Apple Vs. Trump Tariffs: Will Buffett's Top Tech Stock Crack?

Table of Contents

Warren Buffett, the Oracle of Omaha, famously bet big on Apple. But the imposition of Trump-era tariffs cast a long shadow over this seemingly unshakeable investment. This article delves into the impact of the Trump tariffs on Apple, exploring how they affected the supply chain, consumer prices, and the stock market reaction, ultimately examining whether Buffett's faith in Apple—his top tech stock—was justified. We will analyze the challenges posed by the "Trump Tariffs" to Apple and assess the long-term implications for the tech giant and its investors.

The Impact of Tariffs on Apple's Supply Chain

The Trump administration's tariffs, primarily targeting goods from China, significantly disrupted Apple's finely-tuned global supply chain.

Increased Production Costs

- Affected Components: Tariffs increased the cost of importing crucial components like displays (often sourced from South Korea and China), processors (many manufactured in Taiwan and China), and various other parts.

- Manufacturing in China: A substantial portion of Apple's manufacturing relied on Chinese factories. The tariffs increased the cost of producing iPhones, iPads, and MacBooks within China.

- Relocation Costs: To mitigate the impact, Apple faced the significant expense and logistical challenges of shifting some production to other countries, a costly and time-consuming process. Keyword integration: "Apple supply chain," "tariff impact," "manufacturing costs."

Shifting Production Strategies

Apple's response to the tariffs involved a complex strategy of diversifying its manufacturing base.

- Production Shifts: Apple gradually shifted some of its production to countries like India and Vietnam, seeking lower manufacturing costs and reduced tariff exposure.

- Challenges of Relocation: Establishing new manufacturing facilities in these locations involved substantial investment, overcoming infrastructural hurdles, and training local workforces.

- Cost Implications: While diversification mitigated some tariff impacts, it also introduced new costs associated with establishing and operating facilities in different countries. Keyword integration: "Apple production," "offshoring," "tariff mitigation."

Price Increases for Consumers

The increased production costs resulting from tariffs ultimately translated into higher prices for consumers.

- Price Hikes: Apple implemented price increases for some of its products to offset the increased manufacturing expenses.

- Consumer Response: While some consumers absorbed the price increases, others delayed purchases or opted for alternative brands, impacting Apple's sales figures.

- Impact on Sales: The combination of higher prices and increased competition potentially dampened overall sales growth during the tariff period. Keyword integration: "Apple prices," "consumer impact," "tariff consequences."

Warren Buffett's Investment and the Stock Market Reaction

Warren Buffett's continued investment in Apple during the tariff period was a key indicator of his confidence in the company's long-term prospects.

Buffett's Confidence in Apple

- Investment Strategy: Buffett's investment philosophy focuses on long-term value and strong companies. His continued Apple holdings demonstrated his belief in Apple's ability to weather the tariff storm.

- Long-Term Prospects: Buffett likely viewed the tariffs as a temporary challenge, anticipating Apple's resilience and ability to adapt its supply chain. Keyword integration: "Warren Buffett," "Apple stock," "investment strategy."

Stock Market Volatility

The imposition of tariffs created volatility in the stock market, impacting Apple's stock price.

- Apple Stock Performance: While Apple's stock price experienced fluctuations, it generally showed resilience, indicating investor confidence in its fundamental strength.

- Comparison to Other Tech Stocks: Apple's performance compared favorably to some other tech companies during the tariff period, suggesting its relative strength within the sector. Charts illustrating Apple's stock performance during the tariff period would be ideal here. Keyword integration: "Apple stock price," "market volatility," "tariff effects."

Long-Term Outlook for Apple Stock

Despite the challenges posed by tariffs, Apple's long-term outlook remains positive.

- Diversification Strategy: Apple's strategic diversification of its supply chain reduced its dependence on any single country, enhancing its resilience to future disruptions.

- Resilience to Challenges: Apple's ability to adapt to changing market conditions, navigate geopolitical risks, and maintain its brand strength demonstrates its capacity to overcome future challenges. Keyword integration: "Apple future," "long-term investment," "stock outlook."

Lessons Learned and Future Implications

The Trump tariffs provided valuable lessons for global businesses, particularly regarding supply chain management and geopolitical risk.

Supply Chain Diversification

- Best Practices: The experience highlighted the importance of diversifying supply chains to mitigate risks associated with geopolitical instability, trade wars, and natural disasters.

- Geopolitical Factors: Businesses need to consider geopolitical factors when designing their supply chains, seeking greater geographic diversification and redundancy. Keyword integration: "Supply chain management," "risk mitigation," "global trade."

Government Policy and Business

- Impact of Trade Wars: Government trade policies can significantly impact global businesses, forcing them to adapt their strategies and potentially incur substantial costs.

- International Relations: Businesses must consider the broader geopolitical landscape and the potential impact of international relations on their operations and supply chains. Keyword integration: "Trade policy," "global business," "geopolitical risks."

Conclusion: Will Apple Weather Future Storms?

The Trump tariffs presented a significant challenge to Apple, impacting its supply chain, production costs, and consumer prices. However, Apple demonstrated remarkable resilience, adapting its strategies and maintaining its position as a leading technology company. Warren Buffett's continued investment underlines his confidence in Apple's long-term potential. The experience underscores the importance of supply chain diversification and careful consideration of geopolitical risks for all global businesses. To stay informed about the ongoing impact of tariffs and Apple's future strategies, continue researching the interplay between "Apple," "Trump Tariffs," and "Buffett's Top Tech Stock." Understanding these dynamics is crucial for investors and business leaders alike.

