Apple Stock: Long-Term Bullish Despite Price Cut - Wedbush's Perspective

Table of Contents

Recent price adjustments for Apple products haven't dampened the enthusiasm of Wedbush Securities, a prominent investment firm. Their bullish outlook on Apple stock remains strong, projecting significant long-term growth despite short-term market fluctuations. This article delves into Wedbush's analysis and explains why they maintain a positive perspective on Apple stock as a long-term investment, even amidst concerns about the recent Apple price drops.

Wedbush's Rationale for Maintaining a Bullish Apple Stock Outlook

Wedbush's confidence in Apple stock stems from a multifaceted analysis of the company's strengths and future prospects. Their positive Apple stock forecast is grounded in several key factors:

-

Strong Fundamentals: Apple consistently demonstrates robust financial performance. Its revenue generation is remarkably stable, boasting high profit margins year after year. This financial strength is underpinned by an unparalleled level of brand loyalty, a key indicator of long-term sustainability. Analyzing Apple's financial reports reveals a company built for enduring success.

-

Innovation Pipeline: Apple's commitment to innovation is a crucial driver of their bullish outlook. Upcoming product releases, such as the highly anticipated Vision Pro headset, promise to disrupt existing markets and create new revenue streams. Future iPhone iterations and continued expansion of its services ecosystem further solidify Apple's position as a technological leader. These planned innovations represent significant growth opportunities for Apple stock.

-

Services Growth: Apple's services segment is a major contributor to its overall revenue, and this sector continues to experience significant growth. Apple Music, iCloud, Apple TV+, and other subscription services generate recurring revenue, providing a stable and predictable income stream. The continued expansion of this area is key to the long-term health of Apple stock.

-

Global Market Dominance: Apple holds a dominant market share across various tech segments, solidifying its position as a leader in the industry. This established market presence provides a robust foundation for continued growth and resilience. Their influence on the consumer electronics market only further increases their attractiveness as an investment.

-

Resilience to Economic Downturns: Apple has historically demonstrated a remarkable ability to withstand economic slowdowns. This resilience is a testament to the enduring appeal of its brand and the essential nature of many of its products and services. This resilience is a key point in Wedbush's bullish Apple stock forecast.

Addressing the Impact of Recent Apple Product Price Cuts

Recent price reductions for certain Apple products have raised some concerns, but Wedbush believes these adjustments are strategically sound:

-

Competitive Pressure: Price cuts are often a strategic response to competitive pressures. The tech market is fiercely competitive, and price adjustments can be effective in maintaining market share and attracting new customers. This is a normal dynamic in a rapidly developing market.

-

Economic Factors: Inflation and fluctuating consumer spending have undeniably played a significant role. Price adjustments can help to maintain affordability and sales volume in the face of economic uncertainty.

-

Wedbush's Perspective: Wedbush views the price cuts as a short-term adjustment to address current market conditions, not a reflection of long-term weakness. They believe this strategic maneuver will ultimately benefit Apple's market position and long-term growth.

-

Impact on Sales Volume: Wedbush anticipates that the price cuts will stimulate demand and increase sales volume, ultimately offsetting the reduced revenue per unit. This strategy aims to maintain overall growth and profitability.

Long-Term Growth Opportunities for Apple Stock

Apple's future potential is vast, and Wedbush highlights several key avenues for long-term growth:

-

Expansion into New Markets: Untapped markets and demographic groups represent significant opportunities for Apple's expansion. Strategic initiatives to penetrate these markets offer substantial growth potential for Apple stock.

-

Strategic Acquisitions: Future acquisitions could further enhance Apple's product offerings and expand its capabilities, creating new revenue streams and strengthening its position in the market.

-

Technological Advancements: Apple's ongoing investments in cutting-edge technologies such as augmented reality (AR), virtual reality (VR), artificial intelligence (AI), and autonomous vehicles are poised to create new product categories and drive future growth.

-

Sustainability Initiatives: Apple's commitment to environmental sustainability resonates with environmentally conscious consumers and investors, positively impacting its brand image and potentially attracting further investment.

Risks and Considerations for Investing in Apple Stock

While the outlook for Apple stock is generally positive, potential investors should acknowledge certain risks:

-

Geopolitical Factors: International conflicts and trade tensions can impact Apple's global supply chains and sales. These geopolitical factors represent inherent risks for all globally operating companies.

-

Supply Chain Disruptions: Disruptions to Apple's global supply chains can lead to production delays and impact revenue. This risk is ever-present in the globalized electronics industry.

-

Competition from Rivals: Companies like Samsung, Google, and Meta represent significant competitive threats, constantly vying for market share.

-

Market Volatility: Investing in the stock market always involves risk, and Apple stock is not immune to market fluctuations.

Conclusion:

Despite recent price adjustments, Wedbush Securities maintains a strong long-term bullish outlook on Apple stock. Their analysis highlights Apple's fundamental strengths, innovative pipeline, and significant growth opportunities. While inherent risks exist in any investment, the potential for long-term returns from Apple stock appears substantial. If you are considering a long-term investment in the tech sector and are seeking a potentially strong performer, Apple stock warrants serious consideration. However, conduct your own thorough research and consult with a financial advisor before making any investment decisions regarding Apple stock or any other equities.

