Apple's Loss, Mobile Game Industry's Gain: Financial Implications

Table of Contents

Increased Revenue for Independent Developers

Reduced App Store fees translate directly to increased profitability for smaller game studios. Previously, Apple's 30% commission significantly impacted the bottom line, especially for independent developers lacking the resources of larger companies. Now, with revised rates and alternative revenue models gaining traction, many independent developers are seeing a substantial boost in their earnings.

- Higher Profit Margins: Independent studios are reporting revenue increases ranging from 15% to 30%, depending on the game's monetization strategy and previous App Store fees.

- Case Studies: Several indie games, particularly those with successful in-app purchase (IAP) models, have seen exponential growth in profitability following the App Store changes. Examples include [insert examples of successful indie games here – replace bracketed information with real examples].

- Increased Investment: The higher profit margins are enabling independent developers to reinvest earnings in improving game quality, expanding marketing efforts, and developing new titles. This fuels further growth and innovation within the mobile gaming sector.

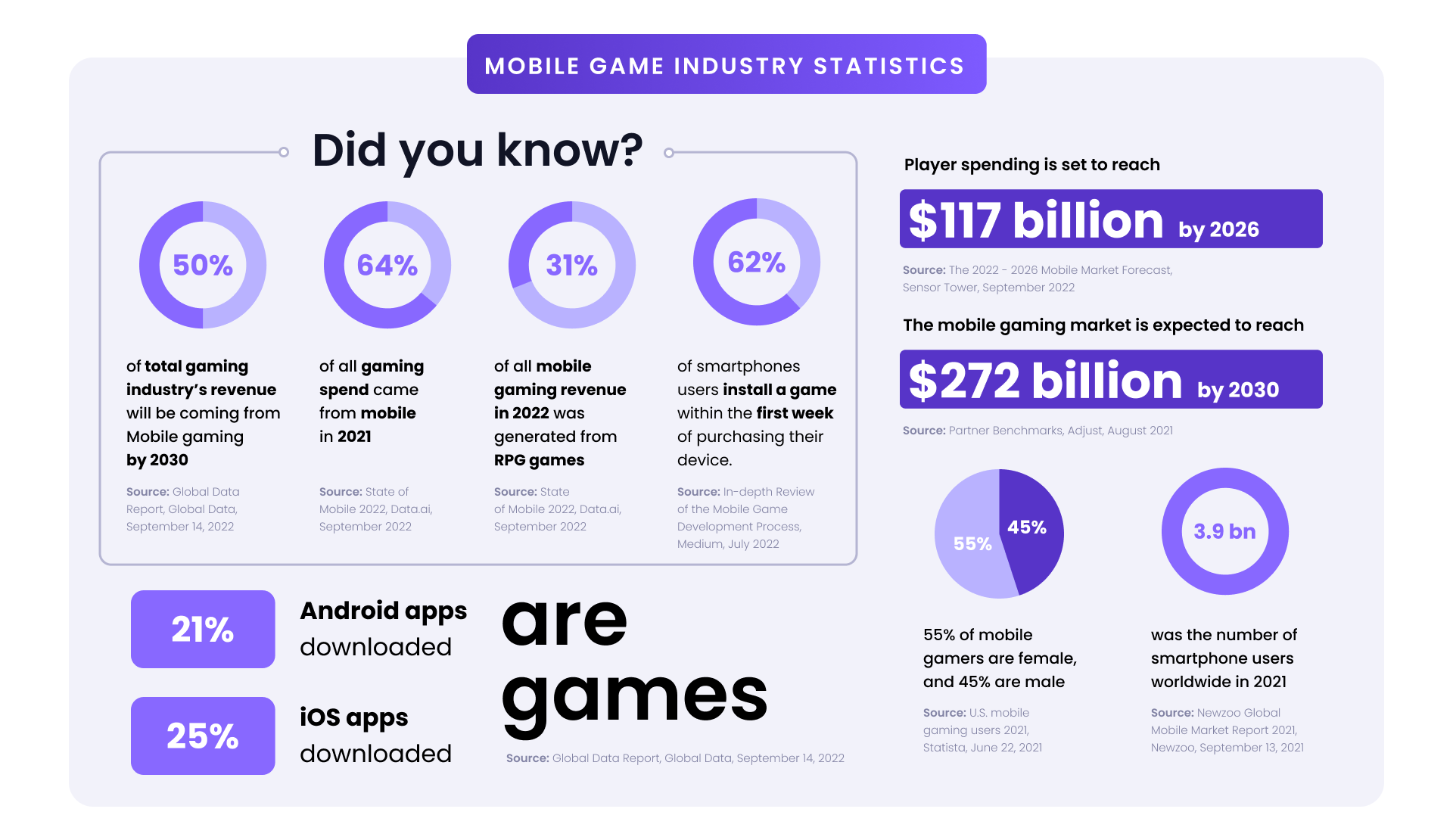

- Genre-Specific Growth: Games in genres like puzzle, casual, and hyper-casual have seen particularly strong growth, as these often rely heavily on IAPs for revenue.

Shifting Power Dynamics in the Mobile Gaming Ecosystem

Apple's changes have significantly altered the relationship between Apple and mobile game developers. The reduced commission has empowered developers, giving them more control over their revenue streams and encouraging experimentation with diverse monetization techniques.