Featured Posts

-

Garazh Ryazanova Satira Plenum I Neglasnaya Podderzhka Brezhneva

May 25, 2025

Garazh Ryazanova Satira Plenum I Neglasnaya Podderzhka Brezhneva

May 25, 2025 -

Texas Under Flash Flood Warning Heavy Rainfall And Storm Impacts

May 25, 2025

Texas Under Flash Flood Warning Heavy Rainfall And Storm Impacts

May 25, 2025 -

Carmen Joy Crookes Latest Musical Offering

May 25, 2025

Carmen Joy Crookes Latest Musical Offering

May 25, 2025 -

Anchor Brewing Companys Closure A Legacy In Beer Brewing Ends

May 25, 2025

Anchor Brewing Companys Closure A Legacy In Beer Brewing Ends

May 25, 2025 -

Deadly Myrtle Beach Hit And Run Suspect Apprehended

May 25, 2025

Deadly Myrtle Beach Hit And Run Suspect Apprehended

May 25, 2025

Latest Posts

-

Shooting At Popular Southern Vacation Spot Prompts Safety Review And Debate

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review And Debate

May 25, 2025 -

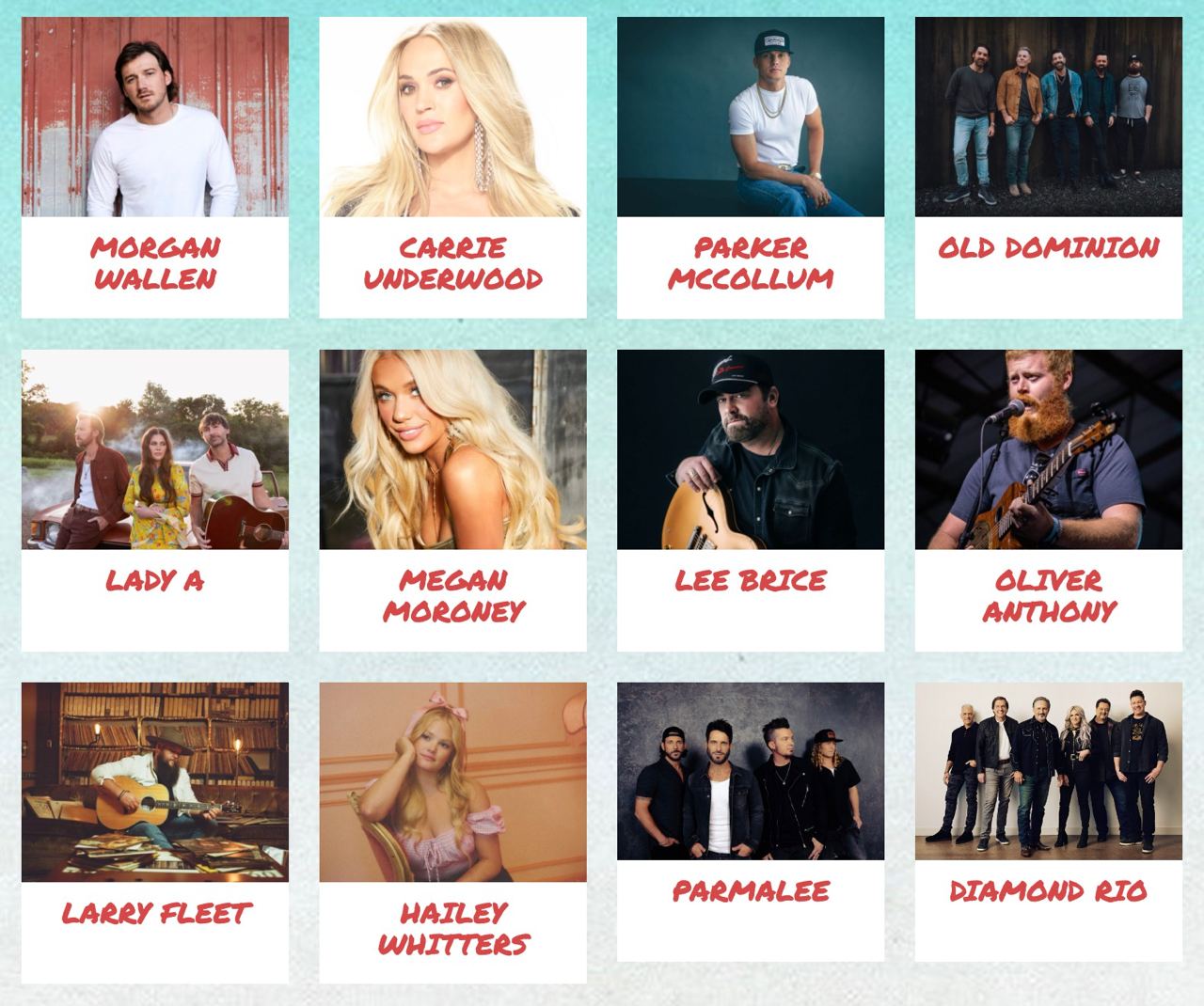

2025 Carolina Country Music Fest Tickets No Longer Available

May 25, 2025

2025 Carolina Country Music Fest Tickets No Longer Available

May 25, 2025 -

Southern Vacation Destination Disputes Safety Concerns Following Shooting Incident

May 25, 2025

Southern Vacation Destination Disputes Safety Concerns Following Shooting Incident

May 25, 2025 -

Popular Southern Vacation Area Responds To Criticism After Shooting

May 25, 2025

Popular Southern Vacation Area Responds To Criticism After Shooting

May 25, 2025 -

Dispute Over Safety Rating Southern Vacation Spot Rebuts Claims Following Shooting

May 25, 2025

Dispute Over Safety Rating Southern Vacation Spot Rebuts Claims Following Shooting

May 25, 2025