Featured Posts

-

Karisik Seyir Avrupa Borsalarinin Guen Sonu Degerlendirmesi

May 25, 2025

Karisik Seyir Avrupa Borsalarinin Guen Sonu Degerlendirmesi

May 25, 2025 -

Heavy Showers Spark Flash Flood Warning In South Florida

May 25, 2025

Heavy Showers Spark Flash Flood Warning In South Florida

May 25, 2025 -

Wolff Speaks More Hints On Russells Long Term Future With Mercedes

May 25, 2025

Wolff Speaks More Hints On Russells Long Term Future With Mercedes

May 25, 2025 -

H Nonline Sk Prehlad Prepustani V Nemeckych Spolocnostiach

May 25, 2025

H Nonline Sk Prehlad Prepustani V Nemeckych Spolocnostiach

May 25, 2025 -

Nightcliff Robbery Teenager Arrested In Darwin Shop Owners Death

May 25, 2025

Nightcliff Robbery Teenager Arrested In Darwin Shop Owners Death

May 25, 2025

Latest Posts

-

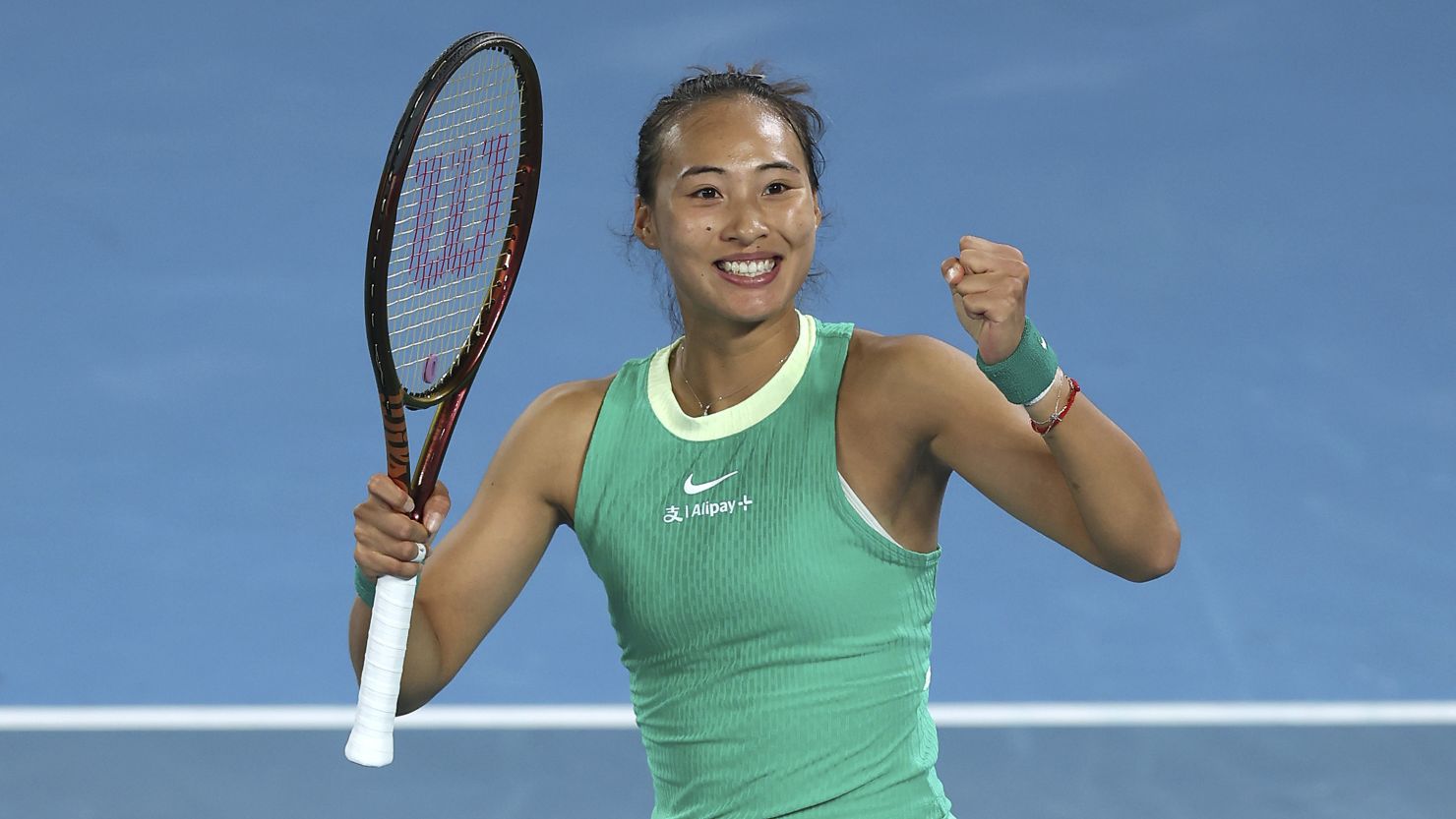

Zheng Qinwens Impressive Italian Open Semifinal Showing

May 25, 2025

Zheng Qinwens Impressive Italian Open Semifinal Showing

May 25, 2025 -

Italian Open 2024 Zheng Qinwens Semifinal Journey

May 25, 2025

Italian Open 2024 Zheng Qinwens Semifinal Journey

May 25, 2025 -

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 25, 2025

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 25, 2025 -

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal

May 25, 2025

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal

May 25, 2025 -

F1 I Mercedes Afinei Ton Verstappen

May 25, 2025

F1 I Mercedes Afinei Ton Verstappen

May 25, 2025