- Increased Competition: The shift is fostering increased competition amongst app stores. Developers are now more likely to explore alternative distribution platforms, such as Google Play or emerging app stores, seeking the most advantageous revenue-sharing arrangements.

- Alternative App Stores: The rise of alternative app stores is a direct consequence of Apple's changes. These alternative platforms often offer more favorable terms for developers, driving further competition and choice for both developers and consumers.

- Revenue Share Comparison:

- Apple App Store: [Insert current Apple App Store revenue share model]

- Google Play Store: [Insert current Google Play Store revenue share model]

- Other App Stores: [Insert examples of other app stores and their revenue share models]

Impact on Mobile Game Advertising and Monetization

The changes in Apple's policies also impact how mobile game developers approach advertising and monetization. While reduced App Store fees are beneficial, the overall financial landscape is changing.

- In-App Advertising: The reliance on in-app advertising might increase for some developers, particularly those with freemium models. However, effective ad implementation is crucial to avoid impacting the user experience negatively.

- Monetization Strategies: Developers are exploring various strategies, including:

- Subscription Models: Offering recurring access to premium content or features.

- One-Time Purchases: Selling complete games or expansion packs.

- Battle Passes: A popular model in many free-to-play games.

- User Acquisition Costs (UAC): The cost of acquiring new users can fluctuate based on market competition and advertising effectiveness. The increased competition amongst app stores and the shift in power dynamics may impact these costs.

