April's Uber Stock Performance: Reasons Behind The Double-Digit Increase

Table of Contents

Stronger-than-Expected Q1 Earnings Report

Uber's Q1 2024 earnings report significantly exceeded analyst expectations, acting as a major catalyst for the April stock price increase. This positive surprise sent a strong signal to investors, demonstrating the company's robust financial health and growth trajectory.

-

Key Performance Highlights:

- Revenue Growth: Uber reported revenue growth of X% (replace X with actual percentage), significantly surpassing the projected Y% (replace Y with projected percentage) increase anticipated by analysts. This robust revenue growth showcased the company's ability to capitalize on increasing demand for its services.

- Increased Ridership and Driver Engagement: The number of rides booked and the engagement of drivers both saw substantial increases, indicating a healthy and expanding ecosystem. This points to strong consumer confidence and satisfaction with the Uber platform.

- Improved Profitability Margins: Uber demonstrated improved profitability margins, signaling increased operational efficiency and better cost management. This positive trend is a key indicator of sustainable long-term growth.

- Positive Future Outlook: The company issued a positive outlook for the coming quarters, further boosting investor confidence and fueling the stock price increase.

-

Investor Reaction: The positive earnings surprise led to immediate and significant upward pressure on the Uber stock price. Numerous analysts upgraded their ratings and increased their price targets for Uber stock, reflecting the overwhelmingly positive market reaction. For example, Analyst A at Firm B increased their price target from Z to W (replace A, B, Z, and W with actual data).

Growing Demand for Ridesharing and Delivery Services

The surge in Uber's stock price is also inextricably linked to the booming demand for ridesharing and food delivery services. Several factors contributed to this heightened demand:

-

Drivers of Demand:

- Post-Pandemic Recovery: The post-pandemic economic recovery led to a significant increase in consumer spending and mobility, directly benefiting Uber's core businesses.

- Tourism and Travel Boom: The resurgence of tourism and travel significantly boosted demand for ride-hailing services, contributing to Uber's strong Q1 performance.

- Delivery Service Reliance: Increased reliance on food and grocery delivery services, especially in urban areas, continues to fuel strong growth for Uber Eats.

- Market Expansion: Uber's ongoing expansion into new markets and demographics further broadens its reach and potential for future growth.

-

Competitive Advantage: Uber's established brand recognition, extensive network, and technological advancements have allowed it to maintain a strong competitive position in a rapidly expanding market, effectively capturing significant market share.

Strategic Initiatives and Technological Advancements

Uber's proactive implementation of strategic initiatives and investments in technological advancements also contributed to the April stock price surge. These investments signal a commitment to innovation and long-term growth.

-

Key Strategic Moves:

- Technological Investments: Significant investments in autonomous driving technology, along with improvements to the Uber app's user experience, enhance efficiency and attract new customers.

- Service Expansion: The expansion of service offerings, such as new partnerships and the growth of freight services, diversifies Uber's revenue streams and reduces reliance on a single service.

- Cost Optimization: Uber's ongoing focus on cost-cutting measures and increased operational efficiency strengthens its profitability and investor confidence.

- Sustainability Focus: The company's commitment to sustainability initiatives resonates positively with environmentally conscious investors and customers.

-

Investor Confidence: These strategic moves showcase Uber's forward-thinking approach and commitment to long-term growth, contributing to the positive investor sentiment reflected in the April stock price increase.

Overall Positive Market Sentiment and Economic Factors

The broader macroeconomic environment played a significant role in Uber's April stock performance. A positive market sentiment, coupled with favorable economic indicators, created a tailwind for the company.

-

Economic Factors:

- Positive Tech Sentiment: A generally positive investor sentiment towards the tech sector provided a supportive environment for Uber's stock performance.

- Interest Rate Stabilization: Signs of stabilization or moderation in interest rate hikes reduced uncertainty in the market, encouraging investment in growth stocks like Uber.

- Consumer Confidence: Improved consumer confidence boosted spending and travel, positively impacting demand for Uber's services.

- Inflation Slowdown: A slowdown in inflation rates or signs of inflation peaking reduced concerns about economic instability, further contributing to positive market sentiment.

-

Market Sentiment: The combination of these positive economic indicators and the company's strong Q1 performance fueled overall positive market sentiment towards Uber, leading to the substantial stock price increase observed in April.

Conclusion

April's remarkable double-digit increase in Uber stock price can be attributed to a confluence of factors, including exceeding Q1 earnings expectations, robust growth in ridesharing and delivery services, strategic initiatives, and a generally favorable macroeconomic environment. These positive indicators suggest a promising outlook for Uber's future.

Call to Action: Want to stay informed about the latest developments impacting Uber stock performance? Follow our blog for regular updates and in-depth analyses on Uber stock and other market trends. Understanding the factors influencing Uber stock price is key to informed investment decisions. Keep up-to-date with our analysis of Uber stock performance and make smarter investment choices.

