Analyzing XRP (Ripple) Investment Potential Below $3

Table of Contents

With XRP trading below $3, many investors are questioning its potential. Is this a buying opportunity or a sign of further decline? This article will delve into the complex question of XRP (Ripple) investment potential below $3, analyzing the factors that could influence its future price. Our aim is to provide a balanced assessment of the risks and rewards associated with investing in XRP at this price point, enabling you to make more informed decisions. This article will explore the factors influencing XRP's price, assessing its risks and rewards for potential investors at this price point.

Understanding the Current Market Sentiment Towards XRP

Recent News and Events Impacting XRP Price

Recent news significantly impacts XRP's price. Understanding this sentiment is crucial for assessing its investment potential below $3.

- Positive News: Successful implementations of Ripple's On-Demand Liquidity (ODL) solution by various financial institutions show growing adoption of XRP in cross-border payments. Positive developments in the ongoing SEC lawsuit could also significantly boost investor confidence. Announcements of new partnerships and technological advancements often lead to price increases.

- Negative News: The ongoing SEC lawsuit against Ripple continues to create uncertainty and volatility. Negative media coverage or setbacks in the legal battle can negatively affect XRP's price. Concerns about regulatory uncertainty in the broader cryptocurrency market also impact investor sentiment. Keywords: SEC lawsuit, Ripple legal battle, ODL adoption, XRP price prediction, Ripple news.

