Analyzing Warren Buffett's Successes And Failures: Investing Strategies Revealed

Table of Contents

Warren Buffett's Core Investing Principles

Buffett's remarkable success isn't based on luck; it's built on a bedrock of core principles. These principles, consistently applied over decades, form the foundation of his legendary investment strategy.

Value Investing

At the heart of Warren Buffett's investment philosophy lies value investing. This strategy focuses on identifying companies trading below their intrinsic value – their true worth based on their assets, earnings, and future potential. Buffett emphasizes a significant margin of safety, purchasing assets at a price substantially below his estimated intrinsic value to mitigate potential losses. This approach necessitates a long-term investment perspective, allowing time for the company's intrinsic value to appreciate and for the market to recognize its true worth.

- Intrinsic Value: Focuses on the underlying worth of a company, not its current market price.

- Margin of Safety: Buying assets significantly below their estimated intrinsic value.

- Long-Term Perspective: Holding investments for extended periods, weathering market fluctuations.

- Competitive Advantage (Moats): Identifying companies with sustainable competitive advantages, like strong brands or unique technologies, that protect their profitability. Berkshire Hathaway's acquisitions, such as Coca-Cola and Geico, perfectly exemplify this strategy.

Long-Term Perspective

Buffett famously avoids short-term market speculation. His long-term investing approach prioritizes patience and avoids the emotional rollercoaster of frequent trading. He believes in the power of compounding, letting his investments grow exponentially over time. This buy and hold strategy requires discipline and a resistance to panic selling during market downturns.

- Patience: The willingness to wait for the market to recognize the value of an investment.

- Compounding: The snowball effect of earning returns on previously earned returns, accelerating wealth accumulation.

- Avoiding Panic Selling: Resisting the urge to sell during market corrections or crashes.

- Long-Term Holdings: Buffett's portfolio includes companies he's held for decades, showcasing the power of this approach.

Understanding Business Fundamentals

Buffett doesn't rely on complex financial models; his success stems from a deep understanding of fundamental analysis. He meticulously examines a company's business model, management team, and financial health before investing. This due diligence process ensures he understands the underlying drivers of a company's profitability. He looks for companies with predictable earnings, stable cash flows, and a clear path to future growth.

- Fundamental Analysis: Thorough examination of a company's financial statements, business model, and competitive landscape.

- Due Diligence: The comprehensive research and investigation process used to assess an investment opportunity.

- Financial Statements: Careful review of balance sheets, income statements, and cash flow statements to assess a company's financial health.

- Management Quality: Assessing the competence, integrity, and long-term vision of a company's management team.

- Predictable Earnings: Focusing on companies with consistent and reliable earnings streams.

Notable Successes of Warren Buffett's Investing Strategies

Buffett's investing prowess is best demonstrated by the phenomenal growth of Berkshire Hathaway under his leadership. This success story is a testament to the power of his core principles.

Berkshire Hathaway's Growth

Berkshire Hathaway's expansion is a remarkable testament to Buffett's investing genius. Strategic acquisitions and astute investment choices have fueled its extraordinary growth.

- Successful Investments: Coca-Cola, American Express, and Geico represent iconic examples of long-term, high-return investments driven by a deep understanding of the underlying businesses.

- Acquisition Strategy: Buffett's focus on acquiring well-managed companies with strong competitive advantages has been instrumental in Berkshire Hathaway's success.

- Portfolio Diversification: While focusing on long-term holdings, diversification across various sectors minimizes risk.

Consistent Outperformance

Buffett's consistent market outperformance over decades isn't just a matter of chance; it's a direct result of his disciplined approach.

- Long-Term Returns: His long-term investment strategy has generated significantly higher returns than most market benchmarks.

- Investment Performance: A consistent track record of exceeding market averages highlights the effectiveness of his strategies.

Analyzing Warren Buffett's Notable Failures and Lessons Learned

Even the Oracle of Omaha has experienced setbacks. Analyzing his mistakes provides valuable insights for all investors.

Investment Mistakes

Buffett hasn't been infallible. While rare, he's acknowledged certain investments that underperformed. These instances highlight the inherent risks in investing and the importance of continuous learning.

- Investment Mistakes: Analyzing specific instances where his investments failed to meet expectations helps identify potential pitfalls to avoid.

- Lessons Learned: Each setback has contributed to his refined investment approach, emphasizing the importance of adaptability.

- Risk Management: Even the best investors experience losses; the key is to minimize risk through rigorous due diligence and a diversified portfolio.

Adaptability and Evolution

Buffett's success isn't solely defined by adherence to rigid rules; it includes adapting to the changing investment landscape. He has shown a remarkable ability to evolve his strategies in response to market shifts and technological advancements.

