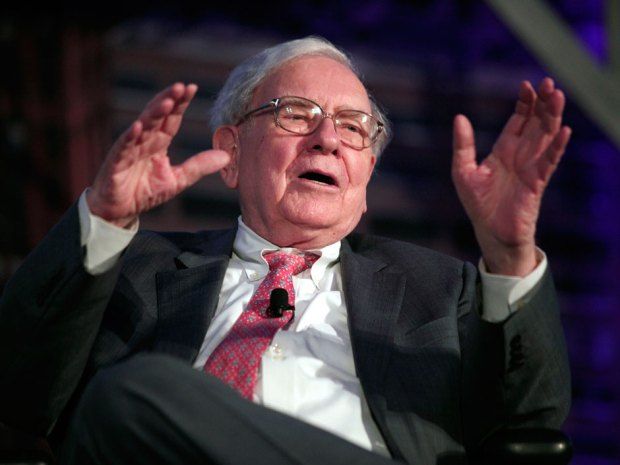

Analyzing The Potential Canadian Successor To Warren Buffett

Table of Contents

Key Traits of a Successful Investor (à la Buffett)

To identify a potential "Canadian Warren Buffett," we must first understand the key characteristics that defined Buffett's success. These extend beyond mere financial acumen and encompass a broader investment philosophy.

Value Investing Principles

Buffett's approach is fundamentally rooted in value investing – identifying undervalued companies with strong fundamentals and holding them for the long term. This principle is equally applicable to the Canadian market, albeit with some unique considerations.

- Examples of Canadian companies that exemplify value investing: Companies with a history of consistent dividend payments, strong balance sheets, and a proven track record of profitability, even amidst economic downturns, are prime examples. Think of established companies in sectors like utilities, consumer staples, and financials.

- Metrics used to identify undervalued Canadian companies: Investors employ various metrics, including Price-to-Earnings (P/E) ratio, dividend yield, Price-to-Book (P/B) ratio, and free cash flow to identify undervalued opportunities. Analyzing these metrics within the context of the Canadian market is crucial.

Long-Term Vision and Patience

Successful investing, especially value investing, demands a long-term perspective. It requires patience to weather market volatility and trust in the underlying value of chosen investments.

- Examples of Canadian investors known for their long-term approach: Many Canadian investment firms and individual investors emphasize long-term value creation. Research into their strategies and performance can shed light on the successful application of this approach.

- Challenges of maintaining patience in volatile Canadian markets: The Canadian market, like any other, experiences fluctuations. Maintaining a long-term perspective requires discipline and resilience in the face of short-term market downturns.

Strong Ethical Foundation

Buffett's ethical business practices are integral to his success. He invests in companies with strong ethical foundations, aligning his investments with his values.

- Examples of Canadian companies with strong ESG (Environmental, Social, and Governance) profiles: The Canadian market is increasingly focused on ESG investing. Identifying companies demonstrating strong environmental stewardship, social responsibility, and good corporate governance is vital.

- The growing importance of ethical investing in Canada: Ethical and responsible investing is gaining significant traction in Canada, reflecting a growing awareness of environmental and social issues among investors.

Potential Canadian Successor Candidates

Identifying the "next Canadian Warren Buffett" requires analyzing prominent and emerging investors within the Canadian financial landscape.

Analyzing Prominent Canadian Investors

Several Canadian investors have built significant success through distinct strategies. A comparative analysis against Buffett's investment philosophy is key to assessing their potential.

- For each investor: We need to analyze their investment style (value, growth, etc.), notable investments, historical performance, public profile, and risk tolerance. This will paint a clearer picture of their investment approach.

- Comparison with Buffett’s investment philosophy and successes: How closely does their philosophy and performance align with Buffett's legendary track record?

Emerging Talent in the Canadian Financial Landscape

The Canadian financial landscape is home to many promising young investors and fund managers. Their potential to become future leaders needs careful consideration.

- Key characteristics that make these investors potential future leaders: Look for sharp analytical skills, a deep understanding of the Canadian market, a long-term vision, and ethical business practices.

- Potential challenges they might face in the Canadian market: Competition, market volatility, and the relatively smaller size of the Canadian market compared to the US pose unique challenges.

The Unique Challenges of the Canadian Market

The Canadian market presents both opportunities and challenges compared to its larger US counterpart.

Market Size and Diversification

The Canadian market is smaller and less diversified than the US market, affecting investment strategies and diversification options.

- Advantages and disadvantages of investing in the Canadian market: While offering stability and a strong regulatory framework, the smaller market size limits diversification options compared to the US.

- Opportunities for diversification within the Canadian market: Diversification across different sectors and asset classes within Canada remains crucial to mitigate risk.

Geopolitical and Economic Factors

Geopolitical events and economic conditions significantly impact investment decisions in Canada.

- Examples of external factors impacting Canadian investments: Global economic downturns, shifts in commodity prices, and changes in trade policies all significantly affect the Canadian market.

- Strategies for navigating these market complexities: A deep understanding of macroeconomic factors and the ability to adapt to changing circumstances are critical for success.

The Quest for Canada's Warren Buffett Continues

In conclusion, finding a direct successor to Warren Buffett in Canada is a complex undertaking. The characteristics of a successful investor – value investing principles, long-term vision, patience, and ethical investing – remain crucial. While identifying potential successors among prominent and emerging Canadian investors requires careful analysis, the unique challenges and opportunities within the Canadian market need to be considered. The quest for Canada's Warren Buffett is an ongoing journey, and we encourage you to continue researching Canadian investors and share your thoughts on who might be the next investment guru. Do you have any candidates in mind? Let us know in the comments below!

