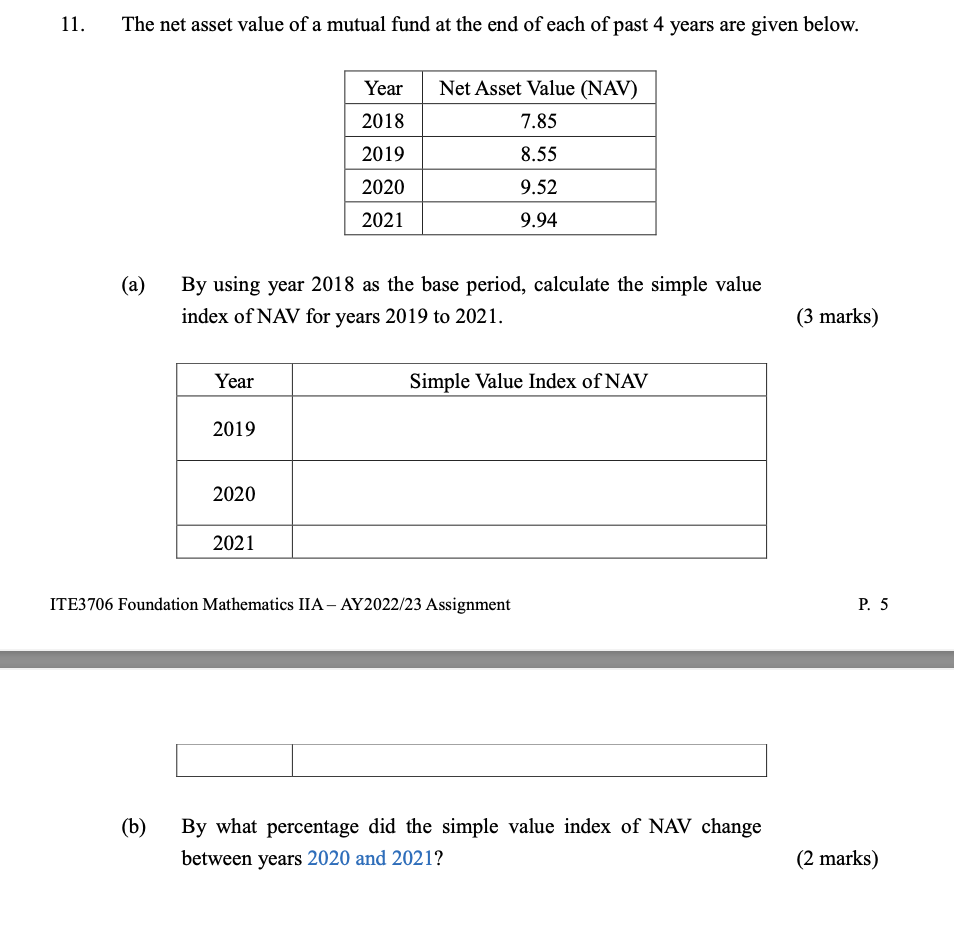

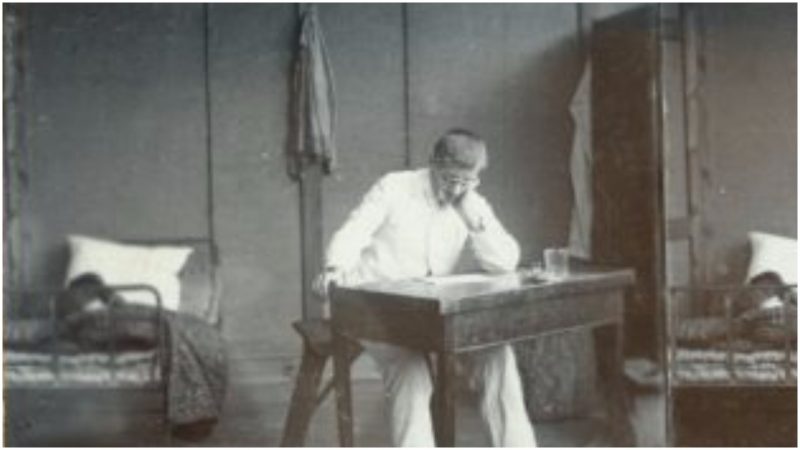

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. For the Amundi Dow Jones Industrial Average UCITS ETF, this is calculated by taking the total market value of all the Dow Jones Industrial Average (DJIA) component stocks held by the ETF, adding any other assets (like cash), and subtracting liabilities (such as management fees and expenses).

-

NAV vs. Market Price: The NAV is different from the market price of the ETF. The market price fluctuates throughout the trading day based on supply and demand, while the NAV is calculated at the end of each trading day. The difference between NAV and market price can offer insights into market sentiment and trading opportunities.

