Apple Stock (AAPL): Where Will The Price Go Next? Key Level Analysis

Table of Contents

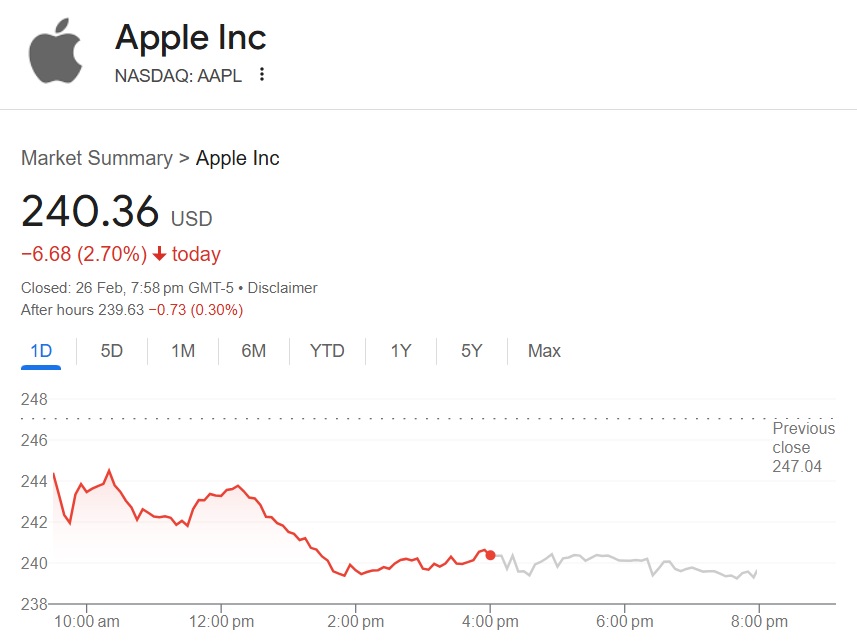

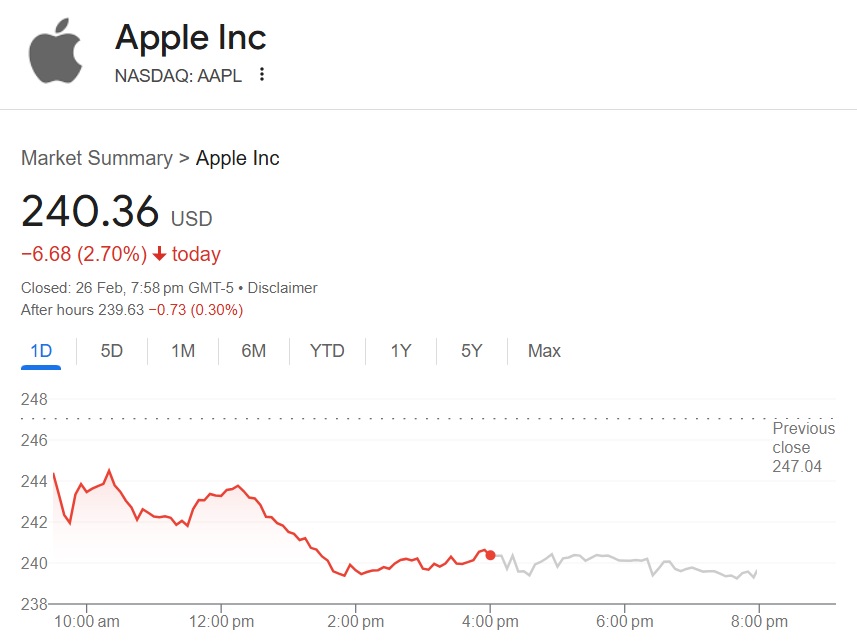

Current Market Conditions and AAPL's Position

The overall market sentiment currently displays a degree of uncertainty, swinging between cautious optimism and bearish concerns depending on the release of economic data and geopolitical events. While some sectors are experiencing growth, others show signs of stagnation. This mixed sentiment significantly impacts the tech sector, which includes Apple.

Recent news impacting Apple's stock price includes the launch of the iPhone 15, generally receiving positive reviews and boosting pre-orders, but also concerns about ongoing supply chain challenges. Furthermore, the latest earnings reports showcased solid revenue growth but also hinted at potential slowing demand in certain product categories. Compared to its competitors, Apple maintains a strong position, but faces increasing pressure from rivals in specific market segments.