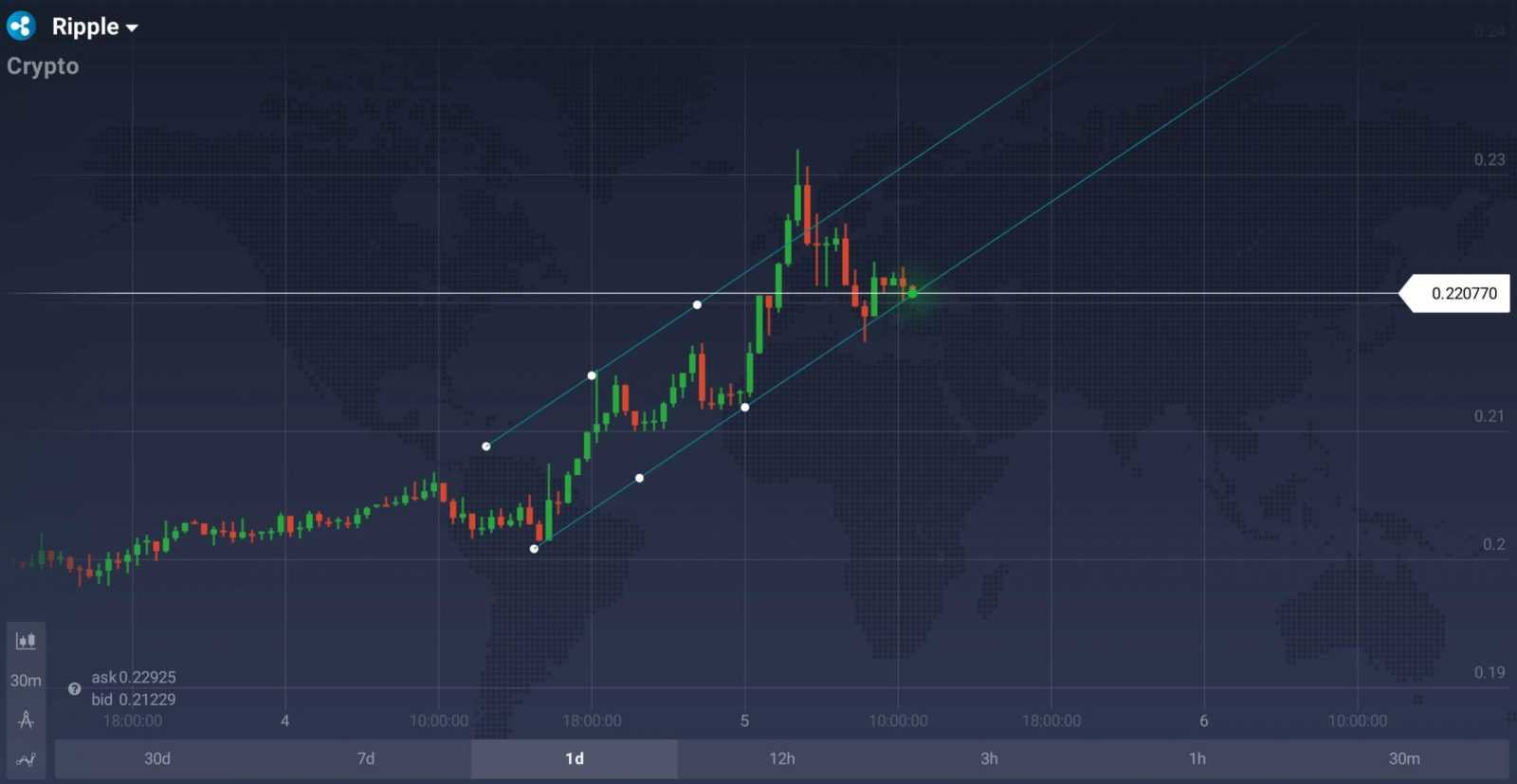

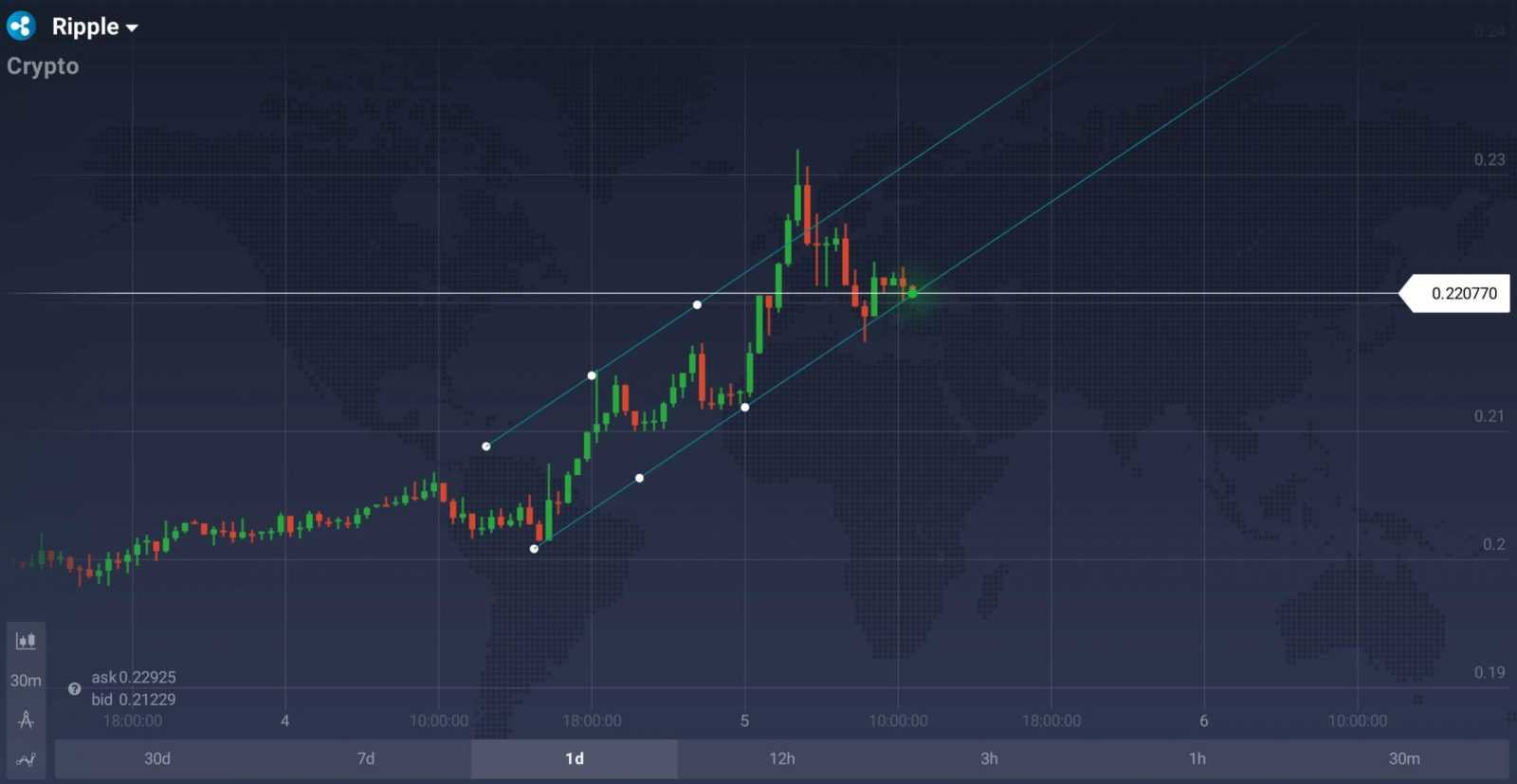

Analyzing Trading Volume and Market Capitalization

Analyzing XRP's trading volume and market capitalization provides insights into investor interest and potential price movements. High trading volume often indicates strong investor interest and potential for significant price changes. Conversely, low volume may suggest a lack of momentum. A significant increase in market capitalization could suggest growing investor confidence. Analyzing these metrics in conjunction with price charts gives a more comprehensive understanding of the current market sentiment towards XRP. Keywords: XRP trading volume, market capitalization, liquidity, XRP chart analysis.

Evaluating the Fundamental Value of XRP

Ripple's Technology and Use Cases

XRP's technology and its use cases are vital in determining its long-term value. Ripple's technology facilitates faster and cheaper cross-border payments through its products like xRapid and xCurrent. Its integration with RippleNet, a global network of financial institutions, further expands its reach and utility.

- Advantages: Speed, low transaction costs, scalability, and integration with existing financial infrastructure are key advantages.

- Disadvantages: Dependence on Ripple's success and the ongoing legal battles remain significant risks. Keywords: xRapid, xCurrent, cross-border payments, blockchain technology, RippleNet.

Assessing Ripple's Partnerships and Adoption Rate

Ripple's partnerships with financial institutions are critical for the widespread adoption of XRP. The more institutions that integrate XRP into their payment systems, the higher the demand and potential for price appreciation. Monitoring the adoption rate helps assess the real-world utility of XRP and its potential for future growth. Key partnerships and their impact on XRP's price and adoption should be meticulously researched. Keywords: institutional adoption, financial partnerships, RippleNet, XRP adoption rate.

Assessing the Risks Associated with Investing in XRP Below $3

Regulatory Uncertainty and Legal Risks

The SEC lawsuit against Ripple presents a significant risk. The outcome could significantly impact XRP's price and future. A negative ruling could lead to a substantial price drop, while a positive outcome could potentially boost its value. Understanding the potential outcomes and their implications is crucial for any investor. Keywords: SEC lawsuit outcome, regulatory risk, legal uncertainty, Ripple lawsuit implications.

Market Volatility and Price Fluctuations

XRP's price has historically been highly volatile. Investing in such a volatile asset carries significant risk. Sharp price swings can occur due to various factors, including news events, market sentiment, and regulatory changes. A thorough understanding of this volatility and its potential impact on your investment is essential. Keywords: XRP price volatility, cryptocurrency risk, market risk, XRP price swings.

