Are Tariffs Killing Tech IPOs? A Market Analysis

Table of Contents

The Impact of Tariffs on Tech Supply Chains

Tariffs, essentially taxes on imported goods, have far-reaching consequences for the tech industry, which relies heavily on global supply chains. These increased costs and disruptions significantly impact the attractiveness of tech companies to investors considering an IPO.

Increased Input Costs: The imposition of tariffs on imported components dramatically increases production costs for tech companies. Semiconductors, crucial for nearly all electronics, are a prime example. Rare earth minerals, essential for various tech applications, are also subject to tariffs, further exacerbating the issue.

- Examples: Tariffs on memory chips from South Korea, tariffs on rare earth minerals from China.

- Quantifiable Data: A 10% tariff on imported semiconductors could increase the production cost of a smartphone by X%, directly impacting profitability.

- Increased costs force companies to either absorb the higher prices, reducing profit margins, or pass them on to consumers, potentially affecting market competitiveness and sales volume.

Supply Chain Disruptions: Tariffs don't just increase costs; they also introduce significant uncertainty and delays. Companies face challenges in securing timely delivery of crucial components, leading to production bottlenecks and missed deadlines.

- Examples: Delays in obtaining crucial components from China due to trade disputes, leading to production halts.

- Impact: Missed revenue projections due to delayed product launches, damaged reputation for late deliveries.

- Geopolitical instability further exacerbates these issues, creating volatile and unpredictable supply chain environments. This volatility makes long-term planning difficult and increases the risk associated with investment.

Tariffs and Investor Sentiment

The uncertainty surrounding tariffs significantly impacts investor confidence in the tech sector. Potential investors are hesitant to commit capital to companies facing unpredictable costs and supply chain disruptions.

Reduced Investor Confidence: The fear of reduced profitability and market share due to tariff-related challenges makes tech companies less appealing to investors.

- Statistics: A decline in the number of IPO filings in the tech sector correlated with the implementation of new tariffs. Reports from investment banks reflecting cautious outlook on tech investments.

- Investor Statements: Public statements from venture capitalists and investment firms expressing concerns about the impact of tariffs on tech valuations.

- Increased risk assessment by investors weighs heavily on decision-making, especially considering the already volatile nature of the tech market.

