Analyzing Trump's Proposal: Can Tariffs Fund The US Government?

Table of Contents

Keywords: Trump tariffs, tariff revenue, funding the government, US government funding, tariff impact, trade policy, economic impact of tariffs

The Theory Behind Tariffs as a Revenue Source

The basic economic principle behind tariff revenue generation is straightforward: tariffs are taxes imposed on imported goods. By increasing the price of imports, tariffs make domestic goods more competitive. A portion of the increased price, representing the tariff itself, is collected by the government as revenue.

- Definition: Tariffs are essentially taxes levied on imported goods, increasing their price for consumers.

- Theoretical Increase: Higher tariffs theoretically lead to increased government revenue as more tariff collections are made on imported goods.

- Historical Examples: Historically, tariffs have contributed to government revenue, particularly in earlier periods of US history when import duties were a more significant source of income. However, these instances rarely involved tariffs as the primary funding mechanism for government operations.

Keywords: Tariff revenue generation, import tariffs, government revenue, economic theory, tax revenue

Examining the Practical Realities of Funding the US Government Through Tariffs

While the theory seems simple, the practical realities of funding the US government solely through tariffs present significant challenges. The limitations are substantial and outweigh any potential benefits.

- Limited Scope: Tariff revenue, even with substantial increases, is dwarfed by the overall magnitude of US government spending. It simply cannot cover the vast array of programs and services the government provides.