- Adaptability: Buffett has adjusted his investment strategies over time to reflect evolving market conditions.

- Market Changes: He acknowledges that the investment world constantly changes, and adaptability is crucial for long-term success.

- Evolution of Investing Strategies: His investment approach continues to refine itself over time, adapting to new challenges and opportunities.

Conclusion

Mastering Warren Buffett's investing strategies is not about replicating every decision; it's about embracing his core principles. This article has highlighted the significance of value investing, a long-term perspective, and thorough due diligence. By studying both his successes and failures, we can gain invaluable insights into building a robust and enduring investment portfolio. Unlock the secrets of Warren Buffett's success and implement his investing principles to embark on your journey towards long-term wealth creation. Learn from the Oracle of Omaha and build a portfolio that stands the test of time.

Featured Posts

-

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

May 06, 2025

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

May 06, 2025 -

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025 -

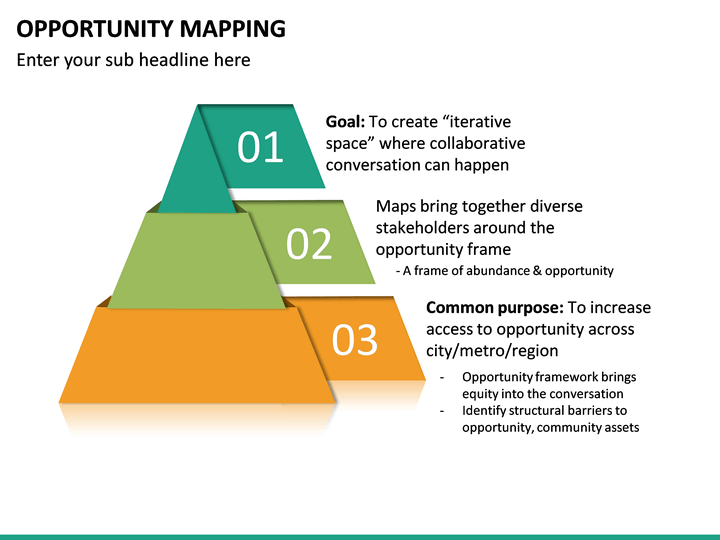

Growth Opportunities Mapping The Countrys Rising Business Centers

May 06, 2025

Growth Opportunities Mapping The Countrys Rising Business Centers

May 06, 2025 -

Russias Putin Avoiding Nuclear Weapons In Ukraine

May 06, 2025

Russias Putin Avoiding Nuclear Weapons In Ukraine

May 06, 2025 -

The Dynamics Of Trump Meetings Keys To Success And Failure

May 06, 2025

The Dynamics Of Trump Meetings Keys To Success And Failure

May 06, 2025

Latest Posts

-

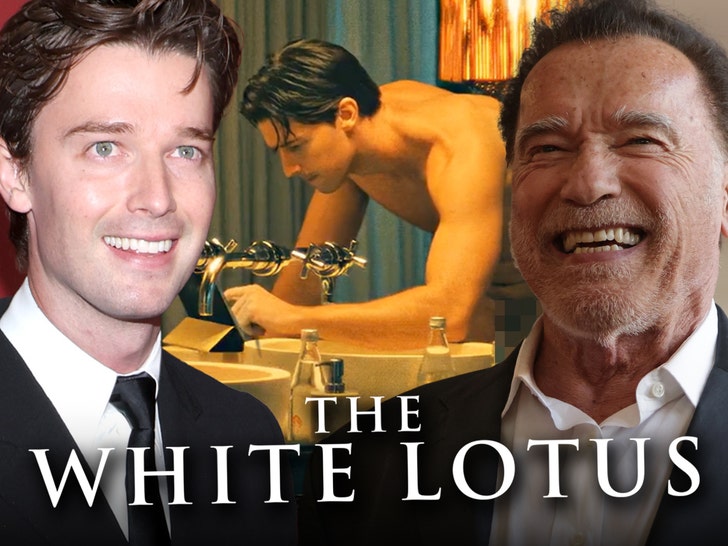

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025 -

Patrick Schwarzeneggers Nudity Arnold Schwarzenegger Weighs In

May 06, 2025

Patrick Schwarzeneggers Nudity Arnold Schwarzenegger Weighs In

May 06, 2025 -

Joseph Baena Arnold Schwarzenegger Bueszke Fianak Utja A Sikerhez

May 06, 2025

Joseph Baena Arnold Schwarzenegger Bueszke Fianak Utja A Sikerhez

May 06, 2025 -

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025

Arnold Schwarzenegger Bueszkeseg Es Oeroem A Fiaval Kapcsolatban

May 06, 2025 -

Shvartsenegger I Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Fotosessiya Dlya Kim Kardashyan

May 06, 2025