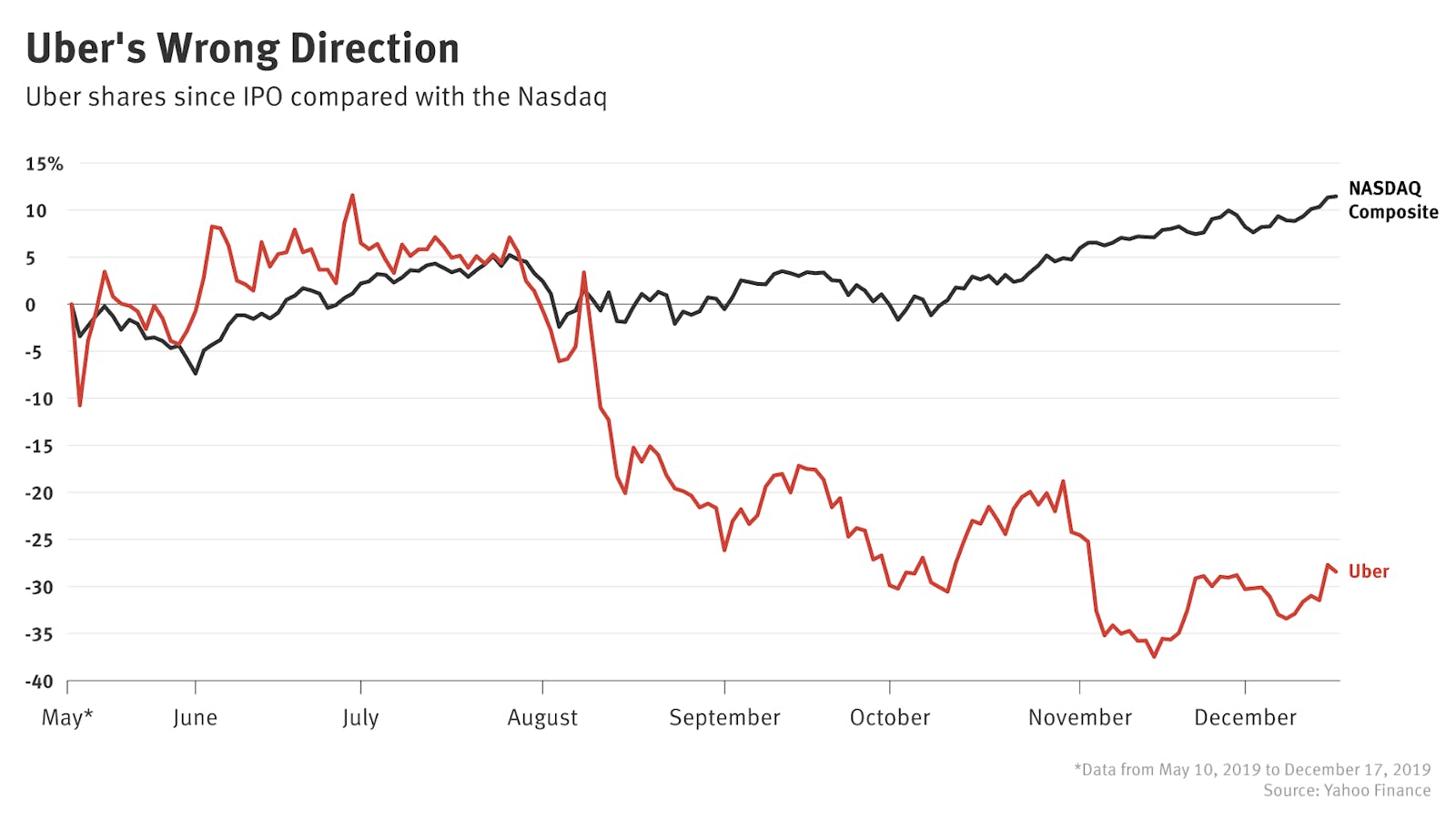

Impact on Valuation: Tariffs directly affect the valuation of tech companies. Increased costs and decreased predictability lead to lower earnings projections, subsequently reducing the company's perceived value during the IPO process.

- Examples: Analysis of how specific tech companies have seen their valuations adjusted downward following the introduction of new tariffs.

- Valuation Multiples: A decrease in price-to-earnings ratios due to reduced projected earnings caused by increased production costs.

- Market forecasts and projections play a pivotal role in determining valuations; and uncertain tariffs negatively impact the accuracy of these forecasts.

Alternative Explanations for the Tech IPO Slowdown

While tariffs undoubtedly play a role, attributing the entire slowdown solely to them would be an oversimplification. Several other macroeconomic factors are at play.

Macroeconomic Factors: The current economic climate, characterized by rising interest rates, inflation, and general economic uncertainty, affects investor behavior across all sectors, including tech.

- Data Points: Correlation between interest rate hikes and decreased IPO activity across various sectors.

- Historical Trends: Comparison of current IPO activity with previous periods of economic uncertainty to contextualize the current slowdown.

- The interaction between tariffs and macroeconomic conditions creates a complex interplay, with each factor amplifying the effect of the other.

