Apple Stock Dip: Key Levels Before Q2 Earnings Report

Table of Contents

Technical Analysis: Identifying Key Support and Resistance Levels

Technical analysis plays a crucial role in predicting stock movements by identifying patterns and trends. By studying charts and graphs, we can pinpoint potential support and resistance levels, offering valuable insights into potential price fluctuations. For AAPL, several key levels are currently in focus.

-

Support level at $160: A break below this significant support level could indicate a continuation of the downward trend and signal further decline. This level has acted as support in the past, and a breach could trigger stop-loss orders, exacerbating the selling pressure.

-

Resistance level at $170: Conversely, a decisive break above the $170 resistance level would suggest a bullish reversal and signal a potential upward trend. This level represents a significant psychological barrier for many traders.

-

Moving averages (50-day, 200-day) analysis: The 50-day and 200-day moving averages provide insights into the short-term and long-term trends. A bullish crossover (50-day crossing above 200-day) would generally be viewed as positive, while a bearish crossover would signal a potential downturn.

-

Relative Strength Index (RSI): The RSI is a momentum indicator that helps assess whether the stock is overbought or oversold. An RSI above 70 typically suggests the stock is overbought, while an RSI below 30 suggests it's oversold. These levels can help identify potential buying or selling opportunities.

Market Sentiment and Investor Expectations

Current market sentiment towards Apple and the broader tech sector is cautiously optimistic, but mixed. While Apple remains a dominant player, concerns exist regarding several factors.

-

Impact of global economic slowdown: A global economic slowdown could negatively impact consumer spending, potentially reducing demand for Apple products, particularly higher-priced items like iPhones and Macs. This is a significant factor influencing investor confidence.

-

Analyst predictions and ratings: Analyst ratings and predictions for Apple stock are a crucial element in shaping market sentiment. A divergence between analyst expectations and actual Q2 results could cause significant price volatility.

-

Influence of social media and news headlines: Social media and news headlines can significantly impact investor psychology. Negative news, even if unsubstantiated, can lead to selling pressure, while positive news can boost investor confidence and drive prices upwards. This highlights the importance of separating fact from speculation.

Potential Catalysts for Apple Stock Movement

Several factors could significantly impact Apple's stock price in the lead-up to and following the Q2 earnings report.

-

Positive Catalysts: Strong Q2 earnings exceeding analyst expectations, successful new product launches (such as new iPhones or Apple Watch models), strategic partnerships, and positive regulatory developments could all boost investor confidence and drive the stock price higher.

-

Negative Catalysts: Weaker-than-expected earnings, intensifying competition, regulatory hurdles, supply chain disruptions, and negative macroeconomic developments could all negatively impact the stock price. Geopolitical uncertainty also poses a risk.

-

Expected Q2 earnings growth and revenue projections: Analysts' estimates for Q2 earnings growth and revenue projections play a crucial role in shaping market expectations. A significant deviation from these estimates could lead to substantial price movements.

Conclusion

This analysis of the Apple stock dip before the Q2 earnings report underscores the importance of incorporating technical analysis, market sentiment, and potential catalysts into your investment decision-making process. We've identified key support and resistance levels for AAPL, along with potential factors that could significantly influence its performance. Understanding these elements is critical for navigating the inherent volatility of the pre-earnings period.

Call to Action: Stay informed about the upcoming Apple Q2 earnings report and continue to monitor these key levels for potential trading opportunities. Understanding the factors influencing the Apple stock dip is essential for making sound investment decisions regarding your Apple stock portfolio. Regularly review market analysis and adjust your strategy accordingly to effectively manage your Apple stock holdings amidst fluctuations.

