Analyzing Uber Stock's Performance During Economic Slowdowns

Table of Contents

Historical Performance of Uber Stock During Past Recessions

The 2008 Financial Crisis and Uber's Pre-IPO Performance:

The 2008 financial crisis occurred before Uber's initial public offering (IPO). However, it’s crucial to analyze the broader economic context of its early years. The rise of ride-sharing services, including Uber, was partly fueled by a need for more affordable transportation options, possibly exacerbated by the 2008 recession's impact on public transportation budgets and employment. While Uber itself wasn't publicly traded, the economic climate undoubtedly shaped its initial growth trajectory and fundraising strategies.

- Funding secured during the crisis: Despite the challenging environment, Uber managed to secure significant funding rounds, demonstrating investor confidence in its long-term potential even amidst economic turmoil.

- Impact on ridership: While precise data is unavailable, it's plausible to assume that ridership might have been impacted, possibly reflecting changes in consumer spending habits and employment levels.

- Strategic shifts in response to the economic climate: The 2008 crisis may have prompted Uber to focus on cost efficiency and strategic partnerships to navigate the uncertain economic landscape.

The COVID-19 Pandemic and its Impact on Uber's Stock:

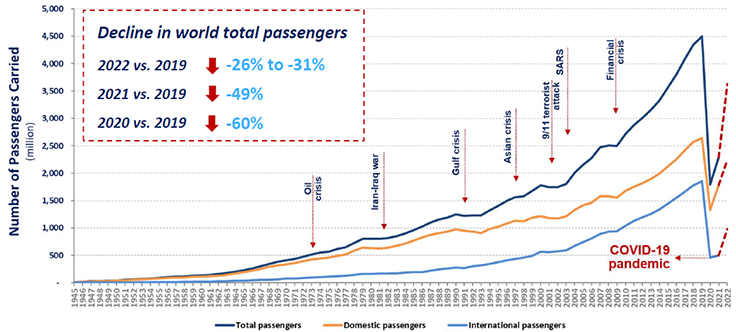

The COVID-19 pandemic presented an unprecedented challenge, triggering a global recession and dramatically impacting Uber's stock price. The initial lockdown measures caused a sharp decline in ride-hailing demand, but the company successfully pivoted to its food delivery (Uber Eats) service, mitigating some of the negative impact.

