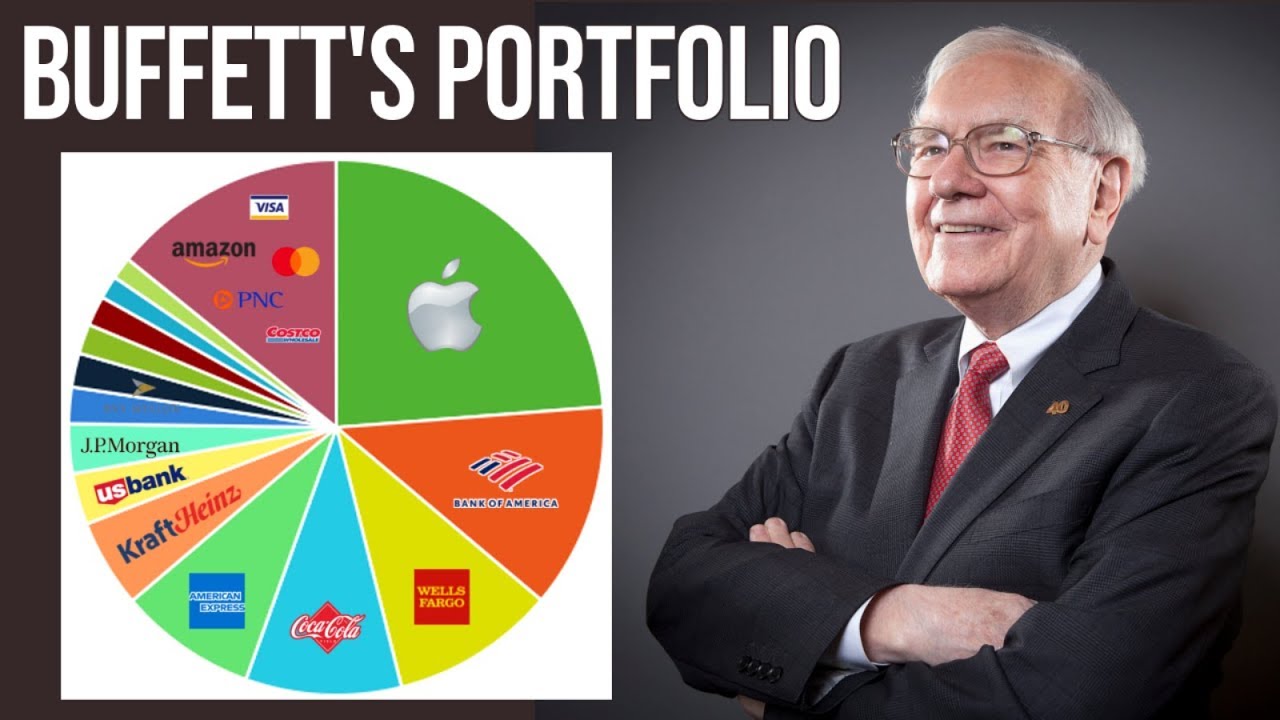

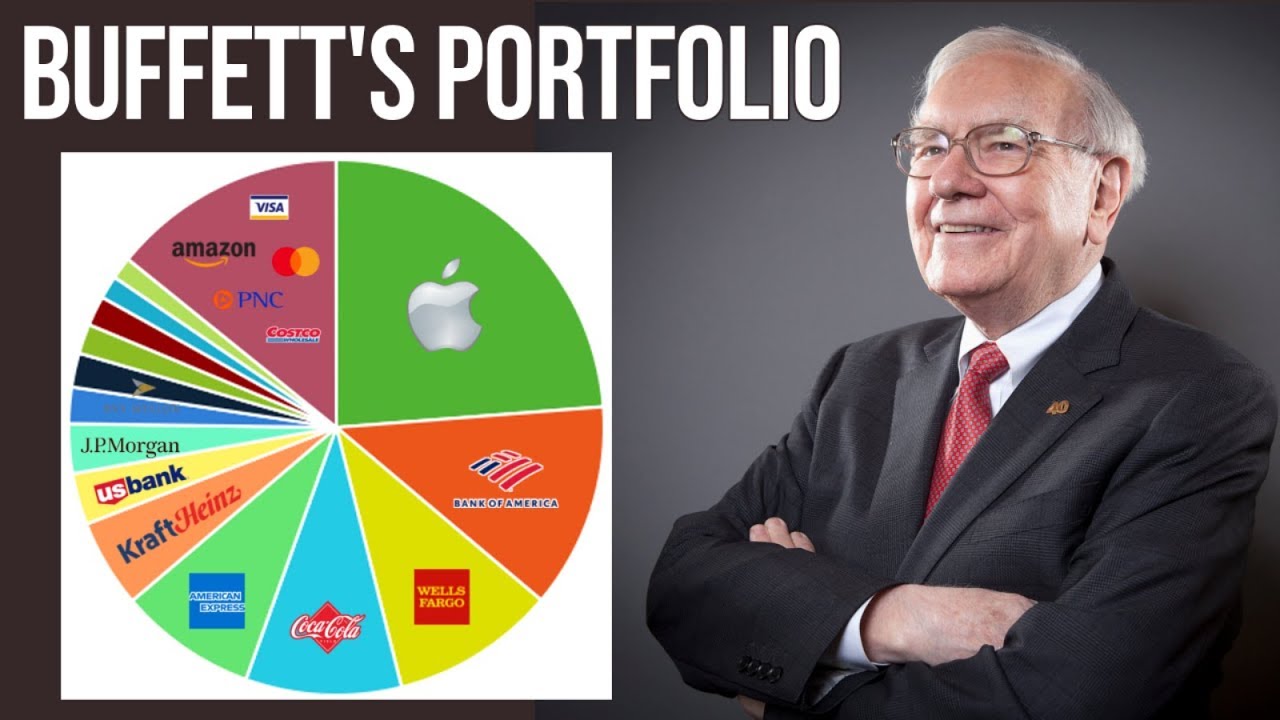

Analyzing Warren Buffett's Apple Investment: Insights For Smart Investing

Table of Contents

The Rationale Behind Buffett's Apple Investment

Buffett's Apple investment represents a fascinating case study, potentially signaling a shift in his traditional value investing approach. This shift highlights the evolving investment landscape and the growing prominence of strong consumer brands within the tech sector.

Shifting Investment Landscape

The technology sector, with its rapid innovation and disruptive potential, has become increasingly important in modern portfolios. While Buffett traditionally focused on established companies with predictable earnings, Warren Buffett's Apple investment reflects an acknowledgment of the powerful long-term growth potential within the tech industry, driven by consumer preference and market dominance.

- Apple's strong brand loyalty and recurring revenue streams from services: Apple boasts an incredibly loyal customer base, ensuring a predictable revenue stream from its expansive ecosystem of products and services, including iCloud, Apple Music, and the App Store. This recurring revenue mitigates some of the risks associated with hardware sales alone.

- Apple's massive cash reserves and strong financial position: Apple's robust financial health provides a safety net, allowing the company to navigate economic downturns and invest in future growth opportunities. This financial stability was undoubtedly attractive to Buffett's value-oriented approach.

- The potential for long-term growth in the tech sector: The global tech market is continuously expanding, presenting substantial opportunities for growth and innovation. Apple's positioning at the forefront of this growth was a key attraction for Buffett.