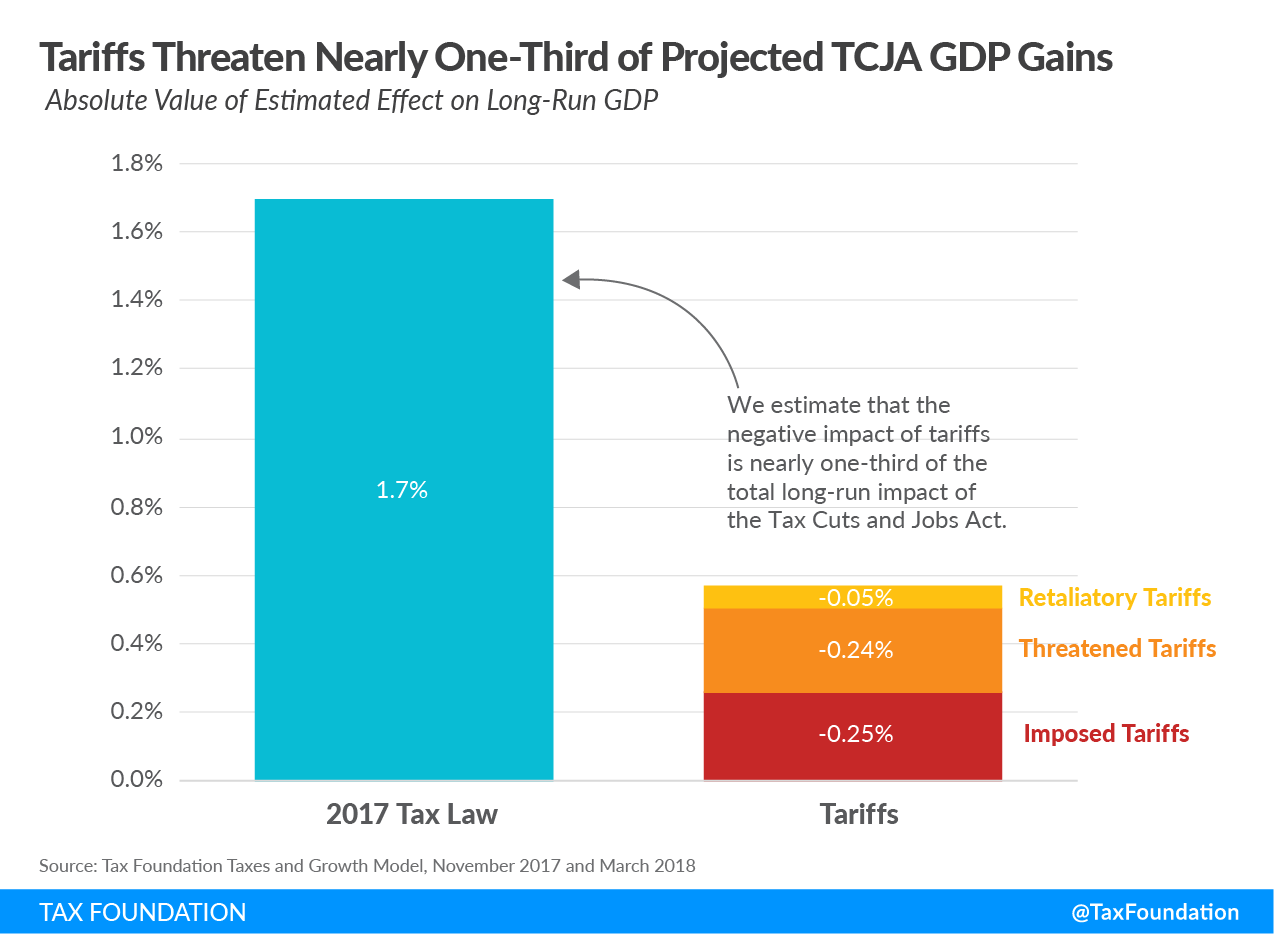

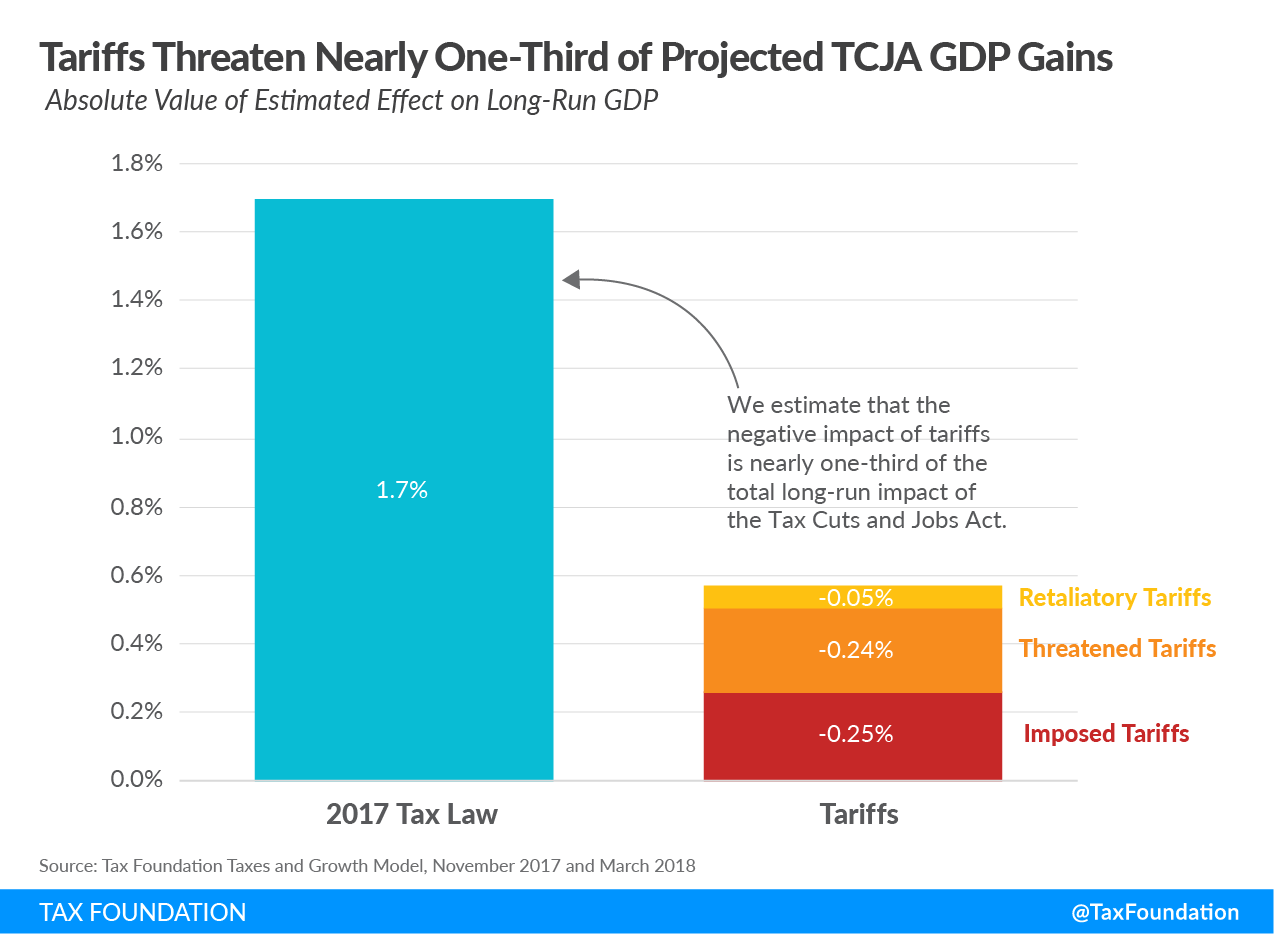

- Retaliatory Tariffs: Imposing high tariffs often provokes retaliatory measures from other countries. These counter-tariffs harm US exports, negating any revenue gains from increased import tariffs and potentially leading to trade wars.

