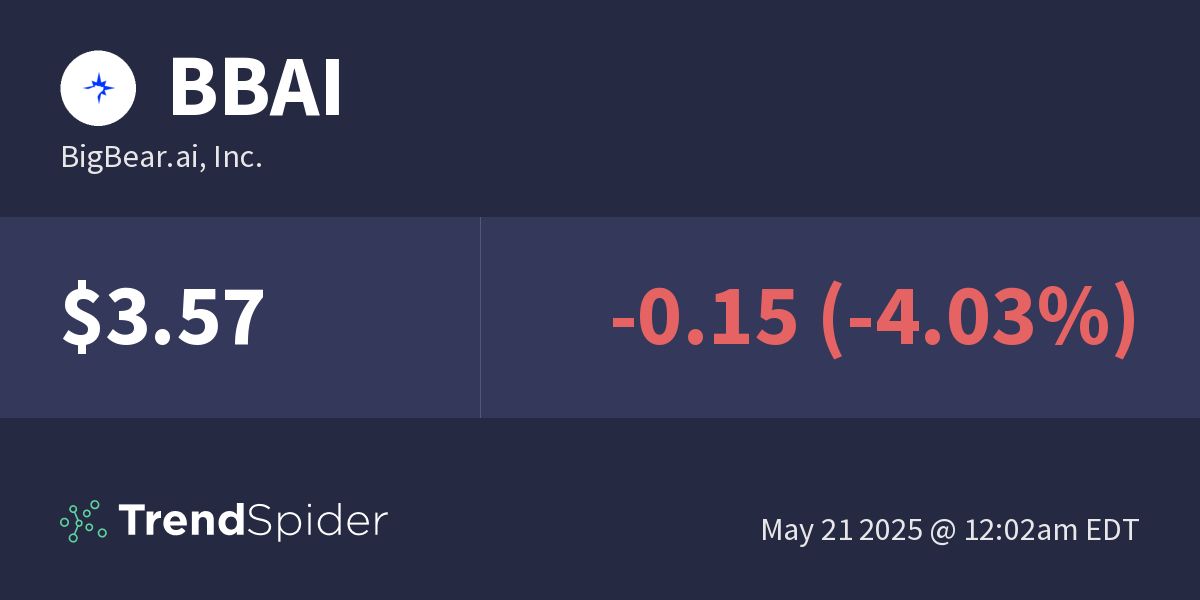

Analyzing The Sharp Decline Of BigBear.ai (BBAI) In 2025

Table of Contents

Macroeconomic Factors Influencing BBAI's Performance in 2025

The dramatic shift in BBAI's stock price in 2025 wasn't solely due to internal factors. Broader macroeconomic headwinds played a significant role, impacting the entire technology sector and growth stocks like BBAI.

-

Impact of rising interest rates on investor sentiment towards growth stocks: Increased interest rates make borrowing more expensive, reducing the attractiveness of growth stocks, which often rely on future earnings projections. Investors shifted their focus to more stable, dividend-paying companies, leading to a sell-off in growth-oriented AI stocks like BBAI.

-

Correlation between inflation and reduced consumer spending affecting BBAI's target market: High inflation eroded consumer purchasing power, impacting demand for products and services that rely on AI technologies. This reduced demand directly affected BBAI's revenue streams and investor confidence.

-

General market volatility and its effect on BBAI's share price: The overall market volatility in 2025 created a climate of uncertainty, leading investors to divest from riskier assets, including BBAI stock. This general market downturn exacerbated BBAI's specific challenges.

Keywords: Macroeconomic factors, interest rates, inflation, market volatility, growth stocks, technology stocks, AI stock market.

Company-Specific Challenges Contributing to BBAI's Decline

Beyond macroeconomic factors, several internal issues contributed to BBAI's 2025 stock decline. Analyzing these company-specific challenges is crucial for understanding the full picture.

-

Execution risks: BBAI faced difficulties in delivering on promised projects and meeting projected targets. This failure to execute effectively eroded investor trust and led to a negative outlook on the company's future prospects.

-

Competition: The AI market is fiercely competitive. Established players and new entrants put immense pressure on BBAI, limiting its market share and impacting its growth potential. This intense competition squeezed profit margins and hindered BBAI's ability to maintain a competitive edge.

-

Financial performance: Analyzing BBAI's financial reports reveals concerns regarding revenue growth, profitability, and cash flow. Slowing revenue growth and declining profitability sent alarming signals to investors.

-

Management changes or strategic shifts: Any significant changes in leadership or strategic direction can create uncertainty and negatively impact investor confidence. If such shifts occurred at BBAI in 2025, they likely contributed to the stock's decline.