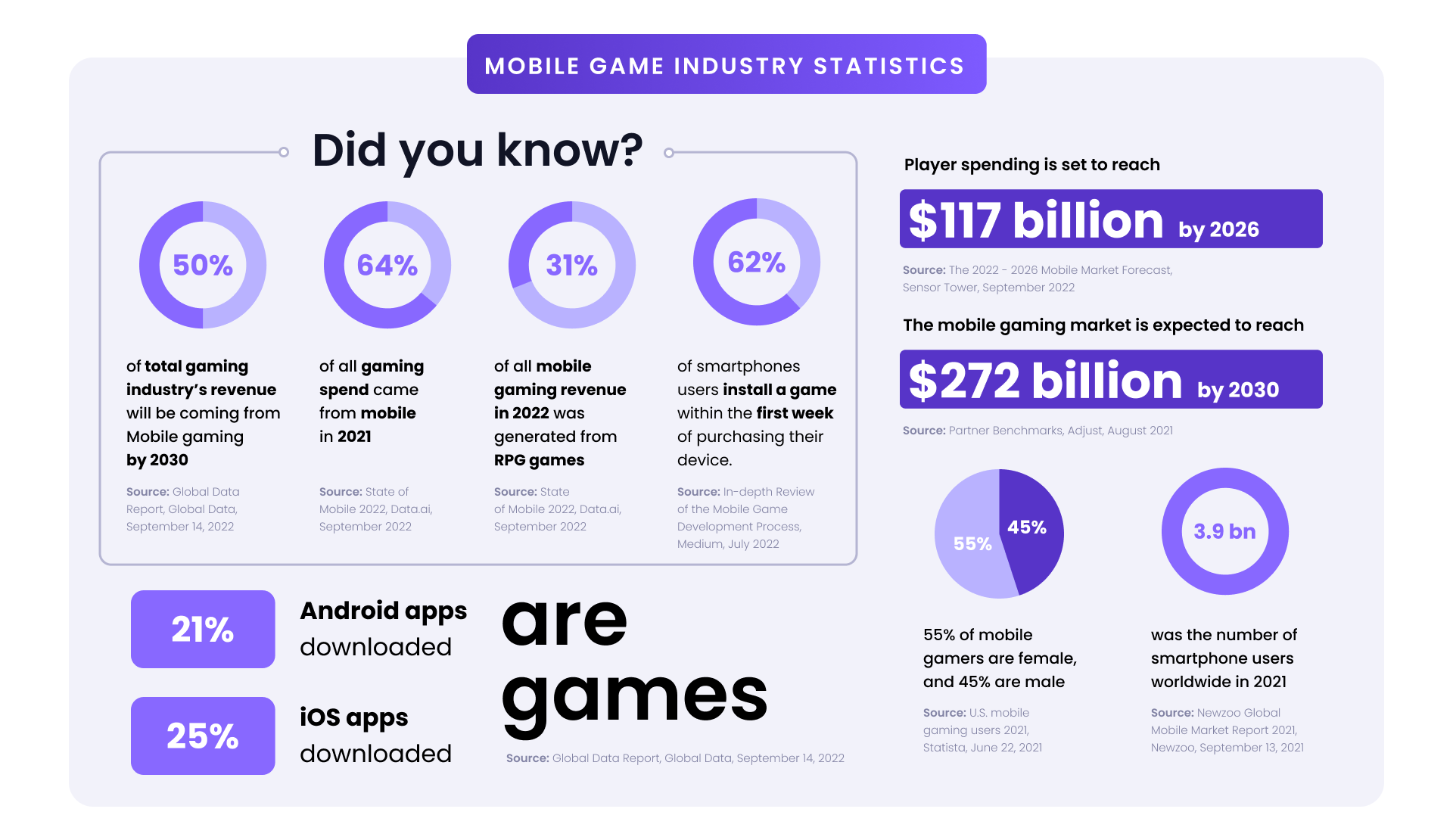

Long-Term Financial Projections for the Mobile Gaming Industry

The long-term outlook for the mobile gaming industry, in the wake of Apple's changes, appears positive. Increased developer revenue and innovation are expected to fuel further market growth.

- Market Growth Forecasts: Analysts predict continued robust growth in the mobile gaming market, with [insert predicted growth percentages and figures here – replace bracketed information with real data].

- Innovation and Diversification: Higher profit margins encourage developers to experiment with new genres, gameplay mechanics, and monetization models, leading to more diverse and innovative game experiences.

- Economic Stability: While risks remain (market fluctuations, competition), the changes have generally strengthened the financial health and stability of the mobile gaming sector.

Conclusion: Navigating the New Landscape of Mobile Game Finance

Apple's adjustments to its App Store policies have created a significant shift in the mobile gaming industry's financial landscape, confirming the notion of "Apple's Loss, Mobile Game Industry's Gain." The changes have empowered independent developers, increased competition, and fueled innovation. Understanding the financial implications of Apple's actions is crucial for navigating the evolving landscape of the mobile game industry. Stay informed and capitalize on these opportunities!

Featured Posts

-

Emergencia En Constanza Incendio Forestal Y Sus Efectos En Residentes

May 31, 2025

Emergencia En Constanza Incendio Forestal Y Sus Efectos En Residentes

May 31, 2025 -

8 Variantes De Crepes Salados Para Una Cena Ligera O Merienda

May 31, 2025

8 Variantes De Crepes Salados Para Una Cena Ligera O Merienda

May 31, 2025 -

Canelo Vs Golovkin Live Stream Results Complete Play By Play Coverage

May 31, 2025

Canelo Vs Golovkin Live Stream Results Complete Play By Play Coverage

May 31, 2025 -

Alberta Wildfires A Looming Threat To Oil Production

May 31, 2025

Alberta Wildfires A Looming Threat To Oil Production

May 31, 2025 -

Trump And Musk A New Chapter Begins

May 31, 2025

Trump And Musk A New Chapter Begins

May 31, 2025