Analyzing XRP (Ripple): Is It A Wise Investment Under $3?

Table of Contents

Understanding Ripple's Technology and Use Cases

What is Ripple (XRP)?

Ripple is not just a cryptocurrency; it's a real-time gross settlement system (RTGS), currency exchange, and remittance network. Unlike Bitcoin, which relies on a decentralized network for transactions, Ripple uses a centralized server network for faster and cheaper transactions. XRP acts as a bridge currency, facilitating seamless cross-border payments between different currencies. Key features include:

- Speed: XRP transactions are significantly faster than many other cryptocurrencies.

- Low Transaction Fees: The cost of sending XRP is generally much lower than traditional banking fees.

- Scalability: The Ripple network is designed to handle a high volume of transactions.

Real-World Applications and Partnerships

Ripple's technology is being adopted by numerous banks and financial institutions globally. Its RippleNet network enables faster, cheaper, and more transparent international payments. Examples include:

- MoneyGram: A major money transfer operator using Ripple's technology for cross-border payments.

- Santander: A leading bank utilizing Ripple for faster and more efficient international transfers.

- Several other banks and financial institutions: Ripple continues to expand its network, hinting at increased XRP adoption and potential for price appreciation. This increased adoption directly impacts XRP price prediction models.

The growing adoption of Ripple's technology underscores its potential for long-term growth and may influence future XRP investment decisions.

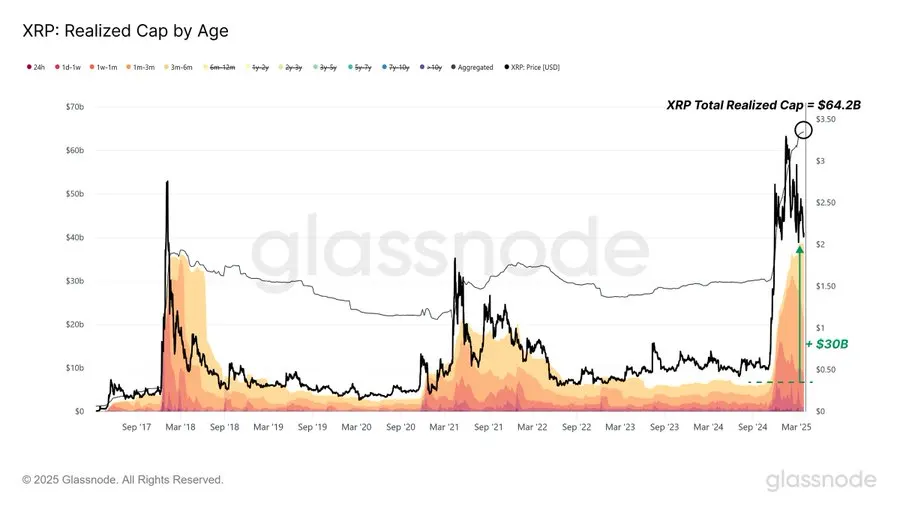

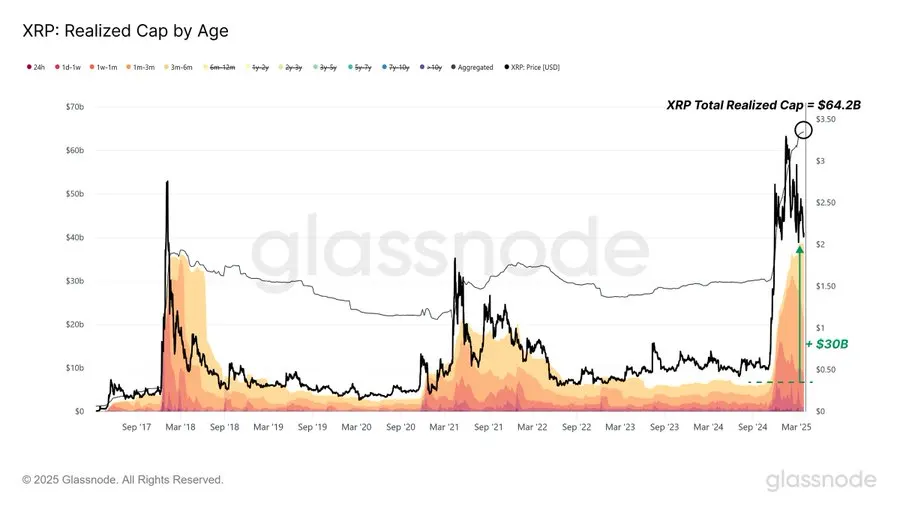

Analyzing XRP's Price Performance and Market Sentiment

Historical Price Analysis

XRP has had a turbulent history. It experienced a meteoric rise in 2017, reaching an all-time high, followed by a significant correction. Price fluctuations have been heavily influenced by:

- Regulatory News: The SEC lawsuit has significantly impacted investor confidence and price.

- Market Trends: Overall cryptocurrency market trends significantly affect XRP's price.

- Adoption Rate: Increased adoption by financial institutions generally leads to price appreciation.