Featured Posts

-

Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025

Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025 -

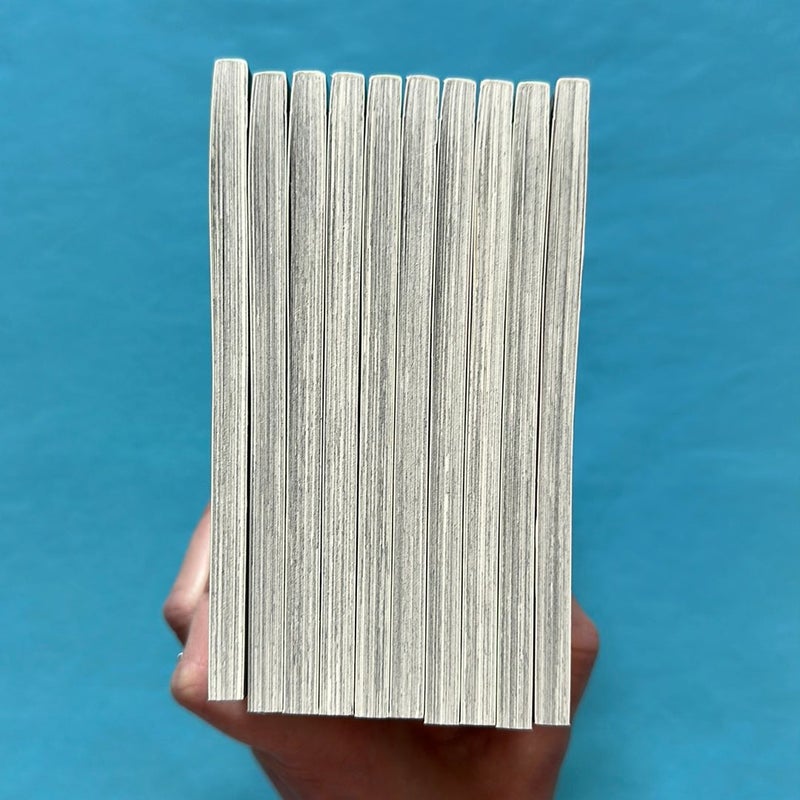

The Book Cover That Holds The Medieval Tale Of Merlin And Arthur

May 10, 2025

The Book Cover That Holds The Medieval Tale Of Merlin And Arthur

May 10, 2025 -

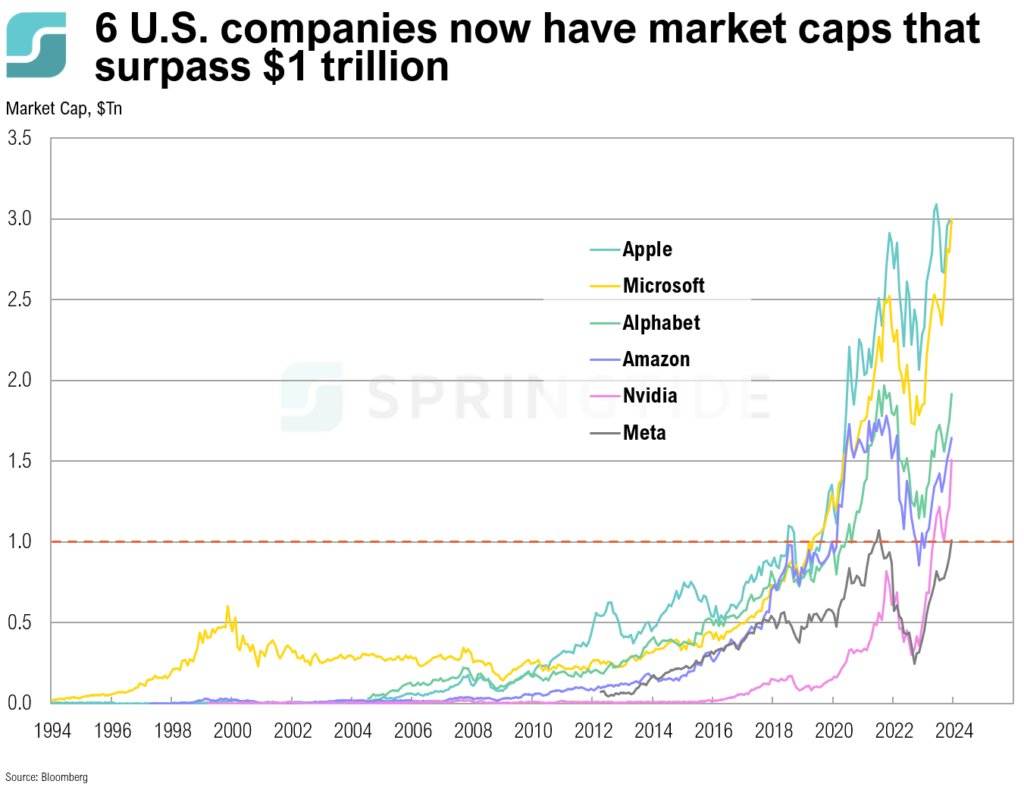

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025 -

Brian Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025

Brian Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025 -

Exploring Four Alternate Perspectives On Randall Flagg In Stephen Kings Novels

May 10, 2025

Exploring Four Alternate Perspectives On Randall Flagg In Stephen Kings Novels

May 10, 2025