Analyzing The Relationship Between Trump Tariffs And Fintech IPOs: The Affirm (AFRM) Perspective

Table of Contents

The Impact of Trump Tariffs on the US and Global Economy

The Trump administration's imposition of tariffs, primarily targeting China, created a significant global trade war. The "Trump tariffs impact" extended far beyond simple import duties, triggering a cascade of macroeconomic and sector-specific consequences.

Macroeconomic Effects

The tariffs' macroeconomic effects were multifaceted and largely negative. The increased cost of imported goods fueled inflationary pressures, squeezing consumer spending power. Supply chain disruptions became commonplace, leading to delays and shortages across various industries. This uncertainty significantly impacted investor confidence, leading to market volatility.

- Increased prices for imported goods: Tariffs directly increased the cost of goods imported from targeted countries, leading to higher prices for consumers.

- Decreased consumer spending: Higher prices and economic uncertainty reduced consumer confidence and disposable income, negatively impacting overall demand.

- Potential for retaliatory tariffs: The tariffs prompted retaliatory measures from other countries, further escalating trade tensions and disrupting global supply chains. This created a complex web of "global trade war" ramifications.

Sector-Specific Impacts

The Fintech industry, while seemingly less directly impacted than manufacturing, still felt the ripple effects. The increased cost of imported technology components, a crucial element for many Fintech companies, added pressure on margins. Accessing international markets became more challenging due to trade restrictions and heightened uncertainty. Reduced consumer confidence also dampened the demand for many Fintech services.

- Increased costs for imported technology components: Many Fintech companies rely on imported chips, software, and other components, increasing their operating costs.

- Challenges in accessing international markets: Tariffs and retaliatory measures made it harder for Fintech firms to expand into foreign markets.

- Reduced consumer spending: Reduced consumer spending power directly impacted the demand for Fintech services like Buy Now Pay Later (BNPL) offerings.

Affirm (AFRM) IPO and its Market Positioning

Affirm (AFRM), a leading player in the Buy Now Pay Later (BNPL) sector, went public amidst the backdrop of the Trump tariffs. Understanding its market positioning and potential exposure to tariff-related risks is crucial for assessing the correlation.

Affirm's Business Model and Growth Trajectory

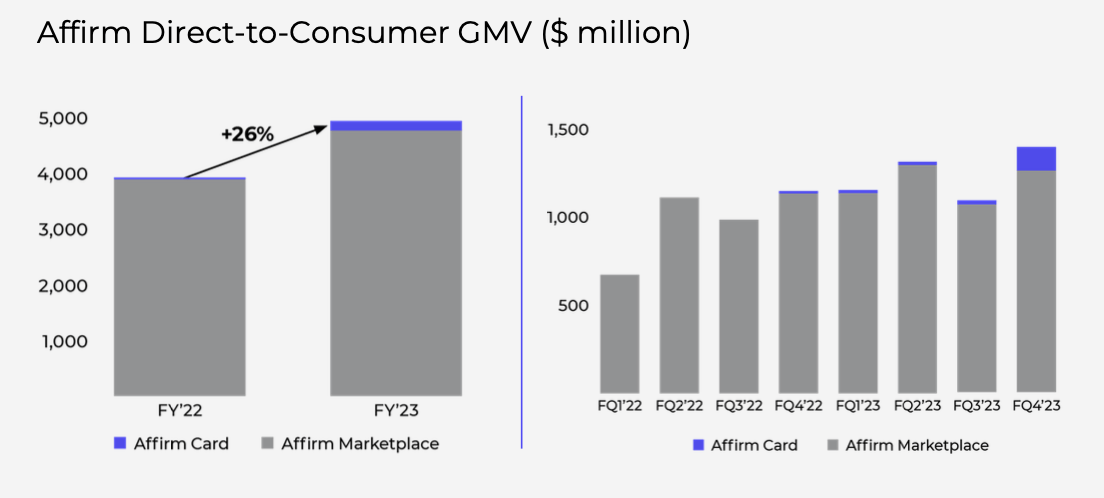

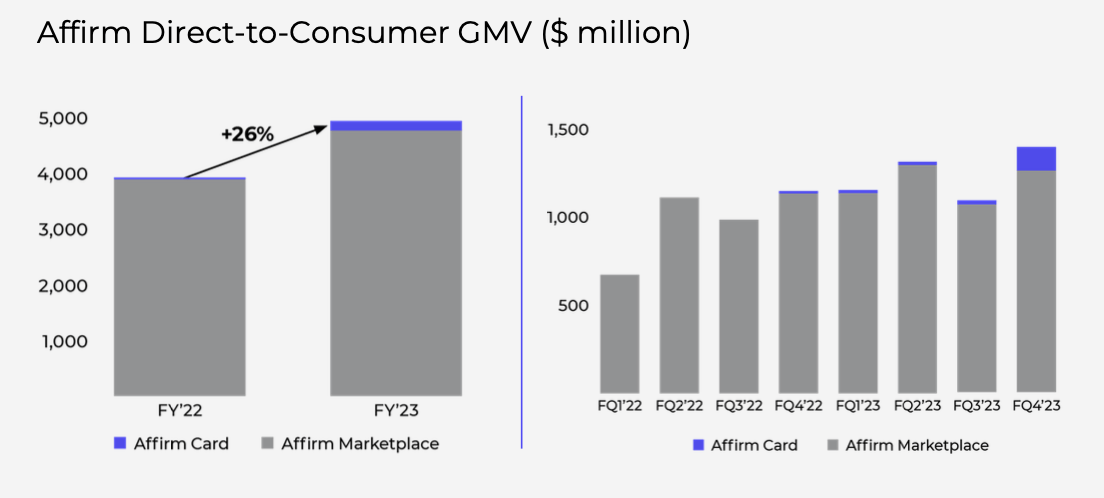

Affirm's business model centers on providing flexible payment options to consumers at the point of sale. Its target market includes millennials and Gen Z, known for their tech-savviness and willingness to adopt new financial technologies. Before and after the tariff implementation, Affirm demonstrated significant growth driven by its innovative approach and expanding partnerships with major retailers.