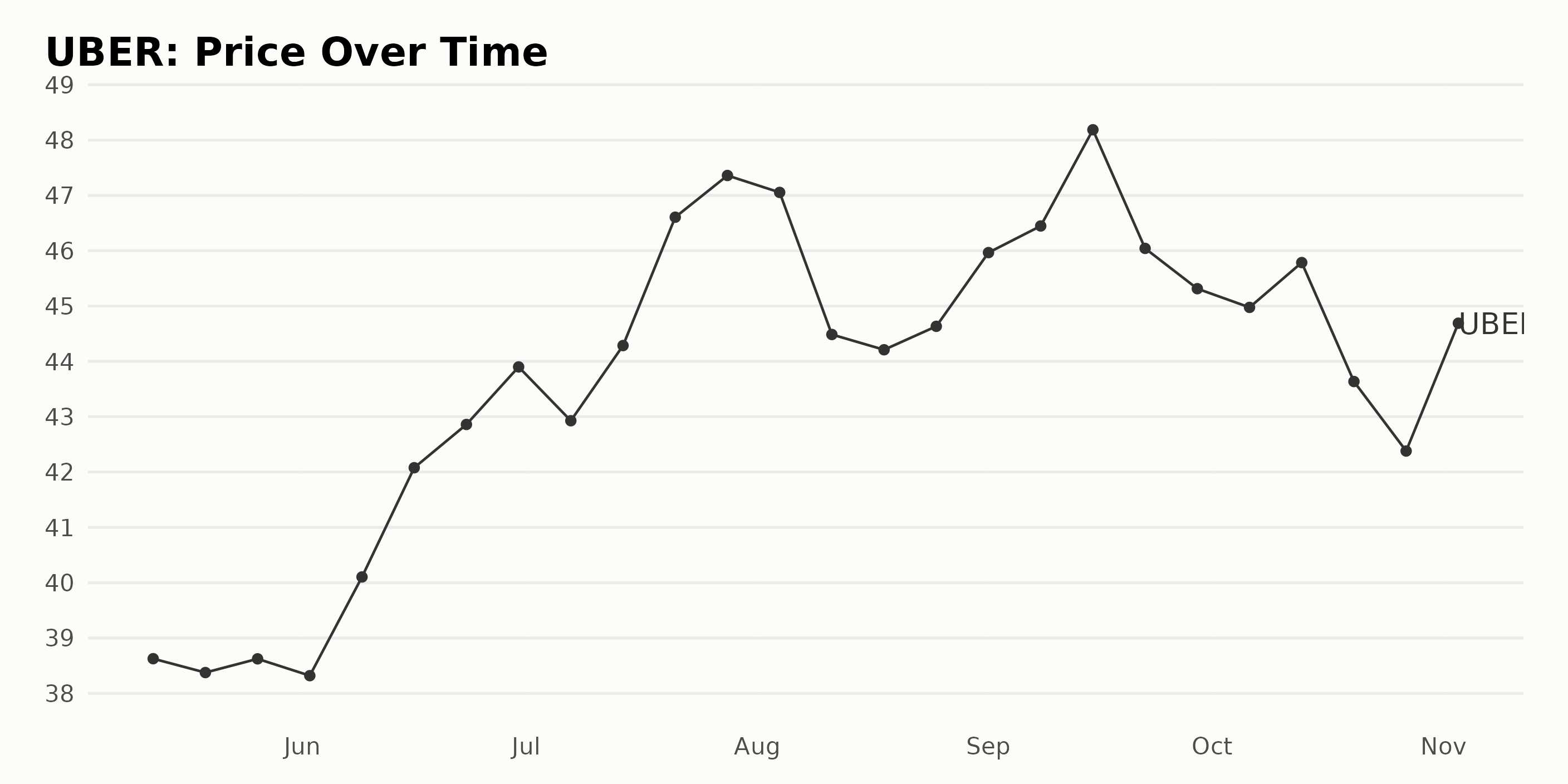

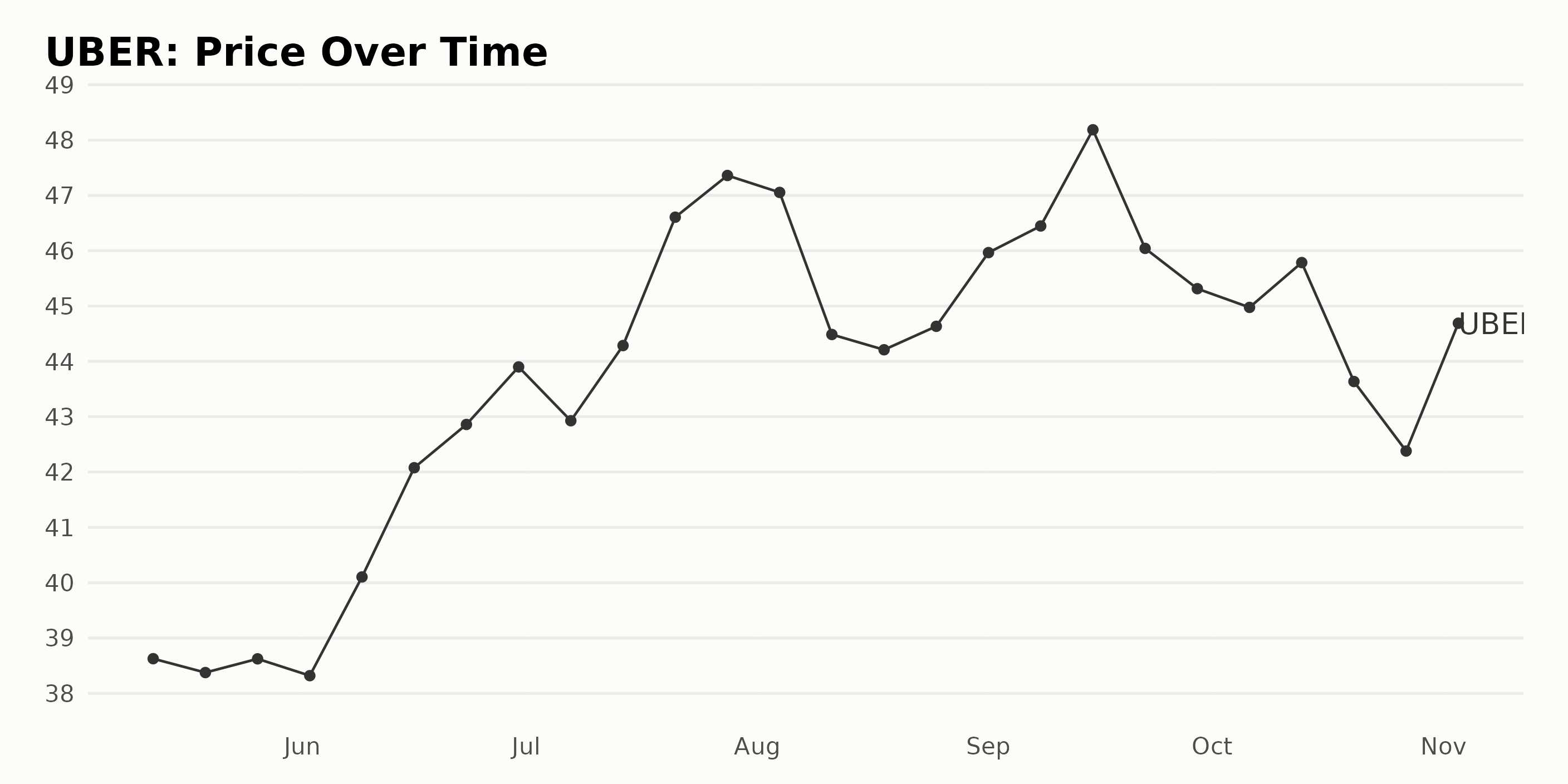

- Stock price fluctuations: Uber's stock experienced significant volatility during the pandemic, reflecting the uncertainty surrounding its business model and consumer behavior shifts.

- Government aid received: Uber, like many companies, benefited from government stimulus programs and financial assistance during the pandemic, impacting its financial stability.

- Shifts in consumer behavior: The pandemic accelerated the shift towards online services, boosting Uber Eats' growth. This diversification proved crucial in mitigating the negative impact on the ride-sharing segment.

- Adaptation strategies: Uber's swift adaptation to the changing environment and focus on delivery services were key to its survival and partial recovery during the pandemic-induced recession.

Comparative Analysis with Other Transportation Stocks:

Comparing Uber's performance during economic downturns with other transportation companies like Lyft provides valuable context. While both experienced considerable volatility during the pandemic, Uber's diversified business model offered a degree of resilience not mirrored by companies solely focused on ride-hailing.

- Performance metrics: Analyzing key performance indicators like revenue growth, profitability, and market share during economic slowdowns helps differentiate their performance and resilience strategies.

- Market capitalization changes: Examining fluctuations in market capitalization highlights investor sentiment and confidence in each company during turbulent economic periods.

- Investor sentiment: Analyzing news sentiment and investor reports during these periods reveals differing perspectives on each company’s future prospects.

