Apple Stock Price Forecast: $254 Target – A Buy At Current Levels?

Table of Contents

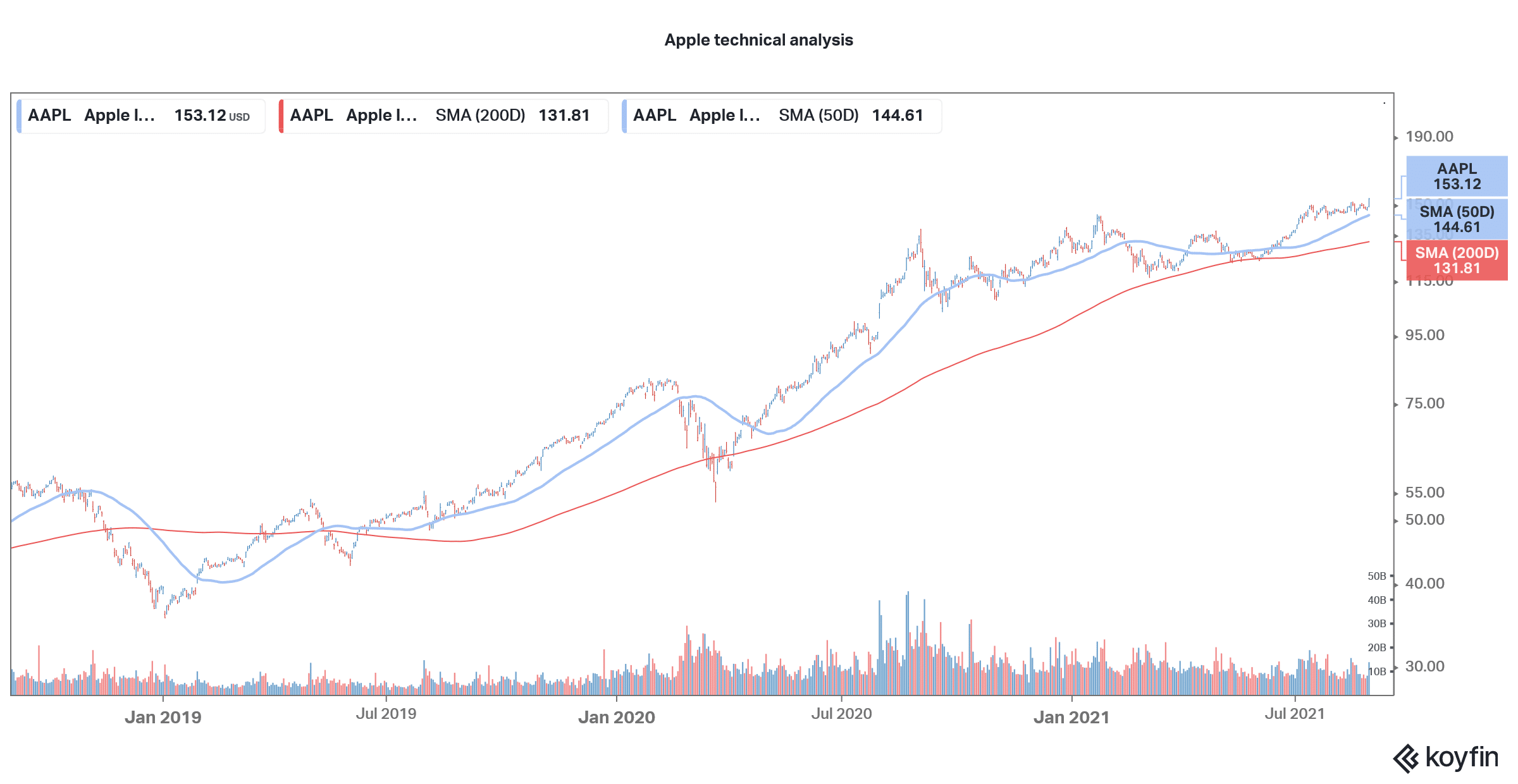

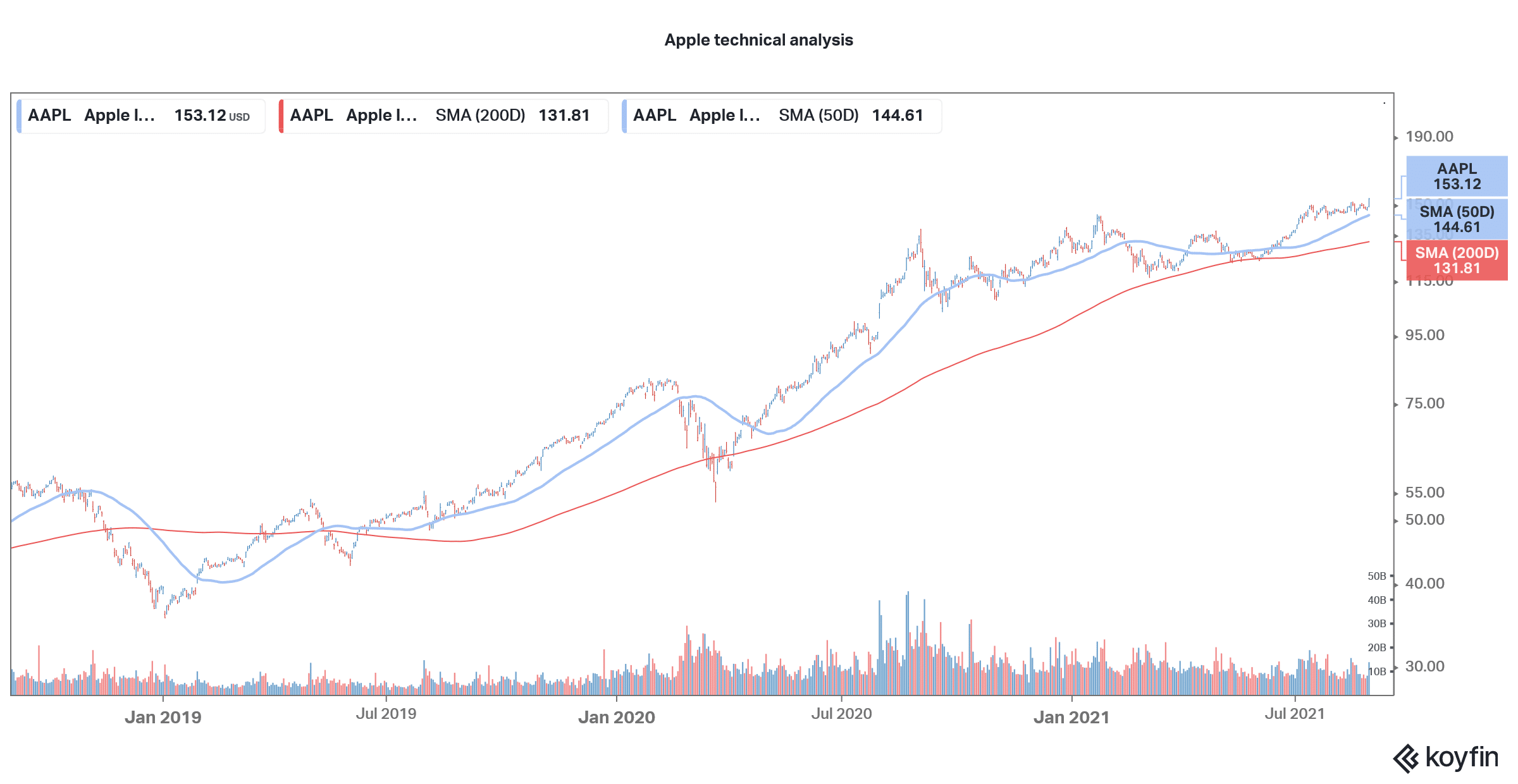

Apple (AAPL) has consistently been a tech giant, delivering impressive returns for investors over the years. But with the current market volatility, many are questioning whether the Apple stock price will reach the projected $254 target and if it's a worthwhile investment at its current levels. This in-depth analysis examines key factors influencing Apple's stock price and provides a forecast to help you make informed investment decisions. We'll explore the potential for growth, risks involved, and ultimately, whether or not a buy recommendation is justified.

Apple's Recent Performance and Financial Health

Revenue Growth and Profitability

Apple's recent financial reports paint a picture of continued growth, albeit with some nuances. Analyzing key performance indicators (KPIs) is crucial for understanding the company's financial health and its potential for future stock price appreciation. Let's delve into some key data points:

- Q[Insert Quarter] 2024 Earnings: Apple reported [Insert Revenue Figure] in revenue, representing a [Insert Percentage]% year-over-year growth. Earnings per share (EPS) reached $[Insert EPS Figure], exceeding analyst expectations.

- iPhone Sales: While iPhone sales might have shown some [Growth/Decline], the Services segment continues to demonstrate robust growth, highlighting the diversification of Apple's revenue streams.

- Mac and iPad Sales: The Mac and iPad segments contributed [Insert Percentage]% and [Insert Percentage]% respectively to overall revenue, demonstrating continued strength in these product categories.

- Operating Margins: Apple maintains healthy operating margins, currently at [Insert Percentage]%, showcasing efficient cost management and strong pricing power. This is [Higher/Lower] compared to the same period last year, indicating [Positive/Negative] trend.

Comparing Apple's performance to its competitors like Samsung and Microsoft reveals a consistently strong position in the market, with Apple often outperforming its rivals in key metrics like revenue growth and profitability.

Innovation and Future Product Pipeline

Apple's continued success hinges on its ability to innovate and introduce groundbreaking products. The future product pipeline holds significant potential for driving future stock price growth.

- iPhone 15 Series: The upcoming iPhone 15 series is expected to incorporate significant improvements in [Mention Key Features], potentially boosting sales and revenue.