This combination of factors, while perhaps not entirely fitting his traditional criteria, likely appealed to Buffett's long-term vision and risk-averse investment philosophy. The stability and future growth potential outweighed the less-traditional characteristics for the Oracle of Omaha.

Analyzing Apple's Intrinsic Value from Buffett's Perspective

How did Buffett assess Apple's intrinsic value? It's likely that he looked beyond traditional metrics like Price-to-Earnings (P/E) ratio. Understanding Warren Buffett's Apple investment requires appreciating his emphasis on qualitative factors.

Beyond Traditional Metrics

Buffett's valuation likely incorporated intangible assets that are often overlooked in traditional financial analysis. This approach to assessing Warren Buffett's Apple investment is a key takeaway for individual investors.

- The importance of intangible assets (brand, ecosystem) in Apple's valuation: Apple's brand recognition and its powerful ecosystem are invaluable assets, contributing significantly to its long-term value and earning power. This intangible value is difficult to quantify but profoundly impacts the company's success.

- Long-term growth prospects and future market dominance: Buffett likely focused on Apple's potential for continued growth and its position as a market leader in several key technology segments.

- The role of consumer behavior and market trends: Understanding consumer behavior and anticipating future market trends are crucial for long-term investment success. Apple’s understanding and adaptation to consumer trends certainly played a role in Buffett's decision.