Keywords: Company performance, execution risk, competition, AI market, revenue, profitability, cash flow, management changes, AI stock performance.

Investor Sentiment and Market Speculation Surrounding BBAI

Negative news, analyst downgrades, and overall negative investor sentiment played a pivotal role in BBAI's 2025 stock price drop.

-

Impact of negative news reports and media coverage: Negative news, whether accurate or exaggerated, can significantly impact investor confidence. Any negative press surrounding BBAI in 2025 likely contributed to the sell-off.

-

Analysis of analyst ratings and price target changes: Downgrades from financial analysts can trigger a wave of selling, as investors react to revised expectations. A decline in analyst ratings for BBAI would have amplified the negative sentiment.

-

Role of short-selling and market speculation: Short-selling, where investors bet against a stock's price, can accelerate a downward trend. Increased short-selling activity in BBAI would have intensified the decline.

-

Social media sentiment and its influence on the stock price: Social media platforms can influence investor sentiment, both positively and negatively. Negative sentiment expressed on platforms like Twitter or Reddit could have contributed to the pressure on BBAI's stock price.

Keywords: Investor sentiment, analyst ratings, short selling, market speculation, social media sentiment, news impact, stock market analysis.

Technical Analysis of BBAI Stock Chart in 2025 (Optional)

(This section would ideally include charts and graphs. The following is textual explanation.) A technical analysis of the BBAI stock chart in 2025 would likely reveal key support and resistance levels breached, indicating significant selling pressure. Moving averages would likely show a clear downtrend, confirming the bearish sentiment. Identifying chart patterns like head and shoulders or descending triangles could further corroborate the decline and predict potential future price movements. Analyzing these technical indicators provides additional context for understanding the magnitude and speed of the price drop.

Keywords: Technical analysis, support levels, resistance levels, moving averages, chart patterns, BBAI stock chart.

Conclusion: Navigating the Future of BigBear.ai (BBAI) Investments

The sharp decline in BigBear.ai (BBAI) stock in 2025 resulted from a confluence of macroeconomic headwinds, company-specific challenges, and negative investor sentiment. Understanding the interplay of these factors is critical for assessing the risks and potential rewards associated with future investments in BBAI. Before making any investment decisions, thorough due diligence is essential. Consider carefully the macroeconomic climate, the company's financial health, its competitive landscape, and prevailing investor sentiment. Continue monitoring the BigBear.ai (BBAI) stock performance, staying informed through reliable financial news sources and company reports. Remember, investing in the AI sector, and particularly in BBAI, involves inherent risks.

Keywords: BigBear.ai (BBAI) investment, future outlook, due diligence, stock market analysis, risk assessment, AI investment, BBAI stock performance. For further research, refer to reputable financial news sources [insert links to relevant financial news sites here] and the BigBear.ai investor relations page [insert link here].

Featured Posts

-

Watch Suki Waterhouses Funny Twinks Tik Tok

May 20, 2025

Watch Suki Waterhouses Funny Twinks Tik Tok

May 20, 2025 -

Robert Pattinson And Suki Waterhouse Love Lives Of Twilight Stars

May 20, 2025

Robert Pattinson And Suki Waterhouse Love Lives Of Twilight Stars

May 20, 2025 -

Exploring Agatha Christies World With Sir David Suchet A Documentary Review

May 20, 2025

Exploring Agatha Christies World With Sir David Suchet A Documentary Review

May 20, 2025 -

Why Buy This Ai Quantum Computing Stock During A Dip

May 20, 2025

Why Buy This Ai Quantum Computing Stock During A Dip

May 20, 2025 -

Canadian Beauty And Tariffs A Balancing Act For Consumers

May 20, 2025

Canadian Beauty And Tariffs A Balancing Act For Consumers

May 20, 2025

Latest Posts

-

Klopp Set For Liverpool Return Before Seasons End

May 21, 2025

Klopp Set For Liverpool Return Before Seasons End

May 21, 2025 -

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Beklentiler Ve Analiz

May 21, 2025

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Beklentiler Ve Analiz

May 21, 2025 -

Juergen Klopps Return To Liverpool A Pre Season Finale

May 21, 2025

Juergen Klopps Return To Liverpool A Pre Season Finale

May 21, 2025 -

Real Madrid De Yeni Bir Doenem Teknik Direktoer Ve Arda Gueler

May 21, 2025

Real Madrid De Yeni Bir Doenem Teknik Direktoer Ve Arda Gueler

May 21, 2025 -

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Etkileri Neler

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Etkileri Neler

May 21, 2025