Are High Stock Market Valuations A Concern? BofA's Take

Table of Contents

H2: BofA's Assessment of Current Market Valuations

BofA's stance on current high stock market valuations is nuanced. While acknowledging the historically elevated levels of certain valuation metrics, they haven't declared an outright bubble. Their assessment leans toward cautious optimism, acknowledging the risks while also considering the supporting factors driving these valuations. They emphasize the need for a careful, considered approach to investment.

- Key Metrics: BofA utilizes various metrics to assess market valuations, including:

- Price-to-Earnings (P/E) ratios: Comparing current share prices to company earnings per share.

- Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): A more robust measure that smooths out earnings fluctuations over time.

- Market capitalization to GDP ratio: This compares the total market value of all listed companies to the nation's Gross Domestic Product.

- BofA's Interpretation: While some of these metrics are currently elevated compared to historical averages, BofA argues that exceptionally low interest rates and robust corporate earnings justify, at least partially, the higher valuations. They also carefully compare current conditions to those of previous market cycles, finding both similarities and crucial differences.

- Sector-Specific Analysis: BofA regularly publishes sector-specific analyses, identifying some sectors as potentially overvalued (e.g., certain technology sub-sectors during periods of rapid growth) and others as relatively undervalued (e.g., cyclical sectors during economic slowdowns). These reports provide granular details to investors.

H2: Factors Contributing to High Stock Market Valuations (According to BofA)

BofA points to several interwoven economic and financial factors underpinning the current high stock market valuations.

- Low Interest Rates: Historically low interest rates have driven investors toward higher-yielding assets, including equities. This increased demand pushes stock prices upward.

- Quantitative Easing (QE): Previous rounds of QE injected significant liquidity into the market, further fueling asset price inflation.

- Strong Corporate Earnings: Many companies have reported strong earnings, exceeding expectations and justifying higher valuations based on future earnings potential.

- Geopolitical Factors: Global uncertainties and geopolitical risks can influence investor sentiment, leading to capital flows into perceived safe havens, thereby impacting valuations.

- Technological Advancements: The rapid pace of technological innovation continues to reshape industries, driving growth and attracting investment in promising companies, thus affecting stock market valuation.

H2: BofA's Recommendations for Investors Facing High Valuations

Given the current environment of high stock market valuations, BofA advocates a strategic and cautious approach to investing.

- Diversification: BofA strongly recommends diversifying investment portfolios across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Asset Allocation: They suggest considering a mix of growth and value stocks, adjusting allocations based on individual risk tolerance and investment goals. Specific asset classes suggested depend on the investor's individual circumstances and risk profile.

- Risk Management: Implementing risk management strategies, such as stop-loss orders and hedging techniques, is crucial to protect against potential market downturns.

- Long-Term Perspective: BofA reiterates the importance of maintaining a long-term investment horizon, weathering short-term market fluctuations.

- Individual Risk Tolerance: Investors should carefully assess their individual risk tolerance and adjust their investment strategy accordingly.

H3: Alternative Perspectives on High Stock Market Valuations

It's important to note that not all analysts share BofA's cautiously optimistic view. Some prominent financial institutions and economists express stronger concerns about the sustainability of current high stock market valuations, pointing to potential risks of a market correction. These alternative perspectives offer valuable counterpoints, highlighting the complexity of evaluating market conditions.

Conclusion: Navigating High Stock Market Valuations – BofA's Insights and Your Next Steps

BofA's analysis suggests that while high stock market valuations present risks, they are not necessarily indicative of an imminent bubble. However, a cautious and strategic approach is warranted. Their key recommendations emphasize diversification, risk management, and a long-term investment horizon. To successfully navigate this market, assess your portfolio's exposure to high valuations, learn more about BofA's market analysis, and develop a robust investment strategy in light of high stock market valuations. Understanding the complexities of high stock market valuations is crucial for making informed investment decisions.