By considering these qualitative factors, Buffett likely arrived at a more comprehensive understanding of Apple's intrinsic value, extending beyond the limitations of traditional financial ratios.

Lessons for Smart Investors from Buffett's Apple Strategy

Warren Buffett's Apple investment exemplifies the importance of adaptability and diversification in investing. Even legendary investors evolve their strategies to align with changing market conditions.

Diversification and Adaptability

The key takeaway from analyzing Warren Buffett's Apple investment is the importance of remaining adaptable to market changes.

- The value of diversifying across asset classes and sectors: Diversification reduces risk by spreading investments across various sectors and asset classes, mitigating the impact of losses in any single area.

- The importance of thorough due diligence and understanding a company's long-term potential: Before investing, conducting thorough research and understanding a company's long-term prospects is vital. This is true whether the investment is in a traditional value stock or a tech giant.

- Recognizing the potential for growth in seemingly unconventional sectors: Don't be afraid to explore opportunities outside your usual investment comfort zone. Thorough due diligence is essential, but a willingness to consider new sectors can lead to significant returns.

Investors can benefit from this lesson by regularly reviewing their portfolios, considering diversification strategies, and staying informed about industry trends.

Potential Risks and Considerations of Buffett's Apple Investment

While Warren Buffett's Apple investment has proven successful thus far, it's crucial to acknowledge inherent risks.

Market Volatility and Technological Disruption

The tech sector is susceptible to market volatility and rapid technological disruption.

- The impact of economic downturns on consumer spending: During economic downturns, consumers might postpone purchasing discretionary items like smartphones and other Apple products.

- The risk of emerging competitors and technological advancements: Apple faces continuous competition from other tech companies that might introduce disruptive technologies, impacting Apple's market share.

- The challenges of maintaining market dominance in a rapidly evolving industry: The tech industry is dynamic, and maintaining market dominance requires continuous innovation and adaptation.

Understanding and mitigating these risks through diversification and a long-term perspective is key to successful investing.

Conclusion

Analyzing Warren Buffett's Apple investment reveals that even legendary investors adapt and embrace change. The rationale behind this investment highlights the importance of considering intangible assets, long-term growth potential, and market trends alongside traditional financial metrics. The key lessons learned emphasize the value of diversification, thorough due diligence, and adaptability in a dynamic market. While risks exist, understanding these risks allows for more informed and successful investment strategies. Learn from Warren Buffett's Apple investment and make smarter investment choices today! Start analyzing your portfolio and incorporating these insights into your investment strategy for long-term success.

Featured Posts

-

Analyzing Westpacs Wbc Reduced Profits A Look At Market Pressures

May 06, 2025

Analyzing Westpacs Wbc Reduced Profits A Look At Market Pressures

May 06, 2025 -

Sam Altman Vs Elon Musk The Race To Build The Ultimate Everything App

May 06, 2025

Sam Altman Vs Elon Musk The Race To Build The Ultimate Everything App

May 06, 2025 -

Government Seeks To Dismantle Googles Dominance In Online Advertising

May 06, 2025

Government Seeks To Dismantle Googles Dominance In Online Advertising

May 06, 2025 -

Celebrating Independence Day Traditions History And Festivities

May 06, 2025

Celebrating Independence Day Traditions History And Festivities

May 06, 2025 -

Sheins London Ipo Delayed Due To Us Tariffs

May 06, 2025

Sheins London Ipo Delayed Due To Us Tariffs

May 06, 2025

Latest Posts

-

Priyanka Chopras Heartfelt Birthday Message To Mannara Chopra Showcases Their Sisterly Love

May 06, 2025

Priyanka Chopras Heartfelt Birthday Message To Mannara Chopra Showcases Their Sisterly Love

May 06, 2025 -

Priyanka Chopras Birthday Post For Sister Mannara Chopra A Celebration Of Unbreakable Bonds

May 06, 2025

Priyanka Chopras Birthday Post For Sister Mannara Chopra A Celebration Of Unbreakable Bonds

May 06, 2025 -

2000

May 06, 2025

2000

May 06, 2025 -

Priyanka Chopras Mother Reveals Refusal To Wear Two Piece At Miss World

May 06, 2025

Priyanka Chopras Mother Reveals Refusal To Wear Two Piece At Miss World

May 06, 2025 -

The Truth About Priyanka Chopras Nose Surgery And Her Fathers Reaction

May 06, 2025

The Truth About Priyanka Chopras Nose Surgery And Her Fathers Reaction

May 06, 2025