(Include relevant charts and graphs here to visually represent historical price data)

Current Market Sentiment and Predictions

Current market sentiment towards XRP is mixed, largely due to the ongoing SEC lawsuit. While some analysts remain bullish, citing the technology's potential and growing adoption, others are more cautious, highlighting the uncertainty surrounding the legal battle. Price predictions vary wildly, with some predicting significant growth while others forecast continued stagnation or even decline. The SEC lawsuit's outcome will heavily influence future XRP price prediction accuracy.

Assessing the Risks and Rewards of Investing in XRP Under $3

Potential Risks

Investing in XRP, or any cryptocurrency, carries significant risks:

- Market Volatility: The cryptocurrency market is inherently volatile, and XRP's price can fluctuate dramatically in short periods.

- Regulatory Uncertainty: The SEC lawsuit creates uncertainty about XRP's future regulatory status.

- Competition: XRP faces competition from other cryptocurrencies and payment technologies.

Potential Rewards

Despite the risks, investing in XRP under $3 could offer substantial rewards:

- Price Appreciation: If XRP gains wider adoption and the SEC lawsuit is resolved favorably, its price could increase significantly.

- Long-Term Growth Potential: The long-term growth potential of the cryptocurrency market is substantial, and XRP could benefit from this trend.

- Increased Adoption: Further adoption by financial institutions could drive higher demand and price appreciation.

Strategies for Investing in XRP Responsibly

Diversification and Risk Management

It's crucial to diversify your investment portfolio and not invest more than you can afford to lose. Consider strategies like dollar-cost averaging (DCA) to mitigate risk. Thorough research is paramount before making any XRP investment.

Secure Storage and Exchange Selection

Securely store your XRP using a hardware wallet or a reputable cryptocurrency exchange. Choose an exchange with robust security measures and a good reputation. Understand transaction fees and security protocols before making transactions.

Conclusion

Investing in XRP under $3 presents a complex scenario. While the technology has potential and adoption is growing, the ongoing SEC lawsuit and inherent cryptocurrency market volatility create significant risks. A balanced perspective is vital; weighing the potential rewards against the substantial risks is crucial before making any investment decisions.

Final Verdict: Whether or not investing in XRP at its current price is "wise" depends entirely on your individual risk tolerance, investment goals, and thorough understanding of the market.

Call to Action: Make informed decisions about your XRP investment by conducting thorough research and considering your individual risk tolerance. Understand the technology behind Ripple, the current market conditions, and the implications of the ongoing legal battle before committing any capital.

Featured Posts

-

Investing In Mental Health A Strategic Approach To Productivity Enhancement

May 02, 2025

Investing In Mental Health A Strategic Approach To Productivity Enhancement

May 02, 2025 -

Train Engine Failure Halts Warri Itakpe Rail Services Nrc Announcement

May 02, 2025

Train Engine Failure Halts Warri Itakpe Rail Services Nrc Announcement

May 02, 2025 -

Ghanas Mental Healthcare System 80 Psychiatrists For 30 Million People A Deep Dive

May 02, 2025

Ghanas Mental Healthcare System 80 Psychiatrists For 30 Million People A Deep Dive

May 02, 2025 -

Warri Itakpe Train Service Resumes Nrc Announcement

May 02, 2025

Warri Itakpe Train Service Resumes Nrc Announcement

May 02, 2025 -

Improved Gameplay Awaits Sonys New Play Station Beta Program

May 02, 2025

Improved Gameplay Awaits Sonys New Play Station Beta Program

May 02, 2025

Latest Posts

-

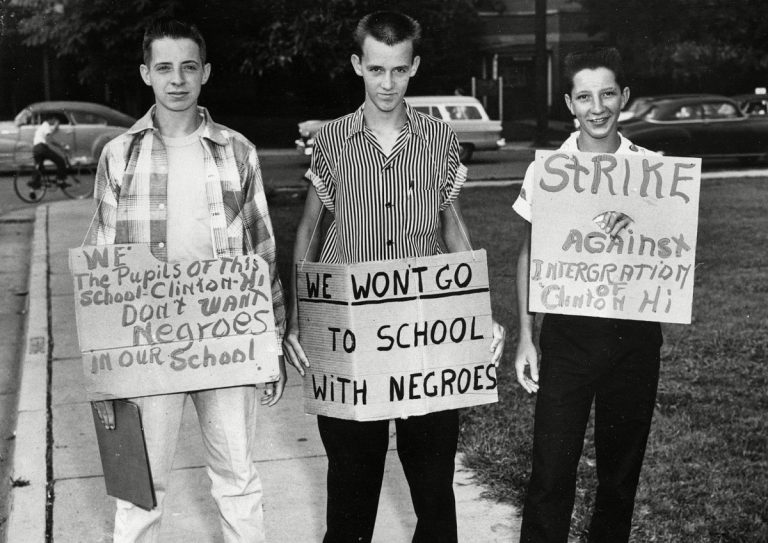

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025 -

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025 -

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025 -

End Of School Desegregation Order Implications For Other Districts

May 02, 2025

End Of School Desegregation Order Implications For Other Districts

May 02, 2025