Featured Posts

-

The Kyle Walker Situation Partying Mystery Women And Annie Kilners Response

May 25, 2025

The Kyle Walker Situation Partying Mystery Women And Annie Kilners Response

May 25, 2025 -

Fujifilm X Half A Refreshing Take On Photography Hands On Impressions

May 25, 2025

Fujifilm X Half A Refreshing Take On Photography Hands On Impressions

May 25, 2025 -

South Floridas Ferrari Challenge A Racing Event Not To Miss

May 25, 2025

South Floridas Ferrari Challenge A Racing Event Not To Miss

May 25, 2025 -

Lewis Hamiltons Comments Condemned As Unfair By Ferrari Boss

May 25, 2025

Lewis Hamiltons Comments Condemned As Unfair By Ferrari Boss

May 25, 2025 -

Guccis New Designer Kering Reports Lower Sales For Q Quarter

May 25, 2025

Guccis New Designer Kering Reports Lower Sales For Q Quarter

May 25, 2025

Latest Posts

-

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025 -

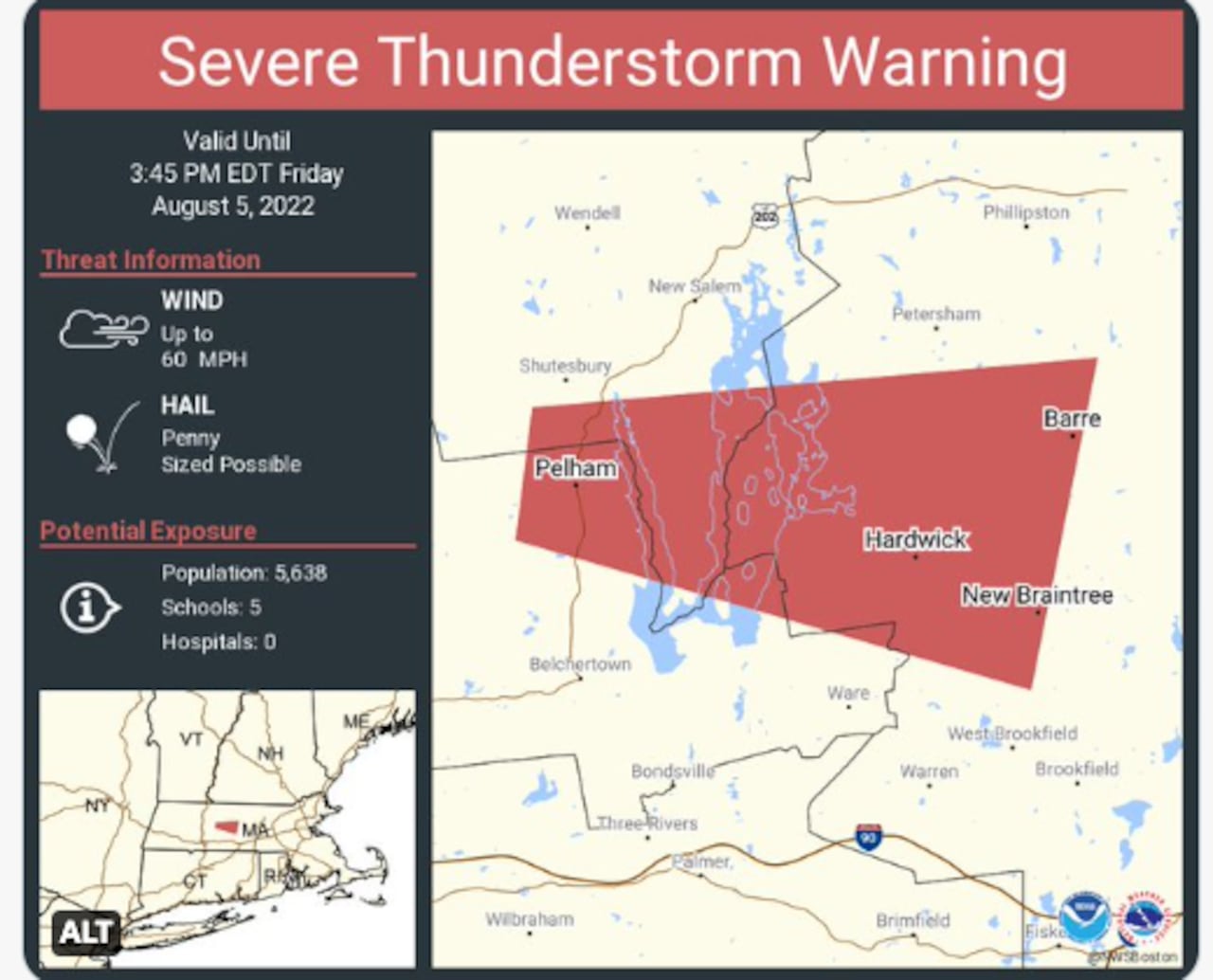

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

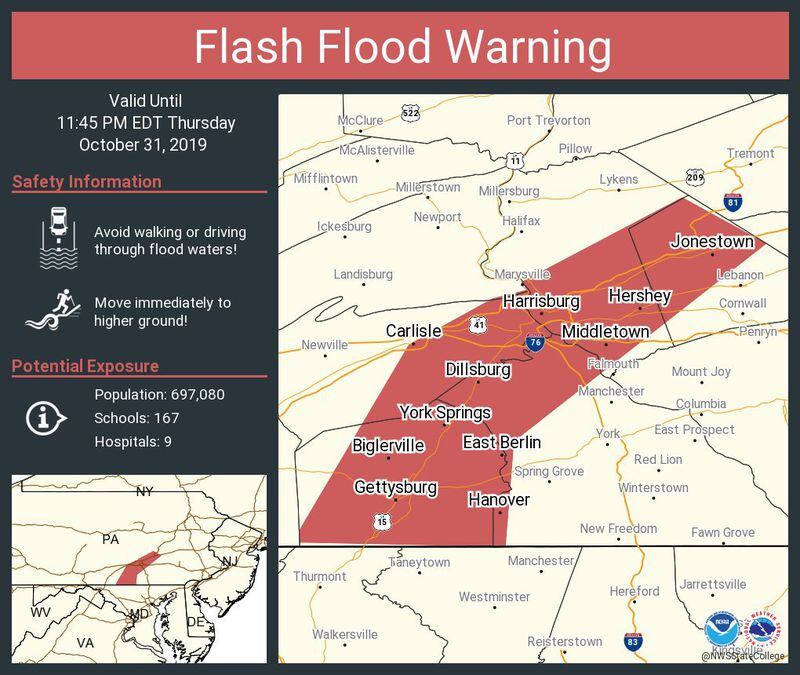

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Pennsylvania Flash Flood Warning Extended To Thursday Morning

May 25, 2025

Pennsylvania Flash Flood Warning Extended To Thursday Morning

May 25, 2025