- Buy Now, Pay Later (BNPL) services: Affirm's core offering provides flexible payment options, making larger purchases more accessible.

- Target customer demographics: Affirm's focus on younger demographics proved a key driver of its growth trajectory.

- Expansion plans: Affirm continued its expansion plans, aiming to broaden its reach across various retail sectors despite the economic headwinds.

AFRM's Exposure to Tariff-Related Risks

While Affirm's direct exposure to tariffs might seem limited compared to manufacturing, indirect risks still existed. The company's reliance on technology infrastructure, which could incorporate imported components, presented a potential supply chain vulnerability. Furthermore, reduced consumer spending due to inflationary pressures and broader economic uncertainty could have impacted the demand for its BNPL services.

- Dependence on imported goods/services: While not heavily reliant, any dependency on imported technology could have increased costs.

- International expansion plans: Geopolitical uncertainty created by the tariffs may have impacted its international expansion efforts.

- Potential impact on consumer spending: A decrease in consumer spending could directly affect the demand for Affirm's BNPL services.

Analyzing the Correlation (or Lack Thereof): Trump Tariffs and AFRM Performance

Determining a direct causal relationship between the Trump tariffs and Affirm's (AFRM) stock performance requires careful analysis and consideration of multiple factors.

Data Analysis and Evidence

Analyzing AFRM's stock price charts alongside the timeline of tariff implementation reveals some interesting, yet inconclusive, patterns. While periods of market volatility coincided with tariff announcements, a direct causal link is difficult to establish. Revenue growth and market capitalization changes need to be considered within the context of broader market trends and the Fintech sector's overall performance. It’s crucial to acknowledge the limitations of this analysis: correlation does not equal causation.

- AFRM stock price: While stock price fluctuated, attributing movements solely to tariffs is an oversimplification.

- Revenue growth: Assessing revenue growth alongside tariff implementation requires controlling for other factors.

- Market capitalization changes: Changes in market capitalization must be considered in the context of the overall market.

- Competitor analysis: Comparing AFRM's performance to competitors helps isolate tariff-specific effects.

Alternative Explanations for AFRM's Performance

Several other factors could have significantly impacted Affirm's performance, overshadowing any potential effects from the Trump tariffs. Market volatility, driven by various macroeconomic factors, played a significant role. Regulatory changes within the Fintech sector and competitive dynamics within the BNPL space also influenced Affirm's trajectory. Investor sentiment, driven by company performance and broader market conditions, is also a critical factor.

- Market volatility: Broader market fluctuations can significantly impact a company's stock price.

- Regulatory changes: Changes in financial regulations could significantly impact the Fintech sector.

- Competitor actions: The actions of competing BNPL companies influenced Affirm's market share and valuation.

- Investor sentiment: Overall investor confidence influenced the demand for AFRM stock.

Conclusion

Analyzing the relationship between Trump tariffs and Affirm's (AFRM) IPO performance reveals a complex interplay of factors. While the tariffs undoubtedly created macroeconomic instability and sector-specific challenges, establishing a direct causal link to Affirm's performance is difficult due to the numerous other influencing variables. Our analysis highlights the limitations of isolating the tariff's impact without considering broader market trends, regulatory shifts, and competitive dynamics.

Key Takeaways: The impact of Trump tariffs on the US economy was far-reaching, influencing various sectors indirectly. While the Fintech industry experienced some challenges, directly linking these to the performance of a specific IPO like Affirm requires careful consideration of numerous confounding factors. A robust analysis requires a multifaceted approach that accounts for macroeconomic forces, regulatory changes, and competitive dynamics.

Understanding the interplay between global trade policies and Fintech growth, particularly in the context of events like the Trump tariffs, is crucial for investors. Continue your research on the impact of Trump tariffs and Fintech IPOs, and follow AFRM's performance closely to gain further insights.

Featured Posts

-

Eurojackpot Ergebnisse Vom Freitag 14 Maerz 2025

May 14, 2025

Eurojackpot Ergebnisse Vom Freitag 14 Maerz 2025

May 14, 2025 -

Jobe Bellingham The Price Chelsea And Tottenham Must Pay

May 14, 2025

Jobe Bellingham The Price Chelsea And Tottenham Must Pay

May 14, 2025 -

Mark Wahlberg And Amanda Seyfried To Voice Ted In Animated Sequel Series

May 14, 2025

Mark Wahlberg And Amanda Seyfried To Voice Ted In Animated Sequel Series

May 14, 2025 -

Alexis Kohler Nouveau Directeur General Adjoint A La Societe Generale

May 14, 2025

Alexis Kohler Nouveau Directeur General Adjoint A La Societe Generale

May 14, 2025 -

Sanremo Evento Musicale Benefico Con La Fondazione L Uomo E Il Pellicano Un Successo

May 14, 2025

Sanremo Evento Musicale Benefico Con La Fondazione L Uomo E Il Pellicano Un Successo

May 14, 2025