Featured Posts

-

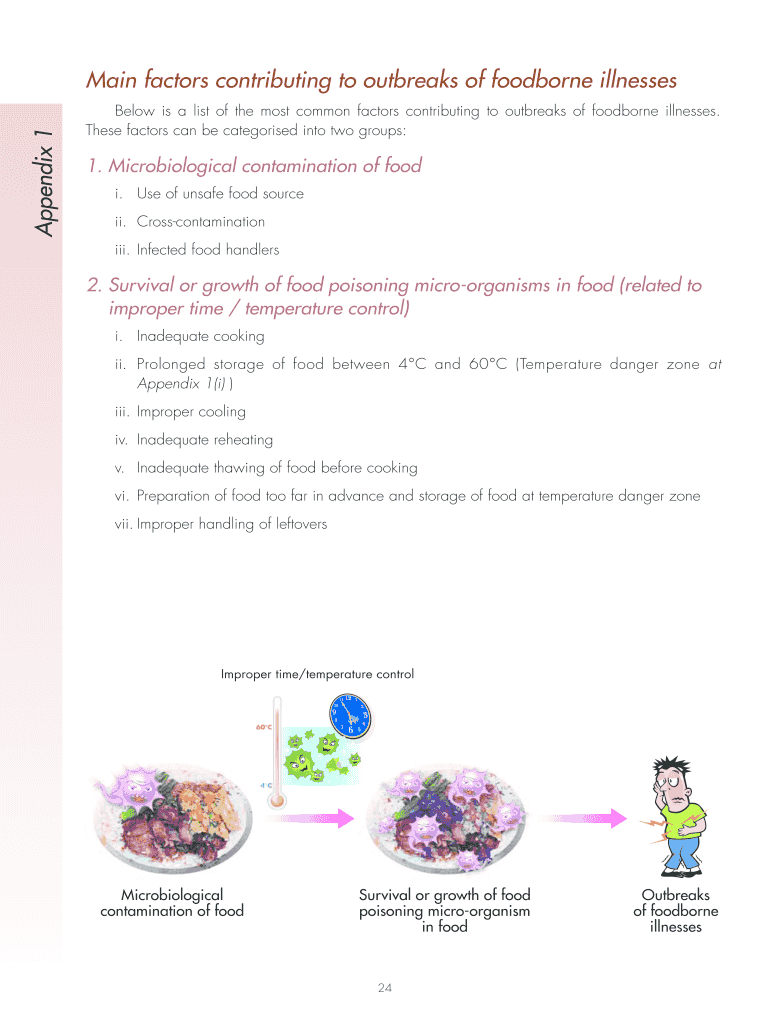

The Ongoing Threat Of Measles Factors Contributing To Persistence And Outbreaks

May 30, 2025

The Ongoing Threat Of Measles Factors Contributing To Persistence And Outbreaks

May 30, 2025 -

French Open 2024 Ruud And Tsitsipas Early Departures Swiateks Continued Success

May 30, 2025

French Open 2024 Ruud And Tsitsipas Early Departures Swiateks Continued Success

May 30, 2025 -

Mqawmt Mkhttat Alastytan Aldfae En 13 Hya Flstynya

May 30, 2025

Mqawmt Mkhttat Alastytan Aldfae En 13 Hya Flstynya

May 30, 2025 -

How A Test Drive Can Turn Into A Carjacking Prevention And Protection

May 30, 2025

How A Test Drive Can Turn Into A Carjacking Prevention And Protection

May 30, 2025 -

Ufc Veteran Dana White Must Pay Jon Jones 29 Million To Get Him In The Octagon

May 30, 2025

Ufc Veteran Dana White Must Pay Jon Jones 29 Million To Get Him In The Octagon