- Analysis of recent earnings reports and their impact on AAPL stock: The most recent earnings beat analyst expectations, resulting in a short-term price surge, but the slower than anticipated growth in some segments led to some investor concern.

- Discussion of competitor performance and its influence on AAPL: Strong competition from companies like Samsung in the smartphone market and from other players in the wearables market puts continuous pressure on Apple's market share.

- Overview of macroeconomic factors affecting the tech sector and AAPL: Rising interest rates and potential recessionary fears have led to a sell-off in technology stocks, impacting AAPL's price alongside other tech giants.

Technical Analysis of Key Support and Resistance Levels

Understanding support and resistance levels is crucial for predicting price movements. Support levels represent price points where buying pressure is strong enough to prevent further price declines. Resistance levels are price points where selling pressure prevents further price increases. Identifying these levels allows investors to anticipate potential price reversals or breakouts.

Using technical indicators such as moving averages (e.g., 50-day and 200-day moving averages) and Fibonacci retracements, we can pinpoint key support and resistance levels for AAPL. Currently, significant support levels might lie around $150 and $140, while resistance might be encountered near $170 and $180. A breakout above the resistance levels would signal a bullish trend, while a break below support could indicate a bearish trend.

- Identification of significant support levels (e.g., $150, $140): These levels represent strong historical price floors where buying pressure typically increases.

- Identification of significant resistance levels (e.g., $170, $180): These levels represent price ceilings where selling pressure often becomes dominant.

- Explanation of how these levels are determined using technical indicators: Moving averages smooth out price fluctuations, helping identify trends, while Fibonacci retracements pinpoint potential reversal points based on historical price swings.

Fundamental Analysis of Apple's Business

Apple's financial health remains robust, showcasing high revenue, impressive profit margins, and manageable debt levels. Its diversified revenue streams, spanning iPhones, Macs, wearables, and services, contribute to its financial strength. Future growth prospects are promising, driven by innovation in areas such as augmented reality, artificial intelligence, and the expansion of its services ecosystem. However, Apple faces risks such as intensifying competition, potential supply chain disruptions, and the overall economic climate.

- Analysis of Apple's revenue streams and their growth potential: The services segment demonstrates consistent growth, while the hardware segment is still heavily reliant on iPhone sales. Expansion into new markets and product categories can further fuel growth.

- Discussion of key risks and challenges facing Apple (e.g., competition, supply chain issues): Geopolitical instability and component shortages can impact production and sales. Intense competition in the smartphone and other tech markets poses a continuous threat.

- Evaluation of Apple’s innovation pipeline and its impact on future growth: Apple's investments in R&D and its ability to introduce innovative products will significantly impact its future growth trajectory.

Predicting Future Price Movement for Apple Stock

Combining the technical and fundamental analyses, several price movement scenarios emerge. A bullish scenario suggests a price increase towards the $180 - $200 range, driven by strong earnings, positive investor sentiment, and successful new product launches. A bearish scenario might see a drop towards the $140 - $150 range, triggered by macroeconomic headwinds, increased competition, or disappointing sales figures. A sideways scenario could maintain the price within a range between $150 and $170 until a clearer market trend emerges.

It's crucial to remember that these are potential scenarios, not certainties. Stock market predictions inherently carry significant uncertainty.

- Potential upside targets based on technical and fundamental analysis: Based on technical breakouts and strong fundamentals, the upside potential remains significant.

- Potential downside risks and their impact on AAPL price: Negative economic news, supply chain issues, or disappointing product launches could trigger price drops.

- Probability estimations for different price scenarios: Assigning precise probabilities is challenging, but based on current conditions, a sideways movement might be the most likely short-term scenario.

Conclusion

This analysis of Apple stock (AAPL) has explored current market conditions, key technical levels, and the fundamental strength of Apple's business to provide insights into potential future price movements. While predicting the precise trajectory of AAPL is impossible, understanding key support and resistance levels, coupled with a thorough assessment of Apple's business fundamentals, can help investors make more informed decisions. Remember to always conduct your own thorough research and consider your risk tolerance before investing in Apple stock (AAPL) or any other security. Continue to monitor these key levels and stay updated on Apple news for the best chance at successful AAPL investing. Track the AAPL stock price, conduct further analysis, and adjust your investment strategy accordingly.