-

Factors Influencing Amundi Dow Jones Industrial Average UCITS ETF NAV: Several factors influence the daily NAV calculation:

- Underlying Asset Performance: The primary driver of the Amundi Dow Jones Industrial Average UCITS ETF NAV is the performance of the 30 companies comprising the DJIA. Strong performance in these stocks leads to a higher NAV, and vice versa.

- Currency Fluctuations: Since the DJIA includes companies from various countries, currency exchange rates can impact the NAV if the ETF holds assets in different currencies.

- Management Fees and Expenses: The ETF's management fees and operating expenses are deducted from the total asset value, directly affecting the NAV.

- Dividend Distributions: When the underlying companies pay dividends, the ETF distributes them to its shareholders. These distributions reduce the NAV on the ex-dividend date.

-

Simple NAV Calculation Example: Imagine the ETF holds $100 million worth of DJIA stocks and $1 million in cash, with $500,000 in liabilities. The NAV would be ($100 million + $1 million) - $500,000 = $100.5 million.

Analyzing the Historical NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing the historical NAV data of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for understanding its long-term performance and assessing its risk profile. This analysis reveals trends and patterns that inform future investment decisions.

-

Accessing Historical NAV Data: You can usually find this data on the Amundi website, dedicated financial news sites (like Yahoo Finance or Google Finance), or through specialized financial data providers like Bloomberg Terminal or Refinitiv Eikon.

-

Interpreting Historical NAV Trends: By examining historical NAV charts, you can identify periods of significant growth, decline, and volatility. This can help in assessing the ETF's responsiveness to market fluctuations and its overall risk profile.

-

Visual Representation: (Insert a chart or graph here showing the historical NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF. This should clearly illustrate key trends, including periods of growth and decline, and volatility.) This visual representation will allow for easier understanding of NAV fluctuation over time.

Comparing the Amundi Dow Jones Industrial Average UCITS ETF NAV to Competitors

To get a comprehensive view, it's beneficial to compare the Amundi Dow Jones Industrial Average UCITS ETF's NAV performance with similar ETFs tracking the Dow Jones Industrial Average.

-

Identifying Competitors: Several ETFs track the DJIA; some key competitors should be identified and their performance compared against the Amundi ETF.

-

Comparative NAV Analysis: This comparison should include examining the historical NAV performance of these competing ETFs against the Amundi ETF, allowing for a relative assessment of growth and volatility.

-

Expense Ratio Comparison: Analyze the expense ratios and other fees associated with each ETF, determining which provides better value for money given its performance.

-

Key Differences: Highlight the significant differences in performance and costs, helping investors make more informed choices based on their investment objectives.

Using NAV to Make Informed Investment Decisions

NAV, when considered alongside other crucial metrics, assists in making informed investment choices.

-

Using NAV with Other Metrics: Don't rely solely on NAV; consider expense ratios, trading volume, and the ETF's overall investment strategy.

-

Investment Goals and Risk Tolerance: Align your investment decisions with your personal financial goals and risk tolerance. A higher-risk tolerance might justify investing in a more volatile ETF, even if its historical NAV shows greater fluctuations.

-

Limitations of Using NAV in Isolation: Remember that NAV provides only a snapshot of the ETF's value at a specific point in time. It doesn't account for future performance or market sentiment.

-

Diversification and Long-Term Strategies: Always diversify your investment portfolio and adopt a long-term investment strategy to mitigate risk and maximize returns.

Conclusion:

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV provides valuable insights into its performance and helps you assess its suitability for your investment portfolio. Understanding how NAV is calculated, its relation to market price, and the factors that influence it are vital for making informed investment decisions. By comparing its historical NAV to competitors and considering other relevant metrics, you can determine whether this ETF aligns with your investment goals. We strongly recommend further researching the Amundi Dow Jones Industrial Average UCITS ETF NAV, consulting the ETF provider's website for detailed information, and seeking advice from a qualified financial advisor before making any investment decisions. Consistent monitoring of the Amundi Dow Jones Industrial Average UCITS ETF NAV is key to successful long-term investing.

Featured Posts

-

Lauryn Goodman Explains Her Sudden Move To Italy Amidst Kyle Walker Transfer News

May 25, 2025

Lauryn Goodman Explains Her Sudden Move To Italy Amidst Kyle Walker Transfer News

May 25, 2025 -

West Ham United Submits Bid For Kyle Walker Peters

May 25, 2025

West Ham United Submits Bid For Kyle Walker Peters

May 25, 2025 -

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025 -

130 Years After Dreyfus Affair French Parliament Considers Posthumous Promotion

May 25, 2025

130 Years After Dreyfus Affair French Parliament Considers Posthumous Promotion

May 25, 2025 -

Brazils Banking Industry Brbs Banco Master Acquisition And Its Implications

May 25, 2025

Brazils Banking Industry Brbs Banco Master Acquisition And Its Implications

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025