Apple Stock Performance: Q2 Earnings Report Looms Large

Table of Contents

Analyzing Recent Apple Stock Performance

Pre-Earnings Speculation and Market Sentiment

Market sentiment towards Apple currently reflects a mix of optimism and caution. While Apple remains a dominant player in the tech sector, concerns about global economic slowdown and increased competition are influencing investor sentiment. Recent news, such as the launch of new products like the Vision Pro headset and ongoing supply chain challenges, also contribute to the pre-earnings speculation. Analyst predictions vary widely, with price targets ranging from conservative to bullish.

- Positive factors impacting stock price: Strong brand loyalty, innovative product pipeline, robust services revenue growth.

- Negative factors impacting stock price: Global economic uncertainty, intensifying competition, potential supply chain disruptions.

- Overall market trend impact: A broader market downturn could negatively impact even strong performers like Apple, while a positive market trend could boost the stock price regardless of the earnings report.

Key Performance Indicators (KPIs) to Watch

Investors will scrutinize several key performance indicators (KPIs) within the Q2 report to gauge Apple's financial health and future prospects. These KPIs are essential for understanding the company's growth trajectory and overall performance.

-

Revenue growth: Overall revenue growth and growth within each product segment (iPhone, Mac, iPad, Wearables, Services) will be closely analyzed. A slowdown in any segment, especially the crucial iPhone sales, could negatively impact the stock.

-

Profit margins: Investors will examine profit margins to assess Apple's efficiency and pricing power. Squeezed margins might signal increasing pressure from competition or rising costs.

-

iPhone sales figures: iPhone sales remain a crucial driver of Apple's revenue. Strong iPhone sales demonstrate continued consumer demand and market leadership.

-

Services revenue growth: The Services segment, including Apple Music, iCloud, and App Store, is a significant driver of recurring revenue and profitability. Strong growth in this area showcases Apple's ability to generate revenue beyond hardware sales.

-

Guidance for the next quarter: Apple's guidance for the next quarter will offer insights into the company's expectations for future performance, significantly influencing investor confidence.

-

Importance of each KPI: These KPIs provide a comprehensive picture of Apple's financial health, operational efficiency, and future growth potential.

-

Expected performance based on previous trends: Comparing Q2 performance to previous years' Q2 results and considering current market conditions helps investors develop realistic expectations.

-

Potential surprises: Unexpectedly strong or weak performance in any of these areas could cause significant stock price volatility.

Factors Influencing Apple Stock Performance Beyond Q2 Earnings

The Macroeconomic Environment

The macroeconomic environment plays a significant role in influencing Apple stock performance. Factors such as inflation, interest rates, and overall global economic growth directly impact consumer spending and demand for Apple products. A recessionary environment could dampen consumer spending, while a strong economy tends to boost demand.

- Specific economic indicators impacting Apple: Inflation rates, interest rates, consumer confidence index, GDP growth, unemployment rates.

- Potential for economic slowdown: A global economic slowdown could significantly impact Apple's sales, especially in discretionary spending categories.

- Impact on consumer spending: Economic uncertainty can lead to reduced consumer spending, potentially impacting demand for Apple's premium-priced products.

Competition in the Tech Sector

Apple faces intense competition in the tech sector from companies like Samsung, Google, and other emerging tech players. This competition impacts Apple's market share, profitability, and innovation. The rise of new technologies and trends, like augmented reality and artificial intelligence, also presents both threats and opportunities.

- Key competitors and their market strategies: Samsung's broad range of Android devices, Google's Android operating system and services, and other companies vying for market share all put pressure on Apple.

- Apple's competitive advantages: Apple’s brand recognition, strong ecosystem, and innovative product design remain key competitive advantages.

- Emerging technologies and their impact: The successful integration and adoption of new technologies like AR/VR or AI will be critical for Apple's continued success and will influence the Apple stock performance.

Strategies for Investors

Analyzing the Q2 Report and its Implications

Investors should meticulously analyze the Q2 earnings report to understand its impact on Apple stock. Focus on the key performance indicators discussed earlier, and compare the reported results to analysts' predictions and previous quarters.

- Key areas to focus on in the report: Revenue growth, profit margins, iPhone sales, Services revenue, and guidance for the next quarter.

- How to interpret the financial data: Compare the results against previous quarters and years, and consider the context of the macroeconomic environment and competitive landscape.

- What to look for beyond the numbers: Look for qualitative information in the earnings call and press release – management commentary, strategic initiatives, and insights into the future.

Risk Management and Diversification

Investing in the stock market inherently involves risk. Apple stock, while generally considered a solid investment, is not immune to market fluctuations. Diversification is crucial for mitigating risk.

- Potential risks associated with investing in Apple: Economic downturns, increased competition, negative publicity, changes in consumer preferences.

- Strategies for managing risk: Diversify investments across different asset classes, sectors, and geographies. Consider dollar-cost averaging to reduce the impact of market volatility.

- Benefits of diversification: Diversification reduces the overall risk of your portfolio and protects you from losses in a single investment.

Conclusion

The Q2 Apple earnings report is paramount for understanding the current state and future trajectory of Apple stock performance. Factors such as macroeconomic conditions, intense competition, and the company's performance across key performance indicators (KPIs) will all play significant roles. By carefully analyzing the report, monitoring key financial indicators, and incorporating sound risk management strategies, investors can make informed decisions regarding their Apple stock holdings. Stay informed about the upcoming Apple Q2 earnings report and its impact on Apple stock performance. Monitor key financial indicators and consider your investment strategy accordingly. By understanding the factors influencing Apple stock, you can make more informed decisions about your portfolio. Learn more about navigating the complexities of Apple stock and other tech investments.