Conclusion: Making Informed Decisions on XRP Investment Potential Below $3

This analysis explored the various factors influencing the XRP (Ripple) investment potential below $3. While the potential for growth exists, given its technological advantages and growing adoption, significant risks remain, primarily due to regulatory uncertainty and inherent market volatility. The ongoing SEC lawsuit casts a long shadow, impacting investor sentiment and price stability.

Therefore, before investing in XRP at this price point, conduct thorough research and carefully consider the risks involved. Understanding the XRP (Ripple) investment potential below $3 requires a comprehensive evaluation of market trends, technological advancements, and regulatory factors. Remember, this analysis is for informational purposes only and does not constitute financial advice. Your investment decisions should always align with your risk tolerance and overall investment strategy.

Featured Posts

-

Ghanas Mental Health Crisis A Critical Shortage Of Psychiatrists

May 02, 2025

Ghanas Mental Health Crisis A Critical Shortage Of Psychiatrists

May 02, 2025 -

Weather Related Delays Friday School Schedule And Trash Pickup Information

May 02, 2025

Weather Related Delays Friday School Schedule And Trash Pickup Information

May 02, 2025 -

Recent Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025

Recent Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025 -

Play Station Network Nedir Ve Nasil Giris Yapilir

May 02, 2025

Play Station Network Nedir Ve Nasil Giris Yapilir

May 02, 2025 -

Fortnite Update 34 40 Server Status And Downtime

May 02, 2025

Fortnite Update 34 40 Server Status And Downtime

May 02, 2025

Latest Posts

-

Bbc Budget Cuts A 1bn Revenue Drop And The Unprecedented Challenges

May 02, 2025

Bbc Budget Cuts A 1bn Revenue Drop And The Unprecedented Challenges

May 02, 2025 -

Catch James B Partridge Live In Stroud And Cheltenham

May 02, 2025

Catch James B Partridge Live In Stroud And Cheltenham

May 02, 2025 -

Unprecedented Crisis Bbcs 1bn Revenue Drop And Its Consequences

May 02, 2025

Unprecedented Crisis Bbcs 1bn Revenue Drop And Its Consequences

May 02, 2025 -

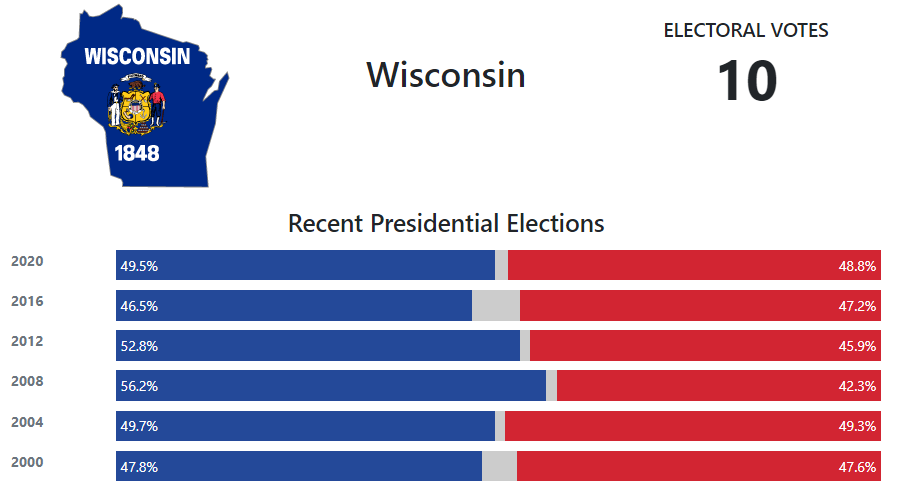

Florida And Wisconsin Turnout A Window Into The Current Political Landscape

May 02, 2025

Florida And Wisconsin Turnout A Window Into The Current Political Landscape

May 02, 2025 -

The Untold Story Why Nick Robinson And Emma Barnett No Longer Co Host On Radio 4

May 02, 2025

The Untold Story Why Nick Robinson And Emma Barnett No Longer Co Host On Radio 4

May 02, 2025