Featured Posts

-

Find The Best Australian Crypto Casino Sites For 2025

May 17, 2025

Find The Best Australian Crypto Casino Sites For 2025

May 17, 2025 -

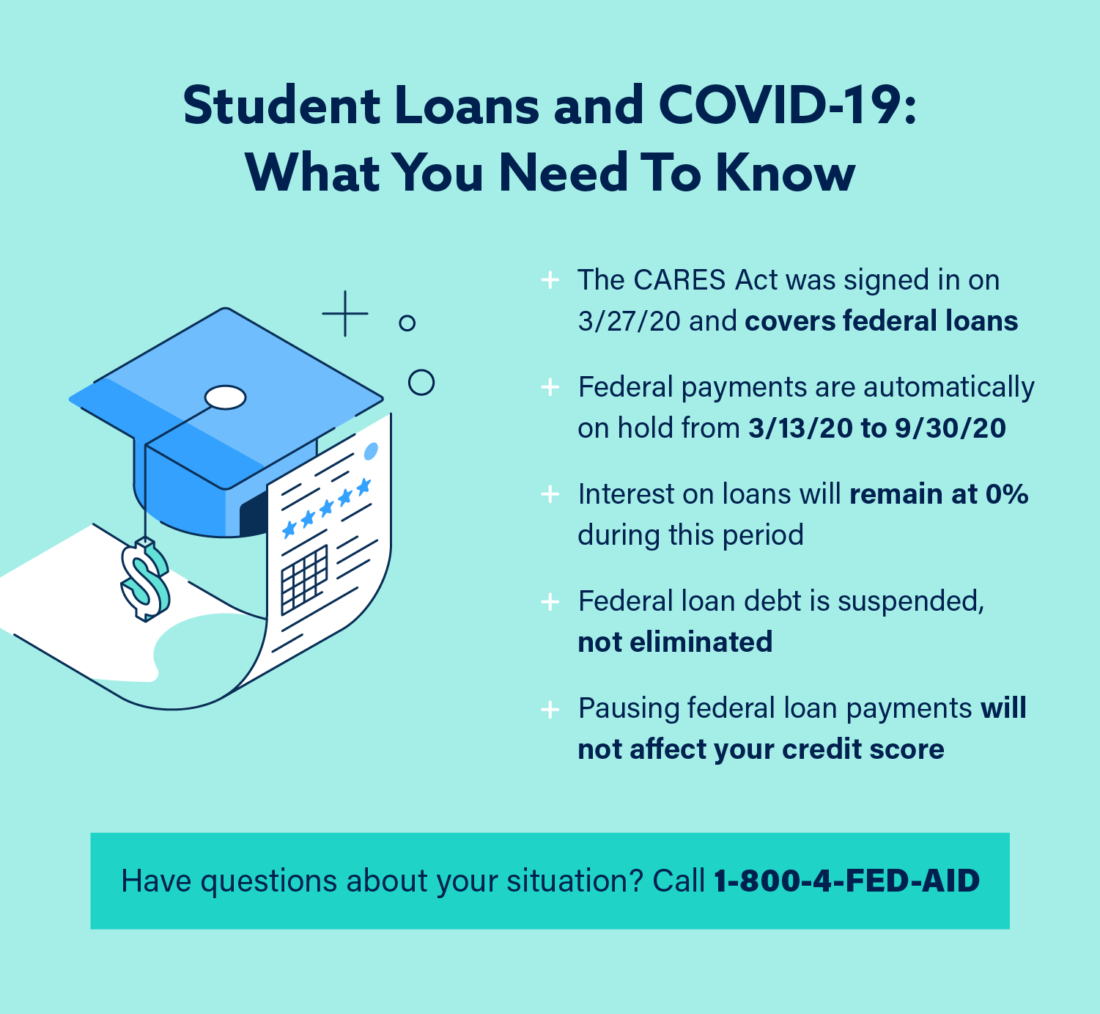

How Late Student Loan Payments Impact Your Credit

May 17, 2025

How Late Student Loan Payments Impact Your Credit

May 17, 2025 -

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Apo Tin Megaloprepi Teleti

May 17, 2025

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Apo Tin Megaloprepi Teleti

May 17, 2025 -

Hudsons Bay Offloads Name Stripes And Brands To Canadian Tire A 30 Million Deal

May 17, 2025

Hudsons Bay Offloads Name Stripes And Brands To Canadian Tire A 30 Million Deal

May 17, 2025 -

Mariners Giants Injury Update Key Players Out For April 4 6 Series

May 17, 2025

Mariners Giants Injury Update Key Players Out For April 4 6 Series

May 17, 2025

Latest Posts

-

Jalen Brunsons Wife Who Is Ali Marks A Look Into The Nba Stars Personal Life

May 17, 2025

Jalen Brunsons Wife Who Is Ali Marks A Look Into The Nba Stars Personal Life

May 17, 2025 -

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025 -

Jalen Brunson Injury Assessing The Impact On The New York Knicks

May 17, 2025

Jalen Brunson Injury Assessing The Impact On The New York Knicks

May 17, 2025 -

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025 -

The Knicks Jalen Brunson Problem A Slow Road To Recovery

May 17, 2025

The Knicks Jalen Brunson Problem A Slow Road To Recovery

May 17, 2025