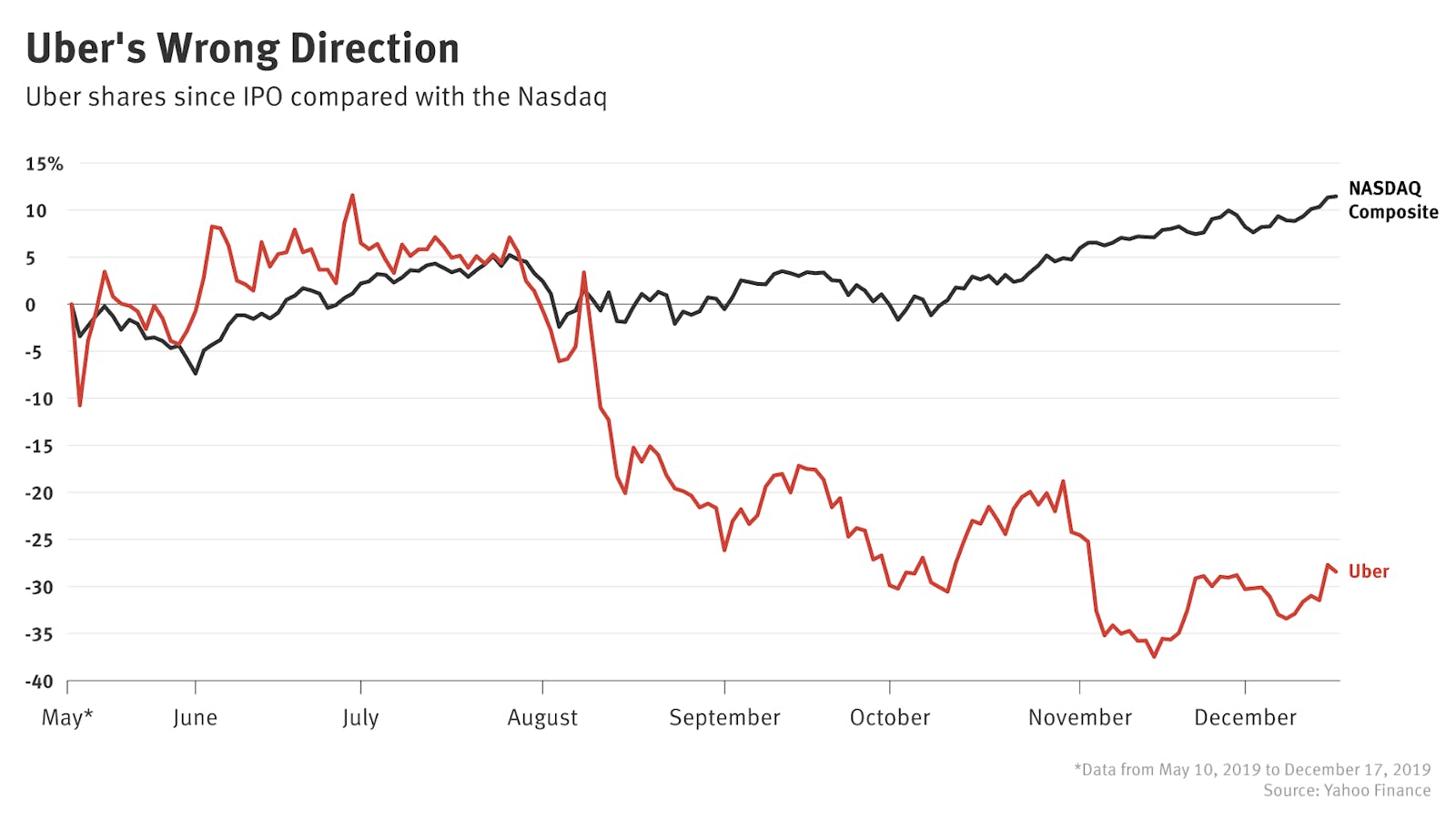

Overvaluation Concerns: The tech sector experienced significant growth in the previous decade, raising concerns about potential overvaluation. The current slowdown could partly represent a market correction from previously inflated valuations.

- Data on Valuations: Comparison of valuations of successful and unsuccessful tech IPOs to highlight the trend of market correction.

- Shift in Market Sentiment: Analysis of how investor sentiment has shifted towards more conservative investment strategies, away from high-growth, high-risk tech ventures.

- Market speculation and hype play a significant role in driving up valuations; the current correction could reflect a more realistic assessment of market fundamentals.

Conclusion

The evidence suggests that tariffs are a contributing factor to the slowdown in tech IPOs, but not the sole cause. Increased input costs, supply chain disruptions, and the resulting uncertainty significantly impact investor sentiment and valuations. However, macroeconomic factors and concerns about previous overvaluation also play significant roles. The relationship between "tariffs killing tech IPOs" is complex and requires further investigation.

Key Takeaways: Tariffs increase production costs, disrupt supply chains, reduce investor confidence, and negatively impact valuations of tech companies, influencing their attractiveness for IPOs. However, other macroeconomic factors and market corrections should also be considered.

Call to Action: Stay informed about global trade policy developments and their potential impact on the tech sector. Understanding the interplay between tariffs and other economic factors is crucial for making informed investment decisions. Subscribe to our newsletter for in-depth market analysis and insights into the ongoing relationship between tariffs and the tech IPO market.

Featured Posts

-

Eurovision 2024 Strong Swiss Franc Presents Challenges For Fans

May 14, 2025

Eurovision 2024 Strong Swiss Franc Presents Challenges For Fans

May 14, 2025 -

Premier League Transfer News Liverpool And Arsenal Meet With Top Agent

May 14, 2025

Premier League Transfer News Liverpool And Arsenal Meet With Top Agent

May 14, 2025 -

Awoniyi Supports Nottingham Muslim Community With Ramadan Iftar

May 14, 2025

Awoniyi Supports Nottingham Muslim Community With Ramadan Iftar

May 14, 2025 -

Mission Impossible Dead Reckoning Part Two Trailer Breakdown What It Gets Right

May 14, 2025

Mission Impossible Dead Reckoning Part Two Trailer Breakdown What It Gets Right

May 14, 2025 -

Jose Mujica Uruguay La Muerte De Un Presidente Transformador A Los 89 Anos

May 14, 2025

Jose Mujica Uruguay La Muerte De Un Presidente Transformador A Los 89 Anos

May 14, 2025