- Apple's Vision Pro Headset: The launch of Apple's mixed-reality headset, Vision Pro, marks a significant foray into a potentially lucrative new market. While initial sales might be limited, its long-term potential for generating significant revenue is substantial.

- Electric Vehicle (EV) Rumours: Although unconfirmed, speculation about an Apple Car continues to fuel investor excitement and contribute to a positive outlook for long-term growth.

- Services Growth: Continued expansion of its Services ecosystem, including Apple Music, Apple TV+, and iCloud, is expected to contribute significantly to revenue diversification and steady growth.

Market Factors Influencing Apple Stock Price

Macroeconomic Conditions

Global macroeconomic conditions significantly influence Apple's stock price, often impacting investor sentiment.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact consumer spending and decrease demand for Apple products, potentially putting downward pressure on the stock price.

- Recessionary Fears: Concerns about a potential recession can lead to investors shifting towards safer investments, causing a decline in tech stocks, including Apple.

- Supply Chain Disruptions: Global supply chain issues could impact Apple's production and delivery of products, leading to temporary setbacks in revenue growth.

Investor Sentiment and Analyst Ratings

Analyst ratings and overall investor sentiment play a critical role in determining Apple's stock price.

- Analyst Target Prices: Many analysts currently have a "Buy" or "Hold" rating on Apple stock, with target prices ranging from $[Insert Low Target] to $[Insert High Target], reflecting a range of opinions about future potential.

- Positive News and Events: Positive news about new product launches, strong earnings reports, and positive analyst upgrades can boost investor confidence and drive up the stock price.

- Negative News and Events: Conversely, negative news about supply chain disruptions, regulatory challenges, or disappointing earnings can negatively impact investor sentiment and lead to a decline in the stock price.

Valuation and Potential Risks

Price-to-Earnings Ratio (P/E) Analysis

Analyzing Apple's Price-to-Earnings (P/E) ratio provides insights into its current valuation.

- Current P/E Ratio: Apple's current P/E ratio is [Insert Current P/E Ratio], which is [Higher/Lower/Similar] to its historical average and compared to its competitors, suggesting it is [Overvalued/Undervalued/Fairly Valued].

- Historical P/E Ratio: A look at Apple's historical P/E ratio can provide context for its current valuation, revealing whether the stock is trading at a premium or discount relative to its past performance.

Potential Downside Risks

While the outlook for Apple is generally positive, several potential downside risks could impact its stock price.

- Increased Competition: Intense competition from other tech companies, especially in the smartphone and wearable markets, could impact Apple's market share and revenue growth.

- Regulatory Scrutiny: Increasing regulatory scrutiny and potential antitrust investigations could pose challenges for Apple.

- Supply Chain Disruptions: Geopolitical events and unexpected disruptions to global supply chains could negatively impact Apple's production and sales.

Conclusion

Our analysis suggests a potential Apple stock price of $254, based on strong financial performance, a promising product pipeline, and positive long-term growth prospects. However, macroeconomic conditions and potential downside risks must be considered. While Apple's recent performance and future innovation potential are compelling, investors need to evaluate the current valuation relative to their risk tolerance and long-term investment goals.

Call to Action: Is Apple stock right for your portfolio? Should you buy Apple stock now? Consider adding Apple stock to your holdings, but remember to conduct thorough due diligence before making any investment decisions. The potential for the Apple stock price to reach $254 or beyond exists, but careful consideration of your own risk profile is paramount.

Featured Posts

-

Are La Landlords Price Gouging After Recent Fires A Stars Perspective

May 24, 2025

Are La Landlords Price Gouging After Recent Fires A Stars Perspective

May 24, 2025 -

Porsche 956 Nin Ters Yuez Edilmis Sergisi Tasarim Ve Muehendislik

May 24, 2025

Porsche 956 Nin Ters Yuez Edilmis Sergisi Tasarim Ve Muehendislik

May 24, 2025 -

Chat Gpt And Open Ai The Ftcs Investigation And Its Potential Outcomes

May 24, 2025

Chat Gpt And Open Ai The Ftcs Investigation And Its Potential Outcomes

May 24, 2025 -

Dylan Dreyers Son Post Surgery Hospital Update From Mom

May 24, 2025

Dylan Dreyers Son Post Surgery Hospital Update From Mom

May 24, 2025 -

New Offers From Canada Post Could Prevent An Upcoming Strike

May 24, 2025

New Offers From Canada Post Could Prevent An Upcoming Strike

May 24, 2025

Latest Posts

-

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Celebrated Amphibian Speaker At University Of Maryland Commencement Ceremony

May 24, 2025

Celebrated Amphibian Speaker At University Of Maryland Commencement Ceremony

May 24, 2025 -

Kermits Words Of Wisdom University Of Maryland Commencement Speech Analysis

May 24, 2025

Kermits Words Of Wisdom University Of Maryland Commencement Speech Analysis

May 24, 2025