May 30, 2025

Latest Posts

-

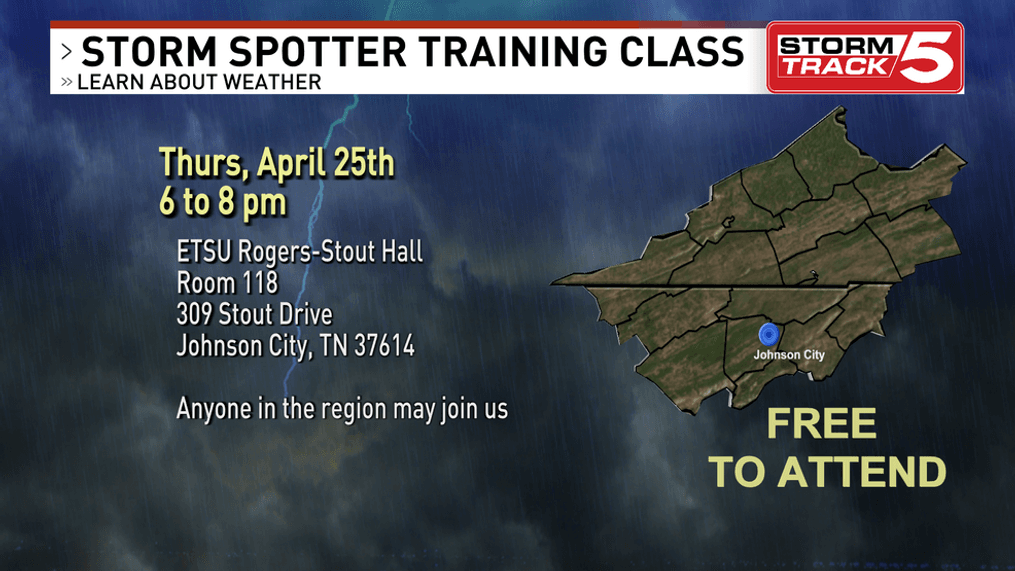

Spring Skywarn Training Learn From Expert Meteorologist Tom Atkins

May 31, 2025

Spring Skywarn Training Learn From Expert Meteorologist Tom Atkins

May 31, 2025 -

Improve Your Storm Spotting Skills Skywarn Class With Tom Atkins

May 31, 2025

Improve Your Storm Spotting Skills Skywarn Class With Tom Atkins

May 31, 2025 -

Skywarn Spring Class A Guide By Meteorologist Tom Atkins

May 31, 2025

Skywarn Spring Class A Guide By Meteorologist Tom Atkins

May 31, 2025 -

Spring Skywarn Training With Meteorologist Tom Atkins

May 31, 2025

Spring Skywarn Training With Meteorologist Tom Atkins

May 31, 2025 -

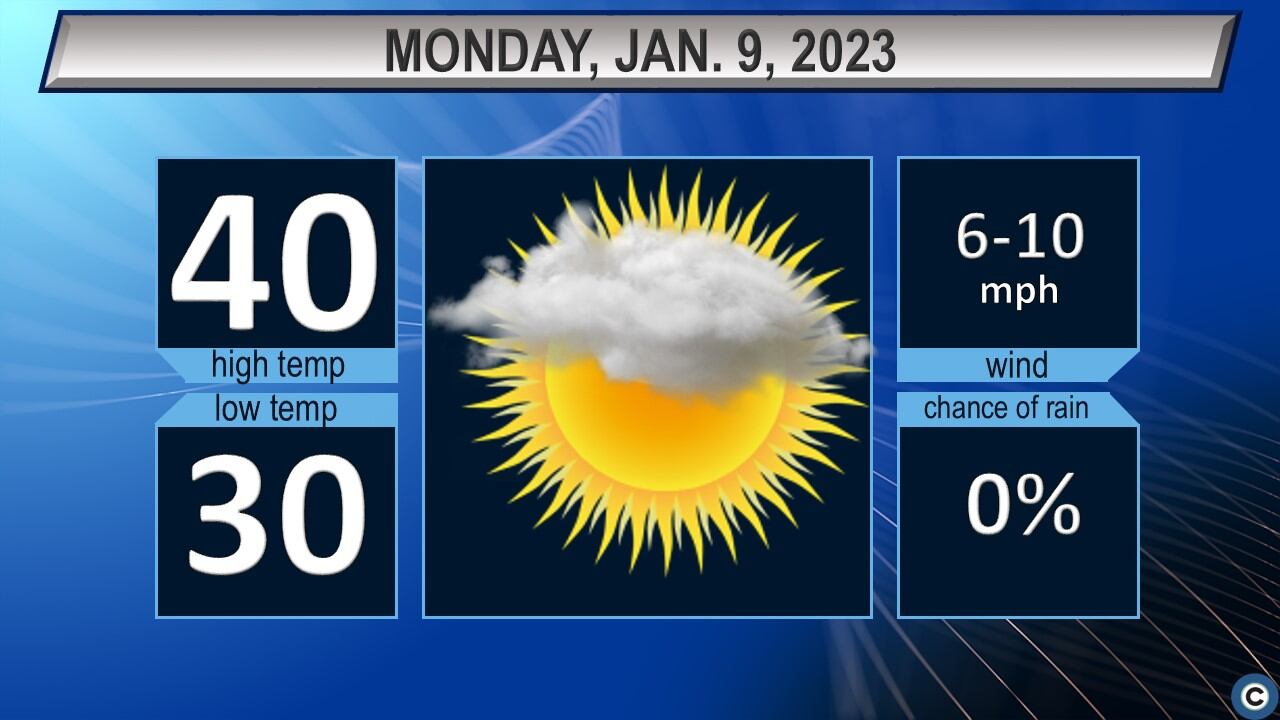

Northeast Ohio To See Rain Thursday Weather Update

May 31, 2025

Northeast Ohio To See Rain Thursday Weather Update

May 31, 2025