Factors Influencing Uber's Stock Performance During Economic Slowdowns

Demand Elasticity:

Uber's services exhibit varying degrees of demand elasticity depending on the economic climate. Ride-hailing is often considered a discretionary expense, highly sensitive to changes in disposable income. Conversely, food delivery might demonstrate greater resilience as consumers may shift spending from dining out to home delivery.

- Price sensitivity: Uber's pricing strategies play a crucial role in maintaining demand during economic downturns. Offering discounts and promotions can stimulate demand, but it also affects profitability.

- Alternative transportation options: The availability of cheaper alternatives such as public transportation or personal vehicles influences consumer choices during economic hardship.

- Impact on different demographics: Lower-income demographics are often disproportionately affected by economic slowdowns, impacting their reliance on ride-hailing services.

Cost-Cutting Measures and Operational Efficiency:

Uber's ability to manage costs during economic downturns significantly impacts its profitability and stock price. Layoffs, reduced marketing spend, and operational efficiencies become crucial for survival.

- Examples of cost-cutting measures: Uber has historically implemented various cost-cutting measures, including workforce reductions, reduced marketing campaigns, and streamlining operations.

- Impact on margins: These measures directly affect profit margins, impacting investor confidence and stock valuation.

- Effect on long-term growth prospects: While cost-cutting is necessary for short-term survival, aggressive measures can hamper long-term growth and innovation.