Featured Posts

-

Analyzing Elon Musks Anger Implications For Teslas Future

May 25, 2025

Analyzing Elon Musks Anger Implications For Teslas Future

May 25, 2025 -

Fyrsta 100 Rafutgafan Af Porsche Macan Nyr Timi I Rafmagnsbilum

May 25, 2025

Fyrsta 100 Rafutgafan Af Porsche Macan Nyr Timi I Rafmagnsbilum

May 25, 2025 -

Used Porsche Macan Buyers Guide Finding The Perfect Pre Owned Suv

May 25, 2025

Used Porsche Macan Buyers Guide Finding The Perfect Pre Owned Suv

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025

Latest Posts

-

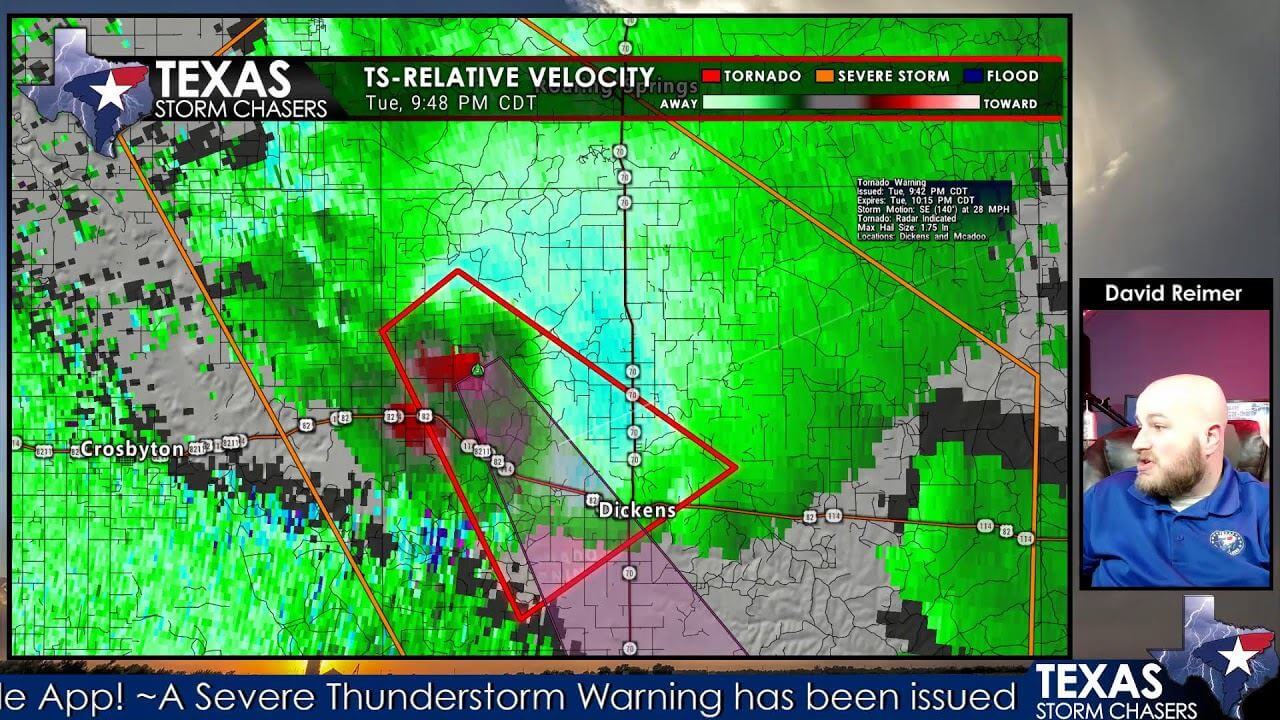

Severe Weather Alert Flash Flood Warning Issued For Parts Of Texas

May 25, 2025

Severe Weather Alert Flash Flood Warning Issued For Parts Of Texas

May 25, 2025 -

Flood Advisories Issued For Miami Valley Due To Severe Storms

May 25, 2025

Flood Advisories Issued For Miami Valley Due To Severe Storms

May 25, 2025 -

Flash Flood Emergency In Texas Severe Weather Prompts Urgent Warnings

May 25, 2025

Flash Flood Emergency In Texas Severe Weather Prompts Urgent Warnings

May 25, 2025 -

Texas Flash Flood Warning Urgent Alert For North Central Region

May 25, 2025

Texas Flash Flood Warning Urgent Alert For North Central Region

May 25, 2025 -

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025