial instruments linked to disaster risk, increased transparency, and potentially even outright bans on certain types of disaster betting.

Conclusion

The practice of betting on wildfires, and natural disasters in general, represents a disturbing trend toward the normalization of disaster. This practice not only raises serious ethical questions about profiting from human suffering but also undermines public safety and preparedness. The desensitization effect of treating disasters as financial opportunities can lead to decreased public concern and inadequate investment in prevention and mitigation efforts. We must actively challenge this normalization of disaster. We must demand stronger regulations to prevent the exploitation of natural disasters for financial gain. Let's work together to stop the practice of betting on natural disasters and prioritize human life and well-being over short-term financial profit. The normalization of disaster is a serious issue; let’s demand change.

Featured Posts

-

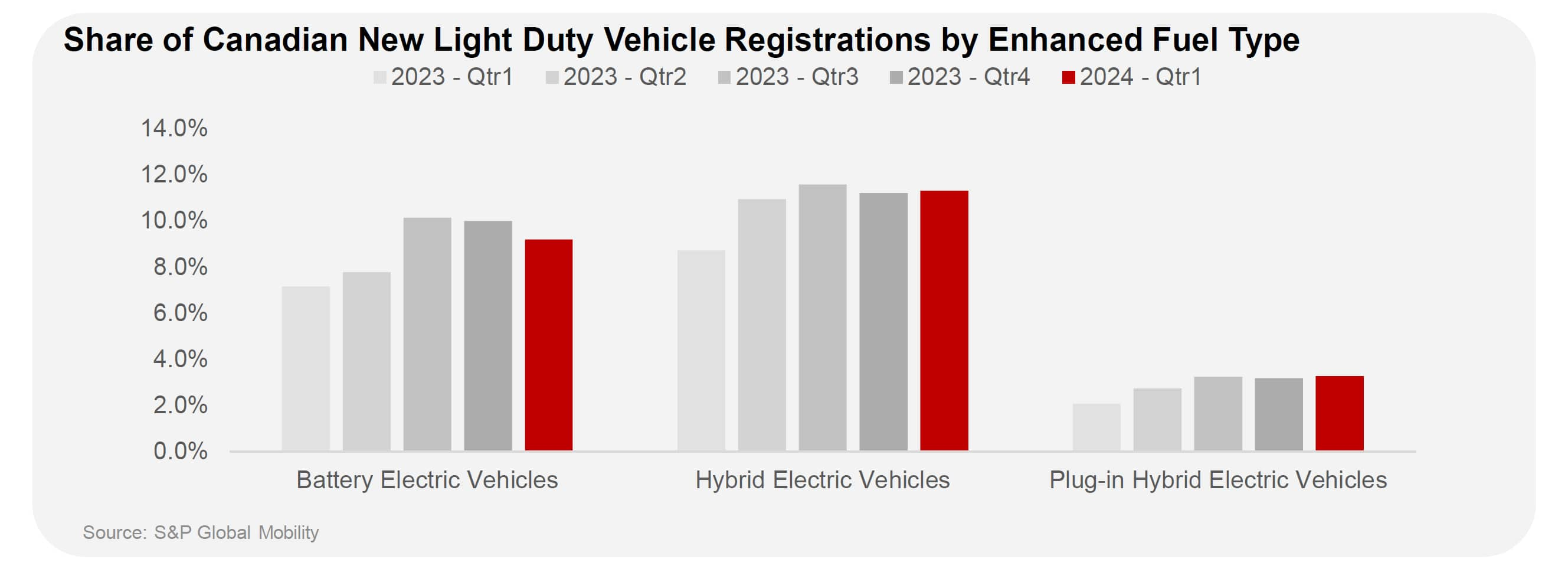

Survey Reveals Drop In Canadian Ev Buyer Interest

Apr 27, 2025

Survey Reveals Drop In Canadian Ev Buyer Interest

Apr 27, 2025 -

La Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 27, 2025

La Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 27, 2025 -

Open Thread Community Discussion February 16 2025

Apr 27, 2025

Open Thread Community Discussion February 16 2025

Apr 27, 2025 -

Trade War Impact Ecbs Simkus Suggests Two More Potential Interest Rate Cuts

Apr 27, 2025

Trade War Impact Ecbs Simkus Suggests Two More Potential Interest Rate Cuts

Apr 27, 2025 -

Mc Cook Jewelers Act Of Kindness Helping Nfl Players Rebuild Their Lives

Apr 27, 2025

Mc Cook Jewelers Act Of Kindness Helping Nfl Players Rebuild Their Lives

Apr 27, 2025

Latest Posts

-

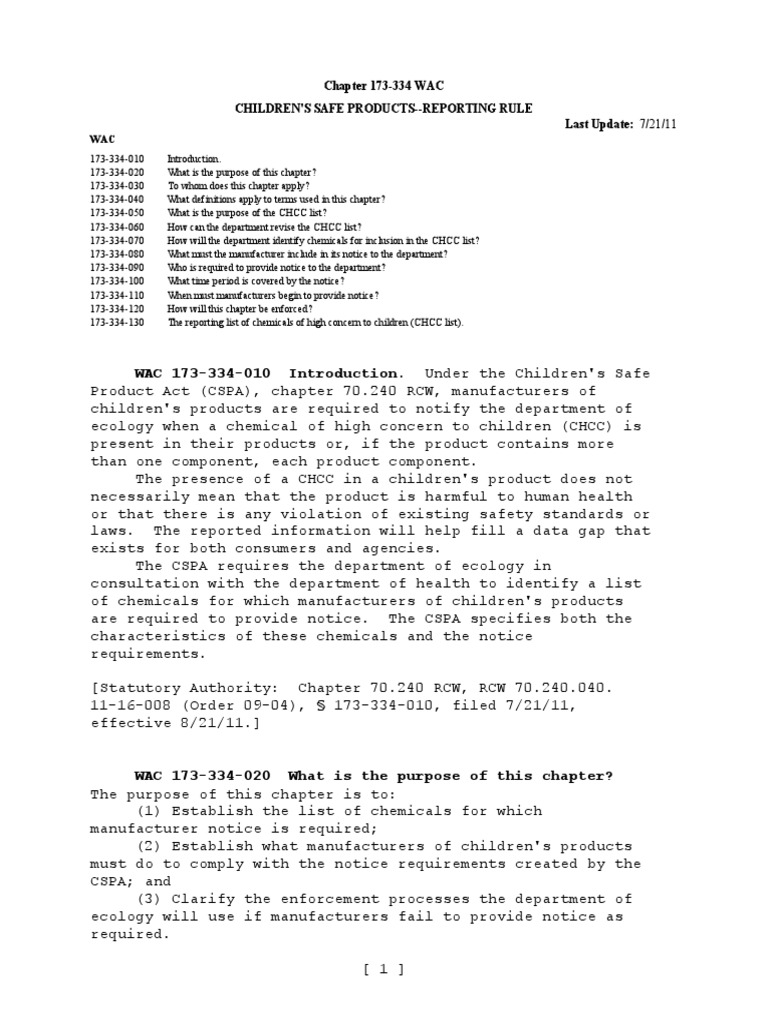

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025 -

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025 -

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025