Government Regulations and Policy Changes:

Government regulations and policies significantly impact Uber's operations and profitability. Changes in labor laws, licensing requirements, or tax regulations during economic slowdowns can either support or hinder its performance.

- Examples of regulations: Changes in minimum wage laws, worker classification regulations, and tax policies directly impact Uber's operational costs and revenue.

- Impact on profitability: Regulations can increase operational costs, reducing profitability and affecting stock prices.

- Long-term implications: Regulatory uncertainty can deter long-term investment and innovation, hindering Uber's future growth prospects.

Predicting Future Performance: Uber Stock in the Next Recession

Current Financial Health and Resilience:

Evaluating Uber's current financial position, including cash reserves, debt levels, and profitability, is crucial for predicting its resilience in the next recession. A strong balance sheet and diversified revenue streams will likely improve its ability to weather economic storms.

- Key financial metrics: Analyzing key financial metrics such as revenue, profit margins, debt-to-equity ratio, and cash flow provides insights into Uber's financial health.

- Debt-to-equity ratio: A high debt-to-equity ratio increases financial risk during economic downturns, making it more vulnerable to financial distress.

- Profitability indicators: Positive and growing profitability indicators demonstrate resilience and ability to navigate economic uncertainties.

Potential Future Growth Drivers:

Identifying potential future growth drivers that can insulate Uber from economic shocks is crucial. Expanding into new markets, developing new services (autonomous vehicles, freight services), and technological advancements can all enhance its resilience.

- Autonomous vehicles: The successful implementation of autonomous vehicle technology could significantly reduce operational costs and improve efficiency, enhancing resilience during economic downturns.

- Freight services: Expanding into the freight market diversifies revenue streams and reduces reliance on the more economically sensitive ride-hailing sector.

- International expansion: Expanding into new international markets reduces dependence on any single region's economic performance.

Investor Sentiment and Market Outlook:

Understanding current investor sentiment towards Uber and the broader market outlook is crucial. Positive investor sentiment and a bullish market outlook can buffer Uber from negative economic impacts.

- Analyst ratings: Following analyst ratings and reports provides insights into market expectations and future growth potential.

- Market trends: Analyzing broader market trends, such as interest rates and inflation, helps predict overall economic conditions.

- News sentiment: Monitoring news sentiment related to Uber and the broader economy offers valuable insights into investor confidence.

Conclusion: Investing in Uber Stock During Uncertain Times – A Summary

This analysis of analyzing Uber stock's performance during economic slowdowns reveals that while Uber is vulnerable to economic downturns, its diversified business model and adaptability offer a degree of resilience. Historically, Uber has shown an ability to pivot and adapt to changing economic conditions. However, its dependence on consumer spending and susceptibility to regulatory changes remain significant risk factors.

For investors, understanding the factors influencing Uber's stock performance during economic slowdowns—demand elasticity, cost-cutting measures, and government regulations—is critical. Diversification within a broader investment portfolio and a thorough understanding of Uber's financial health and future growth prospects are vital for making informed investment decisions. Further research into Uber's financial statements, industry reports, and economic forecasts will enhance your ability to analyze Uber stock's performance during economic slowdowns and navigate future uncertainties. Utilize resources like financial news websites and investment platforms to track key performance indicators and stay updated on market trends.

Featured Posts

-

Jennifer Lawrences Husband Cooke Maroney Couple Seen Publicly After Baby News

May 19, 2025

Jennifer Lawrences Husband Cooke Maroney Couple Seen Publicly After Baby News

May 19, 2025 -

School Employee Among Fsu Shooting Victims Fathers Cia Past Revealed

May 19, 2025

School Employee Among Fsu Shooting Victims Fathers Cia Past Revealed

May 19, 2025 -

Starving For Less Comparing The Earnings Of Starlets And A List Wives

May 19, 2025

Starving For Less Comparing The Earnings Of Starlets And A List Wives

May 19, 2025 -

Melodifestivalen 2025 Final Komplett Guide Till Artister Och Startordning

May 19, 2025

Melodifestivalen 2025 Final Komplett Guide Till Artister Och Startordning

May 19, 2025 -

Air Passenger Numbers At Maastricht Airport Significant Drop Predicted For Early 2025

May 19, 2025

Air Passenger Numbers At Maastricht Airport Significant Drop Predicted For Early 2025

May 19, 2025