- Higher Consumer Prices: Tariffs directly increase the prices of imported goods, impacting consumers through higher costs for everyday items. This can lead to reduced consumer spending and overall economic slowdown.

- Market Inefficiencies: Tariffs distort market mechanisms by artificially inflating prices and hindering free trade. This can lead to inefficient allocation of resources and reduced economic competitiveness.

Keywords: Tariff limitations, retaliatory tariffs, trade wars, consumer prices, economic efficiency, government spending

Alternative Funding Mechanisms and Their Comparison

Compared to other established methods of government funding, tariffs fall short in terms of stability and long-term viability. Let's compare them:

- Income Tax: A progressive tax system, where higher earners pay a larger percentage, generating substantial revenue. However, it can be politically challenging to raise taxes and may discourage economic activity.

- Corporate Tax: Taxes levied on corporate profits. This can stimulate investment and job creation, but it is subject to loopholes and can be shifted to other countries by multinational corporations.

- Value-Added Tax (VAT): A consumption tax levied at each stage of production and distribution. It can generate significant revenue, but it can disproportionately affect low-income consumers and can be complex to administer.

- Debt Financing: Borrowing money through the issuance of government bonds. This can be used to finance large-scale projects but increases national debt and future interest payments.

Keywords: Tax revenue, income tax, corporate tax, VAT, government debt, fiscal policy, public finance

The Political and Geopolitical Implications of Tariff-Based Funding

Relying heavily on tariffs for government funding has far-reaching political and geopolitical consequences:

- Trade Wars: The implementation of high tariffs almost inevitably leads to trade wars, disrupting global supply chains and harming international trade relationships.

- Strained International Relations: Tariff disputes can significantly damage diplomatic ties between countries, impacting overall global stability and cooperation.

- Domestic Political Backlash: Increased prices and potential job losses in certain sectors due to tariffs can lead to significant domestic political fallout and public opposition.

Keywords: Trade wars, international relations, global supply chains, political consequences, economic nationalism

Conclusion

While tariffs can theoretically generate revenue for the US government, relying on them as the primary funding mechanism presents significant economic, political, and geopolitical challenges. The limited revenue potential, coupled with the risk of retaliatory tariffs and negative consequences for consumers and businesses, makes it an unsustainable and potentially damaging approach. Alternative funding mechanisms, such as income tax and corporate tax, offer a more stable and reliable path for financing government operations.

Call to Action: Understanding the complexities of Trump tariffs and their potential impact on the US economy is crucial. Further research and informed debate are needed to find sustainable solutions for funding the US government while avoiding the pitfalls of excessive reliance on trade protectionism. Continue exploring the topic of tariff revenue and its role in government financing for a comprehensive understanding.

Featured Posts

-

Tdaeyat Arqam Jwanka Ela Nady Alnsr Drast Halt

May 01, 2025

Tdaeyat Arqam Jwanka Ela Nady Alnsr Drast Halt

May 01, 2025 -

Easy Crab Stuffed Shrimp In Lobster Sauce Recipe For Beginners

May 01, 2025

Easy Crab Stuffed Shrimp In Lobster Sauce Recipe For Beginners

May 01, 2025 -

Thes Dansants Optimiser Votre Evenement Avec L Accompagnement Numerique

May 01, 2025

Thes Dansants Optimiser Votre Evenement Avec L Accompagnement Numerique

May 01, 2025 -

Offre Speciale Poids En Chocolat Pour Le Premier Ne De L Annee Boulangerie Normande

May 01, 2025

Offre Speciale Poids En Chocolat Pour Le Premier Ne De L Annee Boulangerie Normande

May 01, 2025 -

Open Ai Unveils Simplified Voice Assistant Development

May 01, 2025

Open Ai Unveils Simplified Voice Assistant Development

May 01, 2025

Latest Posts

-

Rekord Grettski N Kh L Obnovila Prognoz Dlya Ovechkina

May 01, 2025

Rekord Grettski N Kh L Obnovila Prognoz Dlya Ovechkina

May 01, 2025 -

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

May 01, 2025

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

May 01, 2025 -

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Life And Career

May 01, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Life And Career

May 01, 2025 -

Cleveland Guardians Playoff Success A Deep Dive Into The Yankees Series

May 01, 2025

Cleveland Guardians Playoff Success A Deep Dive Into The Yankees Series

May 01, 2025 -

Yankees Rodon Fuels Victory In Series Finale Against Cleveland Guardians

May 01, 2025

Yankees Rodon Fuels Victory In Series Finale Against Cleveland Guardians

May 01, 2025