Featured Posts

-

Sean Penns Skepticism Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025

Sean Penns Skepticism Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025 -

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 24, 2025

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 24, 2025 -

The Nfls Tush Push A Celebratory History Of The Butt Focused Play

May 24, 2025

The Nfls Tush Push A Celebratory History Of The Butt Focused Play

May 24, 2025 -

Escape To The Country Living Sustainably In A Rural Environment

May 24, 2025

Escape To The Country Living Sustainably In A Rural Environment

May 24, 2025 -

Harnessing Orbital Space Crystals A New Frontier In Drug Discovery

May 24, 2025

Harnessing Orbital Space Crystals A New Frontier In Drug Discovery

May 24, 2025

Latest Posts

-

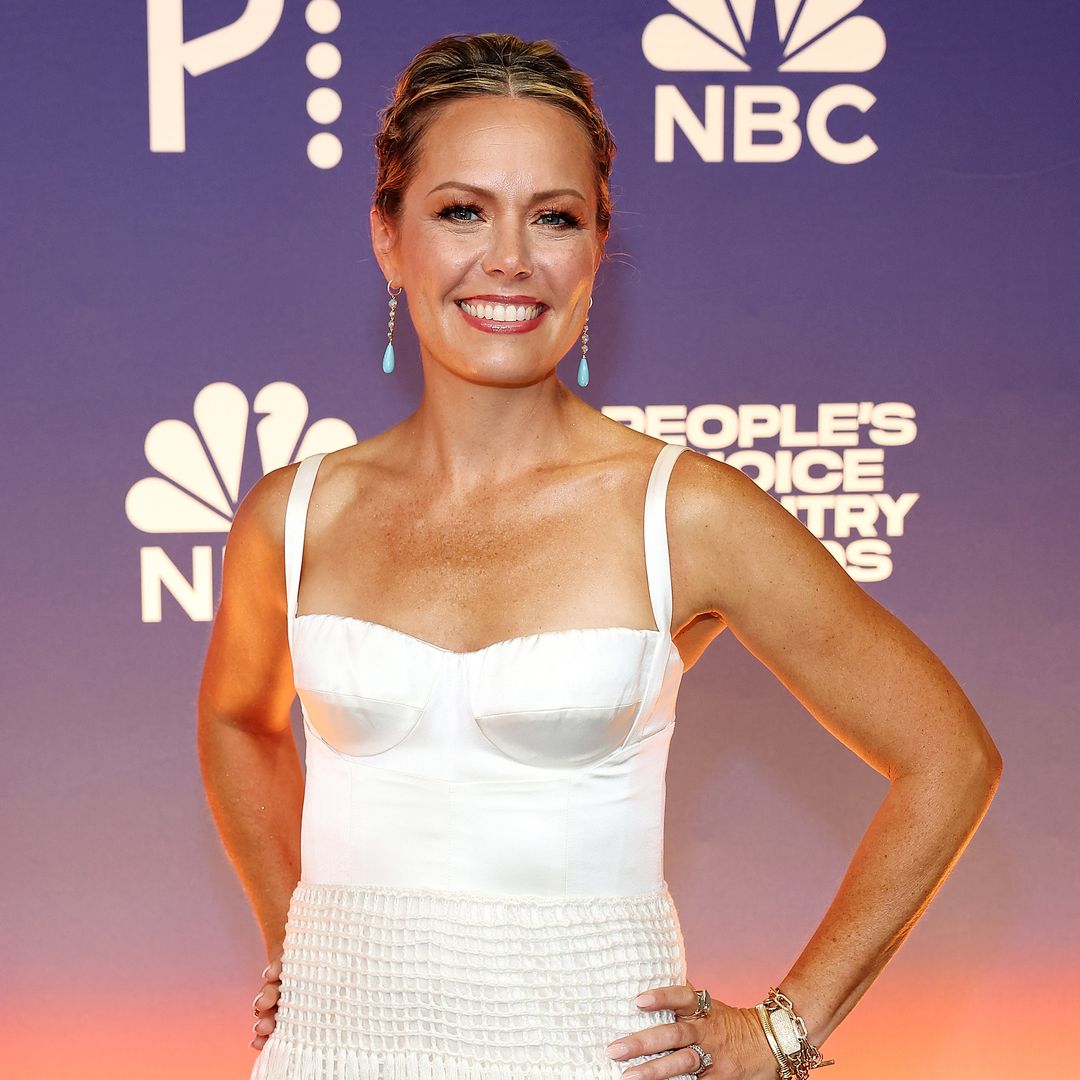

Dylan Dreyers Son Post Surgery Hospital Update From Mom

May 24, 2025

Dylan Dreyers Son Post Surgery Hospital Update From Mom

May 24, 2025 -

Tochniy Goroskop I Predskazaniya Na Mesyats

May 24, 2025

Tochniy Goroskop I Predskazaniya Na Mesyats

May 24, 2025 -

Todays Update Dylan Dreyers Son Post Operation

May 24, 2025

Todays Update Dylan Dreyers Son Post Operation

May 24, 2025 -

Horoscopo Semanal 1 Al 7 De Abril De 2025 Todos Los Signos

May 24, 2025

Horoscopo Semanal 1 Al 7 De Abril De 2025 Todos Los Signos

May 24, 2025 -

Favorable April 14 2025 Horoscopes 5 Zodiac Signs To Watch

May 24, 2025

Favorable April 14 2025 Horoscopes 5 Zodiac Signs To Watch

May 24, 2025